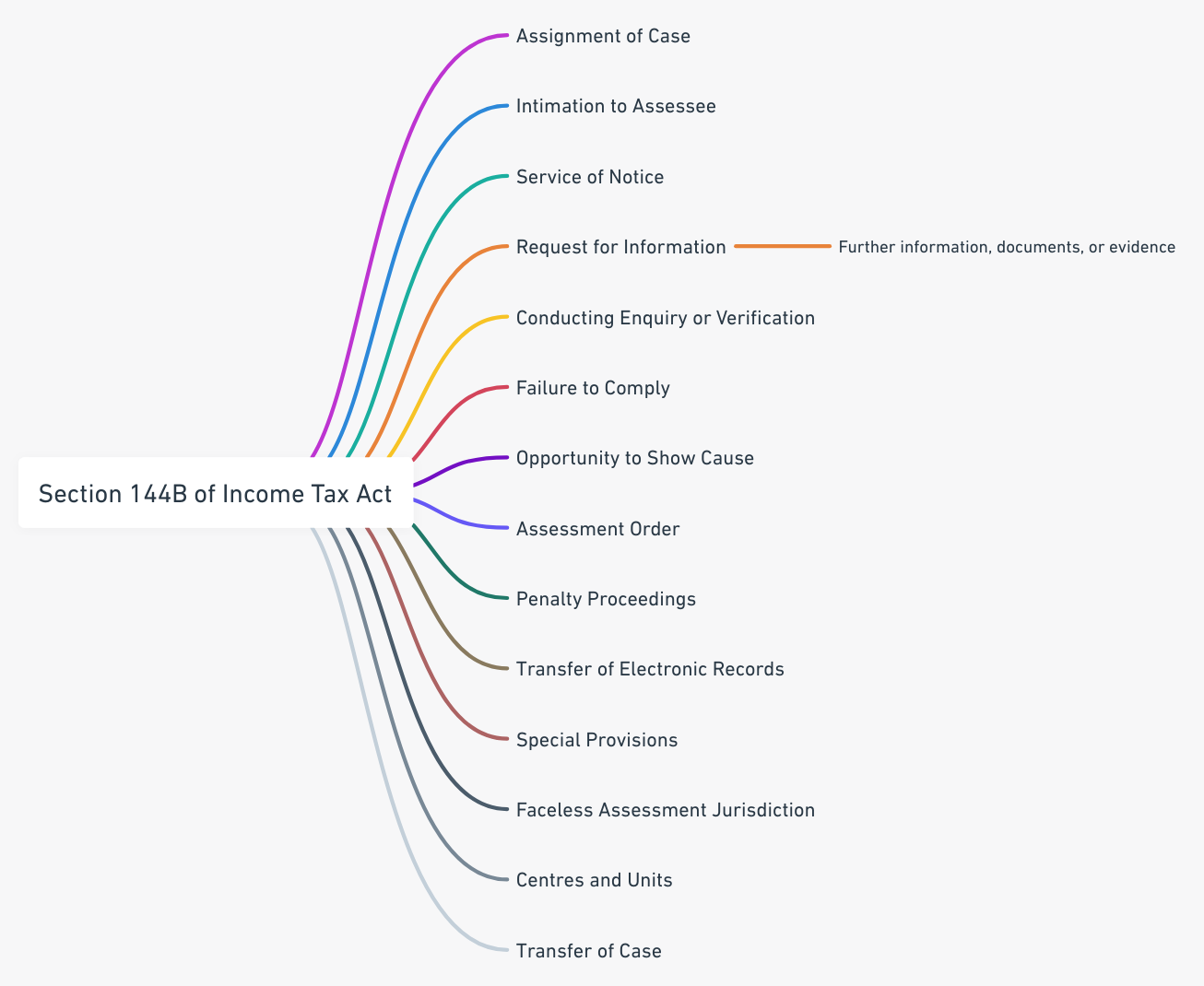

Faceless Assessment Procedure under Section 144B of Income Tax Act- Part 4

Introduction

We have discussed the Introduction to Faceless Assessment, Part 1 of the series discussed provisions related to assignment and communication, Part 2 talked about enquiry, verification, and technical assistance, Part 3 discussed provisions related to assessment and penalties. In this Part, we will delved into provisions related to special provisions for complex cases, territorial area, class specifications and transfer of cases.

11. Special Provisions

Special provisions under Section 144B addresses and handles cases that possess a unique level of intricacy and complexity in their financial accounts. This provision empowers the tax authorities to apply a specialized approach to the assessment process, ensuring that the evaluation is conducted with precision and authenticity.

- Nature and Complexity of Accounts: If the assessment unit, considering the nature and complexity of the accounts, volume of the accounts, doubts about the correctness of accounts, multiplicity of transactions in the accounts, or specialized nature of business activity of the assessee, and the interests of the revenue, believes it is necessary, it may refer the case to the National Faceless Assessment Centre.

- Invoking Special Provisions: The special provisions of sub-section (2A) of section 142 may be invoked, and the case shall be dealt with accordingly.

These special provisions allow for a more detailed examination of complex cases, ensuring that the assessment is conducted with the highest level of accuracy and integrity.

12. Faceless Assessment Jurisdiction

Faceless Assessment Jurisdiction under Section 144B of the Income Tax Act refers to the specific territorial area, persons, incomes, or cases that may be subject to faceless assessment. Here’s a detailed breakdown of this process:

- Territorial Area and Scope: The faceless assessment under Section 144B shall be made in respect of such territorial area, persons, class of persons, incomes, or class of incomes, or cases or class of cases, as may be specified by the Board.

- Centralized Manner: The Board may set up the National Faceless Assessment Centre to facilitate the conduct of faceless assessment proceedings in a centralized manner.

13. Transfer of Case

The Principal Chief Commissioner may transfer the case to the Assessing Officer with prior approval from the Board. The provisions regarding the transfer of a case under Section 144B of the Income Tax Act is detailed as follows:

- Initiation of Transfer: If at any stage of the proceedings, the assessment unit, considering the nature and complexity of the accounts, volume of the accounts, doubts about the correctness of accounts, multiplicity of transactions in the accounts, or specialized nature of business activity of the assessee, and the interests of the revenue, is of the opinion that it is necessary to do so, it may initiate the transfer process.

- Recording of Reasons: The assessment unit must record its reasons in writing for initiating the transfer.

- Reference to National Faceless Assessment Centre: The assessment unit refers the case to the National Faceless Assessment Centre, stating that the provisions of sub-section (2A) of section 142 may be invoked.

- Transfer to Assessing Officer: The Principal Chief Commissioner or the Principal Director General, in charge of the National Faceless Assessment Centre, may, at any stage of the assessment, if considered necessary, transfer the case to the Assessing Officer having jurisdiction over such case.

- Prior Approval from the Board: The transfer of the case to the Assessing Officer requires prior approval from the Board.

This provision ensures that complex cases can be transferred to the appropriate Assessing Officer, allowing for a more detailed and specialized assessment.

Conclusion

In this Part, we discussed provisions related to special provisions for complex cases, territorial area, class specifications and transfer of cases. In Part 5, we will review the Units and Authorities.