Fractional Ownership of Real Estate and Income Tax: How Co-Ownership Platforms Fall Through the Cracks of Section 54 and 54F

Introduction Fractional ownership of real estate has moved from a niche arrangement between family members and business partners to a fully commercialised, technology-enabled inves

Section 56(2)(viib) Angel Tax Abolition 2024: Retrospective Refund Rights of Startups Assessed Between 2012–2024

The Twelve-Year Burden: What Was Angel Tax? When Finance Minister Pranab Mukherjee introduced the Finance Act, 2012, he inserted a clause into the Income Tax Act, 1961 that would g

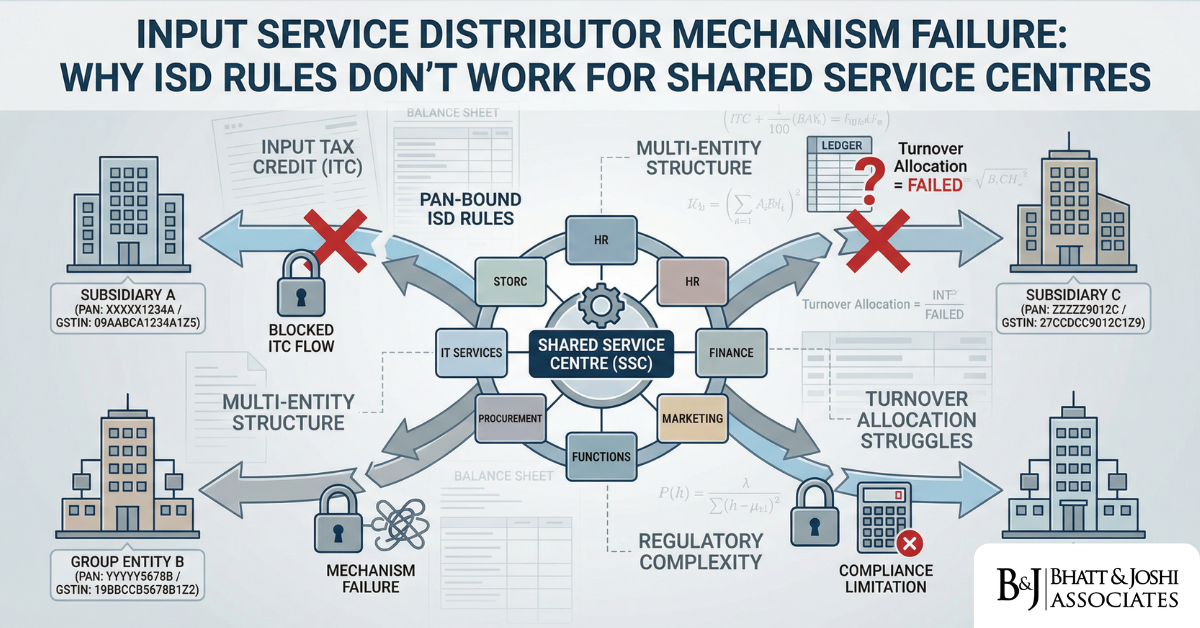

ISD Mechanism Failure in GST: Why Shared Service Centres in Group Companies Can’t Use ISD Rules

Introduction The Input Service Distributor (ISD) mechanism under India’s Goods and Services Tax (GST) framework was conceived as a practical solution for large businesses tha

GST on Crypto-to-Crypto Swaps: Is It Barter Under Schedule I, or Does Section 7 Even Apply to Decentralized Exchanges?

Introduction The law relating to GST on cryptocurrency in India occupies a space that is simultaneously over-discussed and under-resolved. As decentralized finance (DeFi) expands,

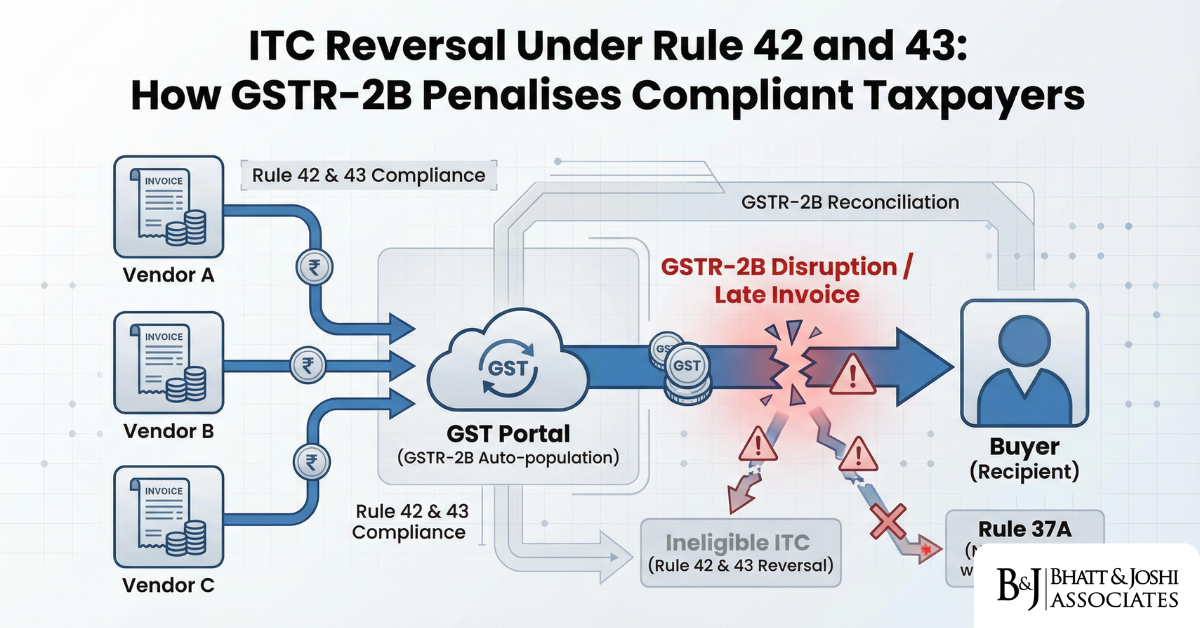

ITC Reversal Under Rule 42 and 43: Why the GSTR-2B Auto-Reversal Formula Penalises Compliant Taxpayers for Vendor Defaults

Introduction The Goods and Services Tax (GST) framework in India, introduced on 1 July 2017, was built on the promise of seamless Input Tax Credit (ITC) flow across the supply chai

Place of Supply Rules for Cloud Services: How Section 12 and 13 of the IGST Act Fail to Address Edge Computing and CDN Networks

Introduction The Integrated Goods and Services Tax Act, 2017 (IGST Act) was drafted before the rise of modern cloud services, edge computing, and Content Delivery Networks (CDNs) i

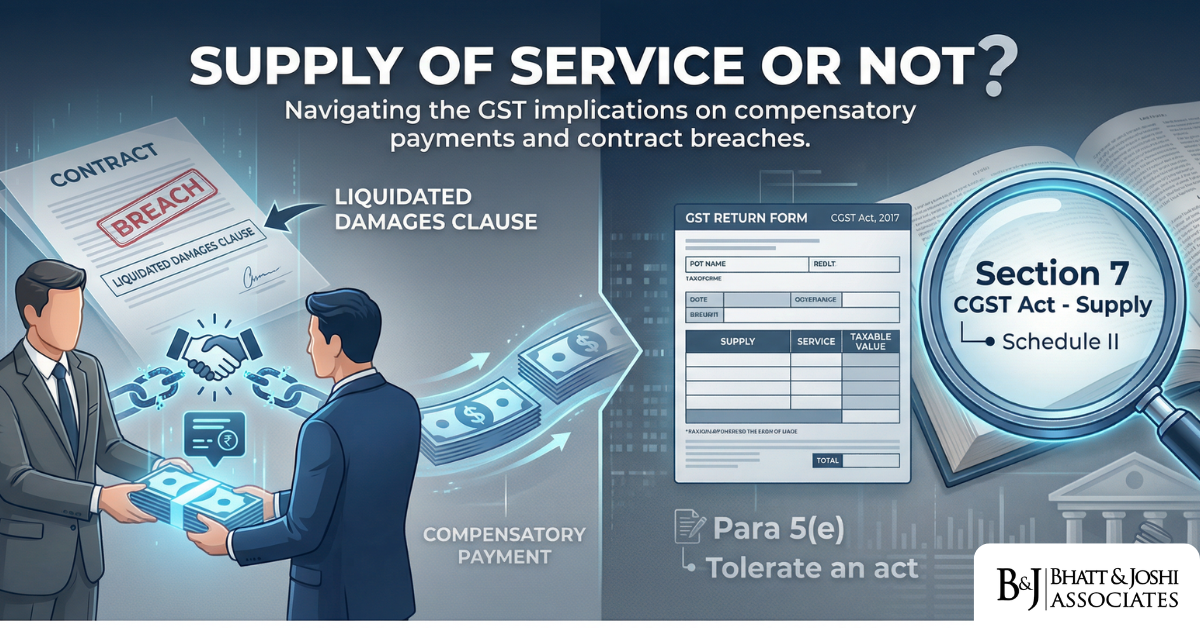

GST on Liquidated Damages: Supply of Service or Not? The Unsettled Jurisprudence After Safari Retreats

Introduction: Liquidated Damages and the Scope of “Supply” Under GST Few questions in Indian GST law have generated as much confusion at the field level as the one that seems d

GST on Corporate Guarantees: Taxability of No-Consideration Transactions Under Section 7(1)(c)?

Introduction A corporate guarantee, at its simplest, is a promise made by one company — typically a parent, holding, or group entity — to discharge the debt or fulfill the obli

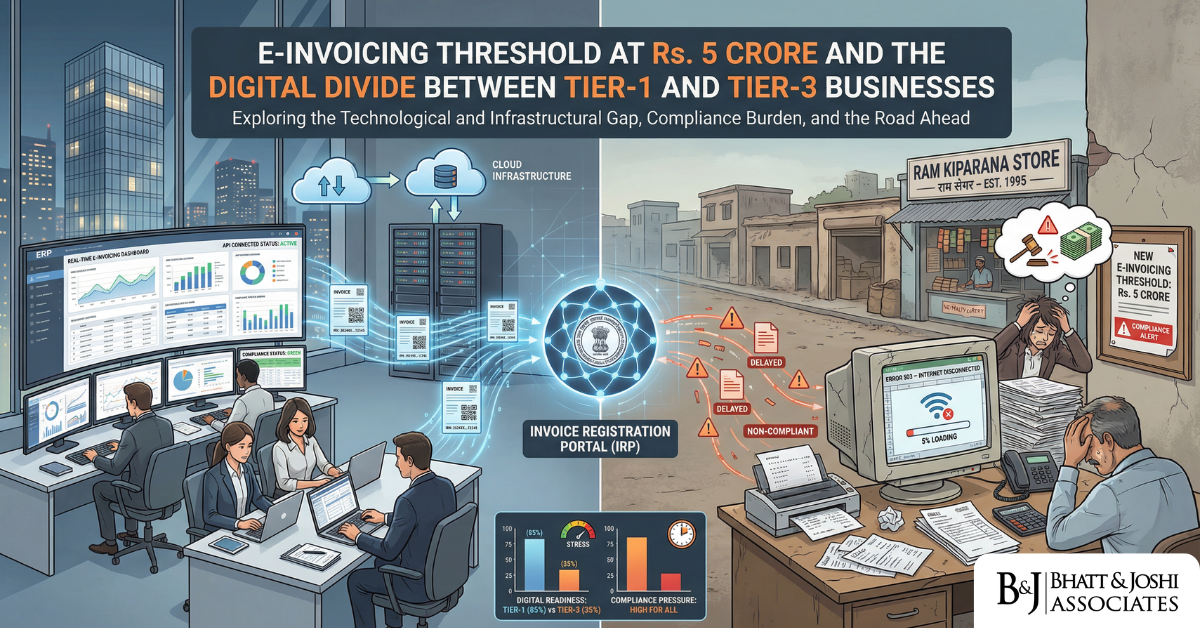

E-Invoicing Threshold Limit of Rs. 5 Crore: Analyzing the Digital Divide Between Tier-1 and Tier-3 Businesses

Introduction India’s Goods and Services Tax regime has always carried within it an ambitious undertaking — not just fiscal reform, but the wholesale digitalisation of how b

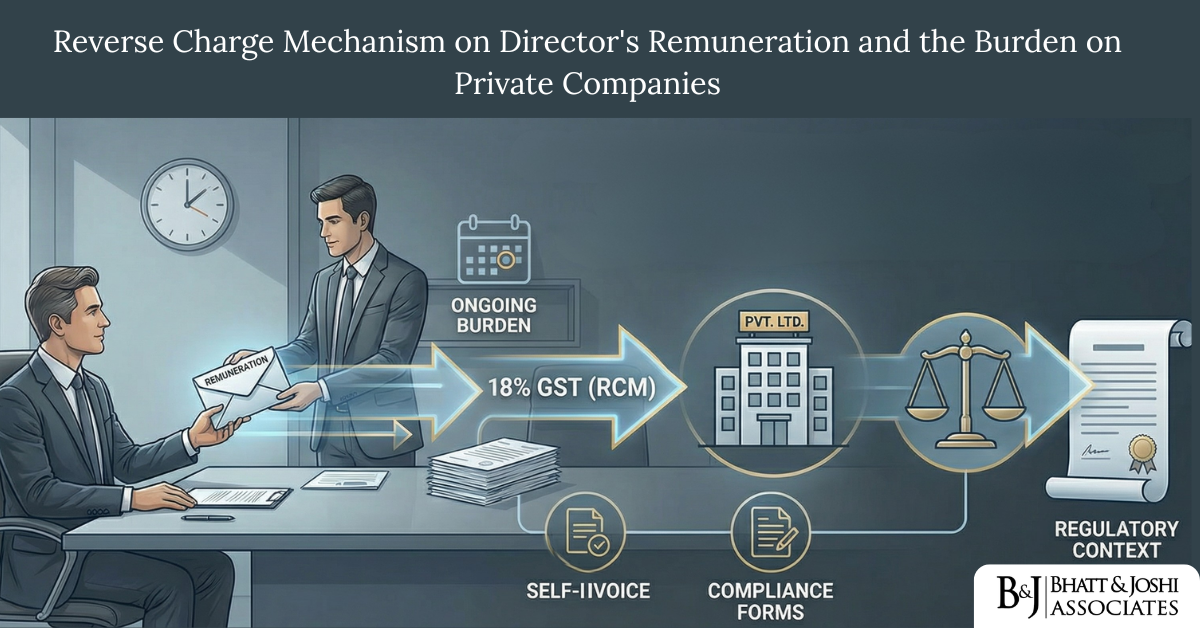

Reverse Charge Mechanism on Director’s Remuneration: The Unintended Tax Burden on Closely-Held Private Companies

Introduction There are very few provisions under the Goods and Services Tax framework that have managed to create as much practical difficulty for small and closely-held private co

Whatsapp

Whatsapp