Taxation Lawyer | Bhatt & Joshi Associates | Ahmedabad

Taxation Lawyers at Bhatt & Joshi Associates – Expert Legal Services for your Taxation Requirements

At Bhatt & Joshi Associates, we understand the complexity of taxation laws and the importance of experienced and qualified taxation lawyers. We offer our clients the finest and most knowledgeable Taxation Lawyers in Ahmedabad, Gujarat. Our team of professionals is proficient in all aspects of taxation laws, including Income Tax, Direct Tax, GST, and more.

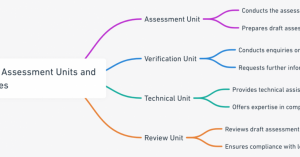

Our Taxation Lawyers provide a comprehensive range of services to our clients, including Law Compliance and Returns, Tax Law Documentation, Legal advice, and Litigation Support. We specialize in all aspects of tax law, including corporate tax, income tax, and GST compliance and registration services, as well as litigation services in the fields of Income Tax and GST.

Our Taxation Lawyers are experienced in inter-disciplinary domains, with critical analyzing skills to provide specific solutions to each situation. We provide advisory services on current government policies in relation to Foreign Investment (inbound) and Repatriation. Our Taxation Lawyers also provide legal taxation services for foreign companies and NRIs.

Our Services

- Corporate Tax – Our Taxation Lawyers and Consultants are skilled and experienced in providing professional advice on tax and regulatory matters on both sides, including Income Tax Lawyers and GST Lawyers.

- Income Tax – Our Taxation Lawyers offer advisory services, including filing of Income Tax Returns (ITR), scrutiny during Dual Taxation advice, foreign tax advice, and more.

- GST – We offer advice and compliance services for various kinds of taxes, including Direct and Indirect Taxation.

- Litigation Support – Our Taxation Lawyers excel at providing advisory services to enhance the levels of corporate governance within an organization. We also handle Income Tax Appeals and Tax Matters with the intention of dispensing optimum solutions. Our online legal documentation and advice related to tax laws are also available.

Our Expertise

At Bhatt & Joshi Associates, we believe that choosing the right Taxation Lawyer is crucial for your legal requirements. Our Taxation Lawyers are young and adept, with the ability to resolve legal disputes, negotiate, and handle contingent tax law matters. They possess efficient research abilities, adaptability to diverse information, and the ability to anatomize evidence. Our Taxation Lawyers are flexible and adaptive to the complex and amalgamated facts of taxation laws, which allows them to assess and provide selective data. They are capable of representing all factual data in front of the presiding officer, ensuring that your case is argued effectively.

Tax litigations can travel from the High Court to the Supreme Court, depending on the complexity of the case. Our Taxation Lawyers are prepared for these consequences and possess the necessary competency to provide foreign tax advice, Foreign Exchange Management Act (FEMA) compliance, and other services. They are well-versed in diverse fields to articulate the arguments proposed for the case accordingly.

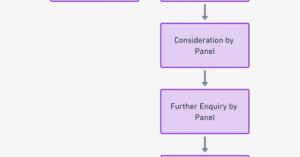

Our Taxation Lawyers offer expert legal services for all taxation requirements, whether it is related to the Income Tax Act, 1961, Customs Act, 1962, or GST Act, 2017 governing the Taxation Sector in India. We provide litigation support services to our clients for their requirements at CIT Appeals and ITAT, Appeal to the Commissioner of Customs (Appeals), GST Adjudicating Authority, First GST Appellate Authority, GST Appellate Tribunal, Customs, Excise, and Service Tax Appellate Tribunal (CESTAT), Gujarat High Court, and Supreme Court.

Choosing the Right Taxation Lawyer

Choosing the right Taxation Lawyer becomes important in the context of complex Taxation Structure of India, for original as well as appellate proceedings before commissioner of appeal, Gujarat High Court, and the Supreme Court of India for Taxation-related litigation support services. A skilled and experienced Taxation Lawyer must be aware of the ever-changing laws and CBDT, CBEC regulations and their strict compliances. They should be well-versed with diverse areas of law, know the multiple way outs to situations, and choose the most effective methodology.

Why Choose Bhatt & Joshi Associates for Taxation lawyers?

At Bhatt & Joshi Associates, we have a team of accomplished and knowledgeable Taxation Lawyers who exhibit traits of fact collection, legitimate research, and representation cohesively. We also have young minds with professionally experienced Taxation Lawyers to provide room for debate and exploration. We acknowledge the importance of references, case studies, and understand the underlying business fundamentals. If you are looking for a reliable and experienced Taxation lawyer in Gujarat, India, Bhatt & Joshi Associates could be a great choice for you. Here are some reasons why:

Experience and Expertise: Bhatt & Joshi Associates is a reputed law firm with over Several years of experience in handling legal matters related to Taxation petitions, among others. The team consists of experienced and knowledgeable lawyers who have successfully represented clients in various high-profile cases.

Personalized Approach: The firm takes a personalized approach to every case, which means that they take the time to understand your specific needs and requirements before formulating a legal strategy. They work closely with you to ensure that your case is handled in the best possible way.

Focus on Results: Bhatt & Joshi Associates is committed to achieving the best possible results for their clients. They use their legal expertise and experience to fight for your rights and interests.

Professionalism and Integrity: The firm follows the highest standards of professionalism and integrity in their work. They maintain confidentiality and transparency throughout the legal process and keep you informed at every stage of your case.

Client-Centric Services: Bhatt & Joshi Associates is known for providing client-centric services. They are easily accessible and responsive to your queries and concerns. We tale pride in building long-term relationships with our clients based on trust, reliability, and mutual respect.

In conclusion, At Bhatt & Joshi Associates, we have a fusion of young and adept Taxation Lawyers and consultants with a vast experience of over years in the field of taxation laws. We possess the knowledge, experience, and skills to provide optimum solutions to our clients’ legal requirements. Our Taxation Lawyers possess the necessary expertise in their field to represent you effectively. Choosing the right Taxation Lawyer is crucial, and we have a team of accomplished and knowledgeable Taxation Lawyers to assist you with your Taxation concerns and provide optimal results.

“Paying taxes is a way of contributing to the betterment of society and making sure that we all have the basic services we need.” – Unknown

Frequently Asked Questions

Read more on Taxation Laws

Get in Touch