INTRODUCTION.

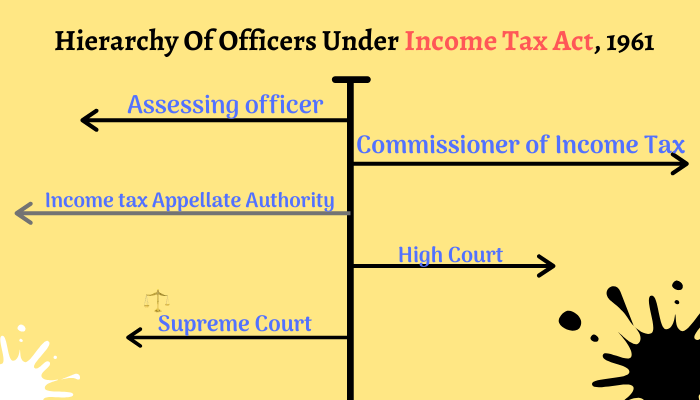

Appeal refers to an act of referring the case to a higher authority against the order passed by a lower authority in respect of that case or matter. It implies a complaint to a higher authority against the order or judgement (alleged to be erroneous) of an administrative authority or appellate authority. At times it may happen that the taxpayer is aggrieved by an order of the Assessing Officer. In such a case he can file an appeal against the order of the Assessing Officer before the Commissioner Of Income-Tax (Appeals) CIT(A). In this part you can gain knowledge about various provisions relating to appeals to CIT(A).

PARTIES TO AN APPEAL.

There are following two parties to any appeal :

Appellant. The person filing an appeal is called ‘appellant’ or ‘applicant’. Under Income Tax, the first appeal can only be filed by assesse and—hence only assesse can be appellant in such a case. However, in subsequent appeals (i.e., appeal to ITAT, HC or SC) appellant can be assessed or C.I.T.

Defendant / Respondent. The person against whom the appeal is filed is called ‘defendant’ or ‘respondent’.

WHEN APPEAL CAN BE FILED ?

As per Section 246 A The CIT(A) is the first appellate authority. Section 246A specifies the orders against which an appeal can be filed before the CIT(A). The list of major orders against which an appeal can be preferred before the CIT(A) is given below:

- Order passed against the taxpayer in a case where the taxpayer denies the liability to be assessed under Income Tax Act.

- Intimation issued under Section 143(1)/(1B) where adjustments have been made in income offered to tax in the return of income.

- Intimation issued under Section 200A(1) where adjustments are made in the filed statement.

- Assessment order passed under Section 143(3) except in case of an order passed in pursuance of directions of the Dispute Resolution Panel

- An assessment order passed under Section 144.

- Order of Assessment, Re-assessment or Re-computation passed after reopening the assessment under Section 147except an order passed in pursuance of directions of the Dispute Resolution Panel

- An order referred to in Section 150.

- An order of assessment or reassessment passed under Section 153A or under Section 158BC in case of search/seizure.

- Assessment or reassessment order passed under Section 92CD(3).

- Rectification order passed under Section 154 or under Section 155.

- Order passed under Section 163 treating the taxpayer as an agent of a non-resident.

- Order passed under Section 170(2)/(3) assessing the successor of the business in respect of income earned by the predecessor.

- Order passed under Section 171 recording the finding about partition of a Hindu Undivided Family.

- Order passed by Joint Commissioner under Section 115VP(3) refusing approval to opt for tonnage-tax scheme to qualifying shipping companies.

Order passed under Section 201(1)/206C(6A) deeming a person responsible for - deduction of tax at source as assesse-in-default due to failure to deduct tax at source or to collect tax at source or to pay the same to the credit of the Government.

- Order determining refund passed under Section 237.

- Order imposing penalty under Section(s) 221/271/271A/271AAA/271F/271FB/272A/272AA/272B/272BB/275(1A)/158BFA(2)/271B/271BB/271C/271CA/271D/271E/271AAB

Order imposing a penalty under Chapter XXI.

FEES TO BE PAID FOR APPEAL.

Form 35 shall be accompanied by a fee as under: `

Where the total income/loss of the assessee as computed by the A.O. in the case to which appeal relates is Rs.1,00,000 or less : Rs. 250

Where the total income/loss of the assessee, computed as aforesaid in the case to which appeal relates exceeds Rs. 1,00,000 but does not exceed Rs. 2,00,000 : Rs. 500

Where total income/loss of the assessee, computed as aforesaid in the case to which appeal relates exceeds Rs. 2,00,000 : Rs. 1,000

Where the subject matter of appeal relates to any matter other than specified in clauses (a), (b) and (c) above : Rs. 250

The fee should be credited in a branch of the authorised bank or a branch of the State Bank of India or a branch of the Reserve Bank oIndia after obtaining a challan from the Assessing Officer and a copy of challan sent to the Commissioner of Income-tax (Appeals).

TIME LIMIT FOR FILING APPEAL

According to Section 249(2) The a

Appeal should be presented within a period of 30 days of

the date of payment of tax, where appeal is under Section 248; or

the date of service of notice of demand relating to assessment or penalty if the appeal relates to assessment or penalty; or

However, where an application has been made under Section 270AA(1), the period beginning from the date on which the application is made, to the date on which the order rejecting the application is served on the assesse, shall be excluded.

the date on which intimation or the order sought to be appealed against is served if it relates to any other cases.

As per Section 268 the date on which the order complained of is served is to be excluded. Further, if the assesse was not furnished with a copy of the order when the notice of the order (say notice of demand) was served upon him then the time required for obtaining a copy of the order should be excluded, i.e. period taken for obtaining the order shall be added to the time limit of 30 days.

PROCESS OF PAYMENT OF TAX ONLINE FOR APPEALS.

1. To pay taxes online, login to http://www.tin-nsdl.com > Services > e-payment. You can go and visit following Link – https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

2. Select the relevant challan i.e. ITNS 280

3. Enter PAN / TAN (as applicable) and other mandatory challan details like accounting head under which payment is made, address of the taxpayer and the bank through which payment is to be made etc

4. On submission of data entered, a confirmation screen will be displayed. If PAN / TAN is valid as per the ITD PAN / TAN master, then the full name of the taxpayer as per the master will be displayed on the confirmation screen.

5. On confirmation of the data so entered, the taxpayer will be directed to the net-banking site of the bank.

6. The taxpayer has to login to the net-banking site with the user id / password provided by the bank for net-banking purpose and enter payment details at the bank site.

7. On successful payment a challan counterfoil will be displayed containing CIN, payment details and bank name through which e-payment has been made. This counterfoil is proof of payment being made.

PROCEDURE FOR FILING APPEAL FORM 35

Login in your Account using User credentials

↓

Go to E-File Link and Choose Income Tax Forms

↓

Choose Form No- 35 –Appeal to Commissioner

Appeals.

↓

Now start Filing Form No 35 Online. You will get some details Pre-filed and fill remaining editable details properly.

↓

Now provide details of the order to be appealed against.

↓

Provide details related to Filed ITR, selected for Scrutiny and against which Appeal is to be filed.

↓

Now Provide details related to Statements of facts, Grounds of Appeal and Additional Evidence related information which is not made available at time of Assessment. This is a very crucial part of Appeal. Adequate attention needs to be paid while preparing Facts and Grounds of Appeal.These are the points on which your case will proceed further. Each matter on which there is controversy/ matter of disputes between assessee and Assessing Officer needs to be explained properly. All facts should be adequately drawn because in case of appeal before ITAT also these Grounds of Appeal play a very crucial role.

↓

Now provide details, whether appeal is filed within time limit or there is any delay in filing Appeal. As explained earlier, appeal is to be filed within 30 days from the date of receipt of order however; CIT (A) has power to condone the delay in filing appeal within the prescribed time period. In case of delay, please provide the reasons of delay. The reason should be genuine.

↓

Now provide details related to Appeal Fees paid and address on which further communication can be done and save the appeal.

↓

After above process, submit the Form 35 and you will get the Acknowledgement number of this Submission

CONCLUSION

The right to appeal is not the natural or inherent right of the assesse. It is available to him only if specifically granted under Income Tax Act. Thus, it is a statutory right of the assesse and cannot be denied to him by any order of the Central Board of Direct Tax (CBDT). It can be snatched from the assesse only by an express provision provided under Income Tax Act. Where it is possible, the CIT(A) shall dispose off the appeal within a period of one year from the end of the financial year in which appeal is filed. The order should be issued within 15 days of last hearing.

Author: Mohit Mathur

Editor: Adv. Aditya Bhatt & Adv. Chandni Joshi