Introduction

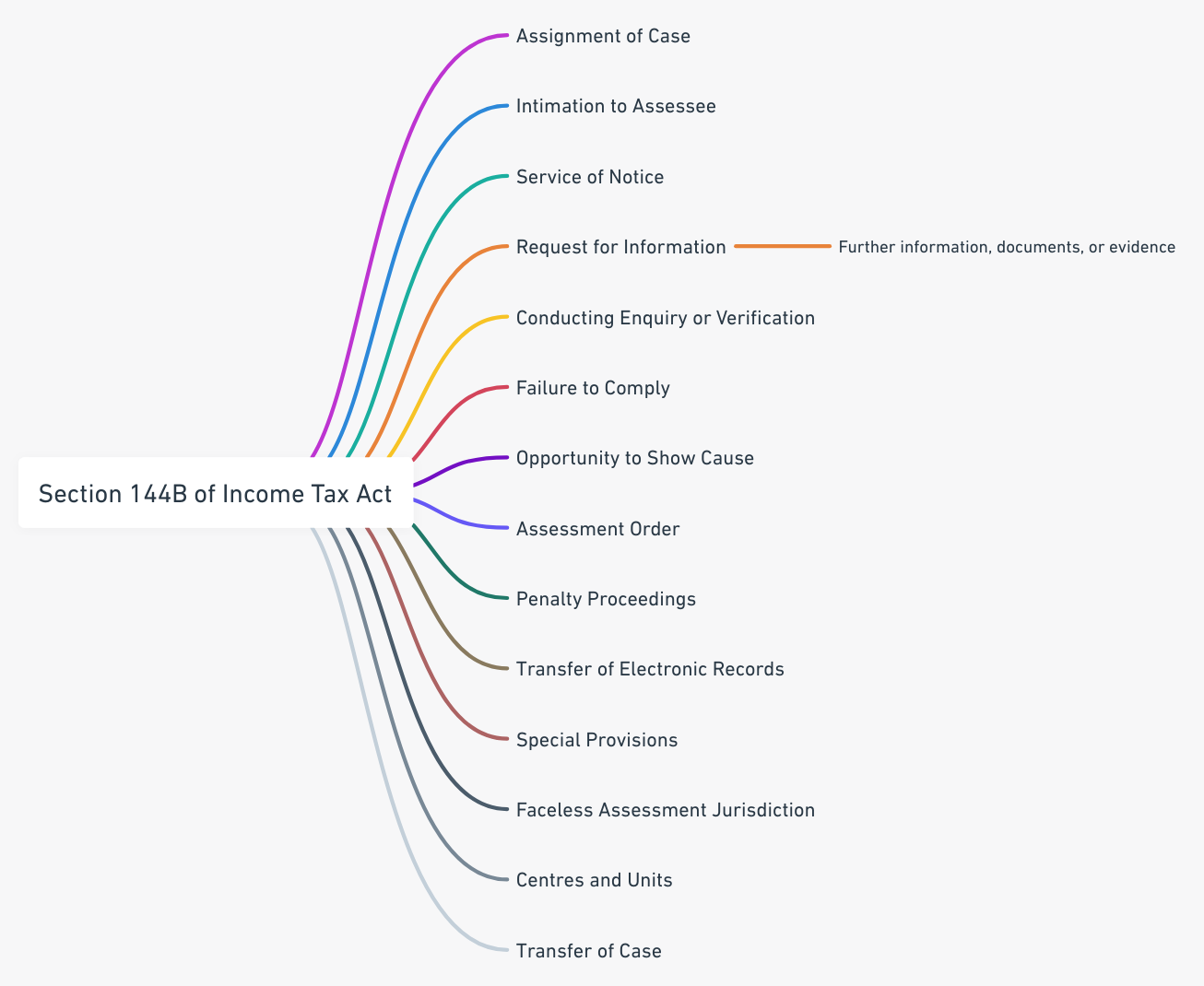

We have delved into the Introduction to Faceless Assessment Procedure under Section 144B, exploring provisions related to automated allocation of cases, intimation and notices to assessee, digital response and compliance in Part 1, of this series. In this Part, we shall discuss request for information and documents, conducting enquiry or verification, failure to comply, opportunity to show cause, filing of response.

Request for Information

Where a case is assigned to the assessment unit, it may make a request through the National Faceless Assessment Centre for obtaining further information, documents, or evidence from the assessee or any other person, conducting an enquiry or verification, or seeking technical assistance.

- Request for Information: The assessment unit may request further information, documents, or evidence from the assessee or any other person. This request is made through the National Faceless Assessment Centre.

- Conducting Enquiry or Verification: The assessment unit may request the conducting of an enquiry or verification by a verification unit.

- Seeking Technical Assistance: The assessment unit may seek technical assistance in matters such as determination of arm’s length price, valuation of property, withdrawal of registration, approval, exemption, or any other technical matter by referring to the technical unit.

- Service of Notice or Requisition: The National Faceless Assessment Centre serves appropriate notice or requisition on the assessee or any other person for obtaining the information, documents, or evidence requisitioned by the assessment unit.

- Filing of Response: The assessee or any other person must file a response to such notice within the time specified or as extended, to the National Faceless Assessment Centre, which forwards the reply to the assessment unit.

- Automated Allocation to Verification or Technical Unit: Requests for conducting an enquiry or verification or reference to the technical unit are assigned by the National Faceless Assessment Centre through an automated allocation system.

This process ensures that the assessment unit has access to all necessary information, documents, and evidence required for the assessment, and can seek specialized assistance as needed.

Conducting Enquiry or Verification

The purpose of conducting an enquiry or verification under Section 144B of the Income Tax Act within the context of the faceless assessment procedure is to ensure a transparent and efficient process of evaluating an assessee’s tax liability.

- Assignment of Request: If the assessment unit makes a request for conducting an enquiry or verification, the National Faceless Assessment Centre assigns the request to a verification unit through an automated allocation system.

- Service of Notice or Requisition: The National Faceless Assessment Centre serves appropriate notice or requisition on the assessee or any other person to obtain the information, documents, or evidence required by the assessment unit.

- Filing of Response: The assessee or any other person must file a response to the notice within the specified time or as extended, to the National Faceless Assessment Centre, which forwards the reply to the assessment unit.

- Conducting Enquiry or Verification: The verification unit conducts the enquiry or verification as requested by the assessment unit.

- Sending Report to Assessment Unit: The National Faceless Assessment Centre sends the report received from the verification unit to the concerned assessment unit based on the request referred to in the clause.

This process ensures that the assessment unit can conduct necessary enquiries or verifications to ascertain the correctness of the information, documents, or evidence provided by the assessee.

Failure to Comply

The process of handling failure to comply with notices under Section 144B of the Income Tax Act is a critical aspect of the faceless assessment procedure. If the assessee fails to comply with the notice served under clause (v) or notice issued under sub-section (1) of section 142 or the terms of notice issued under sub-section (2) of section 143, the National Faceless Assessment Centre takes note of such failure.

- Intimation to Assessment Unit: The National Faceless Assessment Centre intimates such failure to the assessment unit.

Opportunity to Show Cause

The process of providing an opportunity to show cause under Section 144B of the Income Tax Act is an essential part of the faceless assessment procedure.

- Serving Show Cause Notice: If the assessee fails to comply with the notice served under clause (v) or notice issued under sub-section (1) of section 142 or the terms of notice issued under sub-section (2) of section 143, the assessment unit serves a notice on the assessee, through the National Faceless Assessment Centre, under section 144. The notice gives the assessee an opportunity to show cause on a specified date and time as to why the assessment in the case should not be completed to the best of its judgment.

- Filing of Response: The assessee must file a response to the National Faceless Assessment Centre within the time specified in the notice or such time as may be extended based on an application in this regard.

- Further Failure to Respond: If the assessee fails to file a response to the notice served within the specified time or within the extended time, the National Faceless Assessment Centre intimates such failure to the assessment unit.

- Preparation of Proposal or Show Cause Notice: The assessment unit, after taking into account all relevant material available on the record, prepares an income or loss determination proposal or a show cause notice stating the variations prejudicial to the interest of the assessee.

This process ensures that the assessee is given a fair opportunity to present their case and respond to any variations proposed by the assessment unit. It also provides a structured mechanism for the assessment unit to proceed with the assessment if the assessee fails to respond.

Conclusion

In this part, we discussed provisions related to request for information and documents, conducting enquiry or verification, failure to comply, opportunity to show cause, filing of response. In Part 3, we shall discuss the provisions related to Assessment and Penalties.