INTERFACE BETWEEN ADMIRALTY LAW AND IBC

INTRODUCTION

Admiralty Law regulates shipping, navigation, commerce, towage, recreational boating, and piracy by private entities on domestic and international waters. It covers both natural and man-made navigable waters, such as rivers and canals.

In rem admiralty proceedings and the insolvency of a ship owner is fraught with tension. The advantage of arresting a ship, which elevates a maritime claimant to the status of a secured creditor, sits uncomfortably with principles of insolvency law, which do not contemplate an action in rem and the peculiar consequences that follow from it. Admiralty law is already universal; it applies to maritime disputes all over the world.

Many professionals on international insolvencies have called for an international insolvency to solve the issues encountered by the growing range of transactional businesses facing bankruptcy under multiple and regularly conflicting countrywide laws. When an insolvent company’s operations span several countries, the company may be subject to conflicting national bankruptcy laws. When an insolvency spreads across several nations, different courts may not treat creditors equally. A universalist international insolvency treaty would resolve these problems by ensuring cooperation and mutual recognition of bankruptcy proceedings involving various nations’ courts.

Despite the advantages of a universal insolvency system, a treaty to implement such a system would adversely affect another specialized area of law, admiralty. Both admiralty and bankruptcy laws apply when a shipowner becomes insolvent. Admiralty law is substantially similar internationally, unlike Bankruptcy laws.

The IBC was introduced with the main aim to facilitate a corporate faltering in its debt obligations and to protect the interests of all the stakeholders with equity and the Admiralty (Jurisdiction and Settlement of Maritime Claims) Bill, 2016, was introduced with the intent to consolidate the existing laws on civil matters of admiralty jurisdiction of courts, admiralty proceedings on maritime claims, and arrest of ships. The conflict arises when a shipping company, being the owner of the vessel, becomes insolvent and goes into liquidation under the IBC.

The vessel is the subject matter under both the proceedings, as an offender under the Admiralty Act and as an asset under the IBC. In such a scenario, it becomes imperative to ascertain as to which Court or Tribunal would exercise its jurisdiction over the vessel and under which law. The issue of whether the IBC prevails over the Admiralty Act or vice versa has been decided by the High Court of Bombay in Atlantic Shipping Pvt. Ltd vs. Barge by an order passed on May19,2020. The High Court of Bombay applied the rule of Harmonious Construction . Applying this principle, the High Court attempted to seek out the dispute between Admiralty Law and Insolvency Law.

Emphasis was placed on the distinction between an action in rem against a vessel and an action in personam. It was noted that once this distinction is recognized, whereby the vessel is a separate and distinct entity dehors its owner, it is easy to resolve the apparent conflict between admiralty and insolvency proceedings. Hence, it was held that an action in rem against the ship is neither an action against the owner of the ship who may be the corporate debtor as defined under the IBC nor a proceeding against the asset of the corporate debtor. It is a proceeding against the ship to recover the claim from the ship, whereby an action in rem continues as an action in rem, notwithstanding that the owner may have entered appearance, if security is not furnished for the release of the vessel.

Therefore, it is clear that there is no conflict between the Admiralty Law and the IBC, and both can be construed harmoniously .

CASE LAWS

In Cliffs Neddrill Turnkey International vs. M/T Rich DukeThe collision of two vessels off the coast of Aruba was adjudicated in the District of Delaware because the two injured ships had limped into Delaware. The maritime law of Aruba applied, the plaintiff shipowner was Dutch, and the defendants were Bahamian and Japanese, the crews were South Korean, Dutch and American. All of these nations are unlikely to sign the same international insolvency treaty.

In ABC Shipbrokers vs. The Ship ‘Offi Gloria’, while the shipowner was undergoing an insolvency proceeding in Texas, the vessel, registered under the flag of Cyprus, was arrested in New Zealand (after aborted attempts to arrest it in Indonesia, Hong Kong and Singapore), and plaintiffs were Greek and American. Again, these radically different nations are unlikely to sign an international insolvency treaty.

In rem admiralty proceedings and the insolvency of a ship owner is fraught with tension. The advantage of arresting a ship, which elevates a maritime claimant to the status of a secured creditor, sits uncomfortably with principles of insolvency law, which do not contemplate an action in rem and the peculiar consequences that follow from it.

The conflict between these two special jurisdictions came to a head before the Bombay High Court, which in a recent judgement in Raj Shipping Agencies vs. Barge Madhwa and Anr, attempted to reconcile the irreconcilable.

Arrest orders were passed by the Bombay High Court against vessels, whose owners were insolvent. The High Court issued a winding up order against one of the ship owners under the Companies Act, 1956 (“Companies Act”). In parallel, insolvency proceedings were commenced against another ship owner by the National Company Law Tribunal and a moratorium ordered against commencement or continuation of all proceedings against that owner and its assets under the Insolvency and Bankruptcy Code, 2016 (IBC).

The official liquidator in the winding up proceedings objected to the continuation of the admiralty actions without the leave of the Company Court under Section 446 of Companies Act, 1956 . As regards the insolvency proceedings against the other vessel owner, the maritime claimants argued that the morat

under the IBC would not prevent continuation of the admiralty actions in the Bombay High Court.

Question of law

Issue 1. Is there a conflict between actions in rem filed under the Admiralty Act and IBC and if so, how is the conflict to be resolved?

The Court observed that its endeavour would be to give effect to both statutes and their objectives so as to avoid conflict. The judgement proceeded to analyse the distinction between an action in rem under the Admiralty Act and an action in personam under IBC. The Court reasoned that an action in rem is not an action against the corporate debtor/owner of the ship or the assets of the corporate debtor/owner. It accordingly concluded that the moratorium under the IBC would not apply to an action in rem under the Admiralty Act for arrest of the ship and consequently would not prevent the commencement of admiralty proceedings.

According to the court, maritime claimants apart from being treated as secured creditors, should ordinarily be ascribed full value for their claim and the scheme of priorities under the Admiralty Act should be adopted in the resolution plan. The Court ruled that vessels arrested before the moratorium can only be released by the Admiralty Court, upon full payment of security.

The Court similarly reasoned that Section 33(5) of the IBC which bars the commencement or continuation of proceedings in liquidation, would not apply to an action in rem, as the claim is against the res and not against the corporate debtor.

Issue 2. Whether leave under Section 446(1) of the Companies Act is required for the continuation of an Admiralty action where a winding up order has been made or the Official Liquidator has been appointed that owns the ship?

The Court observed that the Admiralty Act, 2017 is a consolidating enactment dealing with arrest of ships, maritime claims, judicial sale of ships and determination of priorities. The jurisdiction of the Admiralty Court was found to be special, unlike that of regular civil courts. A judicial sale of a ship by an Admiralty Court in a public auction is free from all prior claims, liens and encumbrances and the purchaser at the auction acquires a clean title free from any maritime liens, claims or encumbrances. This is unlike a sale of property conducted by the Company Court. The Court accordingly held that no leave of the Company court was required as the Admiralty Act, 2017 being a special enactment, would prevail over Companies Act, 1956

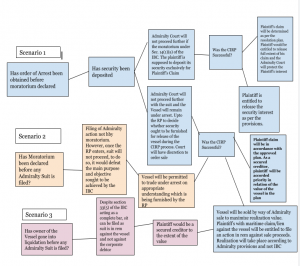

Diagrammatic Representation of Various Scenarios:

Conclusion

The jurisprudence in relation to the interaction and interplay of admiralty law and insolvency law is far from fully developed, and several issues still remain unanswered. In an admiralty action, jurisdiction may be exercised irrespective of the nationality of the ship or that of its owners, or the place of business, domicile or residence of its owners, or the place where the cause of action arose wholly or in part. In such a scenario, situations arise where the ship owner of a vessel is incorporated outside India and is subject to insolvency proceedings in the respective country.

The law in this respect is still evolving and it will be interesting to witness the interpretation and application of the principles of law in times to come.

Author: Khushi Kabra

Editor: Adv. Aditya Bhatt & Adv. Chandni Joshi