Customs Appeal | Bhatt & Joshi Associates | Ahmedabad

Bhatt & Joshi Associates provides a wide range of litigation support services to their clients at the Customs Appeal in Ahmedabad. Our experienced team of lawyers assists clients in filing an appeal, representing them in hearings, and providing legal advice throughout the process. We offer various services such as drafting, filing, and submission of Customs Appeal petitions before the appropriate authorities, preparing and filing replies to show cause notices, and more.

Customs Appeal: A Comprehensive Guide to Stages and Forums

Customs duty is levied on goods imported into or exported out of a country. However, there may arise instances where a tax payer may disagree with the customs department’s decision on levying duty, classification of goods, valuation, or any other matter. In such cases, the tax payer has the right to file a customs appeal against the decision of the customs department. The customs appeal process involves multiple stages and forums where the tax payer can present their case. In this article, we will provide a comprehensive guide to the stages and forums for customs appeal and how Bhatt & Joshi Associates can provide litigation support services to their clients.

There are three stages of customs appeal:

1. First Stage – Original Proceedings / Order in Original passed after hearing of Show Cause Notice.

The first stage of appeal involves filing an appeal to the customs officer who passed the order. This appeal needs to be filed within 60 days from the date of receipt of the order. The customs officer then reviews the order and may either allow or reject the appeal. If the appeal is rejected, the tax payer can proceed to the second stage of appeal.

2. Second Stage – Appeal to the Commissioner of Customs (Appeals).

The second stage of appeal involves filing an appeal to the Commissioner of Customs (Appeals). This appeal needs to be filed within 60 days from the date of receipt of the order. The Commissioner of Customs (Appeals) then reviews the order and may either allow or reject the appeal. If the appeal is rejected, the tax payer can proceed to the third stage of appeal.

3. Third Stage – Appeal to the Customs, Excise and Service Tax Appellate Tribunal (CESTAT)

The third and final stage of appeal involves filing an appeal to the CESTAT. This appeal needs to be filed within 180 days from the date of receipt of the order. The CESTAT then reviews the order and may either allow or reject the appeal. If the appeal is rejected, the tax payer can approach the High Court.

There are Four forums where a Customs Appeal / Customs Matters can be heard:

- Customs Officer / Commissioner of Customs: At the first stage of hearing, the customs officer passes the order in Original, after issuance of SCN – Show cause notice and hearing the party concenred.

- Commissioner of Customs (Appeals) – At the second stage of appeal, the Commissioner of Customs (Appeals) is the forum for hearing the appeal. The Commissioner reviews the order and may either allow or reject the appeal. The Commissioner of Customs (Appeals) derives his powers from Section 128 of the Customs Act, 1962. This section provides for the appointment of a Commissioner of Customs (Appeals) who shall have jurisdiction over the whole of India and who shall exercise such powers and discharge such duties conferred or imposed on him under the Customs Act or any other law for the time being in force. The Commissioner of Customs (Appeals) has the power to hear appeals against any decision or order passed by any officer of customs lower in rank than him.

- Customs, Excise and Service Tax Appellate Tribunal (CESTAT): – At the third and final stage of appeal, the CESTAT is the forum for hearing the appeal. The CESTAT reviews the order and may either allow or reject the appeal. The CESTAT has the power to set aside, modify or confirm the order passed by the customs officer or the Commissioner of Customs (Appeals). The Customs, Excise and Service Tax Appellate Tribunal (CESTAT) derives its powers under the Customs Act, 1962, Section 129A, which provides for the establishment of CESTAT as an independent quasi-judicial body to hear appeals against orders passed by Customs authorities. CESTAT also hears appeals against orders passed by authorities under the Central Excise Act, 1944 and the Finance Act, 1994.

- Appellate Powers of High Court – Under Section 130 of the Customs Act, the High Court has the power to hear an appeal against the orders passed by the CESTAT. The appeal can be filed within 180 days from the date on which the order was received. The High Court can pass orders to confirm, modify or set aside the order passed by the CESTAT. That although the affected party may file an appeal before the High Court aggrieved by the order passed in appeal by the Appellate Tribunal. But, the appeal will be admitted before the High Court only if the High Court is satisfied that the case involves a substantial question of law or facts.

Writ Jurisdiction of High Court

Although multiple remedies are available under the Customs Act, 1962 there is always a constitutional provision available to represent tax litigations before the High Court, wherein a writ petition under Article 226 and Article 227 of the Indian Constitution can be filed.

The High Court has the power to quash any such order or decision if it is found to be illegal, arbitrary, or against the principles of natural justice. The court can also issue writs of mandamus to compel the tax authorities to perform their statutory duties or to prohibit them from acting beyond their powers.

In addition to writ petitions, appeals can also be filed before the High Court against orders passed by the Appellate Tribunal. However, it is important to note that appeals can only be filed on substantial questions of law and not on questions of fact.

In conclusion, the writ jurisdiction of the High Court is a powerful tool for taxpayers to challenge any illegal or arbitrary actions by the tax authorities. It is advisable to seek the assistance of a tax lawyer to understand the nuances of tax litigations and to effectively represent your case before the court.

Litigation Support Services by Bhatt & Joshi Associates

Our litigation support services include the following:

- Assessment of the case: Our team of lawyers analyses the case and provides an assessment of the legal options available to our clients.

- Documentation: We assist our clients in preparing the necessary documentation required for filing the appeal.

- Representation: Our experienced lawyers represent our clients before the customs officer, the Commissioner of Customs (Appeals) and the CESTAT, ensuring that their case is presented effectively.

- Compliance: We ensure that our clients are compliant with all the rules and regulations of the Customs Act, thereby reducing the risk of future litigation.

How Bhatt & Joshi Associates Can Help?

At Bhatt & Joshi Associates, we understand that Customs appeals can be complex and time-consuming. We have a team of experienced Customs appeal lawyers who are well-versed in Customs laws and regulations. Our lawyers can help you at every stage of the appeal process, from filing the appeal to representing you in front of the appellate authorities.

We provide our clients with customized legal solutions that are tailored to their specific needs. Our lawyers work closely with our clients to understand their business and their objectives, and then develop a legal strategy that is designed to achieve those objectives.

Our team of Customs appeal lawyers has a track record of success in handling complex and challenging appeals. We have a deep understanding of the Customs laws and regulations and can provide our clients with sound legal advice that is based on our extensive experience.

If you are looking for the services of the best Customs appeal lawyers in Ahmedabad, look no further than Bhatt & Joshi Associates. We are committed to providing our clients with high-quality legal services that are designed to help them achieve their objectives. Contact us today to schedule a consultation with one of our experienced Customs appeal lawyers.

The freer the flow of world trade, the stronger the tides for economic growth and global prosperity.

Our Publications

Get in touch with Best Customs Appeal Lawyers in Ahmedabad

Frequently asked questions

1. When should I consider hiring a civil lawyer?

You should consider hiring a civil lawyer when facing legal disputes related to contracts, property, personal injury, family matters, or any non-criminal matter where you need legal advice or representation.

2. What is a civil lawyer?

A civil lawyer represents clients in non-criminal legal matters, dealing with disputes between individuals, organizations, or both, over rights, responsibilities, and liabilities.

3. Can a civil lawyer help with contract disputes?

Yes, one of the primary areas of expertise for many civil lawyers is contract law. They can assist with drafting, reviewing, and disputing the terms of contracts.

4. How do civil lawyers differ from criminal lawyers?

While both handle legal disputes, civil lawyers focus on non-criminal cases, often involving private disputes between individuals or organizations. Criminal lawyers, on the other hand, represent individuals or the state in cases involving potential criminal penalties.

5. How are damages determined in civil cases?

Damages are determined based on the actual loss suffered, potential future losses, and sometimes, punitive measures. The nature and amount depend on the specifics of the case and jurisdictional guidelines.

6. What is the usual process of a civil lawsuit?

The typical process involves the filing of a complaint, response from the other party, discovery (exchange of relevant information), negotiations, potential settlement discussions, and if unresolved, a trial. The exact process can vary by jurisdiction.

7. Can a civil lawyer assist in mediation or alternative dispute resolution?

Yes, many civil lawyers are trained in alternative dispute resolution methods like mediation and arbitration, offering solutions outside the traditional courtroom setting.

8. How long does a typical civil lawsuit last?

The duration of a civil lawsuit varies based on the case’s complexity, the court’s schedule, and the willingness of parties to settle. It can range from a few months to several years.

Can Appellate Court Criticism Demoralise Judges? Judicial Independence and the Chilling Effect

Introduction On 13 February 2026, Justice Pankaj Bhatia of the Allahabad High Court made a remarkabl

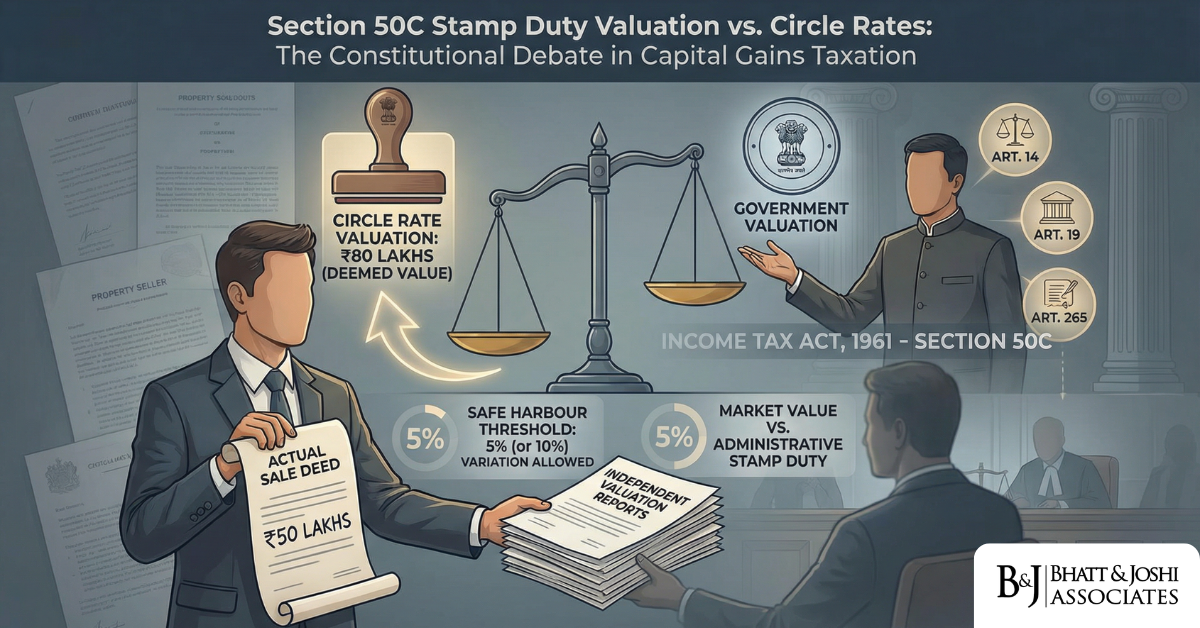

Section 50C of the Income Tax Act, 1961 Stamp Duty Valuation vs. Circle Rates: The Constitutional Validity of Deeming Fictions in Capital Gains

Introduction Few provisions in Indian income tax law generate as much sustained controversy, litigat

Livestream Donations and the TDS Gap on Creator Income in India: Why Streamers and Influencers Have No Withholding

Introduction India’s creator economy has grown into a multi-billion-rupee ecosystem, where gam

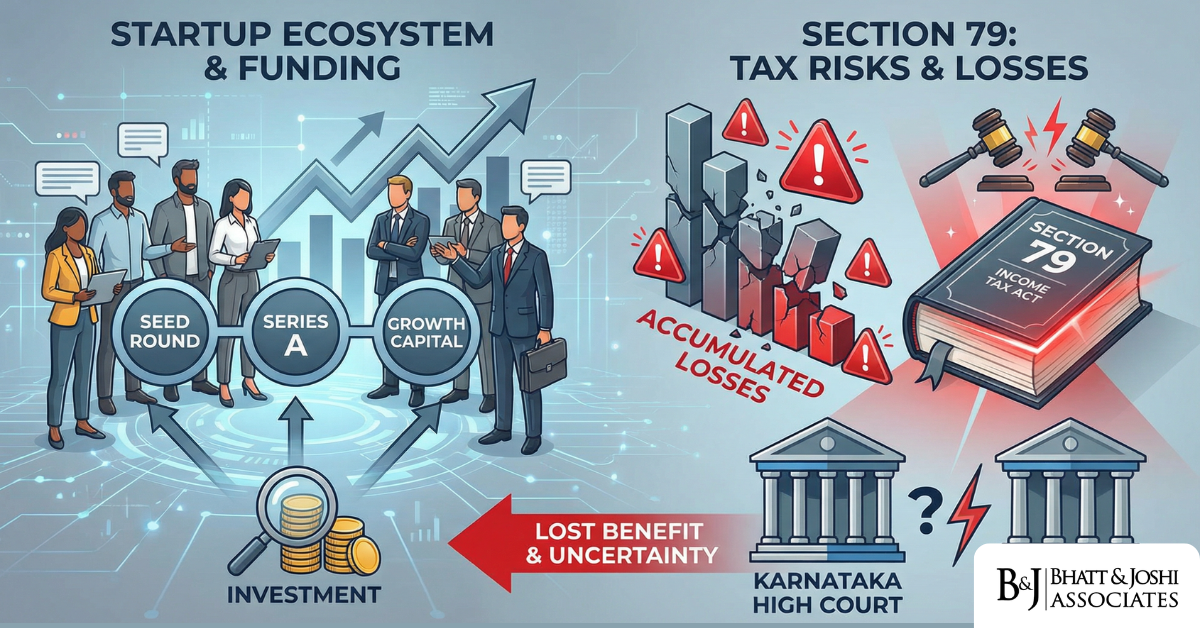

Startup Losses and Section 79 of the Income Tax Act, 1961: When Anti-Abuse Rules Kill Legitimate Restructuring

Introduction India’s startup ecosystem has grown into one of the most dynamic in the world, ye

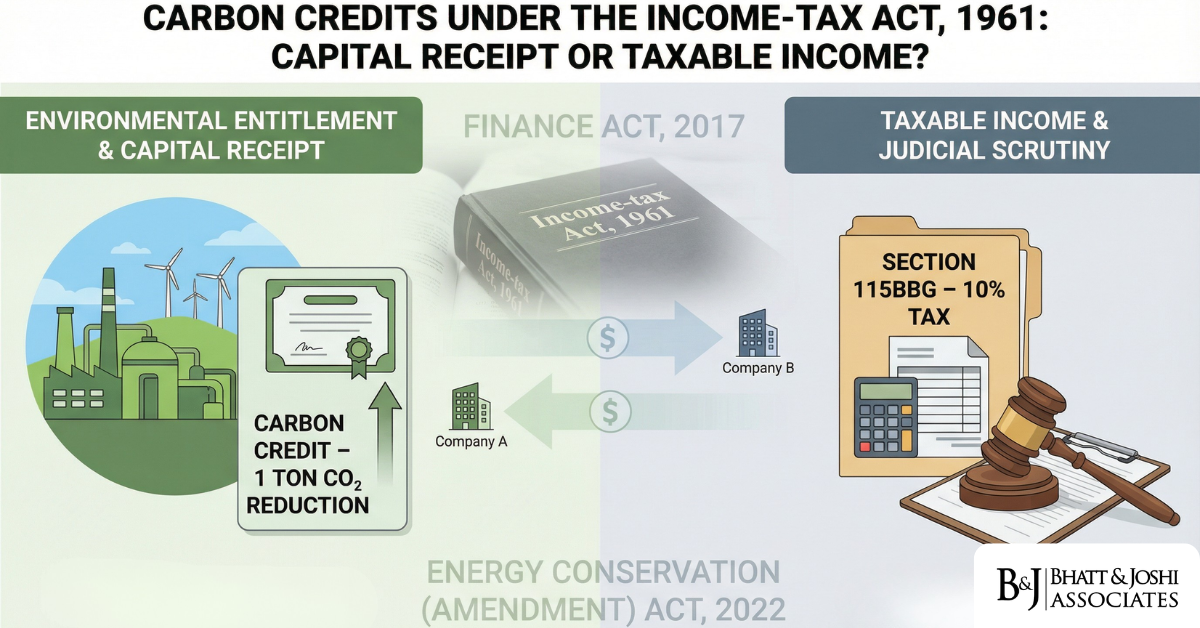

Income Tax Treatment of Carbon Credits: Asset, Income, or Capital Receipt Under the IT Act, 1961?

Introduction Carbon credits — formally known as Certified Emission Reductions (CERs) — have occu

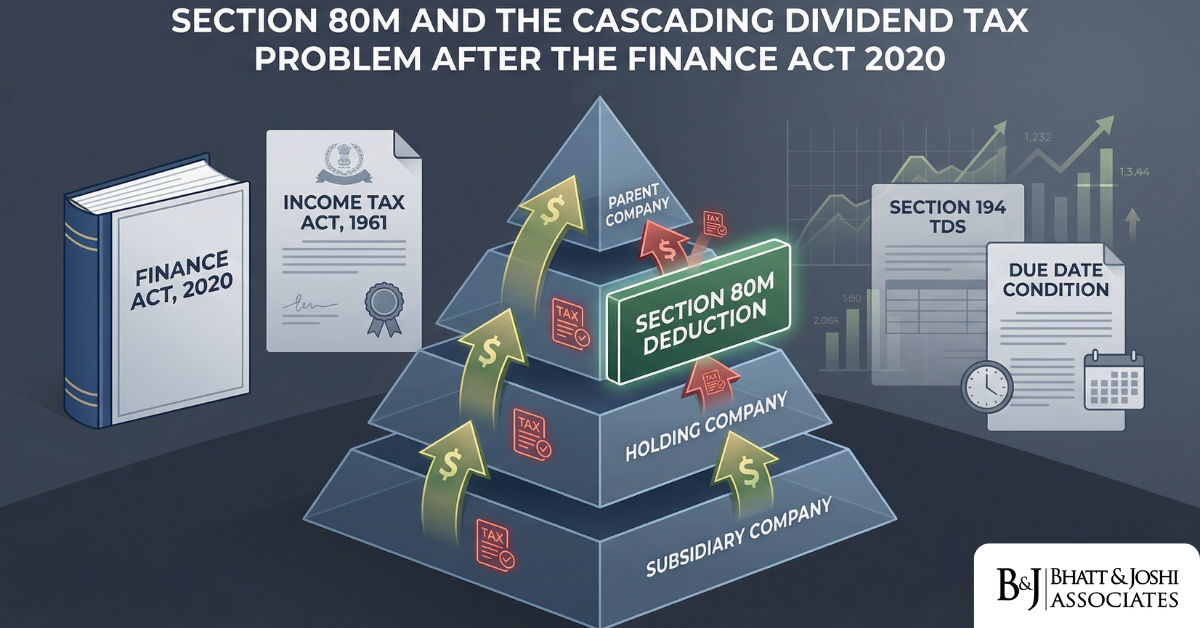

Section 80M Inter-Corporate Dividend Deduction: The Cascading Tax Problem the Finance Act 2020 Left Unresolved

Introduction When the Finance Act 2020 abolished the Dividend Distribution Tax (DDT) under Section 1

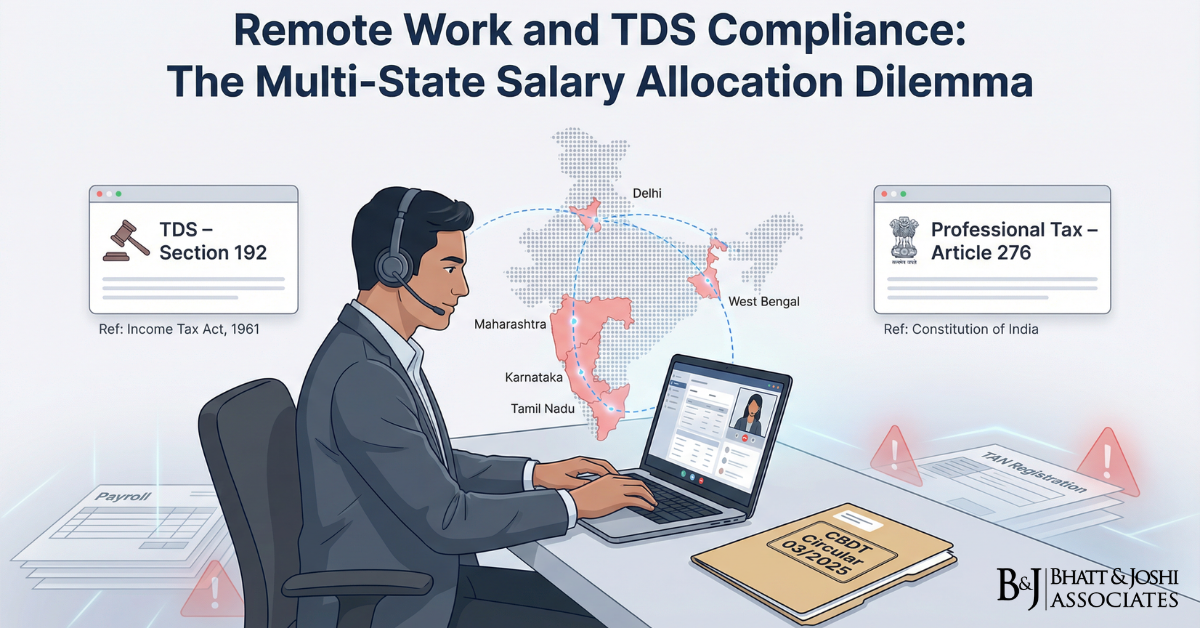

TDS on Salary for Remote Employees Across Multiple Indian States Under Section 192: Compliance Challenges”

Introduction The rise of remote work in post-pandemic India has created a TDS on salary compliance c

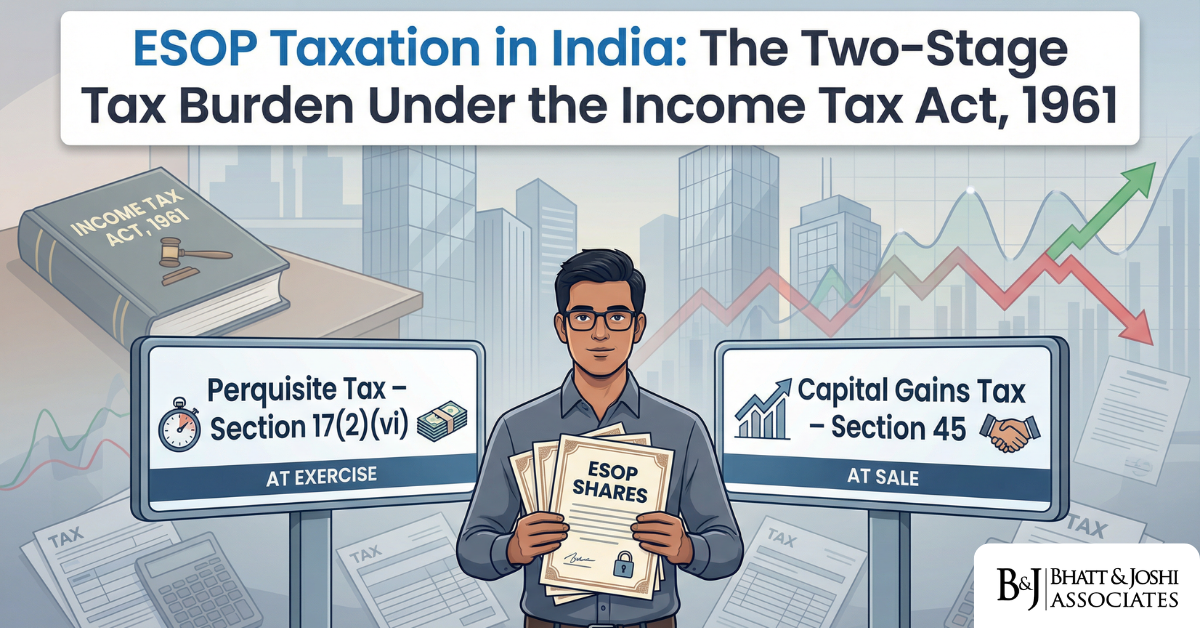

ESOP Taxation After Exit: Why Perquisite Tax at Exercise and Capital Gains at Sale Creates Double Taxation by Stealth

Introduction Employee Stock Option Plans (ESOPs) are among the most powerful instruments that Indian

Crypto Losses Under Section 115BBH: Why the No-Set-Off Rule Creates an Unconstitutional Tax on Notional Gains

Introduction When the Finance Act, 2022 introduced Section 115BBH into the Income Tax Act, 1961, it

Whatsapp

Whatsapp