Introduction

Whenever a Job notification is out the first thing we do is go to the salary section and check what is the remuneration for that particular job. In order to apply for that particular job and later put all the effort and hard-work to get selected, is a long and tiring process. If our efforts are not compensated satisfactorily, we might not really like to get into the long time consuming process.

When we go through the salary section we often see words like Pay Scale, Grade Pay, or even level one or two salary and it is common to get confused between these jargons and to know the perfect amount of salary that we are going to receive.

To understand what pay scale, grade pay, various numbers of levels and other technical terms, we first need to know what pay commission is and how it functions.

Pay Commission

The Constitution of India under Article 309 empowers the Parliament and State Government to regulate the recruitment and conditions of service of persons appointed to public services and posts in connection with the affairs of the Union or any State.

The Pay Commission was established by the Indian government to make recommendations regarding the compensation of central government employees. Since India gained its independence, seven pay commissions have been established to examine and suggest changes to the pay structures of all civil and military employees of the Indian government.

The main objective of these various Pay Commissions was to improve the pay structure of its employees so that they can attract better talent to public service. In this 21st century, the global economy has undergone a vast change and it has seriously impacted the living conditions of the salaried class. The economic value of the salaries paid to them earlier has diminished. The economy has become more and more consumerized. Therefore, to keep the salary structure of the employees viable, it has become necessary to improve the pay structure of their employees so that better, more competent and talented people could be attracted to governance.

In this background, the Seventh Central Pay Commission was constituted and the government framed certain Terms of Reference for this Commission. The salient features of the terms are to examine and review the existing pay structure and to recommend changes in the pay, allowances and other facilities as are desirable and feasible for civil employees as well as for the Defence Forces, having due regard to the historical and traditional parities.

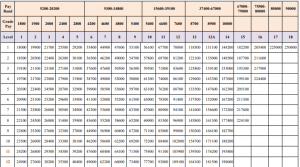

The Ministry of finance vide notification dated 25th July 2016 issued rules for 7th pay commission. The rules include a Schedule which shows categorically what payment has to be made to different positions. The said schedule is called 7th pay matrix

For the reference the table(7th pay matrix) is attached below.

Pay Band & Grade Pay

According to the table given above the first column shows the Pay band.

Pay Band is a pay scale according to the pay grades. It is a part of the salary process as it is used to rank different jobs by education, responsibility, location, and other multiple factors. The pay band structure is based on multiple factors and assigned pay grades should correlate with the salary range for the position with a minimum and maximum. Pay Band is used to define the compensation range for certain job profiles.

Here, Pay band is a part of an organized salary compensation plan, program or system. The Central and State Government has defined jobs, pay bands are used to distinguish the level of compensation given to certain ranges of jobs to have fewer levels of pay, alternative career tracks other than management, and barriers to hierarchy to motivate unconventional career moves. For example, entry-level positions might include security guard or karkoon. Those jobs and those of similar levels of responsibility might all be included in a named or numbered pay band that prescribed a range of pay.

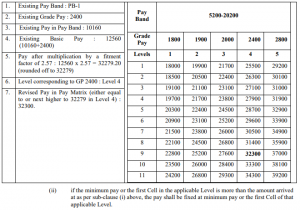

The detailed calculation process of salary according to the pay matrix table is given under Rule 7 of the Central Civil Services (Revised Pay) Rules, 2016.

As per Rule 7A(i), the pay in the applicable Level in the Pay Matrix shall be the pay obtained by multiplying the existing basic pay by a factor of 2.57, rounded off to the nearest rupee and the figure so arrived at will be located in that Level in the Pay Matrix and if such an identical figure corresponds to any Cell in the applicable Level of the Pay Matrix, the same shall be the pay, and if no such Cell is available in the applicable Level, the pay shall be fixed at the immediate next higher Cell in that applicable Level of the Pay Matrix.

The detailed table as mentioned in the Rules showing the calculation:

For example if your pay in Pay Band is 5200 (initial pay in pay band) and Grade Pay of 1800 then 5200+1800= 7000, now the said amount of 7000 would be multiplied to 2.57 as mentioned in the Rules. 7000 x 2.57= 17,990 so as per the rules the nearest amount the figure shall be fixed as pay level. Which in this case would be 18000/-.

The basic pay would increase as your experience at that job would increase as specified in vertical cells. For example if you continue to serve in the Basic Pay of 18000/- for 4 years then your basic pay would be 19700/- as mentioned in the table.

Dearness Allowance

However, the basic pay mentioned in the table is not the only amount of remuneration an employee receives. There are catena of benefits and further additions in the salary such as dearness allowance, HRA, TADA.

According to the Notification No. 1/1/2023-E.II(B) from the Ministry of Finance and Department of Expenditure, the Dearness Allowance payable to Central Government employees was enhanced from rate of 38% to 42% of Basic pay with effect from 1st January 2023.

Here, DA would be calculated on the basic salary. For example if your basic salary is of 18,000/- then 42% DA would be of 7,560/-

House Rent Allowance

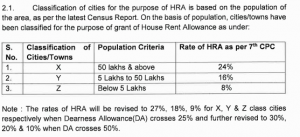

Apart from that the HRA (House Rent Allowance) is also provided to employees according to their place of duties. Currently cities are classified into three categories as ‘X’ ‘Y’ ‘Z’ on the basis of the population.

According to the Compendium released by the Ministry of Finance and Department of Expenditure in Notification No. 2/4/2022-E.II B, the classification of cities and rates of HRA as per 7th CPC was introduced.

See the table for reference

However, after enhancement of DA from 38% to 42% the HRA would be revised to 27%, 18%, and 9% respectively.

As above calculated the DA on Basic Salary, in the same manner HRA would also be calculated on the Basic Salary. Now considering that the duty of an employee’s Job is at ‘X’ category of city then HRA will be calculated at 27% of basic salary.

Here, continuing with the same example of calculation with a basic salary of 18000/-, the amount of HRA would be 4,840/-

Transport Allowance

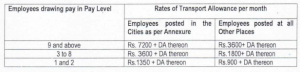

After calculation of DA and HRA, Central government employees are also provided with Transport Allowance (TA). After the 7th CPC the revised rates of Transport Allowance were released by the Ministry of Finance and Department of Expenditure in the Notification No. 21/5/2017-EII(B) wherein, a table giving detailed rates were produced.

The same table is reproduced hereinafter.

As mentioned above in the table, all the employees are given Transport Allowance according to their pay level and place of their duties. The list of annexed cities are given in the same Notification No. 21/5/2017-EII(B).

Again, continuing with the same example of calculation with a Basic Salary of 18000/- and assuming place of duty at the city mentioned in the annexure, the rate of Transport Allowance would be 1350/-

Apart from that, DA on TA is also provided as per the ongoing rate of DA. For example, if TA is 1350/- and rate of current DA on basic Salary is 42% then 42% of TA would be added to the calculation of gross salary. Here, DA on TA would be 567/-.

Calculation of Gross Salary

After calculating all the above benefits the Gross Salary is calculated.

Here, after calculating Basic Salary+DA+HRA+TA the gross salary would be 32,317/-

However, the Gross Salary is subject to few deductions such as NPS, Professional Tax, Medical as subject to the rules and directions by the Central Government. After the deductions from the Gross Salary an employee gets the Net Salary on hand.

However, it is pertinent to note that benefits such as HRA and TA are not absolute, these allowances are only admissible if an employee is not provided with a residence by the Central Government or facility of government transport.

Conclusion

Government service is not a contract. It is a status. The employees expect fair treatment from the government. The States should play a role model for the services. The Apex Court in the case of Bhupendra Nath Hazarika and another vs. State of Assam and others (reported in 2013(2)Sec 516) has observed as follows:

“………It should always be borne in mind that legitimate aspirations of the employees are not guillotined and a situation is not created where hopes end in despair. Hope for everyone is gloriously precious and that a model employer should not convert it to be deceitful and treacherous by playing a game of chess with their seniority. A sense of calm sensibility and concerned sincerity should be reflected in every step. An atmosphere of trust has to prevail and when the employees are absolutely sure that their trust shall not be betrayed and they shall be treated with dignified fairness then only the concept of good governance can be concretized. We say no more.”

The consideration while framing Rules and Laws on payment of wages, it should be ensured that employees do not suffer economic hardship so that they can deliver and render the best possible service to the country and make the governance vibrant and effective.

Written by Husain Trivedi Advocate

CCPA Guidelines on Greenwashing: A Legal Analysis

Introduction

In the present age of environmental consciousness, companies more and more aim to brand their goods and services as environmental friendly. However, not all such claims are genuine or ethical. The term “greenwashing” describes the act of presenting false or unverifiable evidence of environmental goodwill of a product, service or practice. This manipulative tactic is not only fraudulent for consumers but also spurious to legitimate sustainable attempts to change behaviors. In response to this widespread problem and to safeguard consumer interests, guidelines have been issued by the Central Consumer Protection Authority (CCPA), India, to curb greenwashing practices. This paper offers a thorough legal analysis of the regulatory landscape in existence for greenwashing in India, highlighting the CCPA’s position, their effects, and the judicial reactions to this important problem.

Understanding Greenwashing

Greenwashing encompasses a wide range of deceptive practices. These include exaggerated claims about environmental benefits, the use of ambiguous terms like “eco-friendly” or “sustainable,” and the failure to provide verifiable evidence for such assertions. Companies employing greenwashing tactics often aim to capitalize on the growing consumer demand for environmentally conscious products without genuinely committing to sustainable practices. The consequences of greenwashing extend beyond misleading consumers. It creates an uneven playing field in the market, enabling unethical businesses to profit unfairly, while those genuinely committed to sustainability bear higher costs. Furthermore, greenwashing erodes public trust, both in individual brands and in the broader movement toward environmental stewardship.

The Legal Framework for Greenwashing in India

The Consumer Protection Act, 2019

The Consumer Protection Act, 2019, forms the cornerstone of legal action against greenwashing in India. This Act establishes the Central Consumer Protection Authority (CCPA) to address matters related to consumer rights, unfair trade practices, and misleading advertisements. Section 2(47) of the Act explicitly defines an “unfair trade practice” as any deceptive or fraudulent method used to promote the sale, use, or supply of goods or services. Greenwashing, as a form of deceptive advertising, is unequivocally covered under this provision. The Act empowers the CCPA to investigate such practices, impose penalties, and issue directions to rectify misleading claims.

The Act further provides a framework for consumer grievance redressal through district, state, and national consumer commissions. This layered structure ensures accessibility and accountability, enabling consumers to seek remedies against greenwashing practices effectively.

Guidelines for Preventing Misleading Advertisements, 2022

In 2022, the Ministry of Consumer Affairs issued comprehensive guidelines to curb misleading advertising practices. While these guidelines are not exclusively focused on greenwashing, they include provisions that address it indirectly. Advertisers are mandated to provide clear, unambiguous, and substantiated claims. Specifically, they are required to disclose material information such as certifications, scientific data, or other evidence to support their claims. Any use of terms like “green,” “eco-friendly,” or “sustainable” must be substantiated with sufficient clarity and context.

The guidelines also place the onus of accountability on both advertisers and endorsers, ensuring that they share responsibility for any misleading claims. Failure to comply with these provisions can result in penalties, retraction of advertisements, and corrective measures as directed by the CCPA.

Environmental Protection Laws

The Environment (Protection) Act, 1986, complements the Consumer Protection Act by providing a broader legal framework for environmental accountability. While this Act primarily focuses on preventing environmental harm, it indirectly addresses greenwashing by holding businesses accountable for misrepresentations related to environmental compliance. Companies that falsely claim adherence to environmental standards may face penalties under this Act, further reinforcing the regulatory framework against greenwashing.

The CCPA Guidelines on Greenwashing

Scope and Applicability

The CCPA guidelines on greenwashing represent a targeted effort to address deceptive environmental claims. These guidelines are applicable across industries and business sizes, encompassing advertisements in print, digital, and broadcast media. Their primary objective is to ensure that all environmental claims are truthful, transparent, and verifiable. By setting clear standards for environmental advertising, the CCPA aims to protect consumers from being misled and promote accountability among businesses.

Key Provisions

The guidelines emphasize several critical aspects to prevent greenwashing. First, businesses are required to maintain transparency by disclosing the basis of their environmental claims. This includes providing verifiable evidence such as scientific studies, certifications, or compliance reports. Second, any claims based on third-party certifications must explicitly mention the certifying authority and the scope of the certification. This ensures that consumers are not misled by vague or generic endorsements. Third, the guidelines discourage the use of ambiguous terms like “eco-friendly,” “green,” or “sustainable” unless these terms are accompanied by clear explanations and evidence. Finally, the guidelines establish joint accountability for advertisers and endorsers, ensuring that both parties are held responsible for misleading claims.

Enforcement Mechanism

The CCPA has been vested with the authority to investigate complaints related to greenwashing. It can issue notices to businesses, demand substantiation for claims, and impose penalties for non-compliance. In severe cases, the CCPA can direct businesses to retract misleading advertisements and publish corrective statements. This enforcement mechanism underscores the regulatory body’s commitment to addressing greenwashing proactively and effectively.

Judicial Responses to Greenwashing

Indian courts have increasingly recognized the detrimental impact of greenwashing on consumer rights and environmental sustainability. While specific case law on greenwashing is limited, several judgments highlight the judiciary’s stance on consumer protection and corporate accountability.

Hindustan Unilever Limited v. Sebamed

In this case, the court examined the boundaries of truthful advertising. Although the matter was not directly related to greenwashing, it underscored the judiciary’s emphasis on preventing consumer deception. The judgment highlighted the need for advertisements to be factually accurate and supported by evidence, principles that are directly applicable to greenwashing.

MC Mehta v. Union of India

This landmark case, although primarily focused on environmental pollution, laid down principles of corporate accountability that resonate with greenwashing issues. The court emphasized the importance of transparency and ethical conduct by businesses, establishing a precedent for addressing deceptive practices related to environmental claims.

Recent Developments

In a recent ruling by the National Consumer Disputes Redressal Commission (NCDRC), a company was penalized for falsely claiming that its products were environmentally friendly. The judgment reiterated the necessity for businesses to substantiate their environmental claims with credible evidence. This decision marks a significant step in the judicial response to greenwashing, signaling a stringent approach to deceptive advertising.

Global Context and Comparisons

India’s regulatory approach to greenwashing aligns with global trends. Countries such as the United States, the United Kingdom, and Australia have implemented robust frameworks to address misleading environmental claims. For instance, the UK’s Green Claims Code mandates that businesses substantiate their claims with verifiable evidence and avoid vague terminology. Similarly, the Federal Trade Commission (FTC) in the United States has issued Green Guides, which provide specific instructions for environmental marketing claims.

While the CCPA guidelines on greenwashing reflect global best practices, their enforcement poses unique challenges. Unlike developed nations, India faces issues such as limited regulatory capacity and low consumer awareness, which hinder the effective implementation of greenwashing regulations.

Challenges in Regulating Greenwashing

Despite the existence of a robust legal framework, several challenges persist in addressing greenwashing effectively. One significant issue is the lack of awareness among consumers and businesses. Many consumers are unaware of their rights under the law, while businesses often fail to understand the implications of making unsubstantiated environmental claims. Additionally, the complexity of assessing environmental claims poses a significant challenge. Evaluating the validity of such claims requires technical expertise and resources, which are often lacking in regulatory authorities.

Weak enforcement mechanisms further exacerbate the problem. Regulatory bodies often face resource constraints, limiting their ability to monitor and address greenwashing practices effectively. The global nature of many businesses also complicates the regulation of environmental claims, as companies operating across borders may exploit jurisdictional gaps to evade accountability.

Recommendations for Strengthening the Framework

To address these challenges, several measures can be undertaken. First, regulatory authorities must invest in capacity building to enhance their ability to evaluate environmental claims. This includes training personnel, acquiring technical expertise, and strengthening enforcement mechanisms. Second, public awareness campaigns should be launched to educate consumers about greenwashing and their rights under the law. Such campaigns can empower consumers to make informed choices and hold businesses accountable.

Third, collaboration between regulatory bodies, industry stakeholders, and consumer groups should be encouraged. By fostering dialogue and cooperation, these entities can develop more effective strategies to combat greenwashing. Finally, international cooperation is essential to address the global dimensions of greenwashing. Aligning India’s regulations with international standards and fostering cross-border collaboration can help mitigate jurisdictional challenges and ensure consistency in enforcement.

Conclusion

The CCPA guidelines on greenwashing represent a significant step toward addressing a critical issue at the intersection of consumer protection and environmental sustainability. By promoting transparency, accountability, and ethical advertising practices, these guidelines seek to protect consumers from deception and foster trust in environmental claims. However, the success of these measures hinges on effective enforcement, public awareness, and collaborative efforts among stakeholders. As Indian courts continue to shape the legal landscape through landmark judgments, businesses must recognize the importance of adopting transparent and ethical practices. Only through collective action can the dual goals of consumer protection and environmental conservation be achieved, paving the way for a more sustainable future.

Supreme Court Interventions in the Hijab Issue: Legal Analysis

Introduction

The hijab controversy in India has seen significant judicial intervention, culminating in landmark Supreme Court proceedings that address the fundamental tension between religious expression and institutional regulations. This report outlines the major Supreme Court interventions in the hijab issue, providing a comprehensive analysis of the legal developments, key arguments, and constitutional questions at stake.

The Karnataka Hijab Ban Case: Split Verdict of October 2022

The most significant Supreme Court intervention came in the form of a split verdict delivered on October 13, 2022, in the case of Aishat Shifa v. State of Karnataka (Civil Appeal No. 7095/2022). This case emerged from a February 2022 controversy when Muslim students at Government Pre-University College in Udupi were prohibited from entering their college while wearing hijabs.

Background of the Case

On February 5, 2022, the Karnataka Government issued an order mandating that students follow the uniform prescribed by College Development Committees. Since hijabs were not included as part of the approved uniform, Muslim students wearing them were denied entry into educational institutions. The Karnataka High Court upheld this ban on March 15, 2022, ruling that wearing hijab was not an Essential Religious Practice (ERP) in Islam.

Multiple petitions challenging this High Court verdict were filed in the Supreme Court, arguing that the ban violated fundamental rights guaranteed by the Constitution of India. After marathon hearings spanning 10 days, the Supreme Court reserved its judgment on September 22, 2022.

The Split Verdict

A two-judge bench comprising Justice Hemant Gupta and Justice Sudhanshu Dhulia delivered a split verdict on October 13, 2022. The diverging opinions highlighted fundamental differences in interpreting religious freedoms and state authority:

Justice Hemant Gupta’s Opinion (Upholding the Ban):

Justice Gupta affirmed the Karnataka High Court judgment, holding that:

- The Government Order was within constitutional bounds and did not contradict any provisions of the Karnataka Education Act of 1983.

- The purpose of the order was to promote uniformity and encourage a secular environment in schools.

- Religious practices cannot be carried into secular schools maintained with state funds.

- The restriction on hijab was a reasonable limitation on fundamental rights under Article 19(2).

- Students have no right to attend schools while violating mandated uniform policies.

Justice Sudhanshu Dhulia’s Opinion (Against the Ban):

Justice Dhulia disagreed fundamentally, concluding that:

- The Essential Religious Practice test was not relevant to resolving the dispute.

- The High Court should have first examined whether the restrictions were valid using the Doctrine of Proportionality.

- Asking schoolgirls to remove hijabs at school gates violated their privacy and dignity.

- The ban infringed upon Articles 19(1)(a) (freedom of expression), 21 (right to life and personal liberty), and 25(1) (freedom of religion) of the Constitution.

- Wearing hijab should be “simply a matter of choice”.

Due to this split verdict, the matter was directed to be placed before the Chief Justice of India for constitution of a larger bench to resolve the dispute.

Mumbai College Hijab Ban Case: August 2024 Intervention

In a more recent development, on August 9, 2024, the Supreme Court stayed a Mumbai college’s circular that banned hijabs, caps, and badges. This case represents the Court’s continued engagement with the hijab issue.

Key Details:

- A bench comprising Justices Sanjiv Khanna and Sanjay Kumar issued notice to the college on a petition filed by three Muslim students challenging the Bombay High Court order that had upheld the college’s circular.

- The Court specifically stayed Clause 2 of the circular prohibiting hijabs, caps, and badges until November 18, 2024.

- However, the Court allowed the college to continue enforcing its ban on burqas, niqabs, or stoles.

During proceedings, Justice Khanna questioned the rationale behind the ban, asking: “What is this? Don’t impose such a rule… what is this? Don’t reveal religion?”. Justice Kumar further probed: “Will their names not reveal religion? Will you ask them to be identified by numbers?”.

Constitutional Questions at Stake

The Supreme Court interventions in the hijab controversy grapple with several fundamental constitutional questions:

- Religious Freedom (Article 25): Whether wearing hijab constitutes an Essential Religious Practice in Islam deserving constitutional protection.

- Freedom of Expression (Article 19): Whether the ban infringes upon students’ right to express themselves through their choice of attire.

- Right to Privacy and Dignity (Article 21): Whether prohibiting hijabs violates students’ personal autonomy and dignity.

- Right to Equality (Article 14): Whether the ban discriminates against Muslim students.

- Educational Rights: The extent to which educational institutions can enforce uniform policies that restrict religious expressions.

Other Relevant Judicial Precedents

The hijab controversy has seen other significant judicial interventions:

- In Amna Bint Basheer v. CBSE (2016), the Kerala High Court held that wearing hijab constitutes an Essential Religious Practice but still allowed for additional security measures during examinations.

- In February 2022, the Supreme Court initially declined to hear urgent appeals against the Karnataka High Court’s interim order banning hijabs, with then-Chief Justice N.V. Ramana noting that the Court would interfere “only at an appropriate time”.

Conclusion

The Supreme Court interventions in the hijab issue reflect the complex interplay between religious freedoms and institutional regulations in India’s constitutional framework. The split verdict of October 2022 underscores the deep divisions on this issue, with Justice Gupta prioritizing institutional discipline and secular spaces, while Justice Dhulia emphasized individual choice and religious expression. As the matter awaits resolution by a larger bench, the Court’s recent stay on the Mumbai college’s hijab ban suggests a continuing judicial willingness to protect religious expression while balancing institutional concerns.

The ultimate resolution of these cases will likely set important precedents for religious freedom and expression in India’s educational institutions and beyond.

Hyperlocal Weather Forecasting: Legal and Environmental Perspectives

Introduction

Hyperlocal weather forecasting represents a significant leap forward in meteorological science, offering highly localized and precise weather predictions that can be invaluable for various stakeholders, including farmers, urban planners, emergency responders, and businesses. Unlike traditional weather forecasting, which provides general predictions for broader regions, hyperlocal forecasting leverages advanced technologies, including artificial intelligence (AI), machine learning (ML), and Internet of Things (IoT) devices, to generate accurate weather data for specific locations, often down to a few square kilometers or even a single neighborhood. This innovation, however, raises complex legal and environmental issues that necessitate careful consideration and regulation.

Technological Foundations of Hyperlocal Weather Forecasting

The development of hyperlocal weather forecasting relies heavily on data collected from a variety of sources, including satellite imagery, ground-based weather stations, and IoT sensors embedded in urban infrastructure. These technologies gather real-time data on temperature, humidity, wind speed, and atmospheric pressure, which are then analyzed using AI and ML algorithms to produce granular weather forecasts.

Key to this process is the integration of IoT devices. For instance, smart thermostats, rooftop weather sensors, and vehicle-mounted weather trackers contribute to the pool of data, enabling forecasters to capture microclimatic variations. These advancements have made hyperlocal forecasting invaluable for industries like agriculture, where precise predictions can inform irrigation schedules and pest control measures, and for urban management, where localized data can help mitigate the effects of heat islands.

Hyperlocal forecasting is also enhanced by the use of crowd-sourced data, where individuals contribute observations via smartphones or dedicated weather applications. This approach not only increases data density but also improves accuracy by incorporating diverse sources. However, the reliance on such data raises concerns about quality control and verification, which are crucial to maintaining the reliability of forecasts.

Legal Framework Governing Weather Data Collection and Use

The collection and use of data for hyperlocal weather forecasting are subject to various legal frameworks, many of which are still evolving to address the unique challenges posed by this technology. A primary concern is the privacy of individuals whose data may inadvertently be collected through IoT devices or other monitoring systems.

Data Privacy Laws

In jurisdictions such as the European Union, the General Data Protection Regulation (GDPR) imposes stringent requirements on the collection, processing, and storage of personal data. Although weather data is generally not considered personal data, the integration of IoT devices in residential and public areas could lead to incidental collection of information linked to individuals, such as location data. Similar regulations exist in the United States under laws like the California Consumer Privacy Act (CCPA), which grants individuals the right to know what data is collected about them and to request its deletion.

The privacy implications are particularly pronounced in urban environments where dense IoT networks are deployed. Cities equipped with smart infrastructure may collect weather data alongside other forms of environmental monitoring, inadvertently capturing information about residents. This necessitates robust mechanisms for anonymizing data to ensure compliance with privacy laws while enabling the effective use of weather forecasting technologies.

Intellectual Property Concerns

The proprietary nature of algorithms and data used in hyperlocal weather forecasting also raises intellectual property (IP) issues. Companies developing these technologies often protect their algorithms as trade secrets or through patents. However, the use of publicly funded satellite data or government-operated weather stations introduces questions about the ownership and accessibility of derivative data products. In the United States, the National Weather Service (NWS) provides free access to its data, but private companies have faced legal challenges over whether their use of this data constitutes unfair competition or misappropriation.

Legal disputes in this area often center on the balance between promoting innovation and ensuring public access to essential information. The resolution of such disputes has significant implications for the future of hyperlocal weather forecasting, as it determines the extent to which private entities can commercialize data derived from publicly funded sources.

Legal Precedents on Hyperlocal Weather Forecasting

Several landmark cases and legal precedents have shaped the regulatory environment for hyperlocal weather forecasting:

National Weather Service v. AccuWeather

In this case, the NWS accused AccuWeather of unfair competition by leveraging publicly funded data for commercial purposes. The court ruled in favor of transparency and public access, emphasizing that weather data generated by government agencies must remain freely available to ensure broad societal benefits. However, it also highlighted the need for clearer guidelines on the commercialization of such data.

People v. IoT WeatherTech

This case involved a lawsuit against a private weather forecasting company for alleged privacy violations. The company’s IoT devices were found to have collected location data without users’ consent. The court ruled that weather forecasting firms must ensure compliance with data privacy laws and implement robust mechanisms to anonymize data collected through IoT devices.

Environmental Defense Fund v. WeatherData Inc.

This case focused on the environmental impact of deploying large-scale weather monitoring infrastructure. The court ruled that companies must conduct environmental impact assessments before implementing technologies that could affect local ecosystems. This judgement underscored the need for businesses to consider the broader implications of their operations.

Environmental Implications of Hyperlocal Weather Forecasting

Hyperlocal weather forecasting can significantly contribute to addressing environmental challenges, particularly in the context of climate change adaptation and disaster management. By providing precise weather data, these systems can help communities prepare for extreme weather events, reducing their environmental and economic impact.

Mitigating Climate Change Impacts

One of the most significant contributions of hyperlocal forecasting is its potential to enhance resilience against climate change. For instance, farmers can use hyperlocal forecasts to optimize water use during droughts or protect crops from unexpected frost. Similarly, cities can use localized forecasts to design green infrastructure that mitigates the urban heat island effect.

Localized forecasts can also inform reforestation and afforestation efforts by identifying microclimates where trees are most likely to thrive. This has far-reaching implications for carbon sequestration and biodiversity conservation, as it enables more targeted and effective environmental interventions.

Disaster Management

Hyperlocal weather forecasting is also invaluable in disaster management. By providing precise predictions of storms, floods, or wildfires, these systems enable emergency responders to deploy resources more effectively, potentially saving lives and reducing environmental degradation. For example, during Hurricane Ida, hyperlocal forecasts helped authorities identify vulnerable areas and evacuate residents in time.

The integration of hyperlocal forecasts with early warning systems has proven particularly effective in minimizing the impact of disasters. By combining detailed weather predictions with real-time communication channels, authorities can ensure that at-risk populations receive timely alerts, allowing them to take preventive measures.

Regulatory Challenges and Recommendations

While hyperlocal weather forecasting offers numerous benefits, it also presents unique regulatory challenges that require coordinated efforts from governments, private companies, and international organizations.

Establishing Standards for Data Collection

A major regulatory challenge is the lack of standardized protocols for data collection and sharing. Governments and international bodies must establish clear guidelines to ensure that data used for hyperlocal forecasting is accurate, reliable, and collected in compliance with privacy laws. The World Meteorological Organization (WMO) could play a key role in developing such standards.

Standardization is also essential for ensuring interoperability between different forecasting systems. By adopting common data formats and communication protocols, stakeholders can facilitate seamless integration of hyperlocal forecasts with broader meteorological networks.

Promoting Public-Private Partnerships

Collaboration between public agencies and private companies is essential for maximizing the potential of hyperlocal weather forecasting. Governments should incentivize private firms to share their proprietary data with public agencies, ensuring that the benefits of hyperlocal forecasting are widely distributed. For instance, tax incentives or public funding could be offered to companies that contribute to open data initiatives.

Public-private partnerships can also support the development of new forecasting technologies by pooling resources and expertise. By fostering collaboration, these partnerships can accelerate innovation while ensuring that the resulting benefits are accessible to a broad audience.

Addressing Environmental Justice

Hyperlocal weather forecasting must also consider issues of environmental justice. Marginalized communities often face disproportionate risks from extreme weather events, yet they are less likely to have access to advanced forecasting tools. Regulators should ensure that hyperlocal forecasting technologies are accessible to all communities, particularly those that are most vulnerable to environmental hazards.

Efforts to promote environmental justice should include targeted investments in infrastructure and education. By equipping underserved communities with the tools and knowledge needed to utilize hyperlocal forecasts, policymakers can help reduce disparities in climate resilience.

International Regulations and Cooperation

The global nature of weather systems necessitates international cooperation in the regulation of hyperlocal weather forecasting. Agreements such as the Paris Agreement on climate change emphasize the importance of sharing meteorological data to combat global warming. However, the growing commercialization of weather data poses challenges to such cooperation.

Balancing Commercial Interests and Public Good

International frameworks must strike a balance between promoting innovation in the private sector and ensuring that critical weather data remains a public good. For example, the WMO’s Resolution 40 encourages the free exchange of meteorological and hydrological data while allowing member states to establish national policies for data commercialization. This approach has been largely successful in fostering collaboration while protecting the public interest.

To enhance international cooperation, countries should work together to establish harmonized regulations that address the unique challenges of hyperlocal forecasting. By aligning their policies, governments can facilitate cross-border data sharing while ensuring that the benefits of this technology are equitably distributed.

The Role of Courts in Shaping the Legal Landscape

Courts play a pivotal role in resolving disputes and clarifying ambiguities in the regulation of hyperlocal weather forecasting. By interpreting laws and setting precedents, judicial decisions can provide much-needed guidance on issues such as data privacy, intellectual property, and environmental justice.

Landmark Judgements

Several court rulings have addressed the complexities of weather data regulation. For instance, in Environmental Defense Fund v. WeatherData Inc., the court ruled that private companies must adhere to environmental impact assessment requirements when deploying large-scale weather monitoring infrastructure. This judgement underscored the need for companies to consider the broader environmental implications of their operations.

Conclusion

Hyperlocal weather forecasting represents a transformative innovation with the potential to address pressing environmental challenges and improve decision-making across various sectors. However, its development and deployment raise significant legal and regulatory issues, particularly concerning data privacy, intellectual property, and environmental justice. To fully realize the benefits of hyperlocal forecasting, policymakers must establish robust regulatory frameworks that promote innovation while safeguarding public interests. International cooperation and judicial oversight will also be crucial in addressing the complex challenges posed by this emerging technology. By navigating these legal and environmental perspectives effectively, hyperlocal weather forecasting can play a vital role in building a more resilient and sustainable future.

Admissibility of SFIO Reports in Legal Proceedings: A Critical Analysis of Deloitte Haskins & Sells LLP v. Union of India

Introduction

The National Company Law Appellate Tribunal (NCLAT) judgment dated February 28, 2025, in the case of Deloitte Haskins & Sells LLP v. Union of India represents a significant development in the interpretation of provisions relating to the Serious Fraud Investigation Office (SFIO) under the Companies Act, 2013. This judgment provides crucial clarification on the admissibility of SFIO reports in legal proceedings before the National Company Law Tribunal (NCLT) and offers valuable insights into the principles of statutory interpretation, particularly regarding legal fictions. The case emerges from the IL&FS financial crisis investigation and addresses fundamental questions about the evidentiary value of fraud investigation reports in corporate law proceedings.

Background: The IL&FS Investigation and Subsequent Legal Proceedings

The case originates from the investigation into Infrastructure Leasing & Financial Services Limited (IL&FS) and its subsidiaries. The Ministry of Corporate Affairs (MCA), in exercise of its powers under Section 212 of the Companies Act, 2013, directed the SFIO to investigate the affairs of IL&FS and its subsidiaries. Following this investigation, SFIO submitted its First Interim Report on November 30, 2018, and a Second Investigation Report on May 28, 2019, specifically focused on IL&FS Financial Services Limited (IFIN).

Based on the Second SFIO Report, the MCA issued directions under Section 212(14) of the Companies Act, leading to the filing of a criminal complaint before the Special Court. Additionally, the Union of India filed two applications before the NCLT: one seeking impleadment of individual entities (including Deloitte Haskins & Sells LLP) charged under Section 447 of the Companies Act and various sections of the Indian Penal Code, and another seeking to restrain the appellants from creating third-party rights over their assets.

When the matter was listed for arguments on February 7, 2024, the Union of India submitted a compilation of documents consisting of extracts from the SFIO Report. The appellants, including Deloitte Haskins & Sells LLP, challenged the admissibility of these documents and the SFIO Report itself, leading to the present appeals before the NCLAT.

Legal Framework: Serious Fraud Investigation under the Companies Act, 2013

Establishment and Powers of SFIO

Section 211 of the Companies Act, 2013, empowers the Central Government to establish the Serious Fraud Investigation Office for investigating frauds relating to companies. The SFIO is designed as a multi-disciplinary investigative agency comprising experts from various fields, including banking, corporate affairs, taxation, forensic audit, capital markets, information technology, and law.

Section 212: Investigation by SFIO

Section 212 provides a comprehensive framework for investigations by the SFIO. The key provisions include:

- Section 212(1): Empowers the Central Government to assign the investigation into the affairs of a company to the SFIO.

- Section 212(11) and (12): Requires the SFIO to submit interim and final investigation reports to the Central Government.

- Section 212(14): Authorizes the Central Government, upon receipt of the investigation report, to direct the SFIO to initiate prosecution against the company and its officers or employees.

- Section 212(14A): A provision added by the 2019 amendment, allowing the Central Government to file an application before the NCLT for appropriate orders regarding disgorgement when the SFIO report indicates fraud and undue advantage taken by company directors or officers.

- Section 212(15): Creates a legal fiction stating that the investigation report filed with the Special Court for framing charges shall be deemed to be a report filed by a police officer under Section 173 of the Code of Criminal Procedure, 1973.

Section 223: Inspector’s Reports

Section 223 deals with reports submitted by inspectors (not SFIO) and provides:

- Section 223(1-3): Requirements for the submission of inspector reports to the Central Government and accessibility of these reports to interested parties.

- Section 223(4): Authentication requirements for inspector reports to be admissible as evidence in legal proceedings.

- Section 223(5): A crucial provision stating that “Nothing in this section shall apply to the report referred to in section 212”.

Critical Legal Issues in the Judgment

Admissibility of SFIO Reports as Evidence

The primary contention in this case was whether the SFIO Investigation Report could be relied upon as evidence in proceedings before the NCLT. The appellants argued that by virtue of Section 212(15), the SFIO Report is equivalent to a police report under Section 173 of the CrPC, which is not admissible as legal evidence but merely represents an opinion of the investigating officer.

Interpretation of Legal Fiction under Section 212(15)

The interpretation of the deeming fiction in Section 212(15) was central to the dispute. The appellants contended that the deeming provision should be given its fullest effect, making SFIO reports inadmissible as evidence in any proceedings. Conversely, the respondents argued that the deeming fiction was limited to the context of criminal proceedings and framing of charges before the Special Court.

Implication of Section 223(5) on Admissibility of SFIO Reports

Another significant issue was the interpretation of Section 223(5), which excludes the application of Section 223 to reports under Section 212. The appellants argued that this exclusion, read with Section 223(4), which makes inspector reports admissible as evidence, implies that the admissibility of SFIO reports in legal proceedings is not recognized under the Act.

The Court’s Reasoning and Analysis on the Admissibility of SFIO Reports

Principles of Statutory Interpretation Applied

The NCLAT applied several established principles of statutory interpretation in resolving these issues:

- Presumption of Legislative Knowledge: The Tribunal noted that “the legislature which has passed the law is well aware and has complete knowledge of all existing laws.” This principle was particularly relevant in considering how Section 212(14A) interacts with Section 212(15).

- Interpretation of Legal Fictions: The Tribunal cited Supreme Court judgments establishing that “in interpreting a provision creating a legal fiction, the court is to ascertain for what purpose the fiction is created” and that the fiction should not be extended “beyond the purpose for which it is created, or beyond the language of the section by which it is created”.

- Harmonious Construction: The judgment emphasized that “provisions of statute have to be interpreted in a manner to give full effect to every provision of the statute” and that “no word in a statute has to be construed as surplusage”.

Harmonious Construction of Section 212

The NCLAT rejected the appellants’ interpretation of Section 212(15), finding that it would render Section 212(14A) “meaningless and otiose.” The Tribunal noted that when the legislature specifically provided for taking action under Section 212(14A) based on SFIO reports, it could not have intended those reports to be inadmissible in such proceedings.

The judgment states: “When legislature specifically provided that the SFIO Report can be looked into and relied for purpose of proceeding under sub-section (14A), the submission that said report is untouchable, irrelevant or inadmissible has to be rejected”.

Limiting the Scope of Legal Fiction

The NCLAT held that the deeming fiction in Section 212(15) was introduced specifically “to make the SFIO Report as a Report of police officer under Section 173 of the CrPC for framing the charges” and not to render such reports inadmissible for other purposes under the Companies Act. The Tribunal clarified that “Legal fiction was not for the purpose that SFIO Report be treated as inadmissible for the purposes of Companies Act, 2013”.

Regarding Section 223(5), the NCLAT interpreted this provision as merely exempting SFIO reports from the authentication requirements applicable to inspector reports under Section 223(4), not as a provision declaring SFIO reports inadmissible in evidence.

Procedural Requirements for Admitting Documentary Evidence

The appellants also challenged the compilation of documents filed by the Union of India on the ground that there were insufficient pleadings to support these documents. The NCLAT observed that this ground could not be a basis for rejecting the evidence at the preliminary stage, noting that “The issue as to what has been pleaded in the application or the petition and what is the material or evidence on the record are issues which are to be examined when applications are decided on merits”.

This aspect of the judgment emphasizes that technical objections regarding pleadings, particularly in the context of proceedings under the Companies Act which are more summary in nature than regular civil proceedings, may not prevail when substantial justice requires consideration of relevant evidence.

Key Legal Principles Established by the Judgment

1. Purpose-Oriented Interpretation of Legal Fictions

The judgment reinforces the principle that legal fictions must be interpreted according to their purpose and not extended beyond their intended scope. The NCLAT emphasized that the deeming fiction in Section 212(15) was created specifically for the purpose of criminal proceedings and framing of charges, not to render SFIO reports inadmissible in all contexts.

2. Legislative Intent Behind Section 212(14A)

The Court paid particular attention to the legislative intent behind the introduction of Section 212(14A), which was added by the 2019 amendment. The “notes on clauses” of the bill that introduced this amendment indicated that it was designed to allow the Central Government to apply to the NCLT for disgorgement orders based on SFIO reports. This legislative history supported the conclusion that SFIO reports were intended to be admissible and relied upon in such proceedings.

3. Harmonious Interpretation of Statutory Provisions

The judgment emphasizes the need for harmonious interpretation of different provisions within the same statute. The NCLAT noted that “all part of statutory provisions has to be given its meaning and purpose and principle of harmonious construction is to be adopted to give meaning and purpose of all provisions of law”.

Implications for Corporate Law Practice

The NCLAT’s judgment has significant implications for corporate fraud investigations and subsequent legal proceedings:

- Enhanced Evidentiary Value of SFIO Reports: The judgment confirms that SFIO reports can be relied upon as the basis for proceedings before the NCLT, strengthening the regulatory framework for addressing corporate fraud.

- Balanced Approach to Legal Fictions: The decision demonstrates a practical approach to interpreting legal fictions, focusing on their purpose rather than extending them mechanically in ways that might frustrate legislative intent.

- Reinforcement of SFIO’s Role: By upholding the admissibility of SFIO reports in NCLT proceedings, the judgment reinforces the SFIO’s role as a specialized agency for investigating corporate fraud with meaningful legal consequences.

Conclusion: NCLAT’s Clarity on the Admissibility of SFIO Reports

The NCLAT’s judgment in Deloitte Haskins & Sells LLP v. Union of India provides important clarification on the admissibility of SFIO reports in legal proceedings under the Companies Act, 2013. By adopting a purposive and harmonious interpretation of Sections 212 and 223, the Tribunal has ensured that the legislative intent behind empowering the SFIO is not frustrated by overly restrictive interpretations of legal fictions.

This judgment highlights the importance of contextual statutory interpretation, particularly in the realm of corporate law where regulatory frameworks must be effective in addressing complex frauds. By confirming that SFIO reports can be relied upon in NCLT proceedings, the decision strengthens the hands of regulatory authorities in their efforts to ensure corporate accountability and protect stakeholder interests.

For legal practitioners, the case serves as a reminder that technical objections to the admissibility of evidence must be evaluated in light of the broader statutory scheme and legislative intent, particularly in specialized tribunals like the NCLT where procedural flexibility may be necessary to achieve substantive justice.