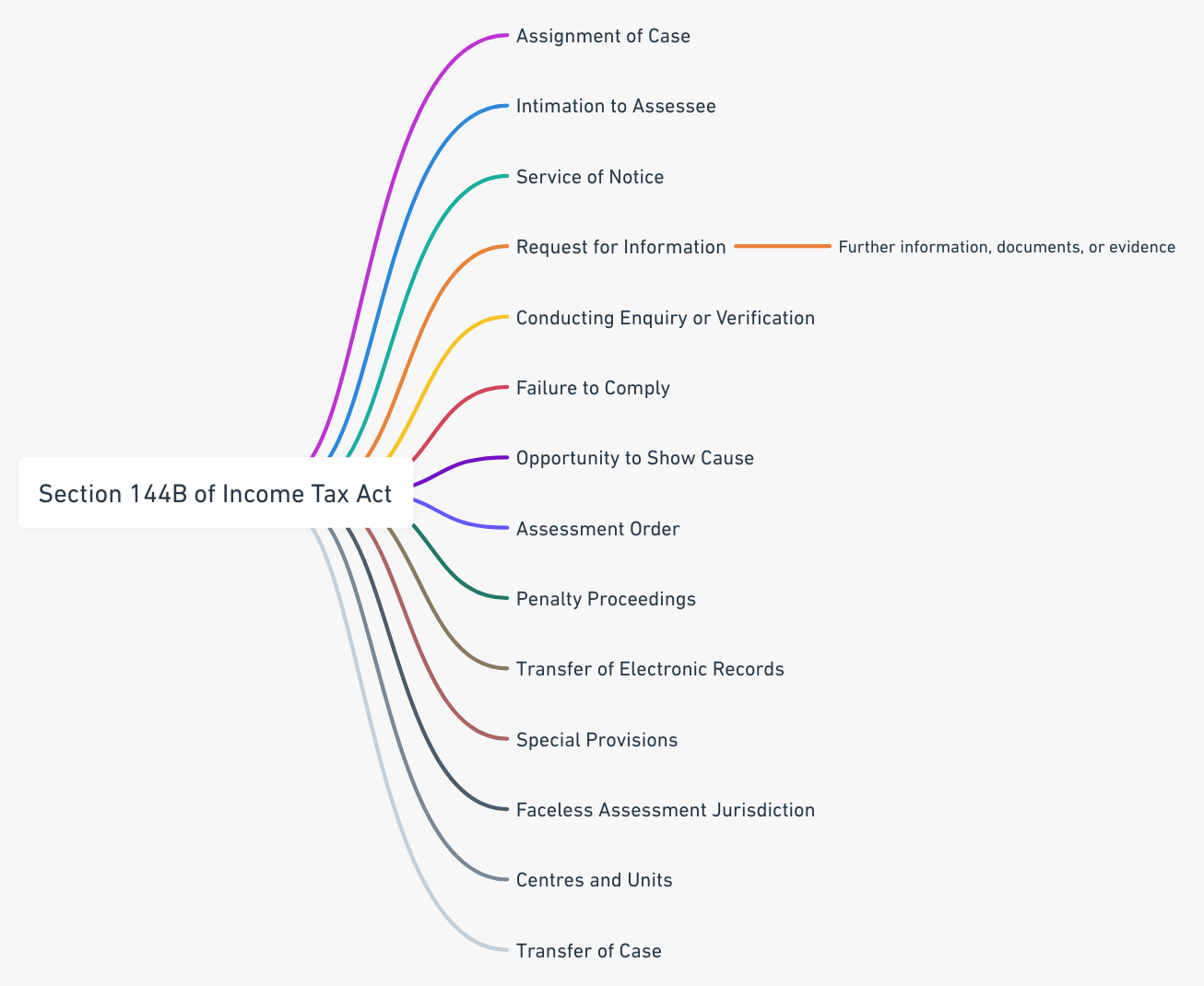

Introduction

Having previously discussed how Faceless Assessment has created a significant shift in the way tax assessments are conducted, this article is a comprehensive breakdown of the step-by-step process. In Part 1, we will discuss about Automated Allocation of Cases, Intimation and Notices to Assessee. Digital Response and Compliance.

Assignment of Case

The National Faceless Assessment Centre assigns the case selected for the purposes of faceless assessment under Section 144B to a specific assessment unit through an automated allocation system.

- Automated Allocation System: This system uses suitable technological tools, including artificial intelligence and machine learning, to optimise the use of resources.

- Selection for Faceless Assessment: The case selected for faceless assessment is assigned to a specific assessment unit, ensuring a transparent and unbiased allocation.

- Integration with Other Units: The process may involve coordination with verification units or technical units, assigned through an automated allocation system, for conducting inquiries, verifications, or seeking technical assistance.

This process ensures that the assignment of cases is done in a systematic and unbiased manner, leveraging technology to enhance efficiency.

Intimation to Assessee

The National Faceless Assessment Centre intimates the assessee that the assessment in his or her case shall be completed in accordance with the procedure laid down under Section 144B of the Income Tax Act.

- Notification to Assessee: This intimation serves as a formal communication to the assessee that the assessment will be conducted under the specific provisions of Section 144B.

- Mode of Communication: The intimation is likely to be sent electronically, ensuring a seamless and transparent communication process, as detailed in Section 144B(1)(ii) and (iii).

- Alignment with Faceless Assessment: This step aligns with the broader objective of conducting assessments in a faceless manner, minimizing human intervention and promoting efficiency.

This process ensures that the assessee is well-informed about the initiation of the faceless assessment and the specific procedures that will be followed.

Service of Notice

A notice is served on the assessee through the National Faceless Assessment Centre, under sub-section (2) of section 143 or under sub-section (1) of section 142, and the assessee may file a response to such notice within the specified date.

- Issuance of Notice: A notice is issued to the assessee through the National Faceless Assessment Centre. This notice may be under sub-section (2) of section 143 or under sub-section (1) of section 142, depending on the context of the assessment.

- Filing of Response: The assessee is given the opportunity to file a response to the notice within the date specified in the notice. The response must be filed with the National Faceless Assessment Centre.

- Forwarding of Response: The National Faceless Assessment Centre forwards the response filed by the assessee to the assessment unit responsible for the case.

- Electronic Communication: The entire process of serving the notice and receiving the response is conducted electronically, aligning with the faceless assessment mechanism.

This process ensures that the assessee is formally informed about the specific requirements or inquiries related to the assessment and is given the opportunity to respond within a specified timeframe.

Conclusion

In this part, we discussed the allocation of cases, intimation of notice and compliance. In Part 2, we shall discuss the provisions related to Enquiry, Verification, and Technical Assistance.