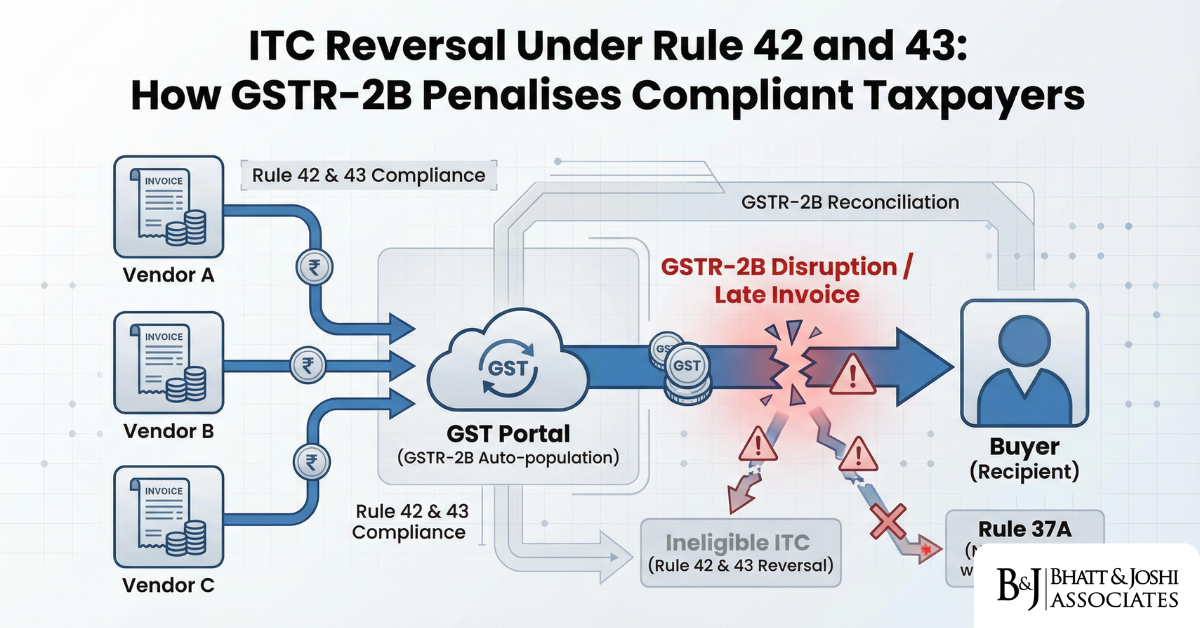

ITC Reversal Under Rule 42 and 43: Why the GSTR-2B Auto-Reversal Formula Penalises Compliant Taxpayers for Vendor Defaults

Introduction The Goods and Services Tax (GST) framework in India, introduced on 1 July 2017, was built on the promise of seamless Input Tax Credit (ITC) flow across the supply chai

Place of Supply Rules for Cloud Services: How Section 12 and 13 of the IGST Act Fail to Address Edge Computing and CDN Networks

Introduction The Integrated Goods and Services Tax Act, 2017 (IGST Act) was drafted before the rise of modern cloud services, edge computing, and Content Delivery Networks (CDNs) i

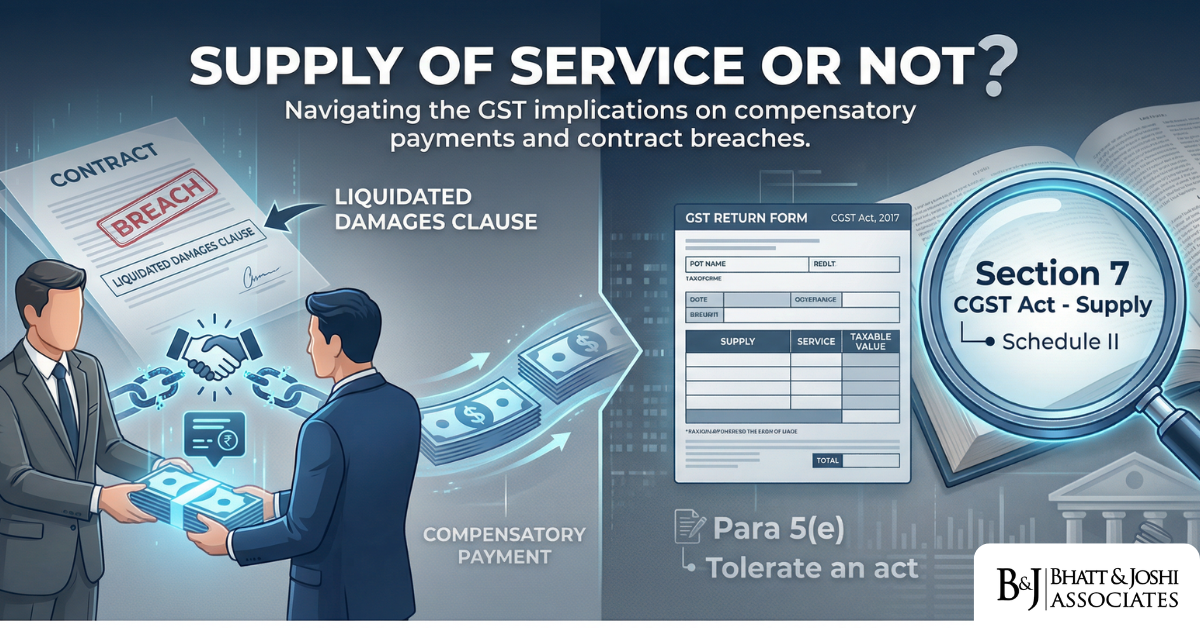

GST on Liquidated Damages: Supply of Service or Not? The Unsettled Jurisprudence After Safari Retreats

Introduction: Liquidated Damages and the Scope of “Supply” Under GST Few questions in Indian GST law have generated as much confusion at the field level as the one that seems d

GST on Corporate Guarantees: Taxability of No-Consideration Transactions Under Section 7(1)(c)?

Introduction A corporate guarantee, at its simplest, is a promise made by one company — typically a parent, holding, or group entity — to discharge the debt or fulfill the obli

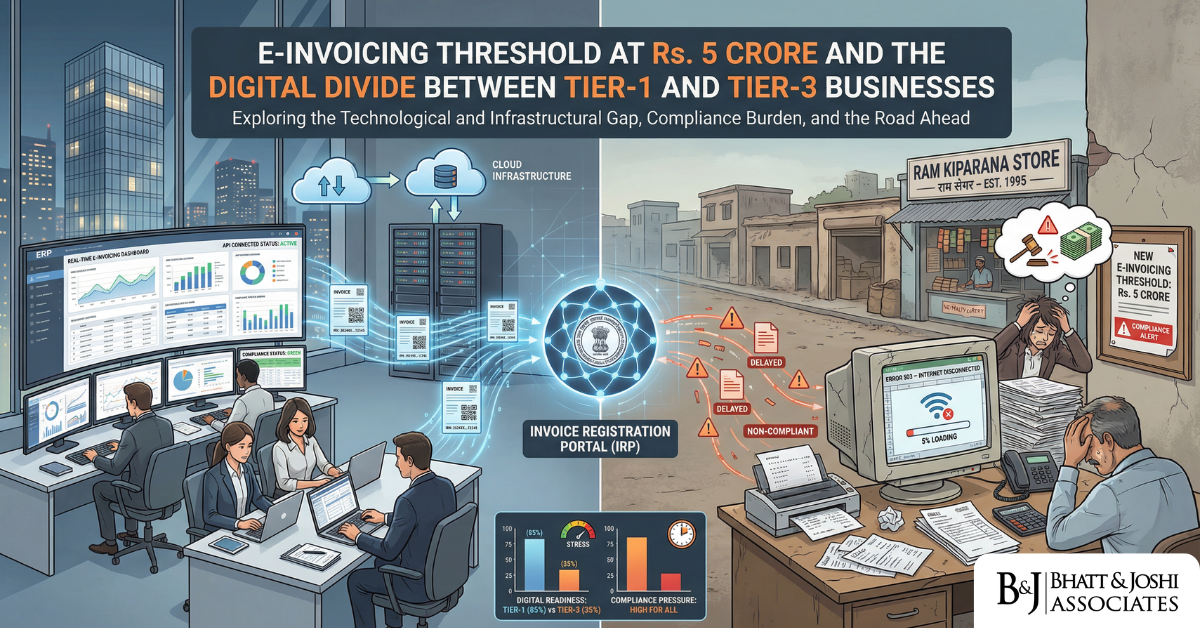

E-Invoicing Threshold Limit of Rs. 5 Crore: Analyzing the Digital Divide Between Tier-1 and Tier-3 Businesses

Introduction India’s Goods and Services Tax regime has always carried within it an ambitious undertaking — not just fiscal reform, but the wholesale digitalisation of how b

Supreme Court Larger Bench Rule: When a 3-Judge Bench Recalls a 2-Judge Bench – India’s Unresolved Doctrine on Co-Equal Bench Powers

Introduction Few questions in Indian constitutional procedure are as persistently contested yet practically consequential as this: what exactly can a bench of three judges do to a

Ad Hoc Judges Under Article 224A: Can the Collegium Appoint Retired Judges Without Bar Council Consent?

Introduction On 3 February 2026, the Supreme Court Collegium took a step that few had anticipated after decades of legislative dormancy — it approved the appointment of five reti

High Court Must Independently Apply Its Mind on SC/ST Act Charges in Appeal Under Section 14A: Supreme Court Emphasizes Active Appellate Scrutiny

Introduction The appellate jurisdiction of High Courts under the Scheduled Castes and Scheduled Tribes (Prevention of Atrocities) Act, 1989, has been a subject of evolving jurispru

Supreme Court Clarifies: Payment of Gratuity Act Does Not Apply to Central Government Employees under CCS Pension Rules

Introduction The question of which statutory regime governs the payment of gratuity to government employees has been a recurring source of litigation in India. In a significant rul

Private Complaints Against Corporate Fraud: The SFIO Mandate Under Companies Act 2013

Introduction Corporate fraud has emerged as one of the most challenging dimensions of white-collar crime in contemporary India, eroding investor confidence and undermining the inte

Whatsapp

Whatsapp