GST Appeal | GST Appeal Lawyers & GST Appeal Advocates

Bhatt & Joshi Associates provides a wide range of litigation support services to their clients at the GST Appeal, Ahmedabad. Our experienced team of lawyers assists clients in filing an appeal, representing them in hearings, and providing legal advice throughout the process. We offer various services such as drafting, filing, and submission of GST Appeal petitions before the appropriate authorities, preparing and filing replies to show cause notices, and more.

Introduction:

The Goods and Services Tax (GST) Appeal is an application to a higher court for a reversal of the decision of a lower court regarding any legal disputes related to tax and procedural obligations. Disputes arise when there are actual or perceived non-compliance situations. The initial resolution of the dispute is done by a departmental officer through a quasi-judicial process that results in the issuance of an initial order known by various names. Bhatt & Joshi Associates is a leading law firm in Gujarat, Ahmedabad providing legal services – litigation support to their prospective clients at the GST Appeal, Ahmedabad.

Overview of GST Appeal Laws:

The GST Act defines the phrase “adjudicating authority” as any authority competent to pass any order or decision under this Act, but does not include the Board, the First Appellate Authority, and the Appellate Tribunal. Every appeal under GST passes through different levels, starting from the Adjudicating Authority to the Supreme Court, depending on the nature of the case. A taxpayer can appeal to the First Appellate Authority, National Appellate Tribunal, High Court, and Supreme Court, respectively.

Steps of appeals under GST

Powers of GST Appeal:

GST Appeal has primary jurisdiction over tax-related and procedure-related obligations. The taxpayer’s compliance with these obligations is verified by the tax officer through audit, anti-evasion, examining, etc. Sometimes there are situations of actual or perceived non-compliance. If the difference in views persists, it results in a dispute, which is then required to be resolved. The GST Appeal has the power to adjudicate cases such as cancellation of registration, best judgment assessment, decision on a refund claim, imposition of a penalty, etc.

Filing of GST Appeal:

To file an appeal under GST to the Appellate Authority, the applicant can follow the procedure detailed in the GST Act. An applicant can file an appeal within three months from the date of communication of the disputed order. The Appellate Authority may condone a delay of up to one month if they are satisfied that there was sufficient cause for such delay.

General Rules for Filing GST Appeals:

All appeals must be made in prescribed forms along with the required fees. The fees will be the full amount of tax, interest, fine, fee, and penalty arising from the challenged order, as admitted by the appellant, and 10% of the disputed amount. In cases where an officer or the Commissioner of GST is appealing, then fees will not be applicable.

Authorized Representative:

Any person required to appear before a GST Officer/First Appellate Authority/Appellate Tribunal can assign an authorized representative to appear on his behalf, unless he is required by the Act to appear personally. An authorized representative can be a relative, a regular employee, a lawyer practicing in any court in India, any chartered accountant/cost accountant/company secretary, with a valid certificate of practice, any retired officer of the Tax Department of any State Government or of the Excise Dept. whose rank was minimum Group-B gazetted officer, or any tax return preparer. Retired officers cannot appear in place of the concerned person within one year from the date of their retirement.

Withdrawal of GST Appeal:

In the 48th GST Council meeting, held on December 22, 2020, the issue of the high number of pending GST appeals was discussed. It was noted that there were around 4.5 lakh GST appeals pending before various appellate forums, including the GST Appellate Tribunal, the High Courts, and the Supreme Court.

To address this issue, the GST Council decided to withdraw all appeals filed by the Central Government or the State Governments or the Union Territory Governments, which are pending as on January 31, 2020, and are below the threshold limit of Rs. 1 crore. This decision was taken with the objective of reducing litigation and easing the burden on the appellate authorities.

The taxpayers were given an option to either pursue their appeals or accept the decision of the lower authorities, subject to certain conditions. If the taxpayer chose to pursue the appeal, they were required to give an undertaking that they would withdraw the appeal if the relief granted by the appellate forum was equal to or less than the amount of tax or input tax credit involved in the appeal.

This move by the GST Council was seen as a positive step towards reducing the burden on the appellate authorities and promoting ease of doing business.

GST Appeals at Bhatt & Joshi Associates:

At Bhatt & Joshi Associates, we understand that GST appeals can be complex and time-consuming. We have a team of experienced GST appeal lawyers who are well-versed in the GST laws and regulations. Our lawyers can help you at every stage of the appeal process, from filing the appeal to representing you in front of the appellate authorities.

We provide our clients with customized legal solutions that are tailored to their specific needs. Our lawyers work closely with our clients to understand their business and their objectives, and then develop a legal strategy that is designed to achieve those objectives.

Our team of GST appeal lawyers has a track record of success in handling complex and challenging appeals. We have a deep understanding of the GST laws and regulations and can provide our clients with sound legal advice that is based on our extensive experience.

If you are looking for the services of the best GST appeal lawyers in Ahmedabad, look no further than Bhatt & Joshi Associates. We are committed to providing our clients with high-quality legal services that are designed to help them achieve their objectives. Contact us today to schedule a consultation with one of our experienced GST appeal lawyers.

Equal justice under law is not merely a caption on the facade of the Supreme Court building, it is perhaps the most inspiring ideal of our society.

Get in touch with Best GST Appeal Lawyers in Ahmedabad

Frequently asked questions

1. When should I consider hiring a civil lawyer?

You should consider hiring a civil lawyer when facing legal disputes related to contracts, property, personal injury, family matters, or any non-criminal matter where you need legal advice or representation.

2. What is a civil lawyer?

A civil lawyer represents clients in non-criminal legal matters, dealing with disputes between individuals, organizations, or both, over rights, responsibilities, and liabilities.

3. Can a civil lawyer help with contract disputes?

Yes, one of the primary areas of expertise for many civil lawyers is contract law. They can assist with drafting, reviewing, and disputing the terms of contracts.

4. How do civil lawyers differ from criminal lawyers?

While both handle legal disputes, civil lawyers focus on non-criminal cases, often involving private disputes between individuals or organizations. Criminal lawyers, on the other hand, represent individuals or the state in cases involving potential criminal penalties.

5. How are damages determined in civil cases?

Damages are determined based on the actual loss suffered, potential future losses, and sometimes, punitive measures. The nature and amount depend on the specifics of the case and jurisdictional guidelines.

6. What is the usual process of a civil lawsuit?

The typical process involves the filing of a complaint, response from the other party, discovery (exchange of relevant information), negotiations, potential settlement discussions, and if unresolved, a trial. The exact process can vary by jurisdiction.

7. Can a civil lawyer assist in mediation or alternative dispute resolution?

Yes, many civil lawyers are trained in alternative dispute resolution methods like mediation and arbitration, offering solutions outside the traditional courtroom setting.

8. How long does a typical civil lawsuit last?

The duration of a civil lawsuit varies based on the case’s complexity, the court’s schedule, and the willingness of parties to settle. It can range from a few months to several years.

Place of Supply Rules for Cloud Services: How Section 12 and 13 of the IGST Act Fail to Address Edge Computing and CDN Networks

Introduction The Integrated Goods and Services Tax Act, 2017 (IGST Act) was drafted before the rise

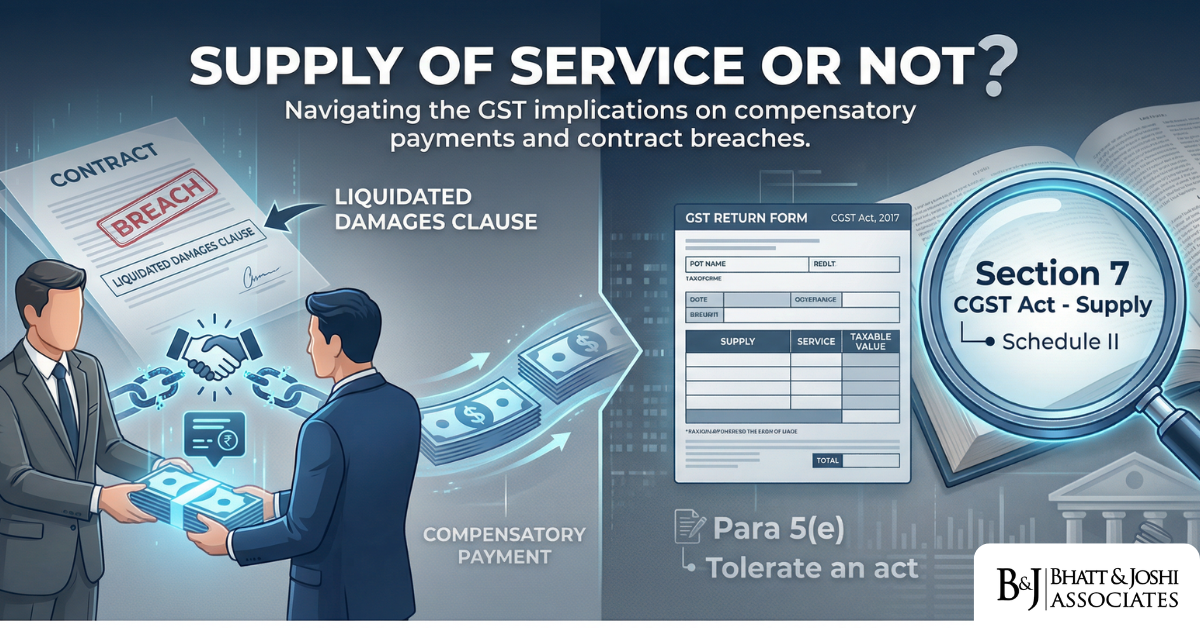

GST on Liquidated Damages: Supply of Service or Not? The Unsettled Jurisprudence After Safari Retreats

Introduction: Liquidated Damages and the Scope of “Supply” Under GST Few questions in Indian GST

GST on Corporate Guarantees: Taxability of No-Consideration Transactions Under Section 7(1)(c)?

Introduction A corporate guarantee, at its simplest, is a promise made by one company — typically

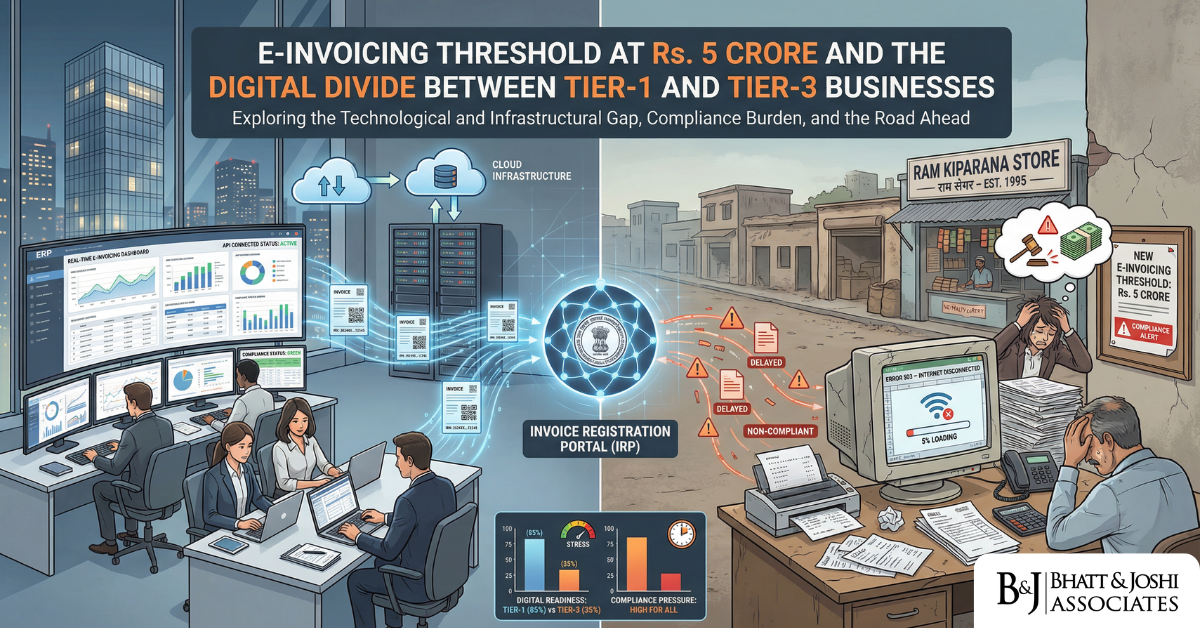

E-Invoicing Threshold Limit of Rs. 5 Crore: Analyzing the Digital Divide Between Tier-1 and Tier-3 Businesses

Introduction India’s Goods and Services Tax regime has always carried within it an ambitious u

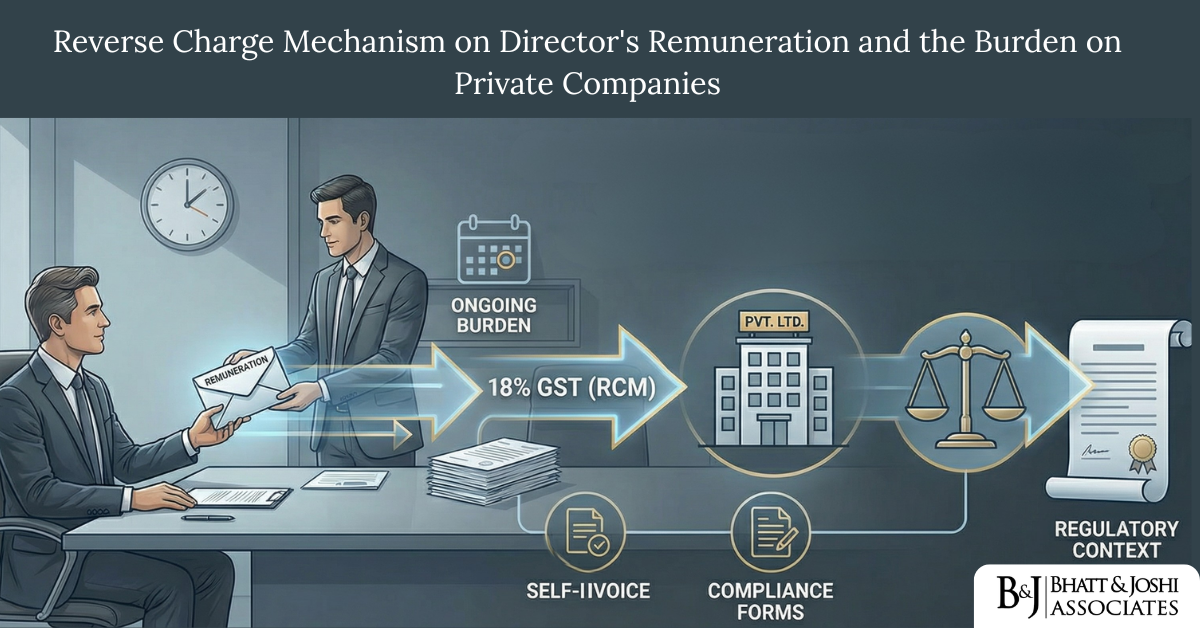

Reverse Charge Mechanism on Director’s Remuneration: The Unintended Tax Burden on Closely-Held Private Companies

Introduction There are very few provisions under the Goods and Services Tax framework that have mana

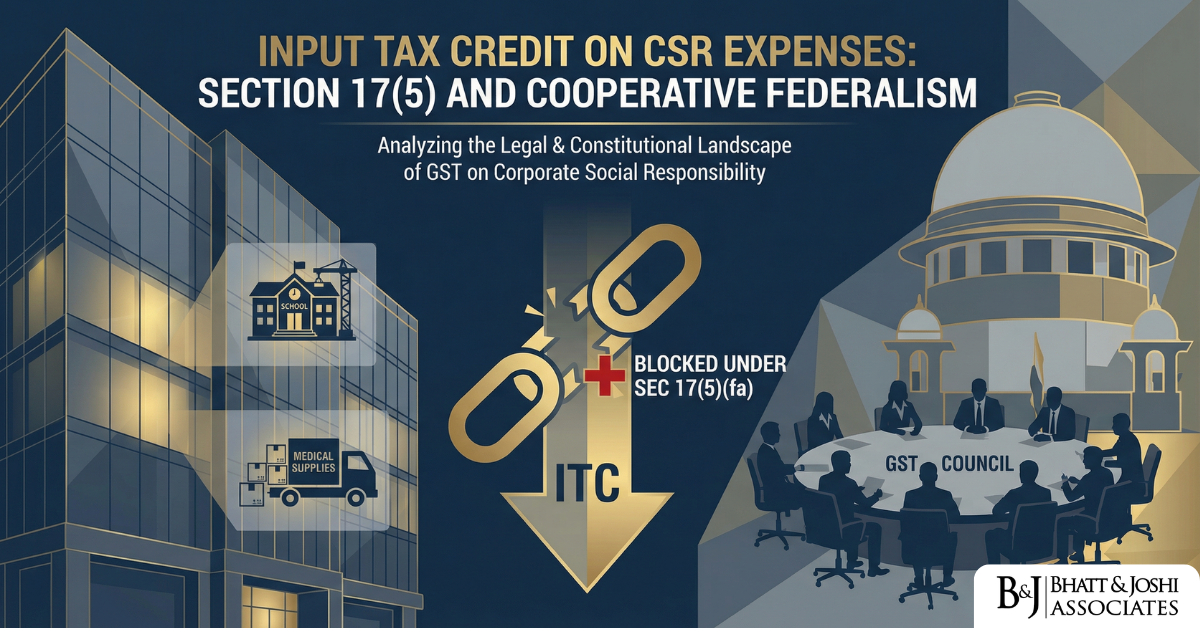

Input Tax Credit on CSR Expenses: Why the Statutory Exclusion Under Section 17(5) Contradicts Constitutional Cooperative Federalism

Introduction India’s Goods and Services Tax framework rests on a foundational promise: that ta

Female Genital Mutilation as a Constitutional Question: FGM, Dawoodi Bohras, and the Limits of Article 25

Introduction At the crossroads of bodily autonomy, religious freedom, and constitutional morality li

The Sabarimala 9-Judge Bench Of April 2026: Rewriting The Essential Religious Practices Test For All Of India

Introduction: The Moment India’s Religion-Law Relationship Gets Renegotiated On February 17, 2

Solid Waste Management Rules 2026 (SWM Rules 2026): Who Bears Legal Liability When Urban Local Bodies Fail Four-Stream Segregation?

Abstract: The Solid Waste Management Rules, 2026, notified by the Ministry of Environment, Forest an

Whatsapp

Whatsapp