INTRODUCTION TO DTAA

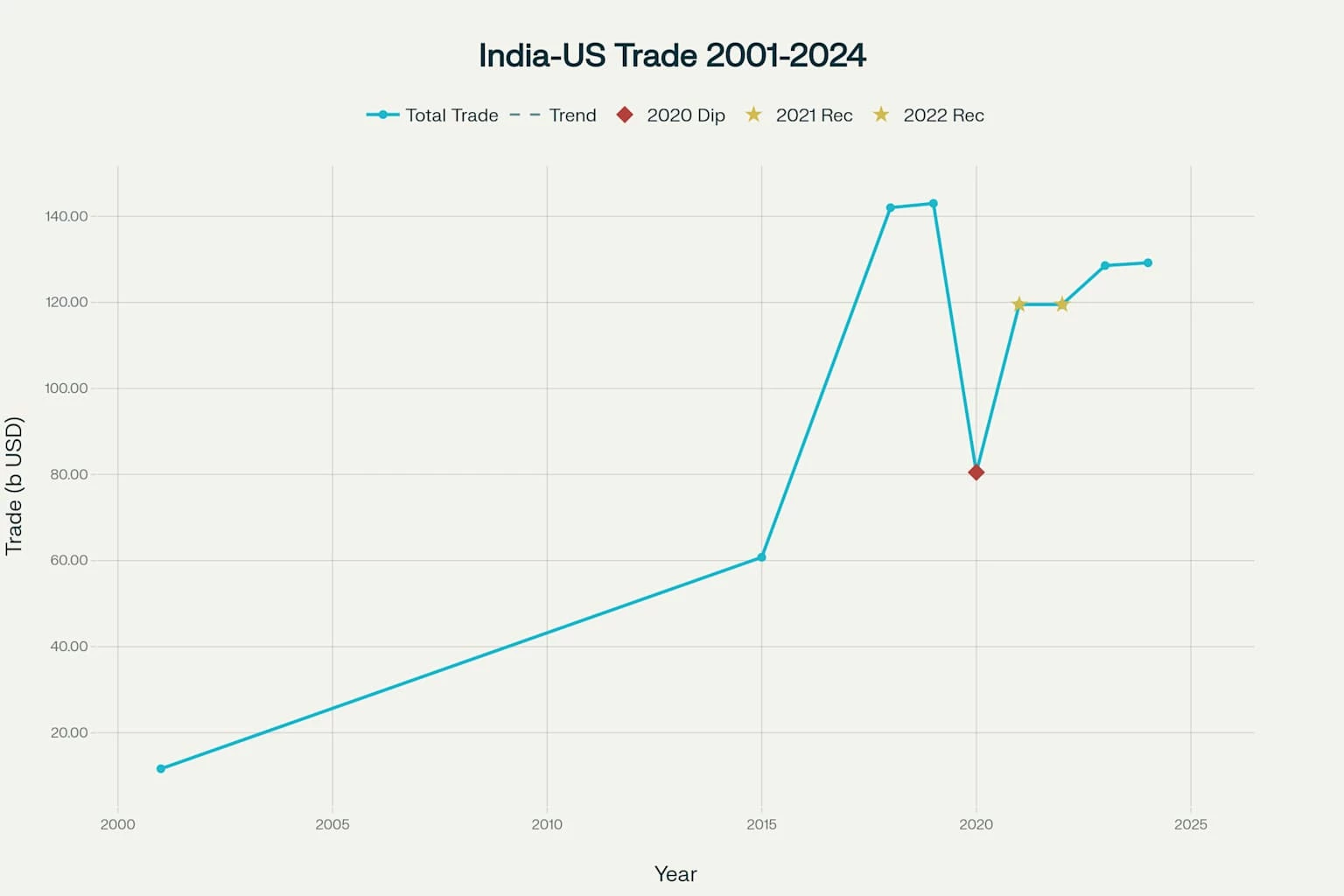

The time has not changed, rather it has transformed – like a piece of coal into a pinnacle of paragon, refracting & reflecting the dews of development throughout the globe. With modernization and ease of transition, the world has become a tiny trade market. It is a well-established notion that with the evolution of human presence in new domains, the control by the state should be an inseparable part to ensure the welfare of all. Foreign trade is the mutual exchange of services or goods between international regions and borders for the self-growth or sufficiency of both nations. Every state, like every man, by nature, is a political animal that primarily focuses on the self good. Thereby, foreign trade and agreements are entered into to serve the ultimate objective of self-growth, by way of aiding other nations/states with sharing strengths in return, overcoming their shortcomings of the needs.

Every country in the globe must address the requirements of its citizens. To satisfy the demands, goods and services are required. The production of services and products necessitates the use of some resources. However, not all countries have adequate resources to produce products and services. As a result, it is unable to satisfy its manufacturing requirements. It obtains procurement help from other locations as a result of this. Foreign trade satisfies this essential requirement.

International Trade and DOUBLE TAXATION AVOIDANCE AGREEMENT UNDER THE INCOME TAX ACT for DTAA

The movement of services or capital created outside of national borders is known as foreign trade. The idea of commerce refers to the buy and sale transactions that enable manufactured commodities and services to be provided to customers. The notion of overseas commerce is represented by these purchases and sales transactions with foreign nations. In terms of delivery of buy and sell transactions, foreign trade takes the shape of import and export. Simply said, this idea encompasses all import and export procedures. In terms of national economic development, export plays a significant role. Frequently, governments implement policies aimed at increasing exports while reducing imports. Multiple countries engage in international trade. The transactions are centered on customs. For its achievement, detailed legislation and implementation processes are carried out. All concerns that may arise throughout the transaction should be guarded against. Foreign trade is the sum of all of these occurrences.

To facilitate streamlined trade, different nations enter into agreements in accordance with their requirements, dimensions of the party nations, and related negotiations for their mutual good. A Double Taxation Avoidance Agreement is a tax treaty between two or more nations that prevents the same income from being taxed twice (DTAA). This means that for any sort of income generated in a country, there are agreed-upon tax rates and jurisdiction. If a taxpayer lives in one country but makes money in another, he is covered by the Double Taxation Avoidance Agreement (DTAA), if both nations have such agreement. DTAAs can be broad, encompassing all sorts of income, or narrowly focused on a single source of income. This is dependent on the sorts of enterprises and holdings that individuals of one country have in another one. Services, salaries, property, capital gains, savings/fixed deposit accounts, and so on are some of the major categories covered by DTAAs.

DTAAs of India and related governance

India, a growing economy filled with diversity and disagreements having more than a billion human resources aims to become a lucrative investment hub in the Twenty-first Century. Countries with DTAAs tend to become successful investment centers since there is no double taxation. This aids in attracting foreign investment and subsequent growth of a country. NRIs can also benefit from DTAAs. If they make money in both India and their current residence nation, the income earned in India will be taxed in both India and their current residence country. NRIs can either avoid paying tax twice or pay a lesser rate of tax if India and the relevant nation have a DTAA in place. On a less concrete level, DTAAs foster formal and informal trust between countries, resulting in diplomatic advantages and friendly ties. India, as a hub for foreign investment and a source of a significant number of immigrants, recognizes the value of DTAAs and has pursued them aggressively. For example, there are 85 current agreements of this type in our nation. Apart from these different international agreements, the Income Tax Act gives double taxation relief, Sections 90 and 91 explore this topic. In the event of a conflict, the provisions of the DTAA will take precedence.

A Double Taxation Avoidance Agreement (DTAA) is an agreement between two governments that non-residents’ income should not be taxed in both their home country and their home country. The Fiscal Committee of the League of Nations created the first model forms in 1927. In April 1976, its successor, the United Nations Social and Economic Council, issued its Model Convention in Geneva. Later, in July 1963, the Fiscal Committee of the Organization for European Economic Co-operation (OEEC) released its Draft Version. In September 1961, the Organization for Economic Co-operation and Development (OECD) was created to supplant the OEEC. The OEEC draught version was approved and renamed the OECD Model Tax Convention. They were amended again in 1974, 1977, and most recently, in April 2019, it was suggested to revise them again to reflect the most recent advancements. On the technical phrases and clauses covered by the stated Model Convention, the OECD gives its own comments.

In view of the Indian economy perspective, it is to be highlighted that there exist three basic models of DTAA followed, which can be briefly understood as follows:

OECD Model Tax Convention for DTAA-

Capital-exporting nations are favored over capital-importing countries under the OECD Model Convention. It frequently avoids or reduces double taxation by requiring the source nation to waive part or all of its tax on specific types of income received by citizens of the other treaty country.

UN Model Double Taxation Convention for DTAA –

The United Nations is primarily acting on the request of LDCs and developing countries for a new model with a framework that is more friendly to capital importing countries that rely on investment destinations for economic growth. The UN Model explicitly and unequivocally indicates that it advocates a “Source Country” taxing right approach or “host of investment,” which is mostly done for the benefit of poor nations, but some affluent countries are now supporting it as well. In comparison to the OECD Model Convention, the United Nations Model Convention places fewer constraints on the source country’s taxation powers; as a result, source nations have more taxing rights under it.

US Model Income Tax Convention for DTAA-

For DTAAs with the United States, the US Model Income Tax Convention is used.

Analysis of India-UAE DTAA in the context of foreign taxation

The UN Model Double Taxation Convention and the OECD Model Tax Convention are two common tax agreements that governments throughout the globe use to prevent double taxation. The OECD Model Convention serves as a model for a number of bilateral tax treaties, and almost all tax treaty discussions in the world now begin with it. The UN Model Tax Convention was established in 1980 to provide a framework for developing and developing nations to negotiate bilateral tax treaties.

Taxation of Fees for Technical Services

There is no particular clause dealing to FTS / FIS in several DTAAs (such as those with Bangladesh, Brazil, Greece, Indonesia, Mauritius, Myanmar, Nepal, Philippines, Namibia, Saudi Arabia, Sri Lanka, Syria, Tajikistan, UAE, UAR Egypt, and Zambia, among others). The lack of the provision in the DTAA is not an oversight, but rather a purposeful mutual agreement by the Contracting States. Similarly, the clause for taxation of Fees for Technical Services is omitted in the India-UAE DTAA, following which, the capital flowing from UAE avoids paying tax to the Indian Government by exploiting the gap in the Indian Sub-continent. It becomes paramountcy important to explore various heads of economic activities or clauses where the income earned can be taxed at the source. In terms of taxation, the following items will be subject to taxation:

- Profits from the firm, as well as any profits from air and shipping transportation

- Dividends, royalties, and interest

- Income derived from the sale or lease of moveable property

- Income generated by delivering personal services.

Following are the key contentions to consider while taxing different economic or commercial activities:

Business Profits:

- The earnings of a Contracting State’s enterprise are taxed entirely in that State unless the company does business in the other Contracting State through a permanent establishment there. If the firm functions as indicated, its earnings may be taxed in the other state, but only to the degree that they can be traced back to that permanent establishment. (Article 7).

- It’s worth noting that, while the OECD and UN Model Conventions have explicit rules on the taxation of royalties, they don’t include anything particular on the taxability of technical fees. As a result, if a charge is paid for technical services, both the UN Model Convention and the OECD Model Convention regard such revenue as “business profits.”

- In the matter of Spice Telecom v. ITO, the Income Tax Appellate Tribunal in Bangalore made an intriguing decision. The ITAT had to decide whether the Act’s provisions would apply in circumstances where the DTAA was silent. The assessee did not deduct tax on revenue obtained from the supply of advice and support services since it was not classified as technical services. The assessee claimed that the DTAA between India and Mauritius did not cover such services. The Assessing Officer, on the other hand, proceeded to levy tax under section 9(1)(vii) of the Act.

- The ITAT overruled the Assessing Officer’s decision, ruling that while the DTAA lacks rules governing the taxation of fees for technical services, the DTAA’s provisions will apply and the revenue would be taxed as business income. The Authority for Advance Ruling (AAR) reiterated this position in the subsequent case of Worley Parsons Services Pty. Ltd.

Income from Immovable Property:

Income from immovable property in another Contracting State received by a resident of one Contracting State (including income from agriculture or forestry) may be taxed in that other Contracting State. (Article 6)

Independent Personal Services:

Income derived by a resident of a Contracting State in connection with professional services or other independent activities of a similar nature is taxable only in that State, except in the following circumstances:

- If he has a fixed base regularly available to him in the other Contracting State for the purpose of performing his activities; in that case, only so much of the income as is attributable to that fixed base is taxable in the other Contracting State.

- If his stay in the other Contracting State is for a period or periods totaling or exceeding 183 days in the relevant “prior year” or “year of income,” as the case may be, only that portion of his income obtained from his activities in that other State may be taxed in that other State. (Article 14)

Other Incomes:

- Items of income earned by a resident of a Contracting State that are not specifically addressed in the paragraphs or articles of the Agreement are taxed exclusively in that Contracting State. (Article 22)

- The Delhi High Court while firmly upholding the view of the Commissioner of Income Tax in the case of CGS International and Marble Arts & Crafts, it was stated that:

“As to whether Article 14 applies to the nature of services provided by CGS International and Marble Arts & Crafts, the CIT(A) observed as follows:

In the DTAA with UAE, there are Articles to consider accessibility of income from immovable property (Article 6), business profit (Article 7), shipping (Article 8), associated enterprise (Article 9), dividends (Article 10), interest (Article 11), royalties (Article 12), capital gains (Article 13), Independent personal services (Article 14), dependent personal services (Article 15) etc. There is no clause or Article governing payment for the so-called technical services as in other DTAAs i.e. Article 13 of DTAA with UK or Article 12 of DTAA with Singapore. In view of the fact that the non-residents do not have any permanent establishment within the meaning of Article 5 of DTAA in India, the remittances to them could only have been considered under Article 14 or Article 22 of DTAA. Under Article 14 of DTAA, the consideration paid to the non-resident is liable to be taxed in the contracting state i.e. UAE. In case remittances are considered as other income under Article 22 of the DTAA, it would also be taxable in the contracting state i.e. UAE.‖ (ITA 325/2014 Page 16)

22. This Court agrees with the CIT(A)‟s approach, quoted above. Since the income of CGS International and Marble Arts & Crafts can only be classified under Article 14 or Article 22 of the DTAA – both of which provide that the income shall be taxable in the State of residence (UAE)-the issue as to whether the services provided by the two UAE entities fall within the scope of “professional services‟ under Article 14 is irrelevant to the outcome of this case. Their incomes would necessarily be taxable in UAE, whether by virtue of Article 14 or Article 22.”

Permanent Establishment and Fixed Base

In alignment with the settled law and the agreement, it is important to understand the definition of Permanent Establishment and Fixed Base, which provides for the taxation in the source or the destination state.

In a landmark decision i.e. CIT Vs. Vishakhapatnam Port Trust [(1983), 144-ITR-146 (AP)] on the subject of “Permanent Establishment”, the Andhra Pradesh High Court has observed as under: “The words “Permanent Establishment” postulate the existence of a substantial element of an enduring or permanent nature of a foreign enterprise in another, which can be attributed to a fixed place of business in that country. It should be of such a nature that it would amount to a virtual projection of the foreign enterprise of one country onto the soil of another country.”

Article 5 (DTAA India-UAE) – Definition of Permanent Establishment

- Also, it becomes paramount to note that even if the fixed base of the operations is not proved within the state, then also, the definition of ‘Permanent Establishment’ enshrined under Article 5 of DTAA between India & UAE provides a wide ambit for its definition making it inclusive rather than exhaustive. As per the definition, it states:

“For the purposes of this Agreement, the term “permanent establishment” means a fixed place of business through which the business of an enterprise is wholly or partly carried on.

The term “permanent establishment” includes especially:

(a) a place of management ;

(b) a branch ;

(c) an office ;

(d) a factory ;

(e) a workshop ;

(f) a mine, an oil or gas well, a quarry or any other place of extraction of natural resources;

(g) a farm or plantation ;

(h) a building site or construction or assembly project or supervisory activities in connection therewith, but only where such site, project or activity continues for a period of more than 9 months;”

Conclusion

In light of the agreement and judicial interpretation of the law, it can be reasonably deduced that with the omission of the clause for “Technical Services” in the DTAA between India & UAE, the taxation for the economic or commercial transactions between the states can be governed under Article 6 (Income from Immovable Property), Article 7 (Business Profits), Article 14 (Independent Personal Services) and Article 22 (Other Incomes).