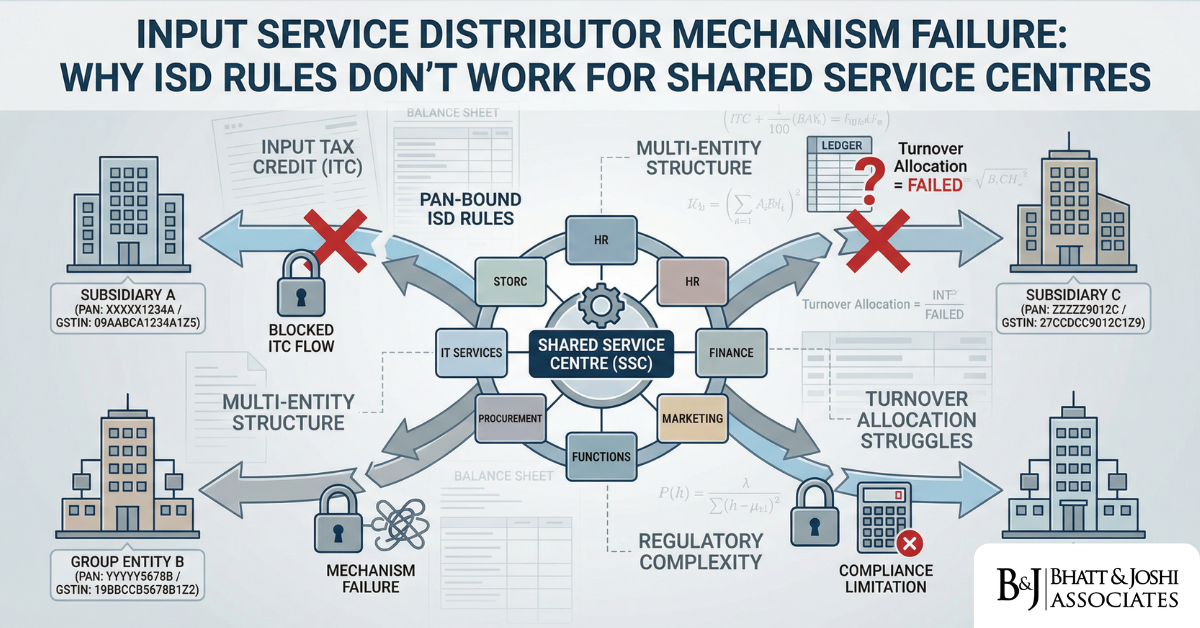

ISD Mechanism Failure in GST: Why Shared Service Centres in Group Companies Can’t Use ISD Rules

Introduction The Input Service Distributor (ISD) mechanism under India’s Goods and Services Tax (GST) framework was conceived as a practical solution for large businesses tha

Comprehensive Legal Defense Against Invocation of Section 74 of the CGST Act, 2017: Analyzing ‘Willful Suppression’ in the Context of Insolvency and Non-Realization of Professional Fees

Executive Summary The present legal analysis evaluates the defense strategy for a Writ Petition challenging the invocation of Section 74 of the CGST Act on allegations of willful s

Debit Notes in GST: Navigating Input Tax Credit Eligibility

Introduction In the realm of Goods and Services Tax (GST), debit notes play a crucial role in rectifying discrepancies in invoicing and ensuring accurate taxation. This article del

GST Notifications in India: Unpacking the Complexities and Implications of Goods and Services Tax (GST) for a Comprehensive Analysis

Introduction: India’s economic evolution over the past few decades has been remarkable, marked by significant reforms and policy changes aimed at fostering growth, stability,

Arrests under CGST Act: Arrest Cannot Be Routine for Mere CGST Act Violation – Key Observations from Bombay High Court’s Judgment

Introduction In a landmark decision, the Bombay High Court has ruled that arrests for alleged violations of the Central Goods and Services Tax (CGST) Act should not be conducted ro

GST Summons: Navigating Legal Insights and Compliance Strategies

Introduction In the complex framework of India’s Goods and Services Tax (GST) regime, the issuance of summons under Section 70 of the CGST Act, 2017, often instills a sense o

Anti-Profiteering Mechanism Upheld: Delhi High Court Validates and Ensures Integrity of GST

Introduction The anti-profiteering mechanism embedded within the Goods and Services Tax (GST) framework, as delineated by Section 171 of the CGST Act, 2017, serves as a safeguard t

Extension of Appeal Period in GST Cases: Upholding Procedural Fairness in Tax Appeals – A Comprehensive Analysis of the Calcutta High Court’s Ruling

Introduction: Taxation laws are integral to the functioning of any modern state, providing the government with the necessary revenue to fund public services and infrastructure. How

Cancellation and Suspension of GST Registration: Legal Framework and Judicial Perspectives

Introduction The Goods and Services Tax regime, introduced in India on July 1, 2017, revolutionized the country’s indirect taxation system by subsuming multiple taxes under a

Offences and Penalties under the Central Goods and Services Tax Act, 2017 (CGST Act)

Introduction The Central Goods and Services Tax Act, 2017 represents a landmark reform in India’s indirect taxation system, introducing a unified tax structure replacing mult

Whatsapp

Whatsapp