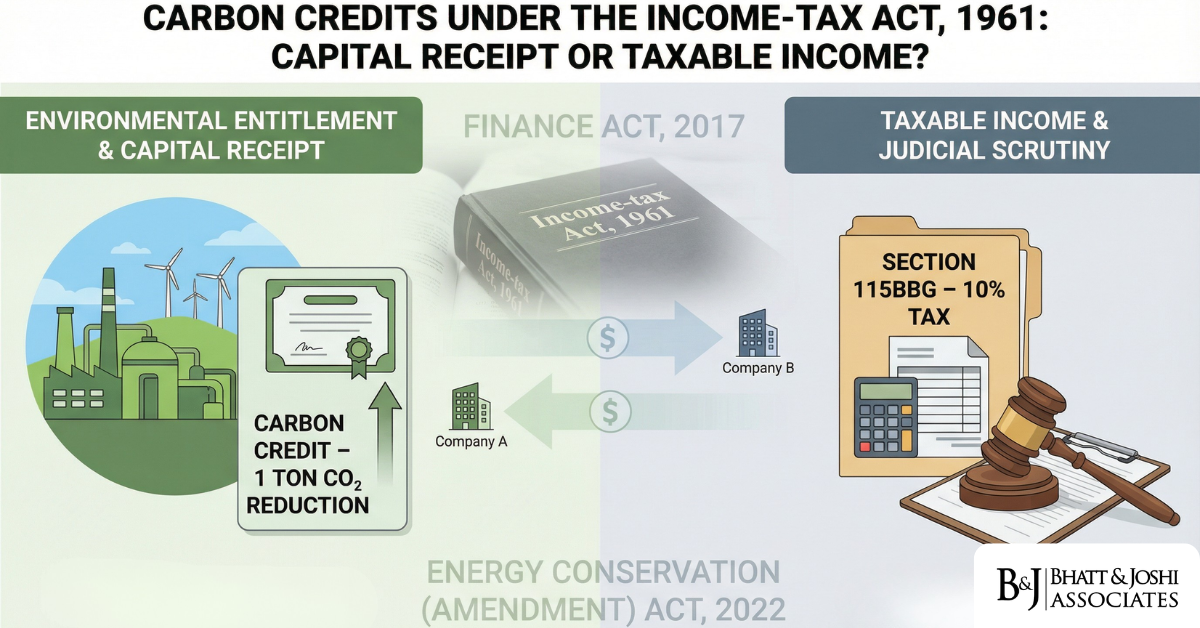

Income Tax Treatment of Carbon Credits: Asset, Income, or Capital Receipt Under the IT Act, 1961?

Introduction Carbon credits — formally known as Certified Emission Reductions (CERs) — have occupied an increasingly contentious space in Indian tax jurisprudence over the past

The Conversion Doctrine: Legal Validity of Converting a Section 133A Survey into a Section 132 Search under the Income Tax Act

Introduction The Indian tax administration system operates through distinct investigative mechanisms designed to detect and prevent tax evasion. Among these, the Income Tax Act, 19

Surveys under Section 133A: The Third-Party Trap in Chartered Accountant Offices

Introduction The Income Tax Department wields significant investigative powers to detect tax evasion and ensure compliance with fiscal laws. Among these powers, the authority to co

Whatsapp

Whatsapp