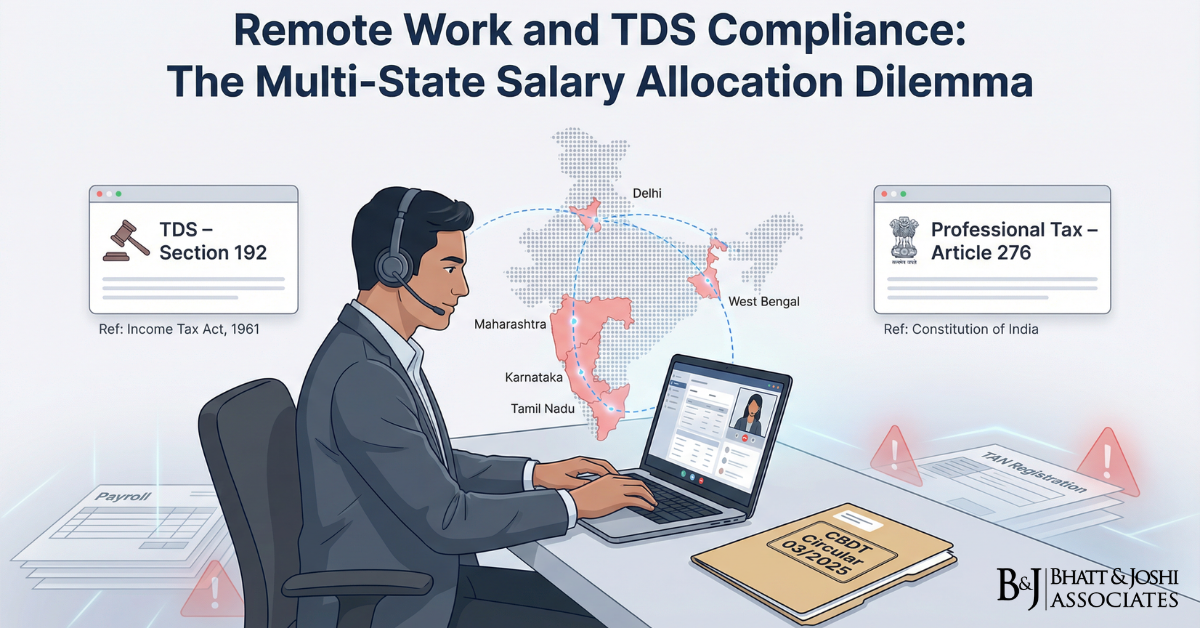

TDS on Salary for Remote Employees Across Multiple Indian States Under Section 192: Compliance Challenges”

Introduction The rise of remote work in post-pandemic India has created a TDS on salary compliance challenge that neither the Income Tax Act, 1961 nor the CBDT has clearly addresse

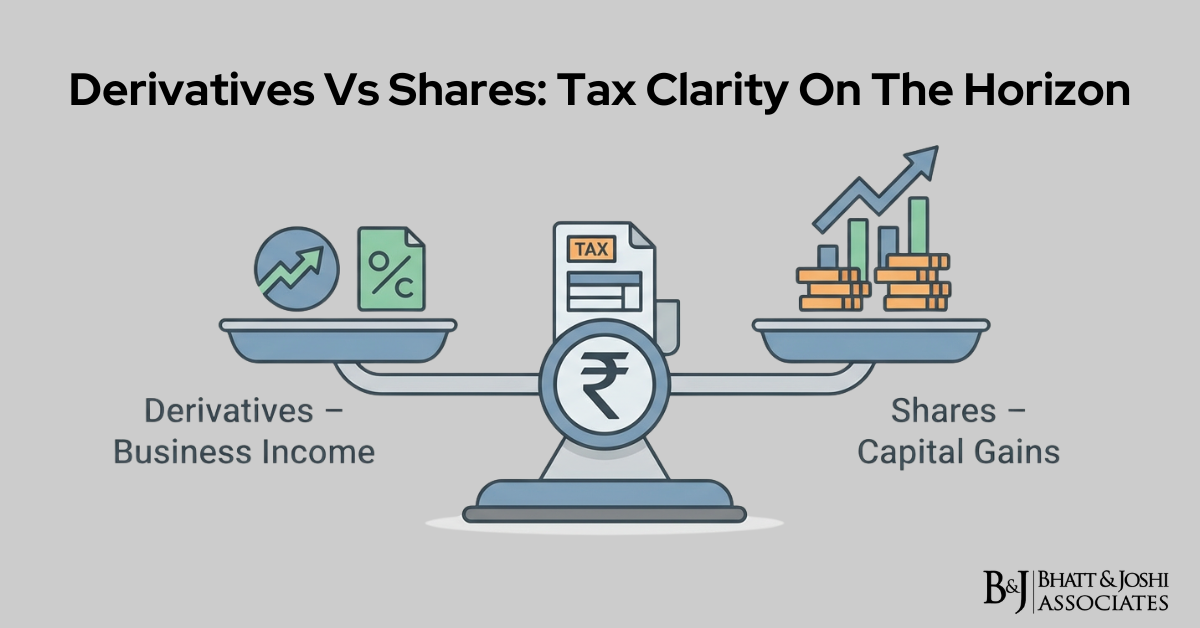

Derivatives Vs Shares: Tax Clarity On The Horizon

The Indian financial markets have witnessed unprecedented growth in derivative trading over the past decade, with retail participation reaching historic levels. This surge has brou

DRP in Transfer Pricing Assessment: Appellate Rights and Lessons from Vodafone

1. INTRODUCTION: THE DUAL-ROUTE ASSESSMENT MECHANISM The Unique Feature of Transfer Pricing Assessment Unlike ordinary income tax assessments, transfer pricing assessments have a m

Block Assessment and Search Assessment: Complete Legal Guide with Procedures, Case Law & Checklists

Evolution, Statutory Comparison, Procedural Safeguards, and Practical Guidance for Tax Professionals Executive Summary: Two Regimes, One Principle India’s approach to taxing

The Satisfaction Note Doctrine in Income Tax Search Assessments: From Calcutta Knitwears to Jasjit Singh

A Comprehensive Legal Analysis of Procedural Safeguards, Judicial Safeguards, and Practical Implementation Under the Income Tax Act, 1961 Executive Summary: Key Takeaways on the Sa

Recorded Satisfaction in Income Tax Penalty Proceedings: Jurisdictional Requirements Under Sections 271E, 271AAC, and 271AAB

Introduction: Understanding “Satisfaction” as a Foundational Concept In the landscape of income tax penalty proceedings, few concepts are as critical—yet equally misu

Section 96 of the LAAR Act, 2013: Comprehensive Analysis of Tax Exemption for Railway Land Acquisition and Fourth Schedule Enactments

Executive Summary The application of Section 96 of the Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013 (LAAR Act) to rail

TDS on Virtual Digital Assets: Legal Framework Explained

Introduction The emergence of Virtual Digital Assets (VDAs) represents one of the most significant developments in the global financial landscape over the past decade. These assets

Advance ruling mechanisms under GST

Introduction The Goods and Services Tax framework in India introduced several mechanisms to ensure clarity and certainty in tax matters for registered taxpayers. Among these, the a

Whatsapp

Whatsapp