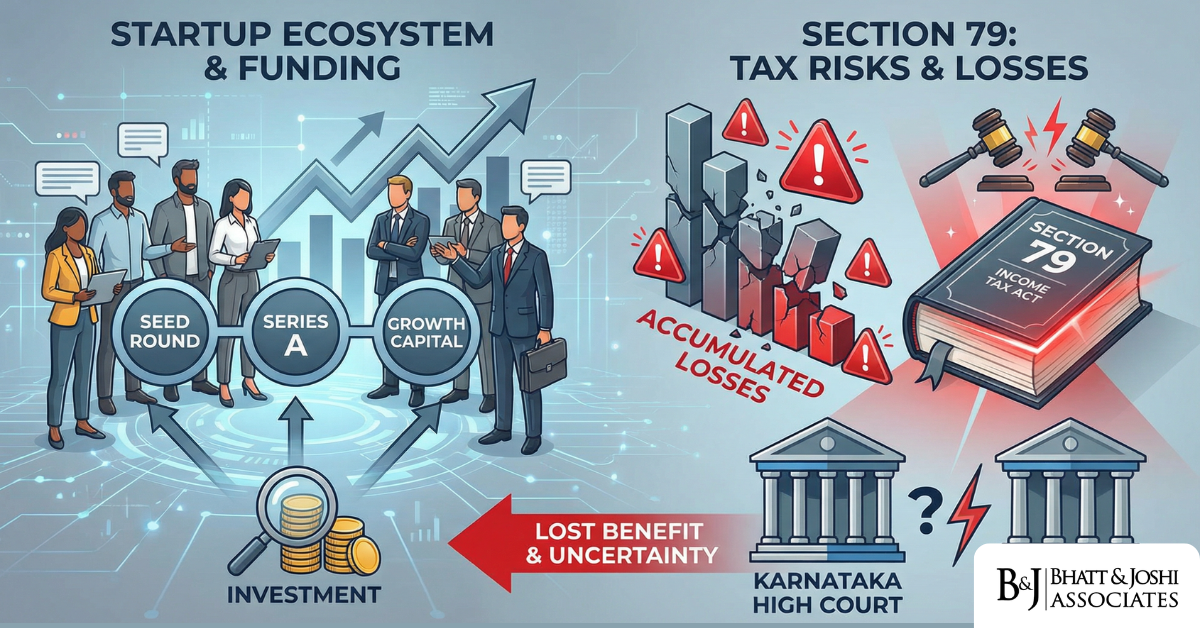

Startup Losses and Section 79 of the Income Tax Act, 1961: When Anti-Abuse Rules Kill Legitimate Restructuring

Introduction India’s startup ecosystem has grown into one of the most dynamic in the world, yet founders and investors continue to grapple with a tax provision that was never

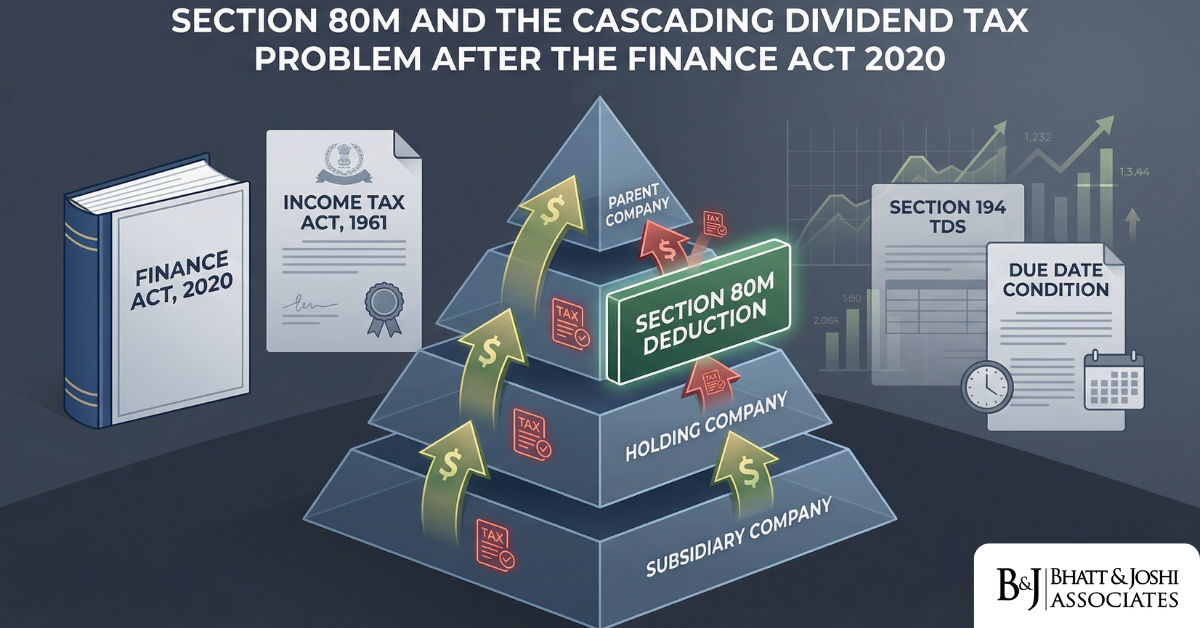

Section 80M Inter-Corporate Dividend Deduction: The Cascading Tax Problem the Finance Act 2020 Left Unresolved

Introduction When the Finance Act 2020 abolished the Dividend Distribution Tax (DDT) under Section 115-O of the Income Tax Act, 1961, India shifted from a company-level tax to the

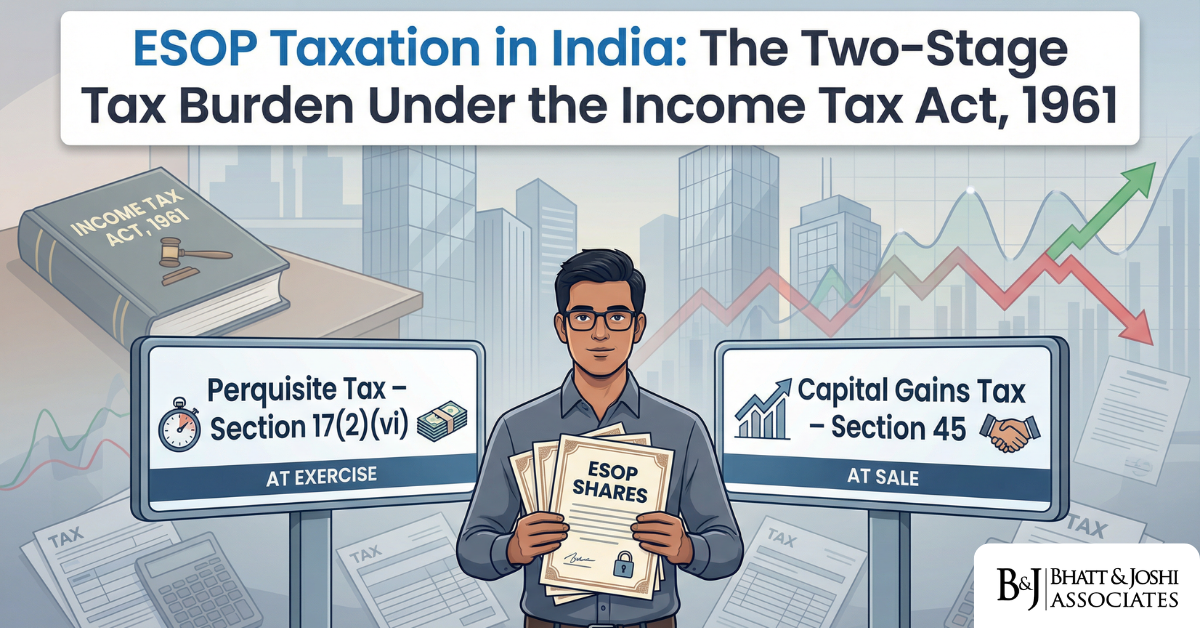

ESOP Taxation After Exit: Why Perquisite Tax at Exercise and Capital Gains at Sale Creates Double Taxation by Stealth

Introduction Employee Stock Option Plans (ESOPs) are among the most powerful instruments that Indian startups and companies use to attract, retain, and motivate talent. ESOPs give

Fractional Ownership of Real Estate and Income Tax: How Co-Ownership Platforms Fall Through the Cracks of Section 54 and 54F

Introduction Fractional ownership of real estate has moved from a niche arrangement between family members and business partners to a fully commercialised, technology-enabled inves

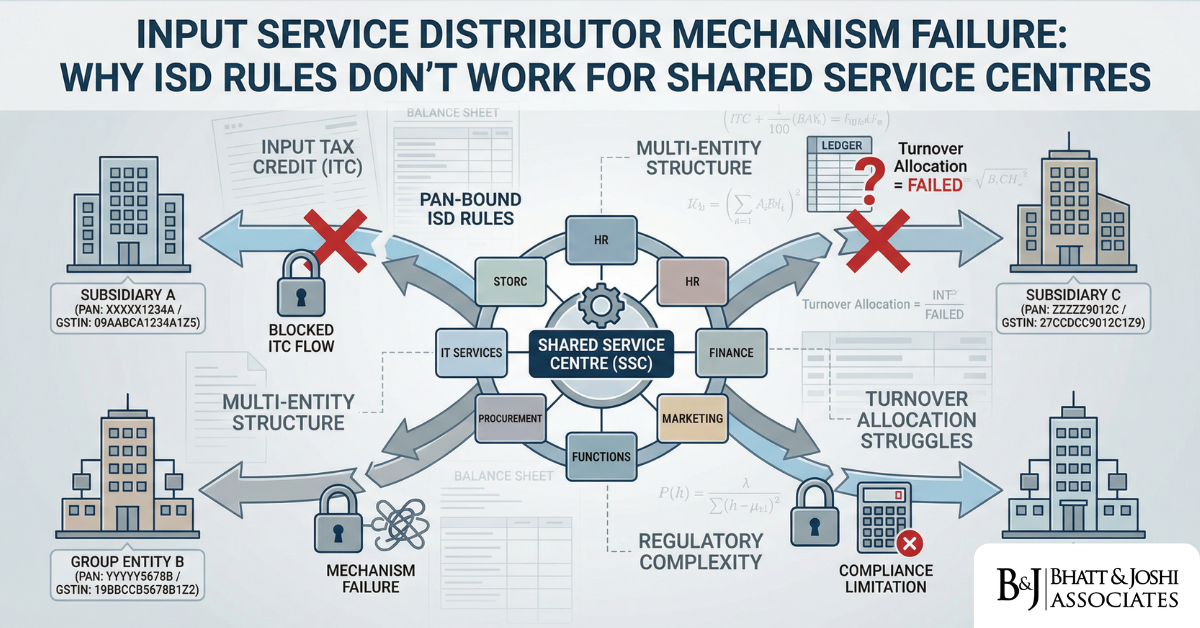

ISD Mechanism Failure in GST: Why Shared Service Centres in Group Companies Can’t Use ISD Rules

Introduction The Input Service Distributor (ISD) mechanism under India’s Goods and Services Tax (GST) framework was conceived as a practical solution for large businesses tha

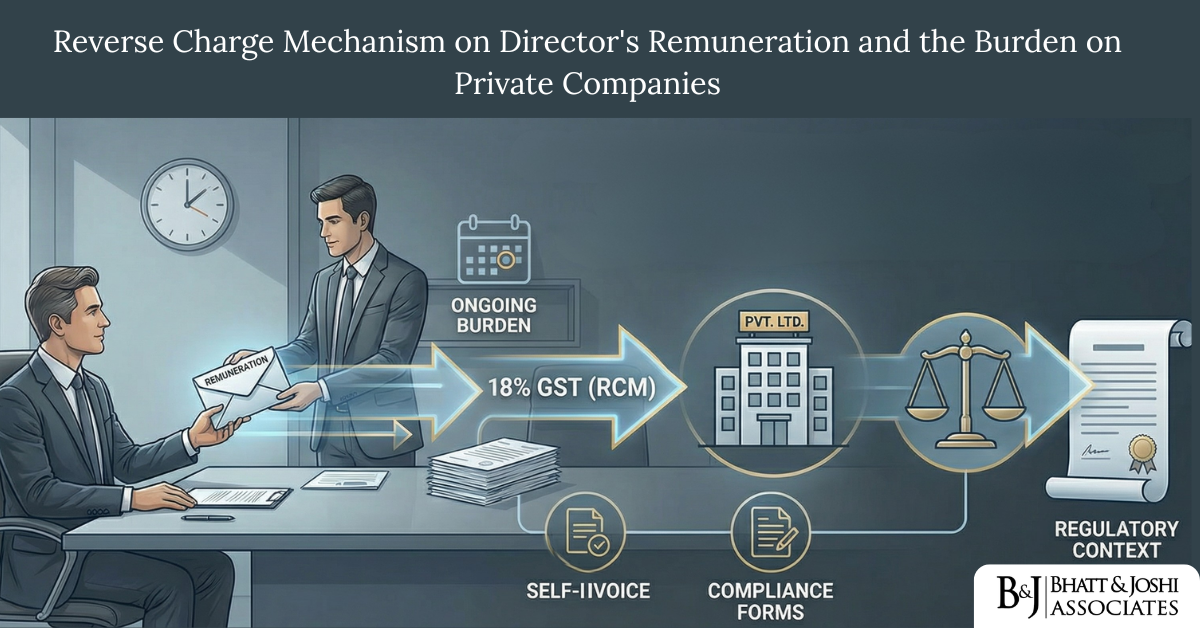

Reverse Charge Mechanism on Director’s Remuneration: The Unintended Tax Burden on Closely-Held Private Companies

Introduction There are very few provisions under the Goods and Services Tax framework that have managed to create as much practical difficulty for small and closely-held private co

Continuity of CrPC Discharge and Framing of Charges Under BNSS: Supreme Court Judgment in Dr. Anand Rai v. State of Madhya Pradesh

Introduction The replacement of the Code of Criminal Procedure, 1973 with the Bharatiya Nagarik Suraksha Sanhita, 2023 marked a major reform in Indian criminal procedure. Questions

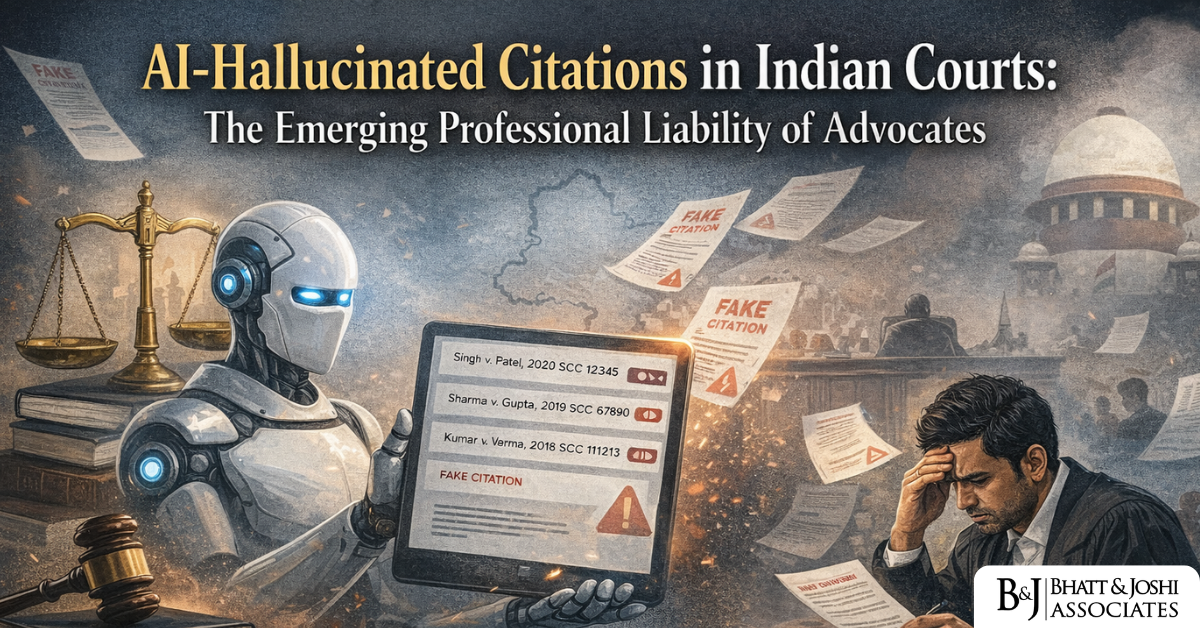

AI-Hallucinated Citations in Indian Courts: The Emerging Professional Liability of Advocates

Introduction The integration of artificial intelligence tools in legal practice has introduced unprecedented challenges to judicial systems worldwide. In India, the emergence of AI

EWS Reservation and Junior Residency Pay: When a Medical Stipend Determines Constitutional Eligibility

Introduction A quiet but constitutionally significant question has been building inside India’s medical education system for several years: what counts as ‘income’ when a doc

Can Courts Recall a Liquidation Order to Protect Market Sentiment: Judicial Economy or Judicial Overreach?

Abstract The Supreme Court of India’s handling of the Bhushan Power and Steel Limited (“BPSL”) insolvency has triggered one of the most consequential debates in I

Whatsapp

Whatsapp