INDIVIDUAL INSOLVENCY: UNDER THE IBC

Introduction

The Insolvency and Bankruptcy code is a landmark piece of legislation providing a facelift to the existing regime in the areas of restructuring and the insolvency and bankruptcy in India. The code provided the biggest missing piece in the existing jigsaw of laws by establishing a framework for time-bound resolution for defaulting debts. The journey of the code is long-lasting as the code will go a long way in bringing an element of certainty and predictability to commercial transactions in the country thereby providing Ease of Doing Business.

What are individual insolvency laws?

Any debtor who is an individual, sole proprietorship or a partnership firm can be governed by individual insolvency laws, when such debtor is unable to meet its obligations to its creditors. These laws give debtors relief by allowing them to go to the court to either restructure their debts or avail discharge from their duty to repay their debts after liquidating their assets and distributing the proceeds to creditors.

The individual insolvency law has a more social perspective, as it aims to save an individual from being pressured by creditors and criticized by society. The goal is to provide relief to the individual so that he can resume his peaceful life. Thus, personal insolvency laws seek to strike a balance between the rights of debtors (by enabling them to be free of debt burdens) and creditors (by ensuring repayments to the extent possible).

Before IBC made its mark, the corporate insolvency law in India too, drew inspiration from personal insolvency law. The personal insolvency law, in turn, was contained in two centenarian (even older!) laws, namely, Presidency Towns Insolvency Act 1909 (PTIA) and Provincial Insolvency act, 1920 (PIA).

Although the new code, IBC contains specific provisions for individual insolvency resolution, it has only been notified of corporate insolvency so far. Individual insolvency provisions in the IBC have only been operationalized for people who have provided guarantees for loans taken out by companies, not for other individuals or businesses (operating as sole proprietorships or partnership firms). Thus, creating lacuna in existing laws and eliminating the possibility of population getting benefitted by the unnotified provisions. So far, the Central Government and IBBI has come up with draft rules and regulations. (INSOLVENCY RESOLUTION PROCESS FOR INDIVIDUALS AND FIRMS) REGULATIONS, 2017 IBBI/2017-1

Insolvency resolution and bankruptcy for individuals and partnership firms

Part III of the code deals with the insolvency resolution and bankruptcy for individuals and partnership firms, where the amount of default is not less than Rs.1,000. The adjudicating authority of insolvency resolution for the individual and partnership firms would be the Debt Recovery Tribunal (DRT). The Notification dated 15th November 2019 (hereinafter “Notification”) of the Central Government brought into force provisions of the Part III of the IBC, providing for insolvency and bankruptcy for individuals and partnership firms was the basis for the writ petitions filed before the High Courts. The Notification brought into force Section 78 and 79 of the IBC relating to applicability of the insolvency and bankruptcy of individuals and partnership firms where the amount of the default is not less than Rs. 1000 and definitions under Part III of the IBC respectively. Further, the said notification brought into force Section 94 to 187 of the IBC providing the framework for the initiation of insolvency resolution process and bankruptcy proceedings of individuals and partnership firms. Section 179 of the IBC provides for the Debt Recovery Tribunal to be the adjudicating authority in relation to insolvency matters of individuals and firms.

Part III of the code provides two methods for resolving the insolvency of individuals i.e. 1) Fresh start process , 2) Insolvency resolution process and , they are as follows:-

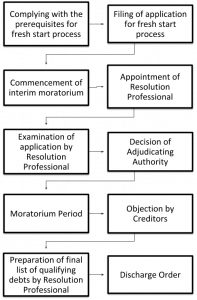

Fresh Start Process

Fresh start is a once‐in‐life‐time opportunity granted to the individual, to seek moratorium, phasing out obligations, etc. so that the individual may start his life afresh.

It provides an opportunity to a debtor who is unable to pay his debts to clear off his debts in a time-bound manner on fulfilling the prescribed condition for the fresh start of his qualifying debts. The applicability of this option is greatly limited by the very narrow monetary limits laid –annual income of Rs 60,000, and assets of Rs 20,000.

Fresh start application may be made by the debtor himself, provided the income and asset criteria are within the thresholds referred to above, and the “qualifying debt” for which the individual seeks relief is limited to Rs 35000/‐ .

The application for insolvency resolution may be led by the creditor or the concerned debtor himself. Once an application is led with DRT for initiating insolvency proceedings a Resolution professional shall be appointed to carry forward and supervise the entire process as prescribed in this chapter.

The prerequisites that need to be complied prior to making an application are as follows:

- The debtor should not be an undischarged bankrupt;

- The debtor should be undergoing fresh start process in relation to his debts;

- No insolvency resolution proceedings should be in process in relation to the debts against the debtor;

- The debtor should not be undergoing bankruptcy proceedings

- No insolvency resolution proceedings should have been admitted during the preceding twelve months to be counted from the date on which a fresh application is led for invoking insolvency resolution process.

Once all the prerequisites are met, an application may be submitted either by the debtor himself or by the resolution professional on behalf of the debtor. Pursuant to this, the code provides for an evaluation of the application by resolution professional, followed by a decision on its acceptance or rejection by the Debt Recovery Tribunal within 14 days of receiving the resolution professional’s recommendations on the application. Where the application is accepted by the DRT, the code provides for legal protection from both current as well as future legal proceedings against the applicant/debtor for a period of 180 days from the date of admission of application.

However, importantly the code provides the creditors in such a situation that bestows on them a right to object any of the facts/grounds listed in an accepted application for fresh start .Such objections shall be submitted by the creditors to the resolution professional who shall then evaluate the accuracy and the importance of such objections. During the process, the resolution professional shall act as the main point of communication between the parties involved (Debtor/Creditor) and DRT. In the event of any change in financial circumstances which could make DRT change its decision on whether to accept or reject the initial application, then it shall be the duty of resolution professionals to ensure that DRT is informed of the relevant change.

Finally after resolution professionals have reviewed all the qualifying debts and compiled a final list of these qualifying debts then the DRT shall pass an order to discharge the debtors from all of the obligations with respect to these debts. Once the order is passed, then the fresh start process shall ultimately come to end thereby providing much-needed relief to the small-time debtors.

Insolvency Resolution Process

The process flow along with the relevant provisions related to the insolvency of individuals and partnership firms are enshrined in chapter III of part III of the Code. The provisions of the insolvency resolution process for individuals & partnership are similar to that of the corporate insolvency resolution process for corporate persons. Only the insolvency application of individuals & partnership firms is filed with DRT.

The application for insolvency resolution may be filed by the creditor or the concerned debtor himself. Once an application is filed with DRT for initiating insolvency proceedings a Resolution Professional (hereinafter, “RP”) shall be appointed to carry forward and supervise the entire process as prescribed in this chapter.

The Adjudicating authority shall on the basis of the received report decide whether to admit or reject the application as was initially submitted to it by the debtor or creditor. Once insolvency proceedings are ordered to be initiated by the DRT, a moratorium period shall commence and thereafter cease to be in effect at the end of one 180 days.

The creditors register their claims with the RP, who in turn, prepares a list of creditors. The debtor prepares a repayment plan in consultation with the RP. The RP then prepares a report on the repayment plan for submission to the AA – also stating whether there is a necessity of summoning a meeting of creditors. Where the meeting of creditors is not summoned, the AA passes an order on the repayment plan as per report prepared by the RP. However, when the meeting of creditors is summoned, the repayment plan has to be approved by the creditors, the AA passes an order on the repayment plan on the basis of the report of the meeting, prepared by the RP.

Bankruptcy Process

Where the attempts to provide an individual debtor either a “fresh start” or an “earned start” fail, the last recourse left is an application for bankruptcy. Under 3 specified circumstances the debtor or the creditor(s) is/are eligible to make an application for bankruptcy order – (1) a resolution application is not admitted, (2) a repayment plan is not approved by creditors or the adjudicating authority, or (3) a repayment plan fails prematurely.

From the bankruptcy commencement date till his discharge, the bankrupt is an “undischarged insolvent” or “undischarged bankrupt” and faces several disqualifications under the Code as well as other laws; his after‐acquired property is also liable to be vested in the trustee.

Once an application is filed, an interim‐moratorium commences. A bankruptcy trustee is appointed to manage the process. Within 14 days of appointment of a bankruptcy trustee, the adjudicating authority passes a “bankruptcy order”. This date becomes the bankruptcy commencement date. The bankrupt is required to submit a statement of financial position within 7 days of the commencement date.

On the bankruptcy order being passed-

- the estate of the bankrupt vests in the bankruptcy trustee,

- the interim‐moratorium ceases and a fresh moratorium starts, and

- the bankrupt submits a statement of financial position (if so required).

The Bankruptcy Trustee performs the process similar to RP and constitutes the “committee of creditors”. The bankruptcy trustee administers and distributes the estate of the bankrupt in accordance with the provisions of Chapter V of Part III. The trustee notifies creditors to prove their claims, and values claims. He makes payment of interim dividend, and before distributing the final dividend, puts up a notice once again, requiring creditors to have one final opportunity to prove their claims.

The bankruptcy trustee applies to the adjudicating authority for a discharge order once the approval of the committee of creditors is obtained or on the expiry of 1 year from the date of bankruptcy order, whichever is earlier. After discharge, the once‐bankrupt is a free man.

Conclusion

This article aimed at understanding the need of individual insolvency laws, the process of individual insolvency and the applicability of the said laws as per the IBBI draft rules.

Although much has been said about corporate insolvency in India, personal insolvency laws have received little consideration. Individual insolvency provisions in the IBC have only been notified for personal guarantors for loans taken out by companies, not for other individuals or partnership firms. This must improve in order to provide better solutions for individuals and small businesses struggling with debt. The central government and IBBI have issued draft rules for individual insolvency as part III of IBC. However, they have not yet been notified. For the easement of debt resolution of non-corporate entities these rules need to come into effect as early as possible.

INSOLVENCY AND BANKRUPTCY BOARD OF INDIA (INSOLVENCY RESOLUTION PROCESS FOR INDIVIDUALS AND FIRMS) REGULATIONS, 2017

Eligibility for resolution professional (Regulation 3)

- An insolvency professional shall be eligible to be appointed as a resolution professional for an insolvency resolution process if he and all partners and directors of the insolvency professional entity of which he is a partner or director, or the insolvency professional entity of which he is a partner or director, are not associates of the debtor.

- An insolvency professional shall not be eligible to be appointed as a resolution professional if he, or the insolvency professional entity of which he is a partner or director, is under a restraint order of the Board.

- An insolvency professional shall not continue as a resolution professional if the insolvency professional entity of which he is a director or a partner, or any other partner or director of such an insolvency professional entity represents any other stakeholder in the same insolvency resolution process.

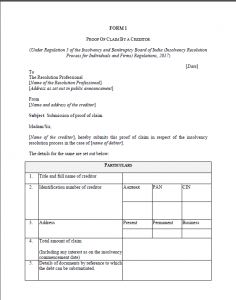

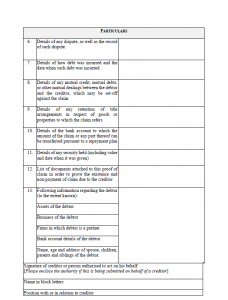

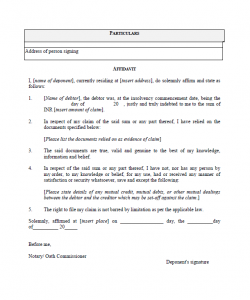

Chapter II Proof of claims of creditors

- Regulation 5 provides that a proof of claim should be submitted by the creditor to resolution professionals in lieu of Form 1.

- Regulation 6 provides that resolution professional shall commence the verification of each claim as soon as it is received, and prepare a list of creditors reflecting the name of the creditors, amount claimed, amount admitted, and security interest in respect of the claims, if any, within the time period stipulated in Section 104 (2). Further under sub regulation (2) of regulation 6, the resolution professional shall file a report certifying the constitution of a committee of creditors on the preparation of the list of creditors, to the Adjudicating Authority under sub-regulation (1).

- Regulation 7 provides that A committee of creditors formed under Regulation 6(2) shall consist of the following members:

- ten largest creditors by value;

- one representative elected by all workmen other than those workmen included in sub-clause (a), if applicable; and

- one representative elected by all employees other than those employees included in sub-clause (a), if applicable.

- Regulation 9 provides that the resolution professional should prepare a statement of affairs that should include the following information –

- debtor’s assets and liabilities for the previous three years;

- details of the excluded assets and excluded debts of the debtor;

- secured and unsecured debts with names of the creditors, and all requisite details for the previous three years;

- particulars of debt owed by debtor to associates of the debtor for the previous three years;

- guarantees given in relation to any of the debts of the debtor, and whether any of the guarantors is an associate of the debtor;

- Details of the financial statements for the business owned by the debtor, or of the firm in which the debtor is a partner, as the case may be, for the previous three years, if applicable;

- Details of the wealth tax statements filed by the debtor, if any, for the previous five years.

Chapter V- Voting by Creditors

- Regulation 19 provides the method for calculation of voting share for the meeting of creditors it says that

- A member of the committee under Regulation 7(1) shall having voting share in proportion of the debt due to such creditor or debt represented by a representative, as the case may be, to the total debt.

- The debt due to any creditor shall be calculated as on the insolvency commencement date, on the basis of the claims admitted.

- For the purposes of Section 109(3), an unliquidated debt shall mean a debt to which a value cannot be assigned by the resolution professional.

Explanation: For the purposes of sub-regulation (1), total debt is the sum of –

- the amount of debt due to the creditors listed in Regulation 7(1)(a);

- the amount of the aggregate debt due to workmen under Regulation 7(1)(b), if applicable; and

- the amount of aggregate debt due to employees under Regulation 7(1)(c), if applicable.

Chapter VI- Repayment plan

- Regulation 22 provides the contents of repayment plan i.e. –

The matters under Section 105(3)(c) that shall be provided for in a repayment plan include the following –

- the duration of the repayment plan;

- implementation schedule for the repayment plan, including the proposed dates of distributions to creditors, with estimates of their amounts;

- source of funds for the insolvency resolution process costs and their payment in priority to all other payments under the repayment plan;

- a minimum budget for the survival of the debtor and immediate family for the duration of the repayment plan;

- if the debtor has any business, the manner in which it is proposed to be conducted during the course of the repayment plan, and the role of the resolution professional;

- the manner in which funds held for the purposes of the repayment plan are to be banked, invested or otherwise dealt with, pending distribution to creditors;

- a comprehensive list of all the creditors of the debtor;

- the functions which are undertaken by the resolution professional, including supervision and implementation of the repayment plan;

- variation of the terms of a contract or transaction involving the debtor;

- that excluded assets will not be transferred or sold;

- financing required for the insolvency resolution process; and

- terms and conditions for the discharge of the debtor

2) further sub regulation (2) says that A repayment plan may provide for the following-

- transfer or sale of all or part of the assets of the debtor, including treatment of excluded assets whose actual value exceeds the prescribed threshold value for excluded assets;

- administration or disposal of any funds of the debtor;

- satisfaction or modification of any security interest;

- reduction in the amount payable to creditors;

- curing or waiving of any breach of a debt due from the debtor;

- modification in the terms of payment of any debt due from the debtor;

- amendment of the partnership deed, if applicable;

- part of the income of the debtor to be used in the repayment of the debt, and the manner of calculating the income of the debtor;

- ratification of insolvency resolution costs which do not require approval of the committee of creditors under Regulation 28;

- the manner in which funds held for the purpose of payment to creditors, and not so paid on the end of the repayment plan, are to be dealt with; and

(k) such other matters as may be required by the committee of creditors.

2) further sub regulation (2) says that A repayment plan may provide for the following-

- transfer or sale of all or part of the assets of the debtor, including treatment of excluded assets whose actual value exceeds the prescribed threshold value for excluded assets;

- administration or disposal of any funds of the debtor;

- satisfaction or modification of any security interest;

- reduction in the amount payable to creditors;

- curing or waiving of any breach of a debt due from the debtor;

- modification in the terms of payment of any debt due from the debtor;

- amendment of the partnership deed, if applicable;

- part of the income of the debtor to be used in the repayment of the debt, and the manner of calculating the income of the debtor;

- ratification of insolvency resolution costs which do not require approval of the committee of creditors under Regulation 28;

- the manner in which funds held for the purpose of payment to creditors, and not so paid on the end of the repayment plan, are to be dealt with; and

(k) such other matters as may be required by the committee of creditors.

Completion of the repayment plan (Regulation 26)

- A repayment plan shall be complete when, in the opinion of the resolution professional, the debtor has complied with all obligations under the repayment plan within the duration of the repayment plan, and a notice to that effect has been issued under section 117(1)(a).

- The resolution professional may issue a notice of completion under section 117(1)(a) if the debtor has substantially complied with all obligations under the repayment plan.

- The Adjudicating Authority shall consider the notice and the report under section 117(1) in passing the discharge order.

Author: Mohit Mathur

Editor: Adv. Aditya Bhatt & Adv. Chandni Joshi