Gujarat Revenue Tribunal | Bhatt & Joshi Associates | Ahmedabad

The Gujarat Revenue Tribunal (GRT) is a statutory body constituted under the Gujarat Revenue Tribunal Act, 1976. It is the highest appellate authority for revenue-related matters in the state of Gujarat. The Gujarat Revenue Tribunal (GRT) has primary jurisdiction over a range of revenue laws in Gujarat. At Bhatt & Joshi Associates, we provide legal services and litigation support to clients for matters falling under the purview of the Gujarat Revenue Tribunal (GRT)

Our Services

We offer a complete range of legal services and expert counsel on land revenue law in Gujarat. Our Gujarat Revenue Tribunal (GRT) lawyers provide advice on all land revenue law-related matters falling under the purview of the Gujarat Revenue Tribunal (GRT). We facilitate the online drafting of all documents, petitions, and representations related to land revenue laws through our expert Gujarat Revenue Tribunal (GRT) lawyers.

Powers of Gujarat Revenue Tribunal (GRT)

There are multiple revenue laws that fall under the purview of the Gujarat Revenue Tribunal (GRT)

- Bombay/Gujarat Public Trust Act, 1950

- Bombay/Gujarat Land Revenue Revenue Code

- Gujarat Tenancy And Agricultural Lands Act 1948

- The Gujarat Agricultural Lands Ceiling Act, 1960

- Jagir Abolition Act

- Talukdari Tenure Abolition Act

- Kutch Tenancy Act (Kutch and Vidarbh Area)

- Kutch Inam Abolition Act

- Saurashtra Land Reforms Act

- Estate Acquisition Act

- Barkhali Abolition Act

- Sarviging Alienation Abolition ACt

- Patal Watan Abolition Act

- Gujarat Panchayat Act, Section 113

- Bombay Revenue Tribunal Act, 1957

- The Gujarat Private Forests (Acquisition) Amendment Act, 1974

Our Expertise

Conclusion

The law is not an inflexible instrument wielded by remote, unknowable forces, but rather a vehicle for the continuing adaptation of society to the realities of social and economic changes.

Our Publications

Get in touch with Best Gujarat Revenue Tribunal Lawyers in Ahmedabad

Frequently asked questions

1. When should I consider hiring a civil lawyer?

You should consider hiring a civil lawyer when facing legal disputes related to contracts, property, personal injury, family matters, or any non-criminal matter where you need legal advice or representation.

2. What is a civil lawyer?

A civil lawyer represents clients in non-criminal legal matters, dealing with disputes between individuals, organizations, or both, over rights, responsibilities, and liabilities.

3. Can a civil lawyer help with contract disputes?

Yes, one of the primary areas of expertise for many civil lawyers is contract law. They can assist with drafting, reviewing, and disputing the terms of contracts.

4. How do civil lawyers differ from criminal lawyers?

While both handle legal disputes, civil lawyers focus on non-criminal cases, often involving private disputes between individuals or organizations. Criminal lawyers, on the other hand, represent individuals or the state in cases involving potential criminal penalties.

5. How are damages determined in civil cases?

Damages are determined based on the actual loss suffered, potential future losses, and sometimes, punitive measures. The nature and amount depend on the specifics of the case and jurisdictional guidelines.

6. What is the usual process of a civil lawsuit?

The typical process involves the filing of a complaint, response from the other party, discovery (exchange of relevant information), negotiations, potential settlement discussions, and if unresolved, a trial. The exact process can vary by jurisdiction.

7. Can a civil lawyer assist in mediation or alternative dispute resolution?

Yes, many civil lawyers are trained in alternative dispute resolution methods like mediation and arbitration, offering solutions outside the traditional courtroom setting.

8. How long does a typical civil lawsuit last?

The duration of a civil lawsuit varies based on the case’s complexity, the court’s schedule, and the willingness of parties to settle. It can range from a few months to several years.

Restorative Justice vs Retributive Justice in Indian Criminal Law

Introduction The Indian criminal justice system has historically operated predominantly on the found

GIFT City as a Hub for Centralised Treasury Functions: The GRCTC Framework

Introduction The Gujarat International Finance Tec-City, commonly known as GIFT City, represents Ind

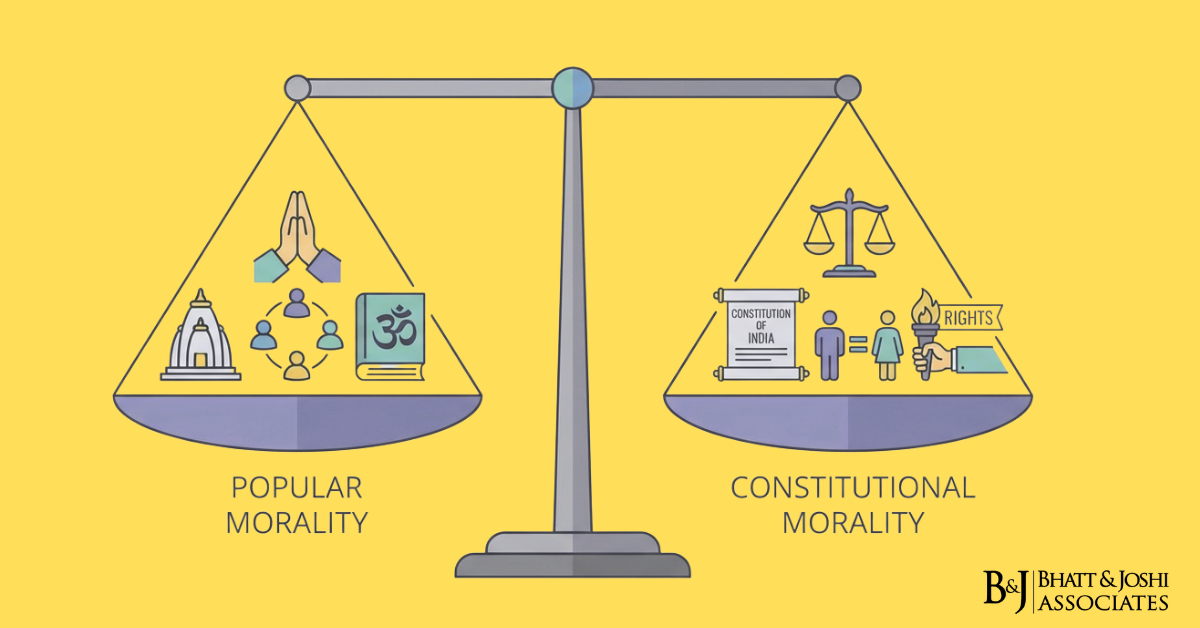

Constitutional Morality Vs Popular Morality: A Judicial Discourse on Rights and Freedoms in India

Introduction The tension between constitutional morality and popular morality represents one of the

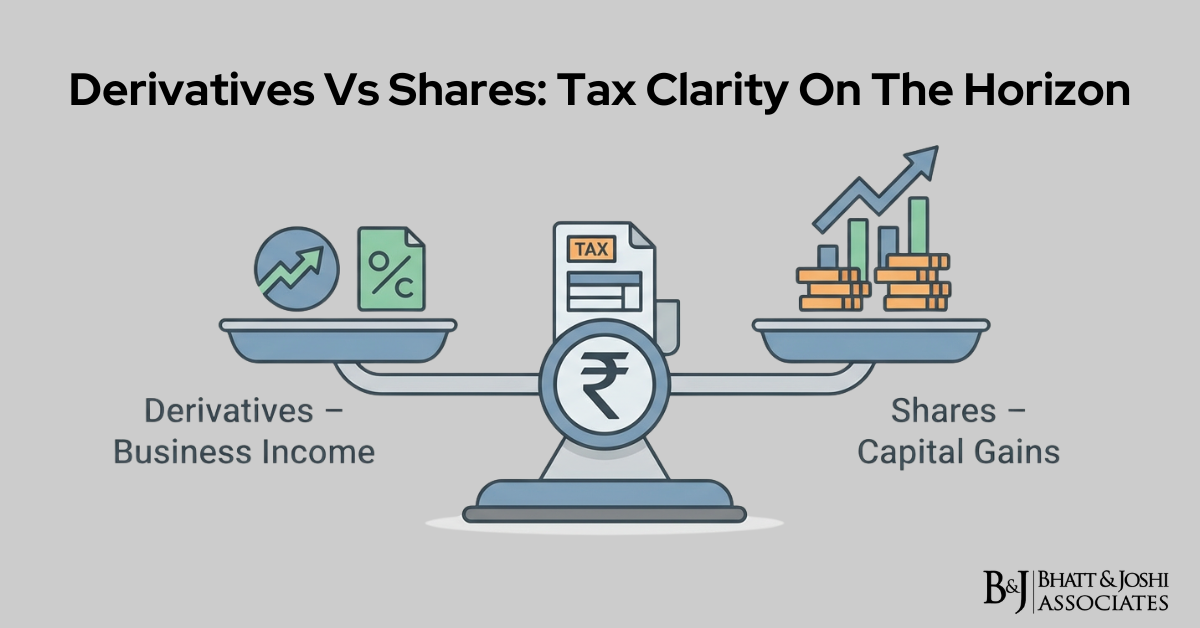

Derivatives Vs Shares: Tax Clarity On The Horizon

The Indian financial markets have witnessed unprecedented growth in derivative trading over the past

Judicial Discretion at the Intersection of Liberty and Process: A Treatise on Supreme Court Jurisprudence Regarding Anticipatory Bail During Pending Non-Bailable Warrants

1. Introduction: The Dialectics of Personal Liberty and Sovereign Compulsion The administration of c

Comprehensive Legal Defense Against Invocation of Section 74 of the CGST Act, 2017: Analyzing ‘Willful Suppression’ in the Context of Insolvency and Non-Realization of Professional Fees

Executive Summary The present legal analysis evaluates the defense strategy for a Writ Petition chal

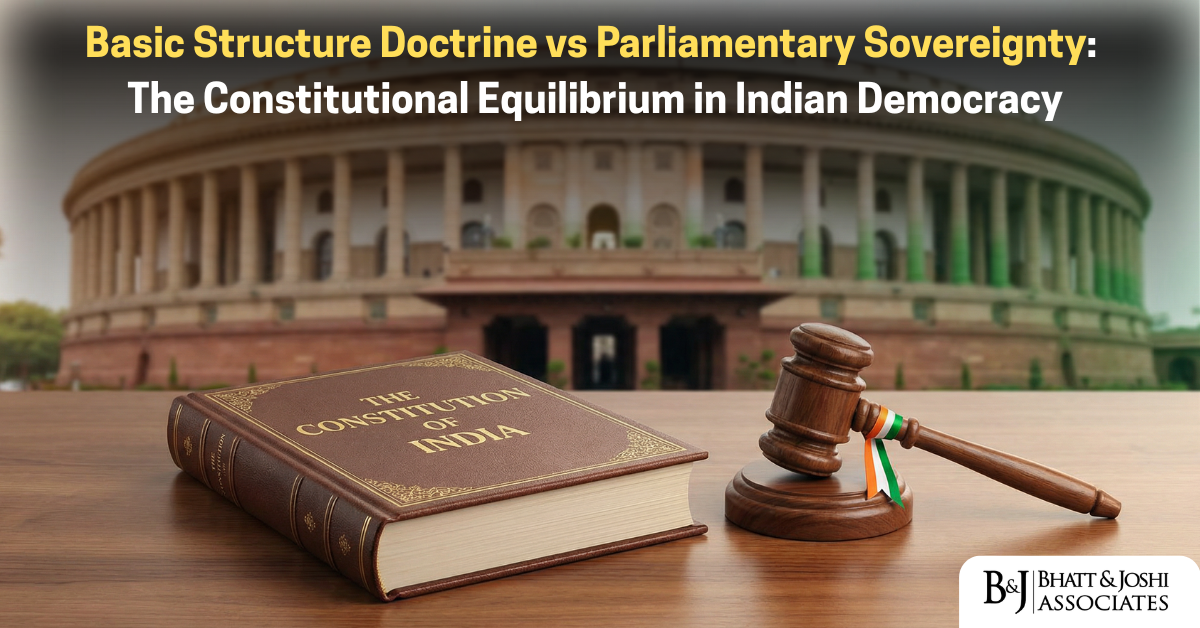

Basic Structure Doctrine vs Parliamentary Sovereignty: The Constitutional Equilibrium in Indian Democracy

Introduction The Indian Constitution represents a delicate balance between flexibility and rigidity,

Preventive Detention Laws vs Due Process Guarantees in India: A Constitutional Analysis

Introduction The intersection of preventive detention laws and due process guarantees represents one

Public Interest Litigation vs Locus Standi Doctrine: A Transformative Journey in Indian Jurisprudence

Introduction The Indian judicial landscape witnessed a revolutionary transformation during the post-

Whatsapp

Whatsapp