Appeals to Commissioner of Income Tax (Appeals) Under the Income Tax Act, 1961

Introduction to Appellate Mechanism in Income Tax Law

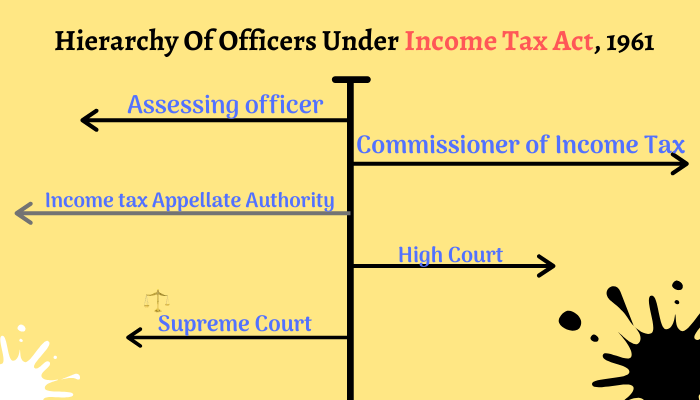

The appellate mechanism under the Income Tax Act, 1961, serves as a crucial safeguard for taxpayers against arbitrary or erroneous decisions by assessing officers. The concept of appeal in income tax law embodies the fundamental principle of natural justice that no person should suffer from decisions made without adequate opportunity for representation and review. The Commissioner of Income Tax (Appeals), commonly referred to as CIT(A), stands as the first appellate authority in the hierarchical structure of income tax administration, providing taxpayers with an accessible and structured forum to challenge unfavorable orders.

The statutory framework governing appeals to CIT(A) is primarily enshrined in Chapter XX of the Income Tax Act, 1961, specifically under Sections 246A, 248, 249, 250, and related provisions. This comprehensive mechanism ensures that taxpayers have recourse to independent review when they believe that the assessing officer has erred in law or fact while determining their tax liability. The appellate process serves not only as a remedy for individual grievances but also contributes to the development and interpretation of tax jurisprudence in India.

The significance of the appellate process extends beyond mere dispute resolution. It acts as a check and balance mechanism within the income tax administration, ensuring that assessing officers exercise their powers judiciously and in accordance with law. Through the appellate process, higher authorities can review, modify, or set aside orders that may be contrary to law or established principles of taxation, thereby maintaining uniformity and consistency in tax administration across the country.

Constitutional Foundation and Statutory Framework

The right of appeal in income tax matters finds its foundation in Article 14 of the Constitution of India, which guarantees equality before law and equal protection of laws. This constitutional principle necessitates that taxpayers should have adequate opportunity to contest decisions that adversely affect their rights and interests. However, it is important to note that the right to appeal is not an inherent or natural right but is a statutory right specifically granted under the Income Tax Act, 1961.

Section 246A of the Income Tax Act, 1961, serves as the cornerstone provision that defines the scope and extent of appealable orders before the Commissioner of Income Tax (Appeals). This section has undergone several amendments since its inception to expand the scope of appealable orders and ensure comprehensive coverage of various situations where taxpayers may be aggrieved by orders of income tax authorities.

The statutory nature of the right to appeal implies that it can only be exercised in circumstances specifically provided under the Act and cannot be denied by any administrative order or circular issued by the Central Board of Direct Taxes (CBDT). This principle was established in the landmark case of CIT v. Vegetable Products Ltd. (1973) 88 ITR 192 (SC), where the Supreme Court held that the right of appeal being a statutory right cannot be taken away except by express provision of law.

Jurisdiction and Powers of Commissioner of Income Tax (Appeals)

The Commissioner of Income Tax (Appeals) derives his authority from Section 251 of the Income Tax Act, 1961, which empowers him to pass orders on appeals filed under Section 246A. The CIT(A) possesses wide powers including the authority to confirm, reduce, enhance, or annul the assessment order under appeal. These powers are not merely revisory but are appellate in nature, allowing the CIT(A) to examine the merits of the case afresh.

In the case of Jute Corporation of India Ltd. v. CIT (1991) 187 ITR 688 (Cal), the Calcutta High Court emphasized that the CIT(A) has the power to examine all aspects of the assessment and is not confined to the grounds raised by the appellant. This wide jurisdiction ensures that justice is done in each case and errors of the assessing officer can be comprehensively addressed.

The CIT(A) also possesses the power under Section 251(1A) to enhance the assessment where he considers that the income assessed by the assessing officer is inadequate. However, this power can only be exercised after giving the assessee reasonable opportunity of being heard. The Supreme Court in CIT v. Max India Ltd. (2007) 295 ITR 282 (SC) held that enhancement powers should be exercised judiciously and only when there are clear grounds for believing that income has been under-assessed.

Detailed Analysis of Appealable Orders Under Section 246A

Assessment Orders and Intimations

Section 246A(1)(a) provides that an appeal can be filed against any order passed by the assessing officer in a case where the assessee denies his liability to be assessed under the Income Tax Act. This provision covers cases where there is a fundamental dispute about the applicability of the Income Tax Act to the assessee’s case. The phrase “denies his liability to be assessed” has been interpreted by courts to mean situations where the assessee contends that he is not liable to tax under the Act at all.

The provision also covers intimations issued under Section 143(1) of the Act where adjustments have been made to the income declared in the return of income. Section 143(1) provides for summary assessment where the income is accepted as declared or adjusted for apparent errors. When such adjustments result in additional tax demand, the assessee has the right to appeal against such intimation under Section 246A(1)(b).

Scrutiny Assessment Orders

Appeals against scrutiny assessment orders passed under Section 143(3) form a significant portion of appeals filed before CIT(A). Section 246A(1)(c) specifically provides for appeals against such orders, except where the order is passed pursuant to directions of the Dispute Resolution Panel (DRP). The exception for DRP cases is because such cases have a separate appellate mechanism under Section 144C.

The scope of appeal against scrutiny assessment orders is comprehensive and covers all aspects of the assessment including addition to income, disallowance of expenses, levy of penalty, and other matters arising from the assessment proceedings. In CIT v. Raman & Co. (1968) 67 ITR 11 (SC), the Supreme Court held that an appeal against an assessment order can raise any ground of law or fact that goes to challenge the correctness of the assessment.

Reassessment Orders

Section 246A(1)(f) provides for appeals against orders of assessment, reassessment, or recomputation passed after reopening under Section 147, except those passed pursuant to DRP directions. Reassessment proceedings under Section 147 are initiated when the assessing officer has reason to believe that income has escaped assessment. Such proceedings often involve complex questions of law and fact, making the right of appeal crucial for taxpayers.

The Supreme Court in GKN Driveshafts (India) Ltd. v. ITO (2003) 259 ITR 19 (SC) held that in reassessment proceedings, the assessing officer must have tangible material to form a belief that income has escaped assessment. If the reassessment is based on mere suspicion or conjecture, it can be challenged in appeal.

Search and Seizure Cases

Section 246A(1)(h) provides for appeals against assessment or reassessment orders passed under Section 153A or Section 158BC in cases involving search and seizure operations. These provisions deal with assessments following search operations conducted under Section 132 of the Act. Given the serious nature of search operations and their implications, the right of appeal assumes special significance in such cases.

The Bombay High Court in CIT v. Kabul Chawla (2015) 380 ITR 573 (Bom) emphasized that in search cases, the burden is on the revenue to prove that the seized material relates to undisclosed income. If this burden is not discharged, the assessee can successfully challenge the assessment in appeal.

Penalty Orders

Section 246A provides for appeals against various penalty orders including those under Sections 271, 271A, 271AAA, 271F, and other penal provisions. Penalty proceedings involve determination of whether there has been concealment of income or furnishing of inaccurate particulars, which are questions of fact requiring careful examination.

The Supreme Court in CIT v. Reliance Petroproducts Pvt. Ltd. (2010) 322 ITR 158 (SC) held that penalty under Section 271(1)(c) can be imposed only when it is established that the assessee has concealed particulars of income or furnished inaccurate particulars. Mere addition to income in assessment does not automatically justify penalty.

Filing Requirements for Appeals to Commissioner of Income Tax

Form 35: The Appeal Form and Its Essentials

Appeals to Commissioner of Income Tax must be filed in Form 35, which is prescribed under Rule 45 of the Income Tax Rules, 1962. The form requires detailed information about the appellant, the order appealed against, grounds of appeal, and other relevant particulars. Section 246A of Income Tax Act enumerates the orders against which an appeal can be filed before the Commissioner of Income Tax (Appeals).

The form can be filed electronically through the e-filing portal of the Income Tax Department or in physical form. Electronic filing has become the preferred mode due to its convenience and the ability to track the status of the appeal online. The form must be accompanied by a copy of the order against which the appeal is filed and proof of payment of applicable fees.

Appeal Fees Structure Under Rule 45A

The fees for filing an appeal under Section 246A are prescribed under Rule 45A of the Income Tax Rules, 1962. The fee structure is based on the total income or loss as computed by the assessing officer in the order under appeal:

For cases where the total income or loss computed by the assessing officer is Rs. 1,00,000 or less, the prescribed fee is Rs. 250. This nominal fee ensures that even small taxpayers have access to appellate remedy without financial hardship.

Where the total income or loss exceeds Rs. 1,00,000 but does not exceed Rs. 2,00,000, the prescribed fee is Rs. 500. This moderate fee structure reflects the policy of keeping appellate remedy accessible to middle-income taxpayers.

For cases where the total income or loss exceeds Rs. 2,00,000, the prescribed fee is Rs. 1,000. This fee, while higher, remains reasonable considering the stakes involved in such cases.

For appeals relating to matters other than income computation, such as procedural issues or penalty matters, the prescribed fee is Rs. 250, ensuring that such appeals are not discouraged by high fees.

Time Limit for Filing Appeals to Commissioner of Income Tax

Section 249(2) of the Income Tax Act prescribes a time limit of 30 days for filing appeals before CIT(A). The starting point for calculation of this period differs based on the nature of the appeal:

For appeals under Section 248 (relating to best judgment assessment), the time limit runs from the date of payment of tax. This provision recognizes that such appeals are typically filed after the taxpayer has paid the demanded tax under protest.

For appeals relating to assessment or penalty orders, the time limit runs from the date of service of notice of demand. The notice of demand is the document that formally communicates the tax liability to the assessee and triggers the right to appeal.

For other cases, the time limit runs from the date on which the intimation or order sought to be appealed against is served. This general provision covers various types of orders and intimations covered under Section 246A.

Section 268 specifically provides that the date on which the order complained of is served should be excluded while computing the time limit. This ensures that the taxpayer gets a full 30 days to prepare and file the appeal.

Condonation of Delay in Appeals to Commissioner of Income Tax

Recognizing that taxpayers may face genuine difficulties in filing appeals within the prescribed time limit, Section 249(3) empowers the CIT(A) to admit an appeal filed beyond the time limit if sufficient cause is shown for the delay. This discretionary power must be exercised judiciously after examining the reasons for delay and their genuineness.

The Supreme Court in Collector, Land Acquisition v. Mst. Katiji (1987) 167 ITR 98 (SC) laid down the principles for condonation of delay, emphasizing that the approach should be liberal rather than pedantic, provided the delay is satisfactorily explained. However, the appellant must demonstrate that the delay was not due to negligence or lackadaisical attitude.

Electronic Filing Process and Digital Compliance

E-filing Portal Navigation

The Income Tax Department’s e-filing portal provides a user-friendly interface for filing Form 35 online. Taxpayers must log in using their registered credentials and navigate to the “e-File” section to access income tax forms. The portal provides step-by-step guidance for completing Form 35, with many fields being pre-populated based on the taxpayer’s profile and previous filings.

The electronic filing system incorporates validation checks to ensure that all mandatory fields are completed and that the information provided is consistent with departmental records. This reduces the likelihood of appeals being rejected for technical defects and ensures faster processing.

Digital Signatures and Authentication

Electronic filing of appeals requires digital signatures for authentication. Taxpayers can use either their own Digital Signature Certificate (DSC) or Electronic Verification Code (EVC) for verification. The use of digital signatures ensures the integrity and authenticity of the filed documents while maintaining the legal validity of electronic filing.

The system also provides for bulk filing capabilities for tax practitioners who need to file multiple appeals on behalf of different clients. This feature streamlines the process for chartered accountants and other tax professionals who handle multiple cases.

Online Payment Integration

The e-filing portal is integrated with various payment gateways to facilitate online payment of appeal fees. Taxpayers can use net banking, credit cards, or debit cards to pay the prescribed fees. The system generates electronic challans and provides confirmation of payment, which becomes part of the appeal record.

The integration with NSDL (National Securities Depository Limited) e-governance infrastructure ensures secure and reliable payment processing. The system maintains detailed audit trails of all transactions, providing transparency and accountability in the payment process.

Grounds of Appeal to Commissioner of Income Tax (Appeals)

Factual Grounds

Appeals can be filed on grounds of fact, law, or mixed questions of fact and law. Factual grounds typically relate to disputes about the existence or quantum of income, allowability of deductions, or applicability of specific provisions to particular circumstances. When raising factual grounds, appellants must provide sufficient evidence and documentation to support their contentions.

The burden of proof in appeal proceedings varies depending on the nature of the issue. For additions made by the assessing officer, the initial burden is on the revenue to justify the addition based on material evidence. Once this burden is discharged, the burden shifts to the assessee to disprove the addition or demonstrate its incorrectness.

Legal Grounds

Legal grounds involve interpretation of statutory provisions, applicability of judicial precedents, or challenges to the legal basis of the assessing officer’s order. Such grounds require careful analysis of relevant case law and statutory provisions. The CIT(A) has the authority to decide questions of law, and his decisions on legal issues carry persuasive value for future cases.

When raising legal grounds, appellants should cite relevant judicial precedents and explain their applicability to the facts of their case. The principle of binding precedent applies in appellate proceedings, and decisions of higher courts must be followed by appellate authorities.

Procedural Grounds

Procedural grounds relate to violations of prescribed procedures during assessment proceedings. These may include failure to provide adequate opportunity of hearing, non-service of notices, or non-compliance with procedural requirements under the Act. Such grounds are often decisive as procedural violations can render the entire assessment invalid.

The Supreme Court in Maneka Gandhi v. Union of India (1978) AIR 597 (SC) established that procedural fairness is an essential component of natural justice. This principle applies to income tax proceedings, and any violation of prescribed procedures can be challenged in appeal.

Powers and Duties of Commissioner of Income Tax (Appeals)

Adjudicatory Powers

The CIT(A) exercises quasi-judicial powers while hearing appeals. Section 251 empowers the CIT(A) to confirm, cancel, or vary the order appealed against, or make such other order as he thinks fit. These wide powers enable comprehensive review of the assessing officer’s order and ensure that justice is done in each case.

The CIT(A) can also remand cases back to the assessing officer for fresh consideration when additional investigation or examination is required. However, remand should be used sparingly and only when absolutely necessary for proper adjudication of the appeal.

Enhancement Powers

Section 251(1A) empowers the CIT(A) to enhance the assessment if he considers that the income assessed by the assessing officer is inadequate. However, this power can only be exercised after giving reasonable opportunity to the assessee to show cause against the proposed enhancement. The power of enhancement acts as a safeguard against frivolous appeals filed merely to delay tax collection.

The Bombay High Court in CIT v. Smt. Tarulata Shyam (1977) 108 ITR 345 (Bom) held that enhancement powers should be exercised cautiously and only when there are clear grounds for believing that income has been under-assessed. The mere fact that an appeal has been filed does not justify enhancement.

Time Bound Disposal

Section 249(4) mandates that the CIT(A) should dispose of appeals within one year from the end of the financial year in which the appeal is filed. This time limit ensures speedy disposal of appeals and prevents indefinite pendency. However, this is a directory provision, and failure to dispose of appeals within the prescribed time does not invalidate the subsequent order.

The provision for time-bound disposal reflects the legislative intent to provide speedy justice to taxpayers and reduce litigation costs. However, complex cases involving detailed examination may require more time, and the CIT(A) has discretion to extend the time for disposal in appropriate cases.

Landmark Supreme Court Decisions on Income Tax Appeals

Landmark Supreme Court Decisions

The Supreme Court has pronounced several landmark judgments that have shaped the law relating to appeals under the Income Tax Act. In CIT v. Sun Engineering Works (P) Ltd. (1992) 198 ITR 297 (SC), the Court held that the CIT(A) has the power to examine all aspects of the assessment and is not confined to the grounds raised by the appellant.

In National Thermal Power Corporation v. CIT (1998) 229 ITR 383 (SC), the Supreme Court emphasized that appellate authorities should exercise their powers judiciously and not interfere with factual findings unless they are perverse or based on irrelevant considerations.

High Court Interpretations

Various High Courts have contributed to the development of appellate jurisprudence through their interpretations of specific provisions. The Delhi High Court in CIT v. Zoom Developers (P) Ltd. (2011) 330 ITR 370 (Del) held that the right to cross-examine witnesses is available in appellate proceedings when the credibility of evidence is in question.

The Bombay High Court has consistently held that appellate authorities should not substitute their judgment for that of the assessing officer unless there are compelling reasons to do so. This principle ensures that appellate intervention is limited to cases where there are clear errors of law or fact.

Recent Judicial Trends in Income Tax Appeals

Recent judicial decisions have emphasized the importance of natural justice in appellate proceedings. Courts have held that appellate authorities must provide adequate opportunity of hearing and cannot decide cases based on material not disclosed to the parties. The principle of audi alteram partem (hear the other side) is strictly enforced in appellate proceedings.

The trend towards digitization has also influenced judicial interpretation. Courts have recognized the validity of electronic filing and digital signatures while emphasizing the need for robust security measures to prevent fraud and manipulation.

Challenges and Future Directions in Appeals to Commissioner of Income Tax

Digital Transformation Impact

The digitization of appellate processes has significantly improved efficiency and accessibility. However, it has also raised new challenges related to digital security, authentication, and the digital divide among taxpayers. The Income Tax Department has been continuously upgrading its technology infrastructure to address these challenges.

The introduction of faceless appeals under the Faceless Assessment Scheme represents a significant shift towards technology-driven dispute resolution. This system promises to eliminate geographical constraints and reduce human interface, thereby minimizing corruption and bias.

Alternative Dispute Resolution

The introduction of the Dispute Resolution Panel (DRP) for certain categories of taxpayers represents a move towards alternative dispute resolution mechanisms. The DRP provides a faster and more informal forum for resolving disputes, reducing the burden on traditional appellate authorities.

The Advance Ruling Authority also serves as a mechanism for preventing disputes by providing clarity on tax implications of proposed transactions. These alternative mechanisms complement the traditional appellate system and provide taxpayers with multiple avenues for dispute resolution.

International Best Practices

India’s appellate system has drawn inspiration from international best practices while adapting to local conditions. The emphasis on time-bound disposal, electronic filing, and reasoned orders reflects global trends in tax administration. Continuous benchmarking against international standards helps improve the effectiveness of the appellate system.

The adoption of risk-based assessment and data analytics in tax administration has implications for the appellate system. As assessment processes become more sophisticated, appellate authorities must also enhance their capabilities to deal with complex technical issues.

Conclusion and Recommendation on the Income Tax Appeal Process

The appellate mechanism under the Income Tax Act, 1961, represents a crucial component of India’s tax administration system. The Commissioner of Income Tax (Appeals) serves as the first line of defense for taxpayers against arbitrary or erroneous decisions by assessing officers. The comprehensive framework provided under Section 246A and related provisions ensures that taxpayers have adequate recourse to challenge unfavorable orders.

The continuous evolution of the appellate system through legislative amendments, judicial interpretations, and administrative reforms demonstrates the commitment to providing effective dispute resolution mechanisms. The emphasis on electronic filing, time-bound disposal, and reasoned orders has significantly improved the efficiency and transparency of appellate proceedings.

However, challenges remain in terms of capacity building, technology adoption, and case management. The increasing complexity of tax laws and business transactions requires specialized expertise among appellate authorities. Investment in training and development of appellate officers is essential for maintaining the quality of appellate decisions.

The future of the appellate system lies in greater integration of technology, adoption of alternative dispute resolution mechanisms, and alignment with international best practices. The goal should be to create a system that is accessible, efficient, transparent, and capable of delivering justice within reasonable time frames.

For taxpayers, understanding the appellate process is crucial for protecting their rights and interests. Proper preparation of appeals, timely filing, and effective presentation of cases can significantly improve the chances of success. The right to appeal is a valuable safeguard that should be exercised judiciously and with proper legal advice.

References and Citations

- Income Tax Act, 1961, Section 246A – Appealable orders before Commissioner (Appeals)

- Income Tax Rules, 1962, Rule 45 – Form of appeal to Commissioner (Appeals)

- CIT v. Vegetable Products Ltd. (1973) 88 ITR 192 (SC)

- Jute Corporation of India Ltd. v. CIT (1991) 187 ITR 688 (Cal)

- CIT v. Max India Ltd. (2007) 295 ITR 282 (SC)

- CIT v. Raman & Co. (1968) 67 ITR 11 (SC)

- GKN Driveshafts (India) Ltd. v. ITO (2003) 259 ITR 19 (SC)

- CIT v. Kabul Chawla (2015) 380 ITR 573 (Bom)

- CIT v. Reliance Petroproducts Pvt. Ltd. (2010) 322 ITR 158 (SC)

- Collector, Land Acquisition v. Mst. Katiji (1987) 167 ITR 98 (SC)

Download Full Judgments (PDF)

- https://bhattandjoshiassociates.s3.ap-south-1.amazonaws.com/judgements/a1961-43.pdf

- https://bhattandjoshiassociates.s3.ap-south-1.amazonaws.com/judgements/Income-Tax Rules,1962 (Part-C) -Amendments upto 16th Amendments.pdf

- https://bhattandjoshiassociates.s3.ap-south-1.amazonaws.com/judgements/Commissioner_Of_Income_Tax_vs_Vegetable_Products_Ltd_on_26_June_1969.PDF

- https://bhattandjoshiassociates.s3.ap-south-1.amazonaws.com/judgements/Jute_Corporation_Of_India_Ltd_vs_Commissioner_Of_Income_Tax_And_Anr_on_4_September_1990.PDF

- https://bhattandjoshiassociates.s3.ap-south-1.amazonaws.com/judgements/Cit_vs_Max_India_Ltd_on_1_November_2007.PDF

- https://bhattandjoshiassociates.s3.ap-south-1.amazonaws.com/judgements/Commissioner_Of_Income_Tax_Gujarat_vs_A_Raman_Company_on_18_July_1967.PDF

- https://bhattandjoshiassociates.s3.ap-south-1.amazonaws.com/judgements/Gkn_Driveshafts_India_Ltd_vs_Income_Tax_Officer_And_Ors_on_25_November_2002.PDF

- https://bhattandjoshiassociates.s3.ap-south-1.amazonaws.com/judgements/Commissioner_Of_Income_Tax_vs_Kabul_Chawla_on_28_August_2015.PDF

- https://bhattandjoshiassociates.s3.ap-south-1.amazonaws.com/judgements/C_I_T_Ahmedabad_vs_Reliance_Petroproducts_Pvt_Ltd_on_17_March_2010.PDF

- https://bhattandjoshiassociates.s3.ap-south-1.amazonaws.com/judgements/impdecsion1_5may.pdf

Whatsapp

Whatsapp