Dispute Resolution Panel under Section 144C of the Income Tax Act

Introduction

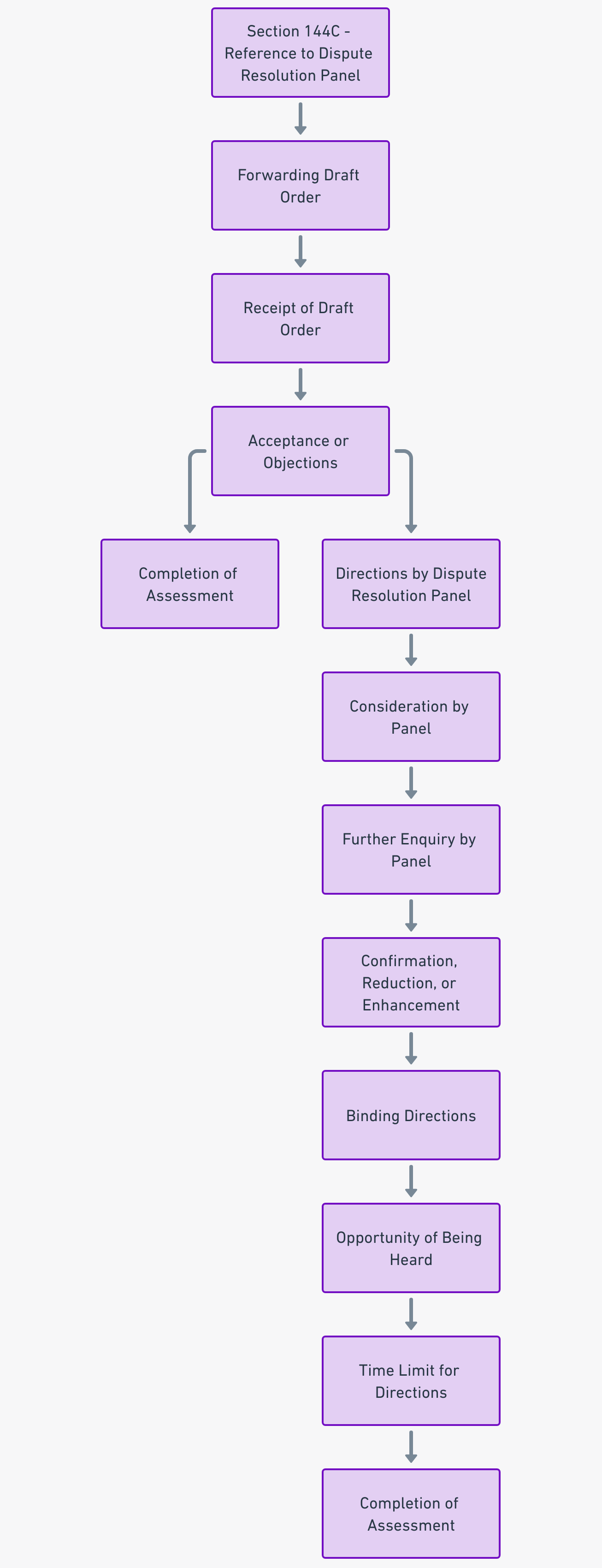

As previously discussed, Section 144B outlines the procedure for faceless assessment, Section 144C deals with the Dispute Resolution Panel. Together, they provide a comprehensive framework for conducting assessments in a faceless manner.

Under Section 144C of the Act, a distinct provision has been established to address specific eligible assessees ie., foreign companies and individuals in whose cases transfer pricing adjustments have been enacted according to sub-section (3) of section 92CA of the Act. In such scenarios, the Assessing Officer (AO) is mandated to take a preliminary step, outlined in the said section. This involves sending a draft assessment order to the eligible assessee, should the AO propose any alteration in the reported income or loss that could potentially undermine the assessee’s interests. This requirement ensures transparency and equity in the assessment process.

Subsequently, the eligible assessee retains the prerogative to raise objections to the proposed variations. These objections are directed to the Dispute Resolution Panel (DRP), which constitutes a collegium comprising three Principal Commissioners or Commissioners of Income-tax. It is noteworthy that the DRP holds a time frame of nine months to formulate and deliver directions. These directions, once issued, carry a binding effect on the Assessing Officer, thereby accentuating the significance of this particular provision in maintaining a fair and effective assessment procedure. Below is the detailed step-by-step process:

Forwarding Draft Order

According to this section, the Assessing Officer is required to send a preliminary draft assessment order, referred to as the draft order, to an eligible assessee if any proposed variation in the assessment could potentially harm the assessee’s interests. This process was introduced on or after October 1, 2009, as a means of ensuring transparency and fairness in the assessment procedure.

Receipt of Draft Order

Upon receiving the draft order, the eligible assessee is granted a period of thirty days to consider the proposed variations. During this time, the assessee has two options: (a) accept the variations and intimate the Assessing Officer accordingly, or (b) file objections to the proposed variations. These objections are to be submitted to both the Dispute Resolution Panel and the Assessing Officer.

Completion of Assessment on Draft Order

The Assessing Officer can proceed to finalise the assessment based on the draft order if the eligible assessee either accepts the proposed variations or fails to raise objections within the thirty-day window. This provision streamlines the assessment process while ensuring that the assessee’s concerns are appropriately addressed.

Passing Assessment Order

Despite the stipulations of sections 153 and 153B, the Assessing Officer is required to pass the assessment order within one month from the end of the month in which either the acceptance of variations is received from the assessee or the objection filing period expires. This timeline underscores the importance of timely assessments.

Directions by Dispute Resolution Panel

This section empowers the Dispute Resolution Panel, comprising three Principal Commissioners or Commissioners of Income-tax, to issue directions that guide the Assessing Officer in completing the assessment process when objections are raised by the eligible assessee. The panel’s role is pivotal in ensuring that the assessment is carried out justly and consistently.

Consideration by Dispute Resolution Panel

The Dispute Resolution Panel’s directions are formulated after a careful evaluation of various factors, including the draft order, objections filed by the assessee, furnished evidence, reports from relevant authorities, and collected evidence. This comprehensive consideration ensures that the panel’s directions are well-informed and equitable.

Further Enquiry by Panel

The Dispute Resolution Panel holds the authority to conduct further inquiries or request additional investigations if it deems them necessary before issuing directions. This provision enables the panel to gather all relevant information before making informed decisions.

Confirmation, Reduction, or Enhancement

Following its assessment, the Dispute Resolution Panel can choose to confirm, reduce, or enhance the proposed variations mentioned in the draft order. However, the panel cannot entirely set aside any proposed variation, and it is prohibited from issuing directions that would lead to further inquiries.

Binding Directions

Every direction issued by the Dispute Resolution Panel holds a binding effect on the Assessing Officer. This ensures uniformity and consistency in the assessment process and prevents discrepancies that could arise from different interpretations.

Opportunity of Being Heard

This section underscores the principles of natural justice by stipulating that no direction under sub-section (5) can be issued without granting the eligible assessee and the Assessing Officer an opportunity to be heard on directions that could affect their interests.

Time Limit for Directions

To ensure efficiency, the Dispute Resolution Panel must issue directions within nine months from the end of the month in which the draft order is sent to the eligible assessee. This provision prevents unnecessary delays in the assessment process.

Completion of Assessment

Upon receiving the directions from the Dispute Resolution Panel, the Assessing Officer is required to complete the assessment in line with those directions within one month from the end of the month in which the directions are received. This further emphasises the importance of timely assessment completion.

Conclusion

Section 144C of the Act establishes a well-defined framework tailored to specific eligible assessees, such as foreign companies and individuals subject to transfer pricing adjustments. This provision reinforces the principles of fairness and accountability within the assessment process. By requiring the Assessing Officer to transmit draft assessment orders and allowing eligible assessees to raise objections before the Dispute Resolution Panel, the section enhances transparency and safeguards the interests of the assessees. The DRP’s authority to issue binding directions within a stipulated timeframe further ensures consistency and promptness in assessment proceedings. This section’s targeted approach underscores the legislature’s commitment to a just and equitable income tax assessment system.