GIFT City as a Hub for Centralised Treasury Functions: The GRCTC Framework

Introduction The Gujarat International Finance Tec-City, commonly known as GIFT City, represents India’s ambitious stride toward establishing itself as a global financial hub

Constitutional Morality Vs Popular Morality: A Judicial Discourse on Rights and Freedoms in India

Introduction The tension between constitutional morality and popular morality represents one of the most significant debates in contemporary Indian jurisprudence. This conflict ari

Derivatives Vs Shares: Tax Clarity On The Horizon

The Indian financial markets have witnessed unprecedented growth in derivative trading over the past decade, with retail participation reaching historic levels. This surge has brou

Judicial Discretion at the Intersection of Liberty and Process: A Treatise on Supreme Court Jurisprudence Regarding Anticipatory Bail During Pending Non-Bailable Warrants

1. Introduction: The Dialectics of Personal Liberty and Sovereign Compulsion The administration of criminal justice in India rests upon a delicate equilibrium between two competing

Comprehensive Legal Defense Against Invocation of Section 74 of the CGST Act, 2017: Analyzing ‘Willful Suppression’ in the Context of Insolvency and Non-Realization of Professional Fees

Executive Summary The present legal analysis evaluates the defense strategy for a Writ Petition challenging the invocation of Section 74 of the CGST Act on allegations of willful s

Basic Structure Doctrine vs Parliamentary Sovereignty: The Constitutional Equilibrium in Indian Democracy

Introduction The Indian Constitution represents a delicate balance between flexibility and rigidity, between the need for evolutionary change and the preservation of fundamental va

Preventive Detention Laws vs Due Process Guarantees in India: A Constitutional Analysis

Introduction The intersection of preventive detention laws and due process guarantees represents one of the most contentious areas in Indian constitutional jurisprudence. Preventiv

Public Interest Litigation vs Locus Standi Doctrine: A Transformative Journey in Indian Jurisprudence

Introduction The Indian judicial landscape witnessed a revolutionary transformation during the post-Emergency period when the Supreme Court fundamentally altered the traditional un

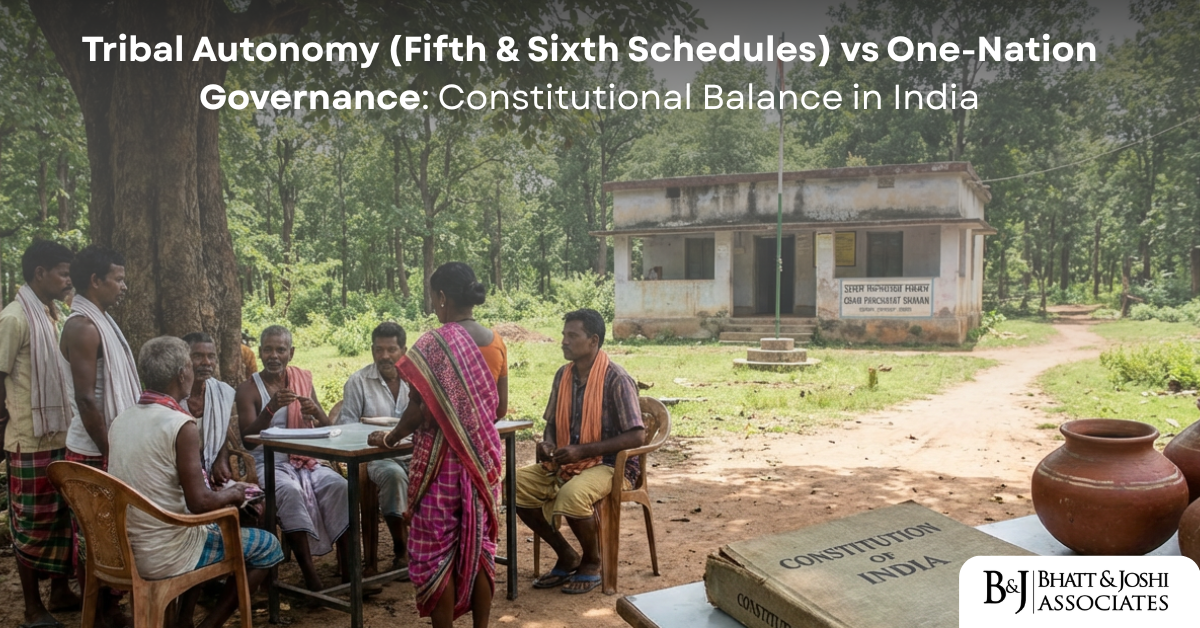

Tribal Autonomy (Fifth & Sixth Schedules) vs One-Nation Governance: Constitutional Balance in India

Introduction India’s constitutional architecture reflects a delicate equilibrium between unified national governance and the protection of tribal rights, a principle central

Supreme Court Directions for CoC in Insolvency Proceedings: Safeguarding Homebuyers’ Interests

Introduction The Indian real estate sector has witnessed unprecedented turmoil over the past decade, with thousands of homebuyers trapped in incomplete projects and their life savi

Whatsapp

Whatsapp