Home Buyers and The Insolvency and Bankruptcy Code (Amendment) Ordinance, 2019

The Insolvency and Bankruptcy Code (Amendment) Ordinance, 2019 was promulgated on December 28, 2019. The government had passed an ordinance to amend the code, with the result that a threshold of minimum 100 home buyers or 10% of total home buyers in a project, whichever is less, is required to take the builder to an insolvency court. Therefore, it becomes interesting to watch how does CIRP would be like after the amendment. Read Part 1

Important amendments to the code:

The most pivoting amendment is the amendment to Section 25A of the Code. One of the drawbacks of the earlier scheme of the Code was the requirement of the vote of each home buyer being calculated individually in proportion to the individual debt owed to him and not as a class of financial creditors. This used to lead situations where none of the agendas put forth before the Committee of Creditors (“CoC”) could be approved, mainly due to many home buyers failing to exercise their votes and thus, the remaining financial creditors (including home buyers who did cast their vote) were not able to form the requisite majority (calculated on total debt share).

In such a scenario, if no Resolution Plan is approved, the corporate debtor was necessarily required to be liquidated. And on liquidation, home buyers being unsecured creditors would stand to lose priority to secured financial creditors such as financial institutions.

- That the amendment sought to be moved through Ordinance, is set to benefit classes of creditors such as home buyers, the Amendment now rectifies this issue by empowering the authorized representative to cast the vote of the entire class of creditors represented by him in accordance with the decision approved by more than 50% of such class of creditors on a present and voting basis.

The Scenario of Typical CIRP before the Amendment for the Home Buyers would be like this:

- if there are 1000 property buyers, in a real estate company undergoing CIRP, where the collective debt of the 1000 home buyers forms 70% of the total debt of all financial creditors.

- Out of these, 300 home buyers attend a meeting of the CoC and 270 of such home buyers, vote in favor of a particular agenda.

- That before Amendment, the vote of the 270 home buyers who voted in favor of the agenda would only count to the extent of their respective individual debt share.

- Thus, although in the present example, almost all home buyers who were present had voted in favor of a particular agenda, the fact that a large number of home buyers abstained from voting would lead to failure to garner the minimum required percentage for approving that particular agenda.

This might not present itself as an issue when minor decisions of the CoC are affected; however in a vote for the approval of a Resolution Plan, such a mechanism for calculating the vote would undoubtedly hinder the effectual resolution of any company undergoing CIRP.

The Scenario of CIRP after the Amendment would be like this:

- Because the majority of the home buyers, i.e., 270 home buyers out of the 300 present and voting have voted in favor of the agenda, the vote of the entire class of financial creditors i.e. of 1000 home buyers forming 70% of total debt share would be cast by the authorized representative in favor of the agenda.

- Thus, now the authorized representative is required to extrapolate the vote of the 270 home buyers, to all the 1000 home buyers being a class of creditors, and backed by the entire voting share of this class, the vote of the collective class of creditors being home buyers would undoubtedly carry more weight and actually lend meaning to home buyers becoming part of the CoC.

Therefore, this Amendment would undoubtedly cause resolution applicants to ensure that the interests of this unique class of creditors is protected and will also encourage all home buyers to exercise their rights responsibly and actively participate in the CoC meetings.

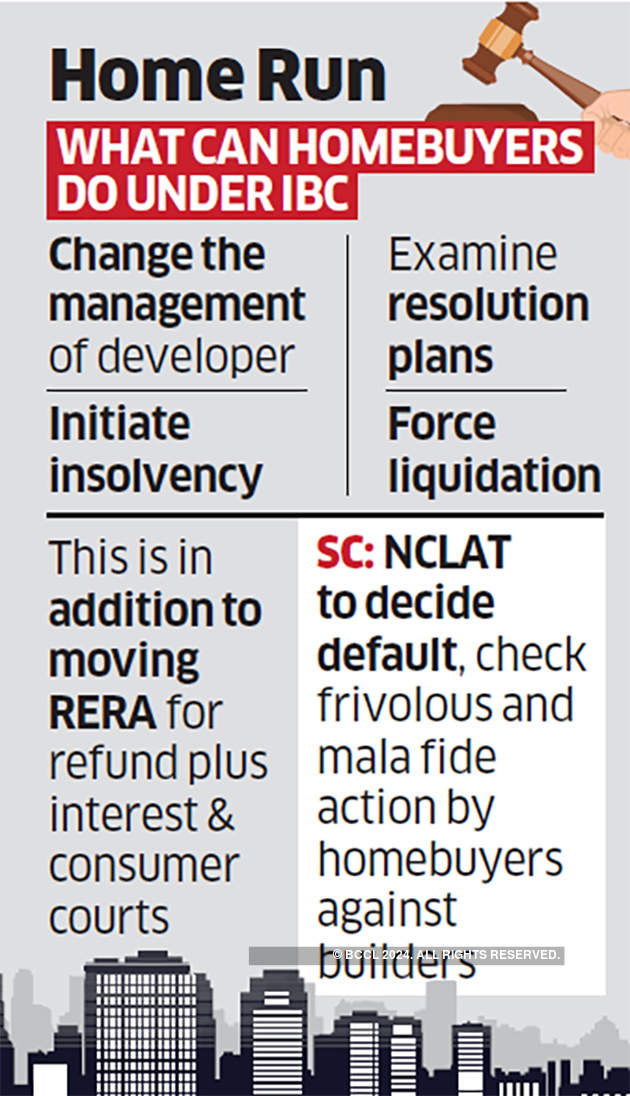

IBC amendment: Supreme Court provides partial relief to home buyers

- The NCLT will have to maintain status quo with respect to the applications already filed by home buyers, investors against defaulting developers, said Aditya Parolia

- The constitutional validity of the IBC amendment will be tested by the SC after hearing the govt and the home buyers

Providing partial relief to home buyers, the Supreme Court has issued a notice to the government of India on the petition filed by home buyers against the amendment of the Insolvency and Bankruptcy Code (IBC) 2016 which introduced a minimum threshold for filing an application with the National Company Law Tribunal (NCLT) against a defaulting developer. “This basically means that the NCLT will have to maintain status quo with respect to the applications already filed by home buyers and investors against defaulting developers,” said Aditya Parolia of PSP Legal, Advocates & Solicitors.

However, the legality and constitutional validity of the amendment will be tested by the Supreme Court after hearing the government and the home buyers, he added. The government recently amended the Insolvency and Bankruptcy Code (IBC) 2016 through an ordinance introducing a threshold of minimum 100 or 10%of allottees in a project or class of investors required that can approach the NCLT in order to start the liquidation process against the defaulting developer.

The Supreme Court after hearing the petition said that till further hearing the NCLT can’t reject the applications of the home buyers or investors for non-compliance of the new amendment brought in by the government introducing a minimum threshold for filing application under the Insolvency and Bankruptcy Code (2016).

The amendment required the existing applications which are yet to be accepted by NCLT to comply with the new regulations within 30 days of the passing of the ordinance. “This is certainly good news for home buyers as under the ordinance there was a clause which says all matter will be dismissed automatically within 30 days if they don’t meet the criteria. So, that has also been put on hold ,” said Aditya Parolia of PSP Legal, Advocates and Solicitors. The Home buyers were represented by the Advocate Piyush Singh and Advocate Aditya Parolia of PSP Legal, Advocates and Solicitors before the Supreme Court.

“However, there is no clarity on the threshold limit as of now as the bench didn’t comment on the same,” said Parolia. Challenging the ordinance, group of home buyers and investors had filed multiple writ petition with the Supreme Court challenging the amendment. Home buyers have argued that the amendment is arbitrary and discriminatory. Prior to this amendment even a single financial creditor, including a homebuyer, with claims of at least ₹1 lakh could move NCLT against the defaulting developer.

Clients of Karvy Private Wealth who saw defaults on their loans to builders introduced by Karvy have also challenged recent amendments to the Insolvency and Bankruptcy Code (IBC). “The Supreme Court has granted a partial stay on the 3rd provison of Section 3 today and issued a notice to the Union of India. This means that all the petitions that were filed before the amendment shall not be bound by the 30 day period given to satisfy the amendment.,” said Advocate Srijan Sinha, a lawyer practicing in the Supreme Court.