Introduction

Village Form No. 8A represents a fundamental cornerstone in Gujarat’s land revenue administration system, serving as the primary record of landholding details for cultivators across the state. This document, commonly referred to as “Khatavahi” or “Khata” in local parlance, functions as a comprehensive repository of agricultural land ownership, cultivation patterns, and revenue obligations. Village Form No. 8A derives its legal standing from the Gujarat Land Revenue Code, 1879, specifically under Section 213, establishing its critical importance within the broader framework of land governance in Gujarat.

The significance of Village Form No. 8A extends beyond mere administrative convenience, as it constitutes a legal document that determines land rights, facilitates agricultural credit, and enables various government welfare schemes targeting farmers and agricultural communities. The form serves as an interface between individual landholders and the state’s revenue machinery, ensuring systematic documentation of land transactions, ownership transfers, and cultivation activities.

Historical Evolution and Legislative Framework

The Gujarat Land Revenue Code, 1879

The foundation of Village Form No. 8A rests upon The Bombay Land Revenue Code, 1879, which was subsequently adopted and modified for Gujarat following the state’s formation. This colonial-era legislation has undergone substantial amendments to accommodate modern administrative requirements while retaining its core structure for land revenue management.

Section 213 of the Gujarat Land Revenue Code specifically mandates the maintenance of Village Form No. 8A, prescribing the format, content, and procedures for its preparation and updating. The section reads: “A register shall be kept by the village accountant in such form as may be prescribed showing the area of land held by each holder in the village, the assessment payable thereon, and such other particulars as may be prescribed.”

Critical Amendments of 1986

A watershed moment in the evolution of Village Form No. 8A occurred on December 16, 1986, when the Gujarat Land Revenue Code underwent comprehensive amendments. The Land Revenue Code was amended on 16-12-1986. New Sections: Sections 135-LL to 135-T were added. New Rules: Land Revenue Rules were amended to add Chapter-15, Rules 113A to 113K. Inclusion: The chapter on Khedut passbook and Khedut Khatavahi was included and covered under the law.

These amendments introduced the concept of the “Khedut Passbook” (Farmer’s Passbook), which works in tandem with Village Form No. 8A to provide farmers with a portable document containing their land and cultivation details. The new sections 135-LL to 135-T specifically addressed the maintenance, updating, and legal validity of agricultural land records, while Chapter-15 of the Rules (Rules 113A to 113K) prescribed detailed procedures for record-keeping and verification.

Structural Components and Documentation Requirements

Essential Elements of Village Form No. 8A

Village Form No. 8A encompasses several critical data elements that collectively provide a comprehensive picture of landholding within a village. These components include:

Landowner Identification: The form contains detailed information about the landowner, including full name, father’s name, address, and any co-owners or joint holders. This information must be verified against official identity documents and cross-referenced with other revenue records.

Survey Number Details: Each parcel of land is assigned a unique survey number that corresponds to the village survey settlement. The form records the survey number, sub-divisions (if any), and the exact boundaries of the land as per the survey records.

Land Classification and Area: The document specifies the classification of land (irrigated, unirrigated, fallow, etc.), the total area in acres and gunthas, and any seasonal variations in cultivable area due to natural or artificial factors.

Assessment and Revenue Details: Village Form No. 8A records the land revenue assessment, water rates (where applicable), and any additional cesses or taxes imposed on the land. This includes details of payment history and outstanding dues.

Cultivation Information: The form documents the type of crops grown, seasonal patterns, and any restrictions on land use imposed by the revenue authorities or agricultural departments.

Integration with the Khedut Passbook System

The 1986 amendments established a dual-document system where the passbook is to be maintained in two copies; one for the cultivators and the other for the competent officer. Responsibility: The competent officer is responsible for maintaining and updating the cultivator’s passbook. This system ensures that farmers have direct access to their land records while maintaining official copies with revenue authorities.

The Khedut Passbook serves as a condensed version of Village Form No. 8A, containing essential information that farmers require for various agricultural and financial transactions. The passbook includes survey numbers, area details, crop information, and certification by revenue officers, making it a valuable document for accessing agricultural credit, insurance claims, and government subsidies.

Interaction with Complementary Revenue Forms

Village Form No. 6: The Mutation Register

Village Form No. 8A maintains an intricate relationship with Village Form No. 6, which serves as the primary mutation register for recording changes in land ownership and rights. Village Form No. 6 or “HakkPatrak 6” serves as a comprehensive record or ‘horoscope’ of the land, detailing its history and transactions, particularly after India’s independence.

The mutation process follows a structured approach where any changes in ownership or land rights are first recorded in Village Form No. 6 through a formal mutation entry. Once the mutation is approved and sanctioned by competent authorities, the corresponding updates are made in Village Form No. 8A to reflect the new ownership or changes in land classification.

The legal framework governing mutations is primarily found in Section 135D of the Gujarat Land Revenue Code, which stipulates the conditions and procedures for mutation entries. It serves as a legal guideline for Talatis and other revenue officers in the mutation process. Non-compliance with Section 135D can lead to legal complications and may invalidate the mutation entry.

Village Form No. 7/12: The Primary Rights Document

Village Form No. 7/12, commonly known as “Satbara” or “7/12 extract,” serves as the foundational document establishing land ownership and rights. The “7/12” extract, also known as “Satbara Utara” in Gujarat, is an extract from the land register maintained by the revenue department of the state government. This document contains comprehensive ownership details, survey numbers, land area, current landowner’s name, agricultural details including crop types, loan information, and tax payment records.

Village Form No. 8A complements the 7/12 extract by providing additional operational details about landholding management, particularly focusing on the administrative aspects of land revenue collection and agricultural monitoring. While the 7/12 extract establishes “what” is owned, Village Form No. 8A details “how” the land is administered from a revenue perspective.

Revenue Collection and Credit-Debit Management

Village Form No. 8-B: Annual Financial Record

Village Form No. 8-B operates as a specialized financial ledger that must be completed annually to document all monetary transactions related to the landholding. This form categorizes holdings into three distinct types: monopoly holdings, auction holdings, and Makta holdings.

Makta holdings represent a unique system where the yield assessment is standardized at the village level rather than being determined individually for each landholder. This system provides predictability in revenue collection while simplifying administrative procedures for both farmers and revenue officials.

The form meticulously records all amounts due from previous years, payments made during the current year, outstanding balances, and any adjustments made through waivers or deferrals. Any miscellaneous receipts related to land revenue must be entered in Village Form No. 8-B immediately after being recorded in Form-4, ensuring comprehensive financial tracking.

Waiver and Deferral Mechanisms

The revenue system incorporates provisions for financial relief through waivers and deferrals, particularly during natural calamities or economic hardships affecting agricultural communities. These relief measures are systematically recorded in Village Form No. 8-B, with corresponding adjustments made to the recoverable amounts. The legal authority for such waivers typically stems from government notifications issued under the disaster management provisions of the Land Revenue Code.

Education Cess Integration and Administrative Procedures

The Gujarat Education Cess Act, 1962

The integration of education cess collection within the land revenue system represents a significant administrative innovation linking agricultural income to educational development. The Gujarat Education Cess Act, 1962 established the legal framework for collecting education cess from landholders, with the collected funds being utilized for educational infrastructure and programs in rural areas.

The procedural requirements mandate that after making an entry of the education cess in Village Form No. 8-A, the Talati must make a corresponding entry in Village Form No. 8-C. Significantly, the legislation specifically excludes any changes to Village Form No. 8-B regarding education cess, maintaining a clear separation between regular land revenue and education cess accounting.

This system demonstrates the multifaceted role of land revenue administration in supporting broader developmental objectives beyond mere revenue collection. The integration ensures that agricultural communities contribute directly to local educational development while maintaining transparent accounting of such contributions.

Digital Transformation and the AnyROR Portal

Evolution of Digital Land Records

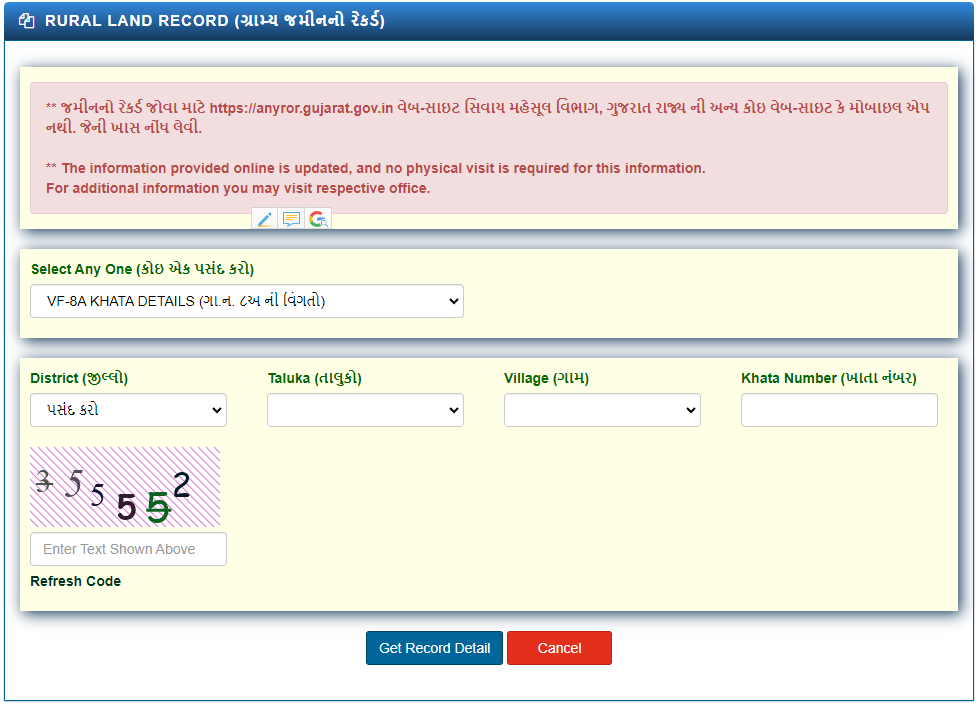

The digitization of land records in Gujarat represents a paradigmatic shift from manual record-keeping to electronic data management. AnyRoR is the official land records portal of Gujarat State. It is managed by Revenue Department, Government of Gujarat. It provides urban and rural land records, property search and property card related information.

The AnyROR (Any Records of Rights Anywhere) portal has revolutionized access to land records, including Village Form No. 8A, by providing online accessibility to authenticated land information. The term Anyror means Any Record of Rights at Anywhere. It simply indicates that the Government of Gujarat has digitized all its land records to make them available to access anytime, from anywhere.

Technical Infrastructure and Accessibility

The digital platform enables stakeholders to access various rural land records, including VF-8A Khata Details, VF-6 Entry Details, 135-D Notice for Mutation, and integrated survey number details. You can check 7/12 8A Gujarat online at Any RoR portal by providing your District, Taluka, Village and Khata Number.

The system provides both informational access and legally valid digitally signed documents. Online land records are only for information purposes. A Digitally signed RoR can be used for any official work. If a digitally signed RoR is not available for your location, then you will require a physical copy of the land record for official purposes.

Legal Validity of Digital Records

The digital transformation maintains legal authenticity through digital signatures and secure authentication mechanisms. Users can obtain certified copies of Village Form No. 8A and related documents through the portal, which carry the same legal weight as physical documents issued by revenue offices. This digital certification process includes verification protocols and audit trails to ensure document integrity and prevent fraudulent alterations.

Regulatory Compliance and Administrative Oversight

Role of Revenue Officials

The maintenance and updating of Village Form No. 8A involves multiple levels of revenue administration, each with specific responsibilities and oversight functions. The Talati (Village Accountant) serves as the primary custodian of village-level records, responsible for day-to-day maintenance, updating, and preliminary verification of information.

The Mamlatdar (Tehsildar) provides supervisory oversight, reviewing and approving significant changes, resolving disputes, and ensuring compliance with revenue regulations. At the district level, the Collector exercises ultimate administrative authority over land revenue matters, including policy implementation and dispute resolution.

Audit and Verification Procedures

Regular audits of Village Form No. 8A and related records are conducted to ensure accuracy, completeness, and compliance with legal requirements. These audits examine the consistency between different forms, verify the accuracy of survey details, and ensure that all transactions have been properly recorded and approved.

The audit process includes field verification of land boundaries, cross-checking with survey records, and validation of ownership claims against supporting documents. Any discrepancies identified during audits must be rectified through prescribed procedures, often involving field surveys and formal hearings.

Legal Challenges and Judicial Interpretations

Evidentiary Value in Legal Proceedings

Village Form No. 8A enjoys significant evidentiary value in legal proceedings related to land disputes, ownership claims, and revenue matters. Courts have consistently recognized these records as primary evidence of land ownership and cultivation rights, subject to proper authentication and verification procedures.

The judicial approach emphasizes the presumptive accuracy of revenue records while allowing for rebuttal through credible evidence. Parties challenging the accuracy of Village Form No. 8A entries must demonstrate specific inaccuracies and provide alternative evidence supporting their claims.

Dispute Resolution Mechanisms

The revenue system incorporates multiple levels of dispute resolution, beginning with informal resolution at the village level and progressing through formal appeals to higher revenue authorities. Section 135D procedures provide specific guidelines for handling disputes arising during mutation processes, with clear timelines and appellate structures.

Revenue courts have jurisdiction over disputes involving Village Form No. 8A entries, with appeals lying to higher revenue authorities and ultimately to civil courts for questions involving title and ownership rights that exceed revenue authorities’ jurisdiction.

Contemporary Relevance and Future Developments

Integration with Agricultural Schemes

Village Form No. 8A serves as a crucial document for implementing various agricultural schemes, including crop insurance, minimum support price programs, and direct benefit transfers. The form’s comprehensive data enables targeted policy implementation and ensures that benefits reach intended beneficiaries.

Recent developments have enhanced the integration between land records and agricultural databases, enabling real-time monitoring of cultivation patterns, crop yields, and farmer welfare program implementation. This integration supports evidence-based policy making and improves the efficiency of agricultural support systems.

Technological Enhancements

Ongoing technological improvements include the integration of satellite imagery for crop monitoring, GPS-based boundary marking, and blockchain technology for secure record maintenance. These enhancements aim to improve accuracy, reduce disputes, and provide real-time updates to land records.

The implementation of artificial intelligence and machine learning algorithms helps identify inconsistencies in records, predict potential disputes, and optimize revenue collection procedures. These technological tools support revenue officials in maintaining accurate and current records while reducing manual errors.

Conclusion

Village Form No. 8A represents far more than a mere administrative document; it embodies the intersection of historical land governance, contemporary administrative efficiency, and future technological innovation in Gujarat’s land revenue system. Its legal foundation in the Gujarat Land Revenue Code, 1879, as amended, provides the statutory framework for comprehensive land record maintenance, while its integration with digital platforms like AnyROR ensures accessibility and transparency in land administration.

The form’s intricate relationships with Village Forms No. 6 and 7/12 create a comprehensive ecosystem of land records that supports multiple governmental functions, from revenue collection to agricultural policy implementation. The integration of education cess collection through Forms 8-B and 8-C demonstrates the system’s adaptability to broader developmental objectives beyond traditional revenue administration.

The digital transformation through the AnyROR portal represents a significant advancement in making land records accessible to stakeholders while maintaining legal authenticity and security. This evolution from manual record-keeping to digital administration exemplifies Gujarat’s commitment to modernizing land governance while preserving the legal foundations established over more than a century of administrative development.

The continuing relevance of Village Form No. 8A in contemporary land administration, combined with ongoing technological enhancements and policy integrations, ensures its central role in Gujarat’s land revenue system for the foreseeable future. Understanding the complexities and legal implications of this form remains essential for legal practitioners, land administrators, and stakeholders engaged in agricultural and land-related activities within Gujarat’s administrative framework.

The comprehensive nature of Village Form No. 8A, its legal validity, and its integration with modern digital systems make it an indispensable tool in the governance of land revenue, thereby cementing its position as a cornerstone document in Gujarat’s land administration system. As Gujarat continues to evolve its land governance mechanisms, Village Form No. 8A will undoubtedly remain a critical component ensuring transparency, accountability, and efficiency in land revenue administration.

References

- Government of Gujarat. (1879). The Bombay Land Revenue Code, 1879. Available at: https://indiankanoon.org/doc/23526241/

- Government of Gujarat. (1962). Gujarat Education Cess Act, 1962. India Code. Retrieved from https://www.indiacode.nic.in/handle/123456789/4390

- Revenue Department, Government of Gujarat. AnyRoR Portal. Official website: https://anyror.gujarat.gov.in/

- Government of Gujarat. (1986). Gujarat Land Revenue Code Amendment Act, 1986.

- IndiaFilings. Gujarat Land Mutation – Application Procedure. Retrieved from https://www.indiafilings.com/learn/gujarat-land-mutation/

- Bajaj Finance. (2024). 7/12 8A Gujarat: How to Check Land Records in Gujarat. Retrieved from https://www.bajajfinserv.in/about-7-12-8a-gujarat

- National Government Services Portal. Check land records in Gujarat online. Retrieved from https://services.india.gov.in/service/detail/check-land-records-in-gujarat-online

- Revenue Department, Government of Gujarat. Transformation of Processes: Computerization of Land Records and E-Dhara. Retrieved from https://revenuedepartment.gujarat.gov.in/transformation-of-processes

- https://bhattandjoshiassociates.s3.ap-south-1.amazonaws.com/judgements/act_BLRC_1879_n.pdf

- https://bhattandjoshiassociates.s3.ap-south-1.amazonaws.com/judgements/educess.pdf