Advance ruling mechanisms under GST

INTRODUCTION

An advance tax ruling is a written interpretation of tax laws. An advance ruling is often requested when the taxpayer is confused and uncertain about certain provisions. It is issued by tax authorities to corporations and individuals who request for clarification of certain tax matters. Advance tax ruling is applied before starting the proposed activity. By means of advance ruling a written interpretation is received on the basis of the companies or individuals as the case may be. This article discusses the nitty-gritties of the “Advance Ruling” mechanism of GST like, its purpose and objective and procedure. In addition to this, the effectiveness of the complete system is also discussed.

discussed.

OBJECTIVES OF ADVANCE RULING

The advance ruling can be obtained by a registered taxpayer (i.e. who has a GST Registration certificate) on a current transaction, i.e. The transaction that has already been undertaken or a proposed transaction.

The objective of any advance ruling, including under GST is to-

- Provide certainty for tax liability in advance in relation to a future activity to be undertaken by the applicant.

- Attract Foreign Direct Investment (FDI) – By clarifying taxation and showing a clear picture of the future tax liability of the FDI. The clarity and clean taxation will attract non-residents who do not want to get involved in messy tax disputes.

- Reduce litigation and costly legal disputes.

- Give decisions in a timely, transparent and inexpensive manner.

PROVISIONS UNDER CGST ACT

“Advance ruling” means a decision provided by the Authority or the Appellate Authority to an applicant on matters or on questions specified in sub-section (2) of section 97 or subsection (1) of section 100 of the CGST Act, 2017, in relation to the supply of goods or services or both being undertaken or proposed to be undertaken by the applicant.

Matters or questions specified in Section 97(2) & Section 100(1) of the CGST Act, 2017:

- Classification of any goods or services or both

- Applicability of a notification issued under the provisions of CGST Act

- Determination of time and value of supply of goods or services or both

- Admissibility of input tax credit of tax paid or deemed to have been paid

- Determination of the liability to pay tax on any goods or services or both

- Whether applicant is required to be registered

- Whether any particular thing done by the applicant with respect to any goods or services or both amounts to or results in a supply of goods or services or both, within the meaning of that term.

Section 100(1) of the CGST Act, 2017 provides that the concerned officer, the jurisdictional officer or an applicant aggrieved by any advance ruling pronounced by the Authority for Advance Ruling, may appeal to the Appellate Authority. Thus it can be seen that a decision of the Appellate authority is also treated as an advance ruling.

PROCEDURE OF OBTAINING ADVANCE RULING

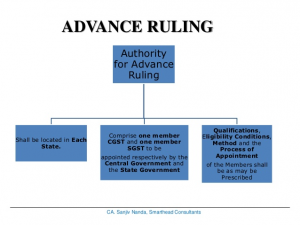

Both the Authority for Advance Ruling (AAR) & the Appellate Authority for Advance Ruling (AAAR) is constituted under the respective State/Union Territory Act and not the Central Act. This would mean that the ruling given by the AAR & AAAR will be applicable only within the jurisdiction of the concerned state or union territory. It is also for this reason that questions on determination of place of supply cannot be raised with the AAR or AAAR.

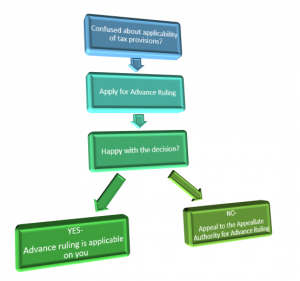

(Section 97 Application for Advance Ruling) If applicant has doubts/problems w.r.t. classification, applicability of notifications, input tax credit, registration, liability of tax, time and value of supply or determination of supply of goods or services or both then he may apply for the advance ruling to advance ruling authority in form AAR 1 along with Fees of Rs 5000. for removing the doubts.

(Section 98 Procedure on receipt of application) AAR may accept or reject the application after calling the records from the concerned officer. AAR shall before reject the application give opportunity of being heard and reasons of rejecting the application to the party. There may be a case if matter is pending or decided in the proceeding then application related to such matter shall not be admitted by the AAR. If AAR accepts the application, the ruling shall be pronounced within 90 days from the date of application.

If on any point the opinion of members of AAR differ, then it states the point of difference and refers to AAAR for final discussion and ruling shall be pronounced by AAAR within 90 days. If on any point the opinion of members of AAAR is differ then no ruling can be pronounced further.

Section 100 Appeal to Appellate Authority If any party, is aggrieved by the pronouncement of ruling of AAR, may appeal to the AAAR within 30 days from the date of receipt of ruling (extension 30 days if sufficient cause of delay) in FORM AAR 2 along with Fees Rs 10,000.

Section 101 Order of the Appellate authority Opportunity of being heard is given to the parties before passing the order by AAAR. Order shall be passed within 90 days from the date of filing of appeal and appellate order shall be communicated to parties.

Section 102 Rectification of Advance Ruling If there is any mistake apparent on record found by the AAR itself or brought to its notice by jurisdictional officer or applicant, application for rectification can be made within 6 months from the date of order.

If rectification results in an increase in tax liability or reduction in input tax credit, OBH must be given by the AAR.

Section 103 Binding effect of Advance Ruling Once the advance ruling is pronounced, binding on the applicant and jurisdictional officer unless there is change in law/facts/circumstances on the basis of which advance ruling had been pronounced by the AAR.

Section 104 Advance Ruling to void in certain circumstances Advance ruling is declared void ab initio if it is found by the AAR/AAAR that ruling has been obtained by misrepresentation of facts or suppression of facts by the party and provision of the Act will be applied as if advance ruling had not been pronounced. Before passing the order opportunity of being heard shall be given to the party and order shall be communicated to the applicant and concerned officer.

CHALLENGING THE AAR ORDER

Since AAR is not the final authority, a pronouncement by AAR is prone to litigation. The Supreme Court has, in the case of Columbia Sports Wear held that the orders of AAR can be challenged by filing a Writ Petition before the High Court.

Moreover, SLP against an advance ruling could also be considered by the Supreme Court if it involves a question of principle of great importance or if a similar question is already pending before the Supreme Court.

EFFECTIVENESS OF ADVANCE RULING MECHANISM

The taxpayers preferred to resort to the AAR mechanism to know the GST implications beforehand instead of facing litigation to decide the matter at a future point of time. A taxpayer can make an application to AAR for ruling in respect of specified matters and obtain an advance ruling in respect of such matters within a relatively shorter span of time.

However, looking at the past rulings by AAR and Appellate Authority for Advance Ruling (‘AAAR’), the majority of rulings have been decided in favour of revenue. This may be because of the fact that the AAR & AAAR is constituted of the Central & State revenue officers without inducting any judicial members.

Further, different AARs have pronounced different rulings on similar issues. This results in compliance challenges for the taxpayers. Due to such divergent rulings, the same taxpayer may be compelled to follow different legal positions in different States for a specific transaction. Though the GST Council has proposed to establish a central-level appellate authority to deal with such cases which can lend some uniformity to such rulings but to expect a judicial approach in such rulings would still be a distant dream.

CONCLUSION

The whole intent behind establishing the AAR was to reduce litigation and to provide certainty to the taxpayers. However, with revenue favored rulings and divergent rulings in case of the same transaction, it appears that the purpose of establishing AAR is not met by the Government. Instead of reducing litigation, the rulings are likely to increase the litigation because of pro-revenue rulings and divergent views on the same transaction.

Additionally, there are divergent views by the High Courts on allowing the writ petition filed against the orders passed by the advance ruling authorities. The legal position with respect to challenging the correctness of orders passed by AAAR before Courts is yet to be crystalized. The view of the Government is that the advance ruling mechanism is beneficial to the assessed as it reduces litigation, however, what would be the benefits to an assessed if the matters are always held in favor of the revenue by AAR/AAAR.