Banking Lawyers in Ahmedabad

Banking is an essential aspect of any country’s economy, and the Indian banking sector is no exception. The Banking Regulation Act, 1949, and the Reserve Bank of India Act, 1934, are the two major laws that govern the banking sector in India. The sector also adheres to various other laws like the SARFAESI Act, 2002, and RDDBFI Act, 1993, amongst others. These laws help regulate the functioning and conduct of banks and other financial institutions.

In such a complex and highly regulated environment, having the right legal representation becomes crucial. Bhatt & Joshi Associates is a leading law firm in Gujarat, Ahmedabad, with a team of highly skilled Banking Lawyers and Financial Lawyers. Our Banking Lawyers offer litigation support to our clients for their requirements in Debt Recovery Tribunal (DRT) and Gujarat High Court.

Expertise in SARFAESI Act, 2002 and RDDBFI Act, 1993

Our Banking Lawyers have an in-depth understanding of the provisions of the SARFAESI Act, 2002, and RDDBFI Act, 1993. We assist lenders/financial institutions in enforcing their rights to recover money through the process of filing appropriate recovery suits at respective Debt Recovery Tribunal and other courts. We also defend the client’s borrowers’ rights against any unlawful actions by Banks and Financial Institutes to recover the amount that is lent to them.

Representation at Various forums

Our Financial Lawyers excel at representing cases before various forums like Commercial Court, DRAT, High Court, or Supreme Court of India. With our efficient and responsive resolving techniques, we ensure that our clients receive the best possible outcome.

Services Offered by our Banking Lawyers

At Bhatt & Joshi Associates, we offer multiple and diverse services for our clients. Our Banking Lawyers and Financial Lawyers are well-versed with RBI Notifications, Banking Regulations, documentation and drafting of contracts, consumer grievance redressal, and debt recovery tribunal. Our goal is to provide top-notch Banking Lawyers to assist in your banking concerns and provide optimal results.

Choosing the Right Banking Lawyer

Choosing the right Banking Lawyer becomes important in the context of DRT, Gujarat High Court, and the Supreme Court of India for Banking-related litigation support services. A skilled and experienced Banking Lawyer must be aware of the ever-changing laws and RBI Banking regulations and their strict compliances. They should be well-versed with diverse areas of law, know the multiple way outs to situations, and choose the most effective methodology.

Why Choose Bhatt & Joshi Associates for Banking lawyers?

At Bhatt & Joshi Associates, we have a team of accomplished and knowledgeable Banking Lawyers who exhibit traits of fact collection, legitimate research, and representation cohesively. We also have young minds with professionally experienced Banking Lawyers to provide room for debate and exploration. We acknowledge the importance of references, case studies, and understand the underlying business fundamentals. If you are looking for a reliable and experienced Banking lawyer in Gujarat, India, Bhatt & Joshi Associates could be a great choice for you. Here are some reasons why:

- Experience and Expertise: Bhatt & Joshi Associates is a reputed law firm with over Several years of experience in handling legal matters related to Banking petitions, among others. The team consists of experienced and knowledgeable lawyers who have successfully represented clients in various high-profile cases.

- Personalized Approach: The firm takes a personalized approach to every case, which means that they take the time to understand your specific needs and requirements before formulating a legal strategy. They work closely with you to ensure that your case is handled in the best possible way.

- Focus on Results: Bhatt & Joshi Associates is committed to achieving the best possible results for their clients. They use their legal expertise and experience to fight for your rights and interests.

- Professionalism and Integrity: The firm follows the highest standards of professionalism and integrity in their work. They maintain confidentiality and transparency throughout the legal process and keep you informed at every stage of your case.

- Client-Centric Services: Bhatt & Joshi Associates is known for providing client-centric services. They are easily accessible and responsive to your queries and concerns. They take pride in building long-term relationships with their clients based on trust, reliability, and mutual respect.

In conclusion, the Indian banking sector is highly regulated, and having the right legal representation becomes crucial. Bhatt & Joshi Associates, with our team of highly skilled Banking Lawyers and Financial Lawyers, offer expert legal services for Banking-related litigation support. We have an in-depth understanding of the provisions of the SARFAESI Act, 2002, and RDDBFI Act, 1993, amongst others, and excel at representing cases before various courts. Choosing the right Banking Lawyer is crucial, and we have a team of accomplished and knowledgeable Banking Lawyers to assist you with your banking concerns and provide optimal results.

Banking is not an easy business where you just rent a space and open the doors and expect people to come in and do business with you.

Our Publications

Get in touch with Best Banking Lawyers in Ahmedabad

Frequently asked questions

1. What do banking lawyers specialize in?

Banking lawyers specialize in the legal aspects of financial transactions and regulations, assisting both individuals and institutions with a wide range of banking-related legal matters.

2. How can banking lawyers assist businesses?

Banking lawyers can guide businesses in obtaining loans, understanding financial regulations, drafting and negotiating financial contracts, and resolving disputes with financial institutions.

3. Can a banking lawyer help with loan disputes?

Yes, banking lawyers can assist in resolving loan disputes, whether it’s related to repayment, interest rates, or terms of agreement.

4. Do banking lawyers handle bankruptcy cases?

While banking lawyers may be well-versed in matters related to financial distress, bankruptcy cases are often handled by specialized bankruptcy lawyers. However, a banking lawyer can work in conjunction with a bankruptcy lawyer in such scenarios.

5. Can a banking lawyer assist with setting up a new bank or financial institution?

Yes, banking lawyers can guide through the regulatory and legal processes required to establish a new bank or financial institution.

6. Can a banking lawyer help in cases of bank fraud or financial malpractice?

Yes, banking lawyers can either defend against allegations or represent victims in cases of bank fraud, financial malpractice, or other related legal disputes.

7. How do banking lawyers assist with digital banking and fintech?

Banking lawyers provide guidance on regulatory compliance, draft and review contracts for digital services, and address legal issues that arise in the realm of digital banking and fintech.

Can Appellate Court Criticism Demoralise Judges? Judicial Independence and the Chilling Effect

Introduction On 13 February 2026, Justice Pankaj Bhatia of the Allahabad High Court made a remarkabl

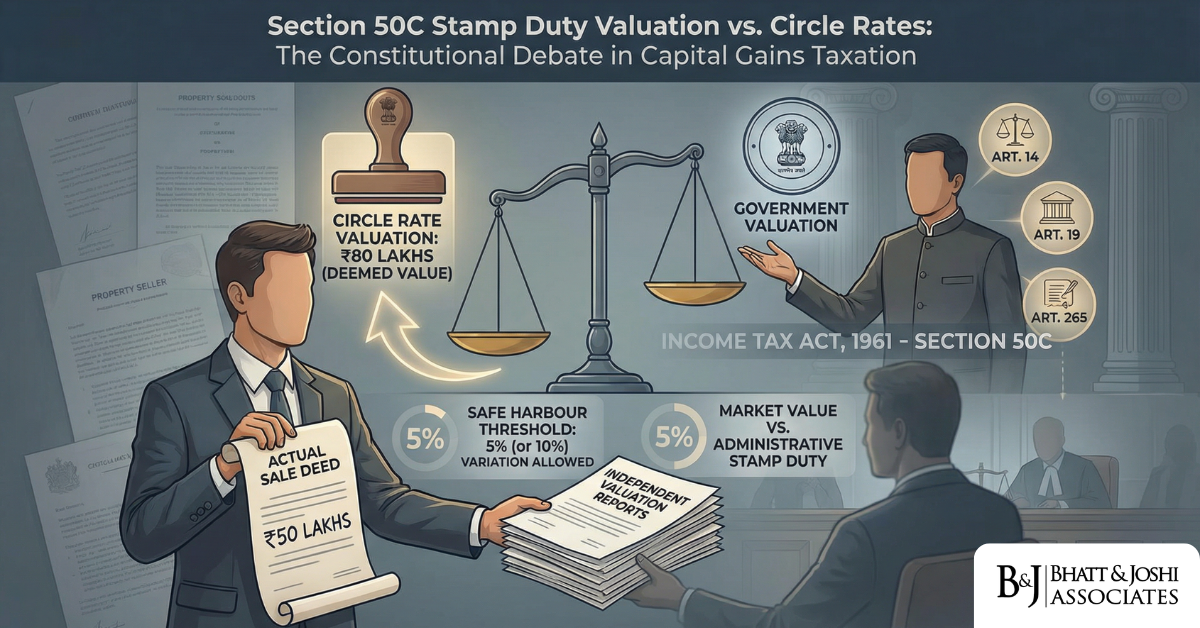

Section 50C of the Income Tax Act, 1961 Stamp Duty Valuation vs. Circle Rates: The Constitutional Validity of Deeming Fictions in Capital Gains

Introduction Few provisions in Indian income tax law generate as much sustained controversy, litigat

Livestream Donations and the TDS Gap on Creator Income in India: Why Streamers and Influencers Have No Withholding

Introduction India’s creator economy has grown into a multi-billion-rupee ecosystem, where gam

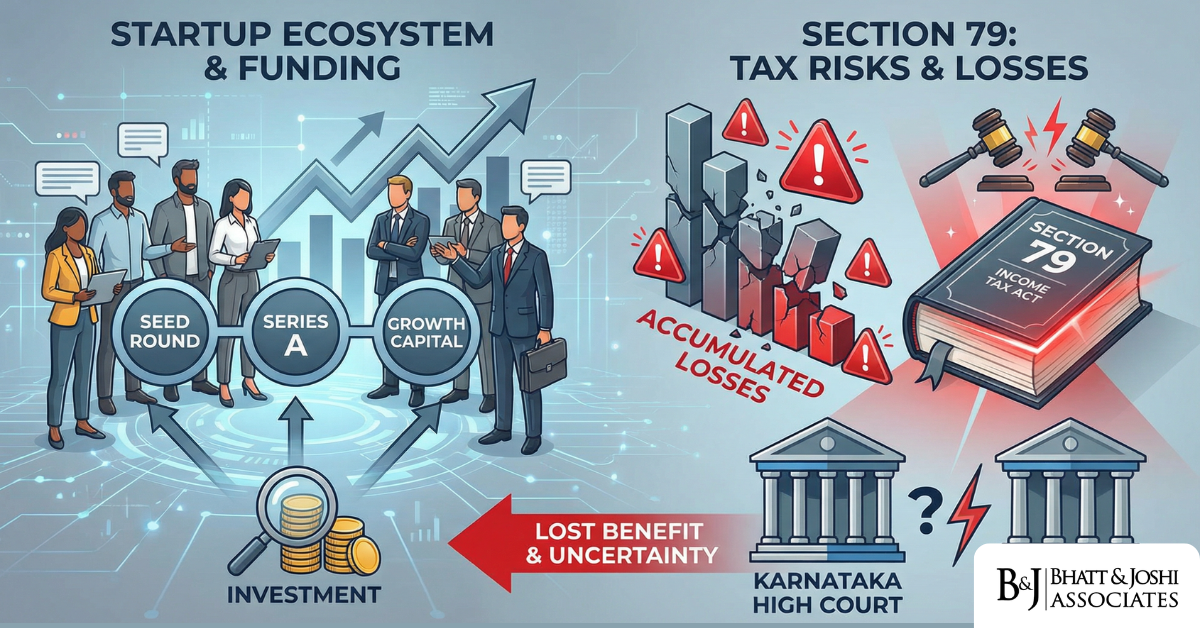

Startup Losses and Section 79 of the Income Tax Act, 1961: When Anti-Abuse Rules Kill Legitimate Restructuring

Introduction India’s startup ecosystem has grown into one of the most dynamic in the world, ye

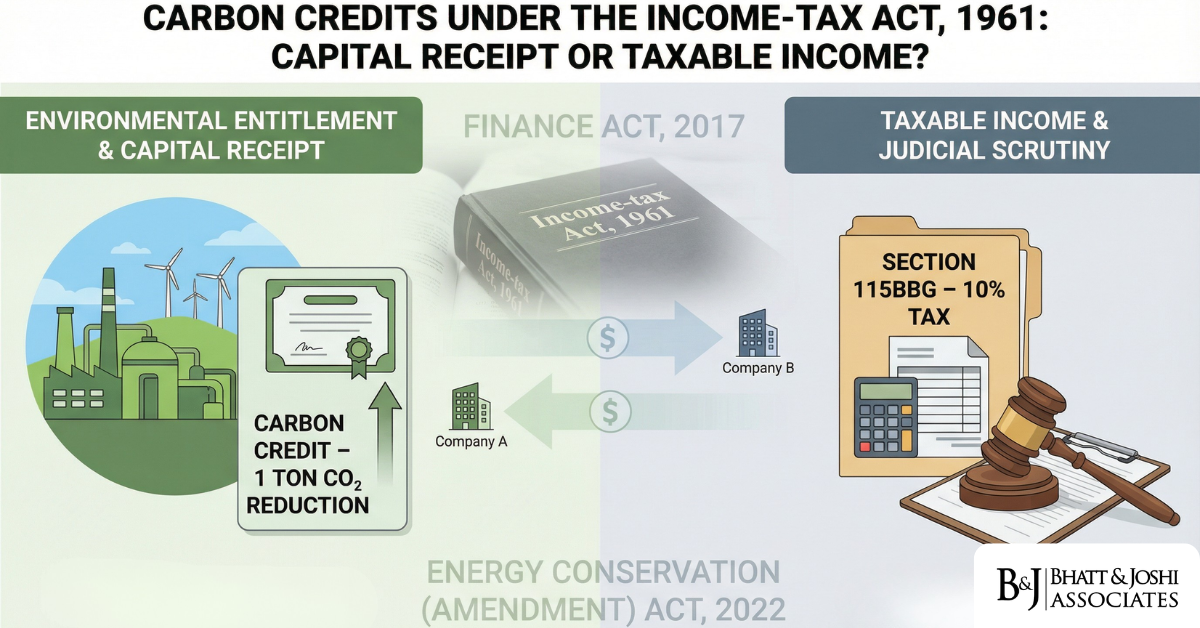

Income Tax Treatment of Carbon Credits: Asset, Income, or Capital Receipt Under the IT Act, 1961?

Introduction Carbon credits — formally known as Certified Emission Reductions (CERs) — have occu

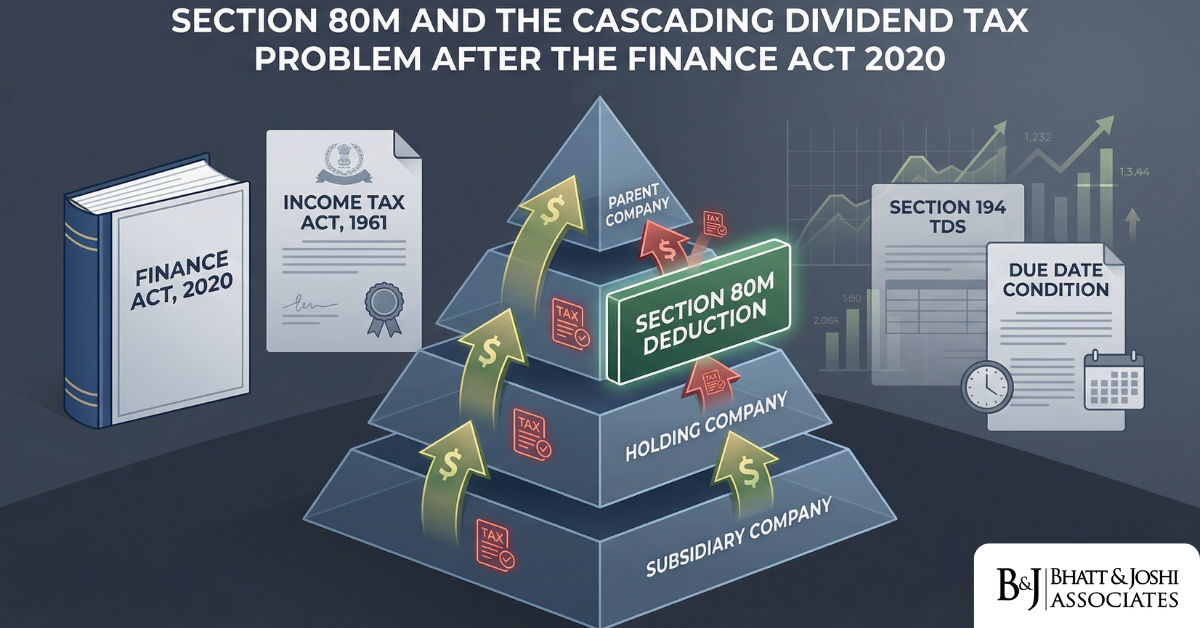

Section 80M Inter-Corporate Dividend Deduction: The Cascading Tax Problem the Finance Act 2020 Left Unresolved

Introduction When the Finance Act 2020 abolished the Dividend Distribution Tax (DDT) under Section 1

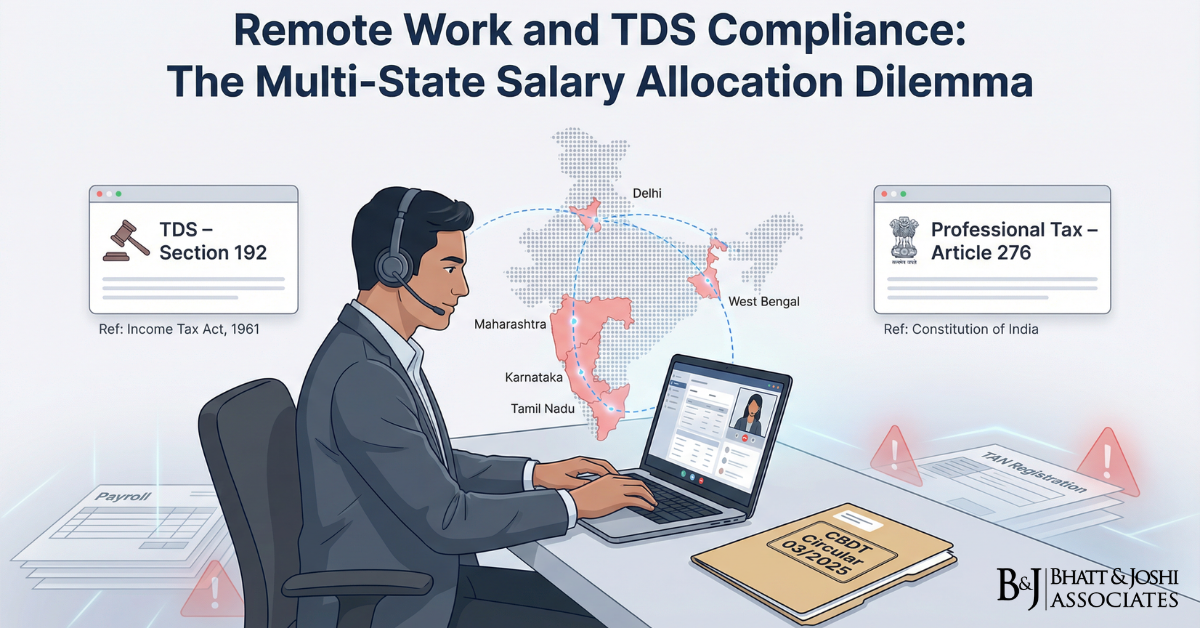

TDS on Salary for Remote Employees Across Multiple Indian States Under Section 192: Compliance Challenges”

Introduction The rise of remote work in post-pandemic India has created a TDS on salary compliance c

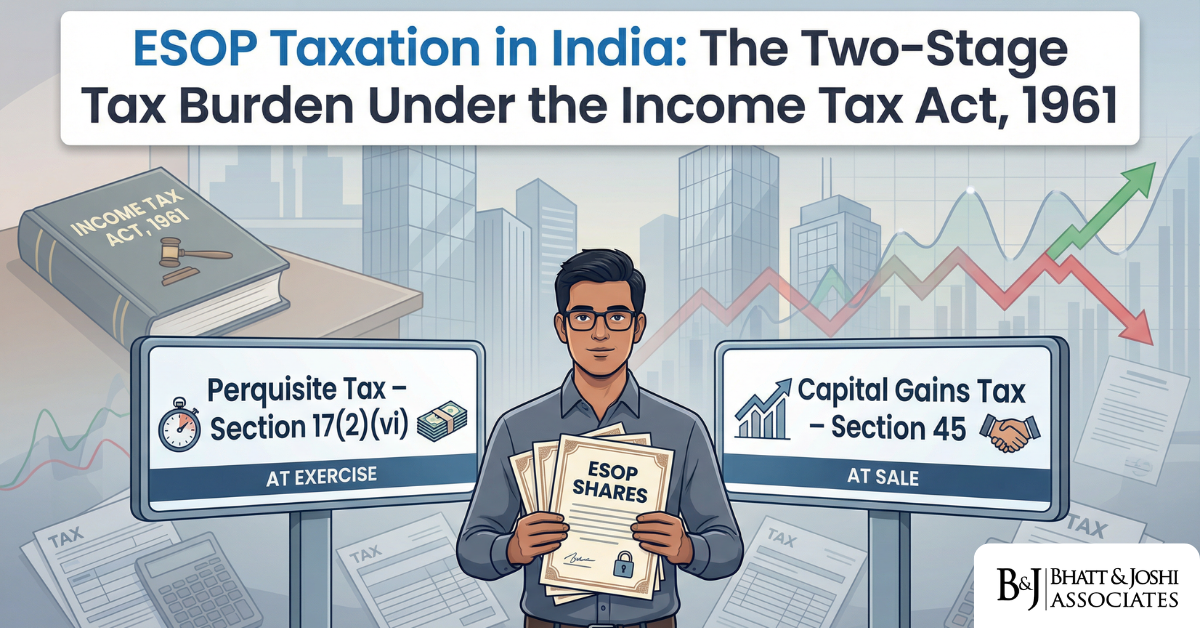

ESOP Taxation After Exit: Why Perquisite Tax at Exercise and Capital Gains at Sale Creates Double Taxation by Stealth

Introduction Employee Stock Option Plans (ESOPs) are among the most powerful instruments that Indian

Crypto Losses Under Section 115BBH: Why the No-Set-Off Rule Creates an Unconstitutional Tax on Notional Gains

Introduction When the Finance Act, 2022 introduced Section 115BBH into the Income Tax Act, 1961, it

Whatsapp

Whatsapp