Gujarat Land Revenue Lawyer

As Land Revenue Lawyers at High Court of Gujarat, Bhatt & Joshi Associates has established a reputation for excellence in handling Revenue petitions. We understand that filing a Revenue litigation can be a complex and challenging process, requiring legal expertise and knowledge of the Revenue Laws. Our team of Revenue Lawyers has a deep understanding of the Revenue rules and related procedures, ensuring that your case is handled with the utmost professionalism and care.

We believe in providing personalized attention to each client, and our lawyers work closely with clients to understand their legal issues and objectives. We pride ourselves on our ability to provide prompt and effective legal solutions to clients, always keeping their interests at the forefront.

At Bhatt & Joshi Associates, we are committed to delivering the best possible outcome for our clients. Our lawyers have extensive experience in handling Revenue petitions, and we have a proven track record of success. We understand the importance of your case, and we work tirelessly to protect your legal rights and interests.

Overview of Land Tenure and key Land Revenue legislation in Gujarat

Land tenure is a complex state subject in India, with a chequered history of land reforms. Land tenure refers to the relationship between the landowner and the tenant or cultivator, and the rights and obligations of each party. The laws governing land tenure are complex, and it is important to choose the right revenue lawyer to ensure that your legal matters are dealt with in a professional and competent manner.

Lead Legislations Governing Revenue Laws

The two leading legislations governing the field of revenue laws in India are the Gujarat Land Revenue Code, of 1879 and Gujarat Tenancy Act, of 1948. The Gujarat Land Revenue Code lays down the rules and regulations related to land revenue matters in Gujarat. The Gujarat Tenancy Act, 1948 on the other hand, governs tenancy-related matters, such as the rights of the tenant, the obligations of the landlord, and the procedures for eviction.

Legal Services Offered

Our highly experienced and professional revenue lawyers handle revenue litigation matters before Land Revenue courts, Deputy Collector – Prant Officer, Collector Land Revenue, Gujarat Revenue Tribunal, SSRD – Special Secretary Revenue Department, Gujarat High Court, and Supreme Court. Our lawyers have the expertise and knowledge to handle complex revenue-related litigations and ensure that our client’s legal requirements are met with utmost precision and competency.

Why Choose Us?

Bhatt & Joshi Associates’ team of revenue lawyers has a combination of experienced, young and dynamic lawyers, and skilled fact collectors. Our lawyers have the ability to assess each pointer before presenting the case at various courts, including Gujarat High Court and Supreme Court. Our proficient revenue lawyers have excellent research abilities, knowledge of important case laws and points of reference, and are capable of presenting strong arguments in front of the presiding judge. Our team of revenue lawyers is thorough with diverse areas of law relating to land revenue matters, and we ensure that our client’s legal requirements are met with the utmost professionalism and competency.

Conclusion

Choosing the right revenue lawyer is crucial when dealing with complex land revenue matters. Bhatt & Joshi Associates provides professional and competent legal services related to land revenue matters. Our team of highly experienced and professional revenue lawyers has extensive knowledge and expertise in dealing with various revenue-related litigations. If you are looking for a trusted and experienced team of Revenue Lawyers for your High Court, SSRD, or GRT matter, Bhatt & Joshi Associates is the right choice for you. Contact us today for all your land revenue-related legal requirements.

Success is not the key to happiness. Happiness is the key to success. If you love what you are doing, you will be successful.

Get in touch with Best Gujarat Land Revenue Lawyer in Ahmedabad

Frequently asked questions

1. What does a land revenue lawyer specialize in?

Land revenue lawyers specialize in the legal aspects related to land ownership, land tax, and land revenue matters, ensuring compliance with regional and state regulations.

2.How can a land revenue lawyer assist me in Gujarat?

In Gujarat, a land revenue lawyer can guide you through the legal procedures of land acquisition, conversion, land tax disputes, land records verification, and other related land revenue matters.

3. Do I need a land revenue lawyer for land conversion processes?

While it’s possible to navigate the land conversion process on your own, a land revenue lawyer can expedite the procedure, ensuring that all legal requirements and paperwork are correctly managed.

4. Can a land revenue lawyer help resolve disputes regarding land taxes in Gujarat?

Yes, land revenue lawyers can represent and advise individuals or entities in disputes related to land taxes, ensuring accurate calculations and compliance with local laws.

5. How do Gujarat land revenue lawyers assist in cases of land acquisition by the government?

They can guide landowners through the legal rights and compensation processes, ensuring fair treatment and adherence to local and state regulations.

6. Are land revenue laws the same across all states in India?

No, land revenue laws can vary from state to state. In Gujarat, specific regulations and procedures apply, and it’s essential to consult with a local expert for guidance.

7. Can a land revenue lawyer assist in verifying land records and titles in Gujarat?

Yes, they can help clients access, verify, and understand land records, ensuring clear titles and avoiding potential legal disputes.

8. What is the significance of the 7/12 extract, and how can a land revenue lawyer help with it?

The 7/12 extract is a crucial document in Gujarat, indicating land ownership and other related details. A land revenue lawyer can assist in obtaining, verifying, and interpreting this document.

9. How can land revenue lawyers help in cases of land encroachments or boundary disputes?

They can assist in mediating disputes, representing clients in court if needed, and ensuring that property boundaries are legally established and protected.

10. Can a land revenue lawyer assist with agricultural land issues specifically?

Yes, they can advise on matters like land use, conversions, tax benefits, and other issues specifically related to agricultural land.

11. How do I know if my land falls under a specific zone, and what are the implications?

A land revenue lawyer can help determine the zoning of your land in Gujarat and advise on the associated rights, restrictions, and potential uses.

12. Do land revenue lawyers handle land inheritance disputes?

While they can assist in matters directly related to land revenue, complex inheritance disputes might require collaboration with a civil lawyer.

Can Appellate Court Criticism Demoralise Judges? Judicial Independence and the Chilling Effect

Introduction On 13 February 2026, Justice Pankaj Bhatia of the Allahabad High Court made a remarkabl

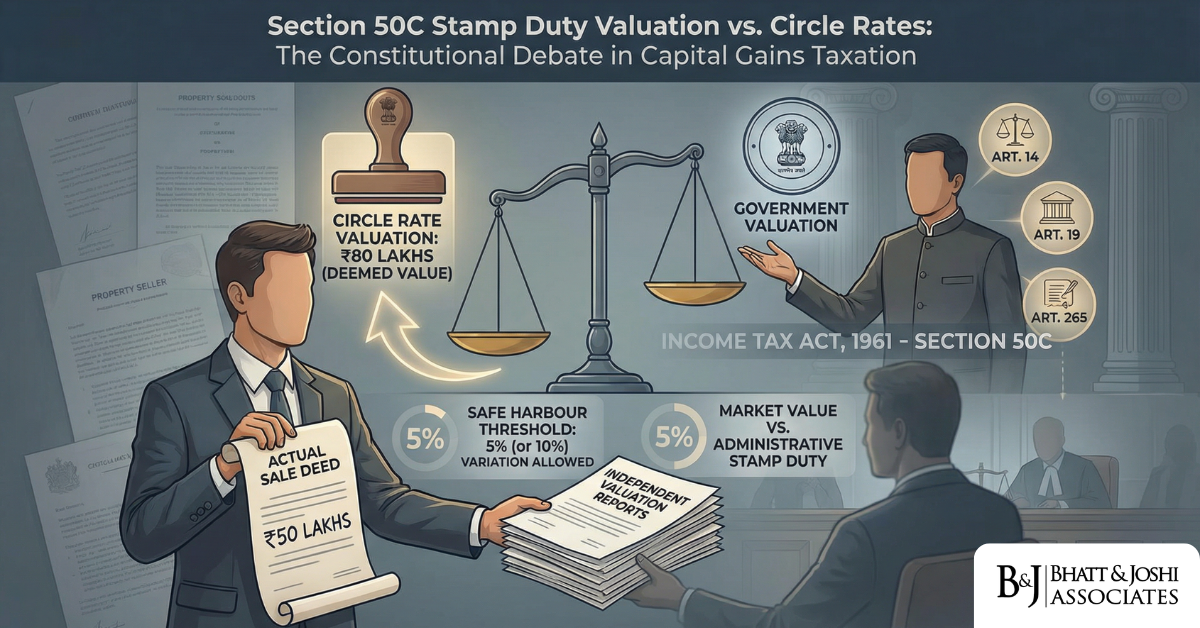

Section 50C of the Income Tax Act, 1961 Stamp Duty Valuation vs. Circle Rates: The Constitutional Validity of Deeming Fictions in Capital Gains

Introduction Few provisions in Indian income tax law generate as much sustained controversy, litigat

Livestream Donations and the TDS Gap on Creator Income in India: Why Streamers and Influencers Have No Withholding

Introduction India’s creator economy has grown into a multi-billion-rupee ecosystem, where gam

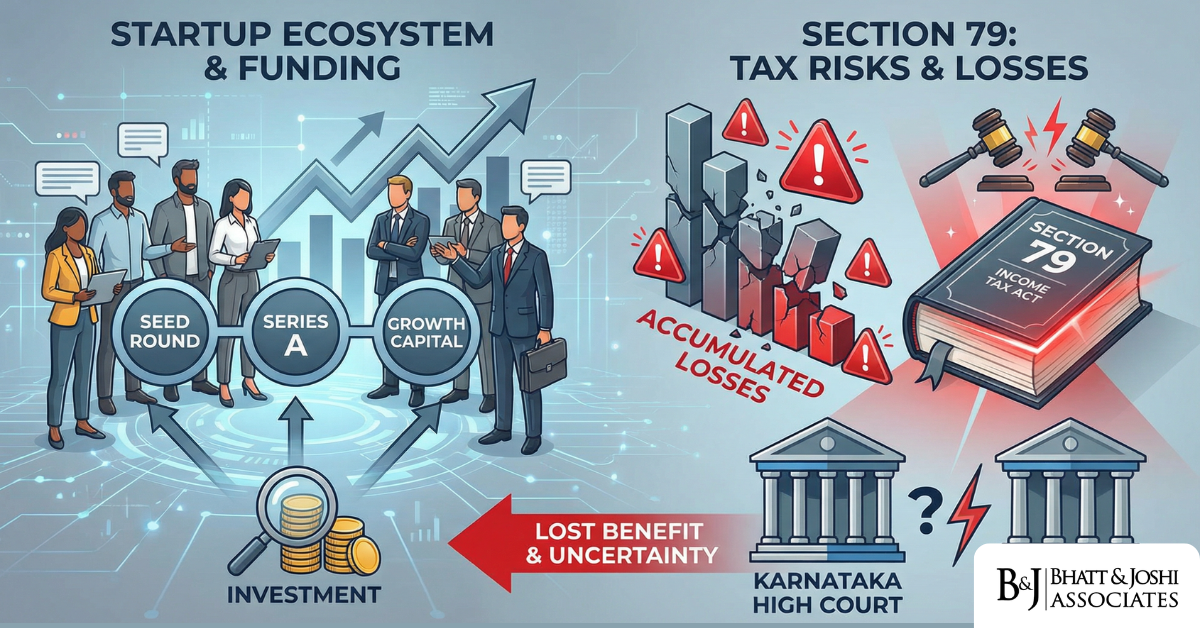

Startup Losses and Section 79 of the Income Tax Act, 1961: When Anti-Abuse Rules Kill Legitimate Restructuring

Introduction India’s startup ecosystem has grown into one of the most dynamic in the world, ye

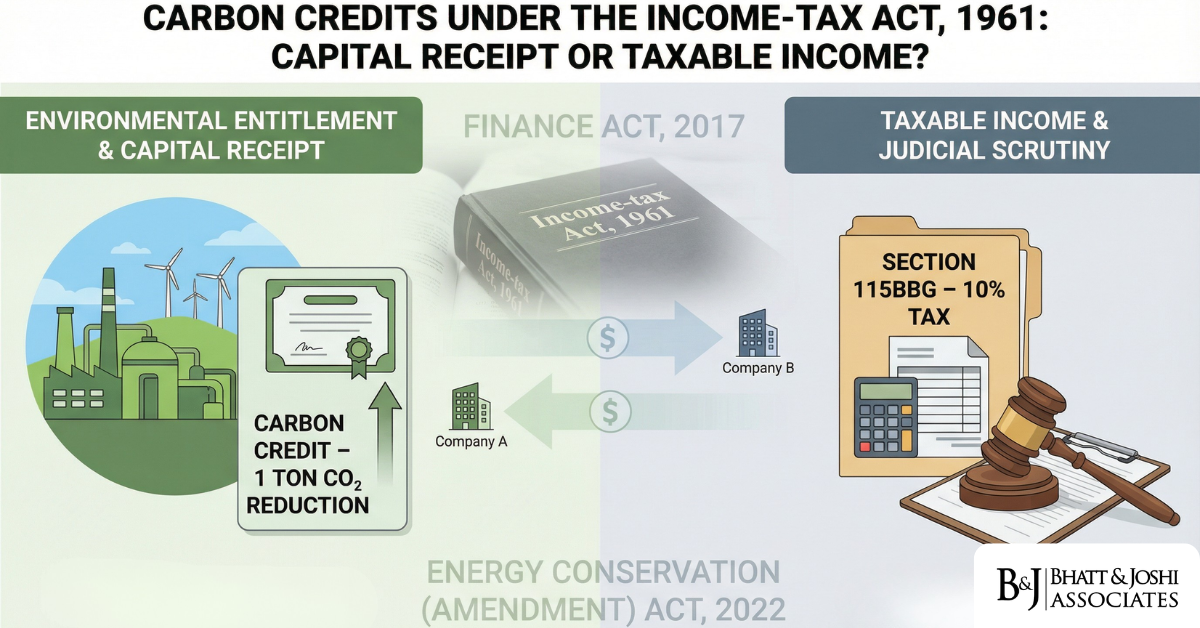

Income Tax Treatment of Carbon Credits: Asset, Income, or Capital Receipt Under the IT Act, 1961?

Introduction Carbon credits — formally known as Certified Emission Reductions (CERs) — have occu

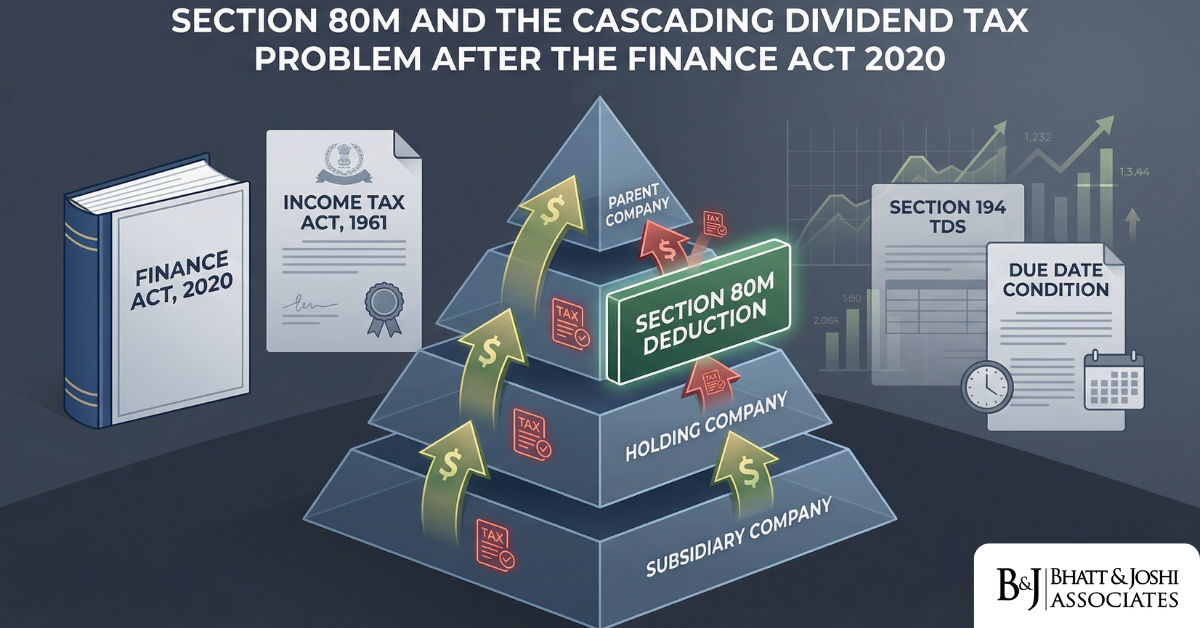

Section 80M Inter-Corporate Dividend Deduction: The Cascading Tax Problem the Finance Act 2020 Left Unresolved

Introduction When the Finance Act 2020 abolished the Dividend Distribution Tax (DDT) under Section 1

TDS on Salary for Remote Employees Across Multiple Indian States Under Section 192: Compliance Challenges”

Introduction The rise of remote work in post-pandemic India has created a TDS on salary compliance c

ESOP Taxation After Exit: Why Perquisite Tax at Exercise and Capital Gains at Sale Creates Double Taxation by Stealth

Introduction Employee Stock Option Plans (ESOPs) are among the most powerful instruments that Indian

Crypto Losses Under Section 115BBH: Why the No-Set-Off Rule Creates an Unconstitutional Tax on Notional Gains

Introduction When the Finance Act, 2022 introduced Section 115BBH into the Income Tax Act, 1961, it

Whatsapp

Whatsapp