AMBIT OF ‘MARRIAGE’ AND ‘GIFT’ UNDER HINDU LAW

THE HINDU LAW

Introduction

Hindu Law is considered to be the most ancient and prolific law in the world. It has around every phase and is 6000 years old. Hindu Law has been established by the people, not for the purpose of removing any crime or transgression from society but was established so that the people will follow it in order to attain salvation. Originally this law was established so that the needs of the people get fulfilled, this concept was initiated for the welfare of the people.

Who is HINDU as per the Law?

A person can be called Hindu:

- Who is born from Hindu Family.

- When one of the parents of a child is Hindu and he/she is brought up as a member of the Hindu Family.

- If a child is born by Hindu Mother and Muslim Father and he/she is brought up as a Hindu then he/she can be considered as Hindu. We can explain that a child’s religion is not necessarily that of the father.

- The Codified Hindu Law lays down that a person who is not a Muslim, Christian, Parsi or Jews id governed by Hindu Law is a Hindu.

Conversion and Reconversion to Hinduism

- Under the Codified Hindu Law, any person converted to Hinduism, Buddhism, Jainism or Sikhism is called a Hindu. For conversion the person should have a Bonafide intention and also should(not) have reason to be converted.

- Reconversion basically happens, when a person is Hindu and gets converted to a Non-Hindu Religion and he/she will again become Hindu if he/she gets converted into any four religions of Hindu.

Sources of Hindu Law

Marriage: HINDU LAW

Hindu Marriage refers to kanyadan which means gifting a girl to the boy by the father with all the tradition and rites or custom. Hindu marriage is an ancient tradition which is prevailing from the Vedic periods to the modern world with different modifications that have occurred until now. There are 16 sacraments in the Shastri Hinduism in which marriage is one of the important sacraments of Hinduism. It is believed that it is the strongest bond between husband and wife. It is an unbreakable bond that remains even after death. The importance of marriage is not to the extent of one generation, but it is an in-depth belief of Hinduism. Without a wife, a person is considered incomplete while performing any rites of Hinduism. It is very important to perform all the rites with the wife.

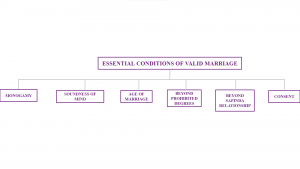

Essential Conditions of Valid Marriage

Monogamy:

Section 5 (1) of Hindu Marriage Act, provides for Monogamy and prohibits Polygamy and Polyandry.

“HINDU’S CAN HAVE ONLY ONE MARRIAGE EXIST AT A TIME.”

Monogamy has always been the ideal type of marriage among Hindus. It is the marriage practice where one man is married to one woman at a time and vice versa. Nowadays, Monogamy has been considered the most natural form of matrimony. It it’s socially and legally approved type of marriage with its existence at the highest stage of culture.

Soundness Of Mind:

Prior to Hindu Marriage Act an Idiot, Lunatic or Impotent person could be married lawfully. But now the position has changed:

- Should be sound to give consent to the marriage.

- Should not be suffering from any kind of mental disorder that makes him/her unfit for marriage or having children.

- Should not be having recurrent attacks of insanity.

Age of Marriage:

The marriageable age for MEN is 21 Years and for WOMEN is 18 Years.

Beyond Prohibited Degrees:

Two persons are said to be within the degrees of prohibited relationships:

- if one is a lineal ascendant of the other. For example, a daughter cannot marry her father and grandfather. Similarly, a mother cannot marry her son or grandson.

- If one was the wife or husband of a lineal ascendant or descendant of the other. For example, a son cannot marry his stepmother. Similarly, a person cannot marry his daughter-in -Law or son -in-law.

- if one was the wife of the brother or of the father’s or mother’s brother or the grandfather’s or grandmother’s brother of the other.

- If the two are brother and sister; uncle and niece; Aunt and Nephew or children of brother and sister of two brothers or two sisters. It must have been noticed that in some communities the marriage with the wife of the brother and mother’s brother and the first cousins are solemnized; those marriages, in the absence of a custom in the community, are not valid marriages.

In plain words, a person cannot marry up to his second cousin from the mother’s side and up to his fourth cousin from the side of the father.

Beyond Sapinda Relationship:

All prohibited relationships are Sapinda, but all Sapinda relationships are not prohibited relationships.

The Sapinda relationship is the chain of all the relationships from the side of the brother and sister in the family; they can’t marry each other due to prohibited relationship and also their generation till three 3 Generations from the FEMALE SIDE and 5 Generation from the MALE SIDE , till that they all are in Sapinda relationship.

Avoidance of Sapinda can be achieved as the Female reaches the 4th Generation and Male reaches the 6th Generation after that both families can have a marriage that will be neither prohibited relationship nor Sapinda relationship.

Gift: HINDU LAW

A Gift is generally regarded as a transfer of ownership of a property where the sender willingly brings into effect such transfer without any compensation or consideration in monetary value. It may be in the form of moveable or immoveable property and the parties may be two living persons or the transfer may take place only after the death of the transferor. When the transfer takes place between two living people it is called inter vivos, and when it takes place after the death of the transferor it is known as testamentary.

Section 122 of Transfer of Property Act defines a gift as the transfer of an existing moveable or immovable property:

Such transfers must be made voluntarily and without consideration.

The transferor is known as the donor and the transferee is called the donee.

The gift must be accepted by the donee.

This Section defines a gift as a gratuitous transfer of ownership in some property that is already existing. The definition includes the transfer of both immovable and moveable property.

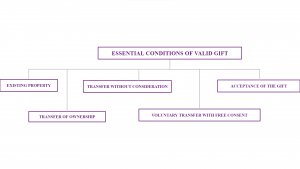

Essential Conditions of Valid Gift

- Existing Property:

The property, which is the subject matter of the gift may be of any kind, movable, immovable, tangible, or intangible, but it must be in existence at the time of making a gift, and it must be transferable within the meaning of Section 5 of the Transfer of Property Act.

Gift of any kind of future property is deemed void. And the gift of spes successionis (expectation of succession) or mere chance of inheriting property or mere right to sue, is also void.

- Transfer of Ownership:

The transferor, i.e., the donor must divest himself of absolute interest in the property and vest it in the transferee, i.e., the donee. Transfer of absolute interests implies the transfer of all the rights and liabilities in respect of the property. To be able to affect such a transfer, the donor must have the right to ownership of the said property. Nothing less than ownership may be transferred by way of gift. However, like other transfers, the gift may also be made subject to certain conditions.

- Transfer Without Consideration:

A gift must be gratuitous, i.e., the ownership in the property must be transferred without any consideration. Even a negligible property or a very small sum of money given by the transferee in consideration for the transfer of a very big property would make the transaction either a sale or an exchange. Consideration, for the purpose of this section, shall have the same meaning as given in Section 2(d) of the Indian Contract Act. The consideration is pecuniary in nature, i.e., in monetary terms. Mutual love and affection are not pecuniary consideration and thus, property transferred in consideration of love and affection is a transfer without consideration and hence a gift. A transfer of property made in consideration for the ‘services’ rendered by the donee is a gift. But a property transferred in consideration of donee undertaking the liability of the donor is not gratuitous, therefore, it is not a gift because liabilities evolve pecuniary obligations.

- Voluntary Transfer with Free Consent:

The donor must make the gift voluntarily, i.e., in the exercise of his own free will and his consent as is a free consent. Free consent is when the donor has the complete freedom to make the gift without any force, fraud, coercion, and undue influence. Donor’s will in executing the deed of the gift must be free and independent. Voluntary act on a donor’s part also means that he/she has executed the gift deed in full knowledge of the circumstances and nature of the transaction. The burden of proving that the gift was made voluntarily with the free consent of the donor lies on the donee.

- Acceptance of the Gift:

The donee must accept the gift. Property cannot be given to a person, even in gift, against his/her consent. The donee may refuse the gift as in cases of non-beneficial property or onerous gift. Onerous gifts are such where the burden or liability exceeds the actual market value of the subject matter. Thus, acceptance of the gift is necessary. Such acceptance may be either expressed or implied. Implied acceptance may be inferred from the conduct of the donee and the surrounding circumstances. When the donee takes possession of the property or of the title deeds, there is acceptance of the gift. Where the property is on lease, acceptance may be inferred upon the acceptance of the right to collect rents. However, when the property is jointly enjoyed by the donor and donee, mere possession cannot be treated as evidence of acceptance. When the gift is not onerous, even minimal evidence is sufficient to prove that the gift has been accepted by donee. Mere silence of the donee is indicative of the acceptance provided it can be established that the donee had knowledge of the gift being made in his favor.

A GIFT OF FUTURE PROPERTY

Gift of future property is merely a promise which is unenforceable by law. Thus, Section 124 of the Transfer of Property Act renders the gift of future property void. If a gift is made which consists of both present as well as future property, i.e., one of the properties is in existence at the time of making the gift and the other is not, the whole gift is not considered void. Only the part relating to the future property is considered void. Gift of future income of a property before it had accrued would also be void under Section 124.

A GIFT MADE TO MORE THAN ONE DONEE

Section 125 of the Act says that in case a property is gifted to more than one donee, one of whom does not accept it, the gift, to the extent of the interest which he would have taken becomes void. A gift made to two donees jointly with the right of survivorship is valid, and upon the death of one, the surviving donee takes the whole.

ONEROUS GIFT

Onerous gifts refer to the gifts which are a liability rather than an asset. The word ‘onerous’ means burdened. Thus, where the liabilities on a property exceed the benefits of such property it is known as an onerous property. When the gift of such a property is made it is known as an onerous gift, i.e., a non-beneficial gift. The donee has the right to reject such gifts.

Section 127 provides that if a single gift consisting of several properties, one of which is an onerous property, is made to a person then that person does not have the liberty to reject the onerous part and accept the other property. This rule is based upon the principle of “qui sentit commodum sentire debet et onus” which implies that the one who accepts the benefit of a transaction must also accept the burden of it. Thus, when two properties, one onerous and other prosperous, are given in gift to a donee in the same transaction, the donee is put under the duty to elect. He may accept the gift together with the onerous property or reject it totally. If he elects to accept the beneficial part of the gift, he is bound to accept the other which is burdensome. However, an essential element of this Section is a single transfer. Both the onerous and prosperous properties must be transferred in one single transaction only then they require the obligation to be accepted or rejected in a joint manner. In case the onerous gift is made to a minor and such donee accepts the gift, he retains the right to repudiate the gift on attaining the age of majority. He may accept or reject the gift on attaining majority and the donor cannot reclaim the gift unless the donee rejects it on becoming a major.

UNIVERSAL DONEE

The concept of universal donee is not recognized under English law, although universal succession, according to English law, is possible in the event of the death or bankruptcy of a person. Hindu law recognizes this concept in the form of ‘sanyasi’, a way of life where people renounce all their worldly possessions and take up spiritual life. A universal donee is a person who gets all the properties of the donor under a gift. Such properties include movables as well as immovables. Section 128 lays down in this regard that the donee is liable for all the debts and liabilities of the donor due at the time of the gift. This section incorporates an equitable principle that one who gets certain benefits under a transaction must also bear the burden therein. However, the donee’s liabilities are limited to the extent of the property received by him as a gift. If the liabilities and debts exceed the market value of the whole property, the universal donee is not liable for the excess part of it. This provision protects the interests of the creditor and makes sure that they are able to chase the property of the donor if he owes them.

REVOCATION OF GIFT:

Section 126 of the Act provides the legal provisions which must be followed in case of a conditional gift. The donor may make a gift subject to certain conditions of it being suspended or revoked and these conditions must adhere to the provisions of Section 126. This Section lays down two modes of revocation of gifts and a gift may only be revoked on these grounds.

- By Mutual Agreement:

Where the donor and the donee mutually agree that the gift shall be suspended or revoked upon the happening of an event not dependent on the will of the donor, it is called a gift subject to a condition laid down by mutual agreement. It must consist of the following essentials: The condition must be expressly laid down

- The condition must be a part of the same transaction, it may be laid down either in the gift-deed itself or in a separate document being a part of the same transaction.

- The condition upon which a gift is to be revoked must not depend solely on the will of the donor.

- Such conditions must be valid under the provisions of law given for conditional transfers. For e.g., a condition totally prohibiting the alienation of a property is void under Section 10 of the Transfer of Property Act.

- The condition must be mutually agreed upon by the donor and the donee.

- Gift revocable at the will of the donor is void even if such condition is mutually agreed upon.

- By Rescission of Contract:

Gift is a transfer; it is thus preceded by a contract for such transfer. This contract may either be express or implied. If the preceding contract is rescinded, then there is no question of the subsequent transfer to take place. Thus, under Section 126, a gift can be revoked on any grounds on which its contract may be rescinded. For example, Section 19 of the Indian Contract Act makes a contract voidable at the option of the party whose consent has been obtained forcefully, by coercion, undue influence, misrepresentation, or fraud. Thus, if a gift is not made voluntarily, i.e., the consent of the donor is obtained by fraud, misrepresentation, undue influence, or force, the gift may be rescinded by the donor. The option of such revocation lies with the donor and cannot be transferred, but the legal heirs of the donor may sue for revocation of such contract after the death of the donor. The limitation for revoking a gift on the grounds of fraud, misrepresentation, etc., is three years from the date on which such facts come to the knowledge of the plaintiff (donor). The right to revoke the gift on the abovementioned grounds is lost when the donor ratifies the gift either expressly or by his conduct.

- Bona Fide Purchaser:

A Bona Fide purchaser is a person who has purchased the gifted property in good faith and with consideration. When such a purchaser is unfamiliar with the condition attached to the property which was a subject of a conditional gift then no provision of revocation or suspension of such gift shall apply.

Conclusion:

Hindu Law is a law which is considered to be of divine nature as it is believed that it has been developed on the words of God, theories given by God. It is one of the most ancient laws and was written by various rishis. They are considered as a parent of Hindu law. It discusses the concept of Hindu marriage; to whom Hindu marriage act 1955 applies, how many forms of marriage are valid in Hindu marriage and different ceremonies performed before the marriage, validity of a marriage, who is sapinda, ritual, and customs of the marriage. To constitute a transfer as a gift it must follow the provisions of the Transfer of Property Act. This Act extensively defines the gift itself and the circumstances of the transfer of such a gift.

Mr. Arsh Ajit Bafna

Legal Intern, Bhatt & Joshi Associates

LJ School of Law