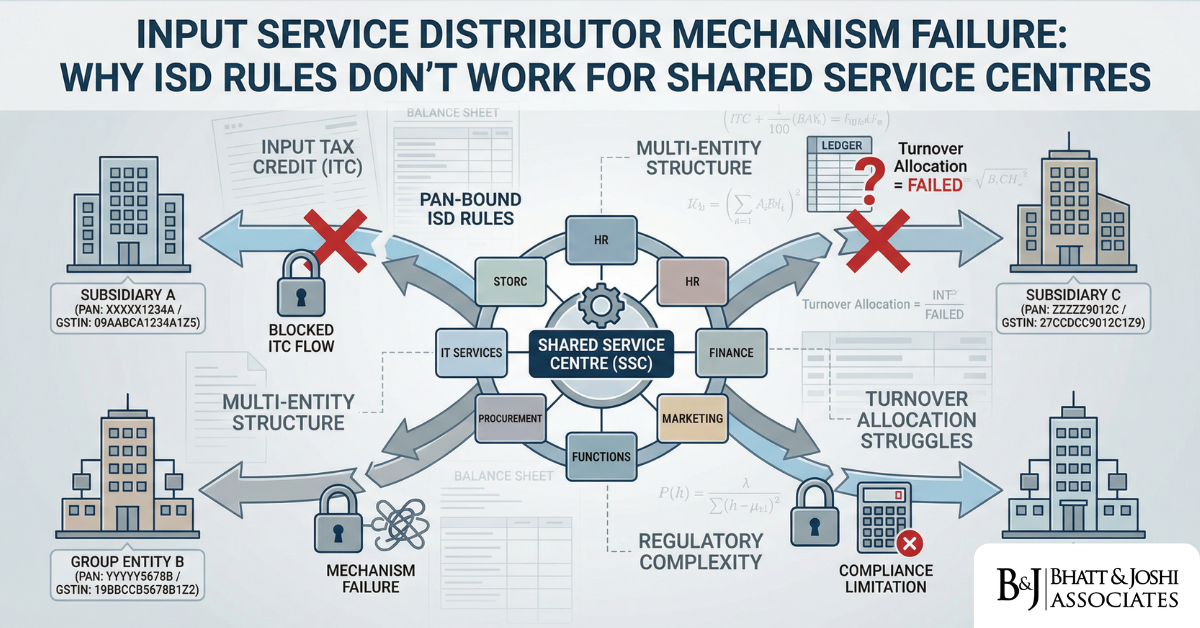

ISD Mechanism Failure in GST: Why Shared Service Centres in Group Companies Can’t Use ISD Rules

Introduction The Input Service Distributor (ISD) mechanism under India’s Goods and Services Tax (GST) framework was conceived as a practical solution for large businesses tha

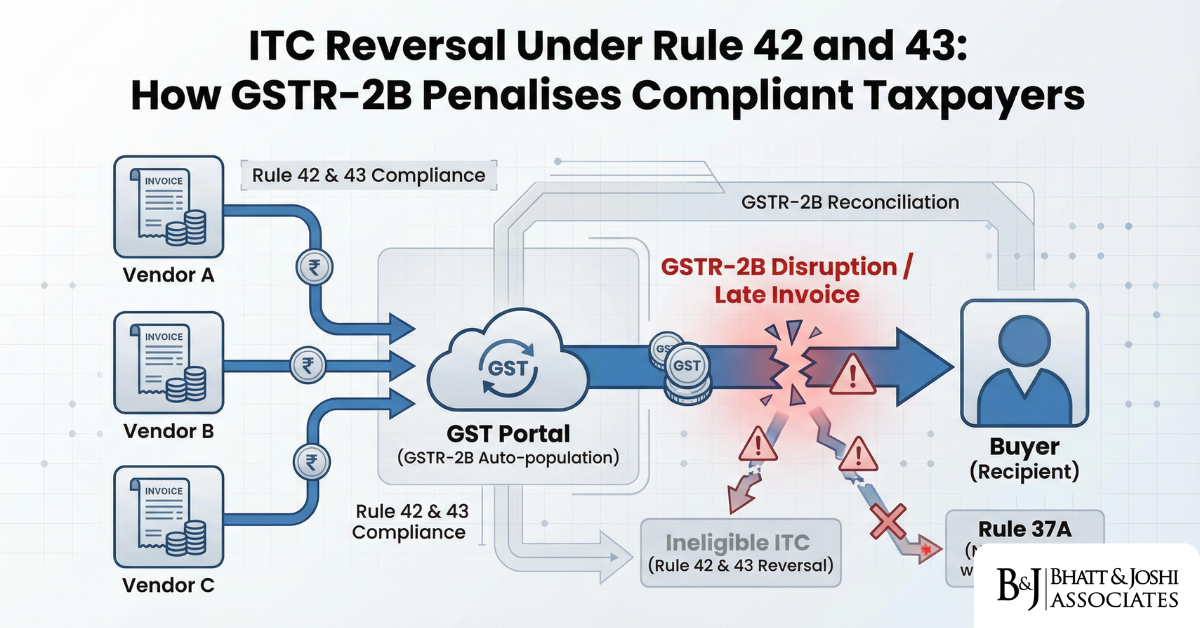

ITC Reversal Under Rule 42 and 43: Why the GSTR-2B Auto-Reversal Formula Penalises Compliant Taxpayers for Vendor Defaults

Introduction The Goods and Services Tax (GST) framework in India, introduced on 1 July 2017, was built on the promise of seamless Input Tax Credit (ITC) flow across the supply chai

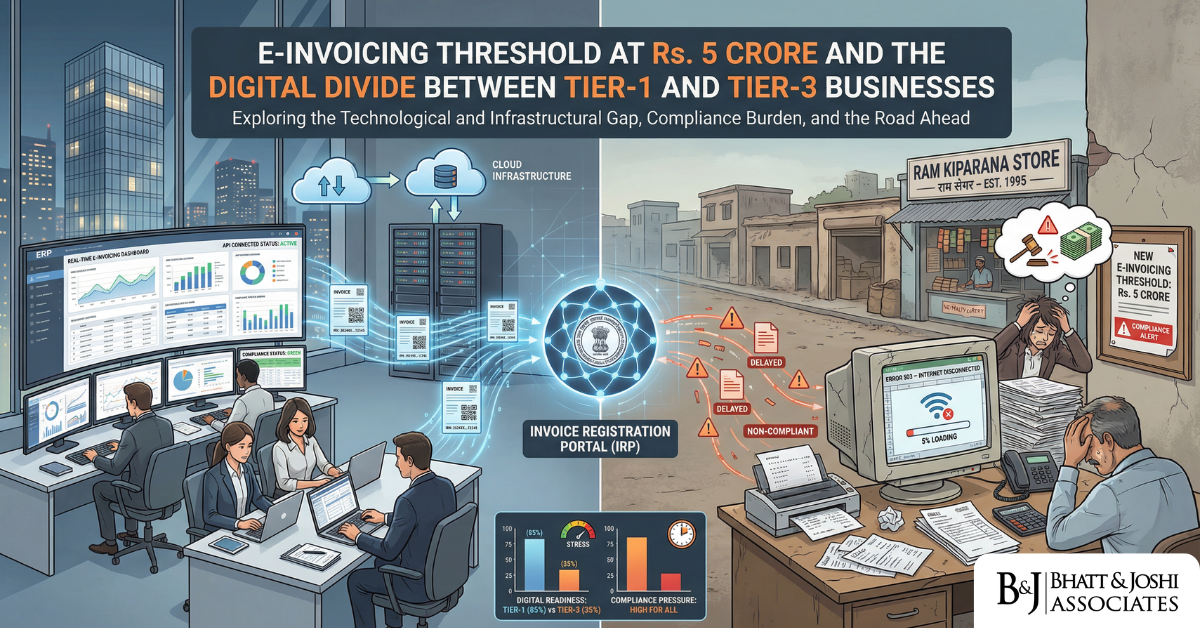

E-Invoicing Threshold Limit of Rs. 5 Crore: Analyzing the Digital Divide Between Tier-1 and Tier-3 Businesses

Introduction India’s Goods and Services Tax regime has always carried within it an ambitious undertaking — not just fiscal reform, but the wholesale digitalisation of how b

Comprehensive Legal Defense Against Invocation of Section 74 of the CGST Act, 2017: Analyzing ‘Willful Suppression’ in the Context of Insolvency and Non-Realization of Professional Fees

Executive Summary The present legal analysis evaluates the defense strategy for a Writ Petition challenging the invocation of Section 74 of the CGST Act on allegations of willful s

GST Compliance Reforms: Analyzing the 56th GST Council Meeting Outcomes

Introduction The 56th meeting of the GST Council, convened on September 3, 2025, under the chairpersonship of Union Finance Minister Nirmala Sitharaman, marked a transformative mil

Late GSTR-3B Filing: No Interest on Late GSTR-3B Filing if tax is deposited in electronic cash ledger within due dates

Introduction In the realm of Goods and Services Tax (GST) compliance, the Madras High Court’s recent judgment has sparked discussions regarding the obligations of taxpayers c

Critical Issues Under GST: Essential GST Compliance Guide for Taxpayers

A comprehensive guide to the challenges and solutions for GST compliance Introduction The Goods and Services Tax (GST) regime, implemented in India on July 1, 2017, represents one

Unjust Cancellation of GST Registration: A Case Study of GST Registration

Introduction The Goods and Services Tax regime, introduced in India on July 1, 2017, revolutionized the country’s indirect taxation system by subsuming multiple centra

Offences and Penalties under the Central Goods and Services Tax Act, 2017 (CGST Act)

Introduction The Central Goods and Services Tax Act, 2017 represents a landmark reform in India’s indirect taxation system, introducing a unified tax structure replacing mult

Whatsapp

Whatsapp