Introduction

Whenever a Job notification is out the first thing we do is go to the salary section and check what is the remuneration for that particular job. In order to apply for that particular job and later put all the effort and hard-work to get selected, is a long and tiring process. If our efforts are not compensated satisfactorily, we might not really like to get into the long time consuming process.

When we go through the salary section we often see words like Pay Scale, Grade Pay, or even level one or two salary and it is common to get confused between these jargons and to know the perfect amount of salary that we are going to receive.

To understand what pay scale, grade pay, various numbers of levels and other technical terms, we first need to know what pay commission is and how it functions.

Pay Commission

The Constitution of India under Article 309 empowers the Parliament and State Government to regulate the recruitment and conditions of service of persons appointed to public services and posts in connection with the affairs of the Union or any State.

The Pay Commission was established by the Indian government to make recommendations regarding the compensation of central government employees. Since India gained its independence, seven pay commissions have been established to examine and suggest changes to the pay structures of all civil and military employees of the Indian government.

The main objective of these various Pay Commissions was to improve the pay structure of its employees so that they can attract better talent to public service. In this 21st century, the global economy has undergone a vast change and it has seriously impacted the living conditions of the salaried class. The economic value of the salaries paid to them earlier has diminished. The economy has become more and more consumerized. Therefore, to keep the salary structure of the employees viable, it has become necessary to improve the pay structure of their employees so that better, more competent and talented people could be attracted to governance.

In this background, the Seventh Central Pay Commission was constituted and the government framed certain Terms of Reference for this Commission. The salient features of the terms are to examine and review the existing pay structure and to recommend changes in the pay, allowances and other facilities as are desirable and feasible for civil employees as well as for the Defence Forces, having due regard to the historical and traditional parities.

The Ministry of finance vide notification dated 25th July 2016 issued rules for 7th pay commission. The rules include a Schedule which shows categorically what payment has to be made to different positions. The said schedule is called 7th pay matrix

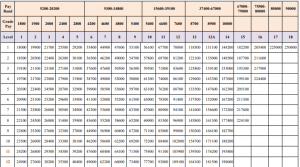

For the reference the table(7th pay matrix) is attached below.

Pay Band & Grade Pay

According to the table given above the first column shows the Pay band.

Pay Band is a pay scale according to the pay grades. It is a part of the salary process as it is used to rank different jobs by education, responsibility, location, and other multiple factors. The pay band structure is based on multiple factors and assigned pay grades should correlate with the salary range for the position with a minimum and maximum. Pay Band is used to define the compensation range for certain job profiles.

Here, Pay band is a part of an organized salary compensation plan, program or system. The Central and State Government has defined jobs, pay bands are used to distinguish the level of compensation given to certain ranges of jobs to have fewer levels of pay, alternative career tracks other than management, and barriers to hierarchy to motivate unconventional career moves. For example, entry-level positions might include security guard or karkoon. Those jobs and those of similar levels of responsibility might all be included in a named or numbered pay band that prescribed a range of pay.

The detailed calculation process of salary according to the pay matrix table is given under Rule 7 of the Central Civil Services (Revised Pay) Rules, 2016.

As per Rule 7A(i), the pay in the applicable Level in the Pay Matrix shall be the pay obtained by multiplying the existing basic pay by a factor of 2.57, rounded off to the nearest rupee and the figure so arrived at will be located in that Level in the Pay Matrix and if such an identical figure corresponds to any Cell in the applicable Level of the Pay Matrix, the same shall be the pay, and if no such Cell is available in the applicable Level, the pay shall be fixed at the immediate next higher Cell in that applicable Level of the Pay Matrix.

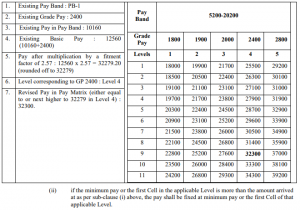

The detailed table as mentioned in the Rules showing the calculation:

For example if your pay in Pay Band is 5200 (initial pay in pay band) and Grade Pay of 1800 then 5200+1800= 7000, now the said amount of 7000 would be multiplied to 2.57 as mentioned in the Rules. 7000 x 2.57= 17,990 so as per the rules the nearest amount the figure shall be fixed as pay level. Which in this case would be 18000/-.

The basic pay would increase as your experience at that job would increase as specified in vertical cells. For example if you continue to serve in the Basic Pay of 18000/- for 4 years then your basic pay would be 19700/- as mentioned in the table.

Dearness Allowance

However, the basic pay mentioned in the table is not the only amount of remuneration an employee receives. There are catena of benefits and further additions in the salary such as dearness allowance, HRA, TADA.

According to the Notification No. 1/1/2023-E.II(B) from the Ministry of Finance and Department of Expenditure, the Dearness Allowance payable to Central Government employees was enhanced from rate of 38% to 42% of Basic pay with effect from 1st January 2023.

Here, DA would be calculated on the basic salary. For example if your basic salary is of 18,000/- then 42% DA would be of 7,560/-

House Rent Allowance

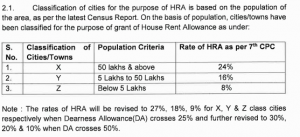

Apart from that the HRA (House Rent Allowance) is also provided to employees according to their place of duties. Currently cities are classified into three categories as ‘X’ ‘Y’ ‘Z’ on the basis of the population.

According to the Compendium released by the Ministry of Finance and Department of Expenditure in Notification No. 2/4/2022-E.II B, the classification of cities and rates of HRA as per 7th CPC was introduced.

See the table for reference

However, after enhancement of DA from 38% to 42% the HRA would be revised to 27%, 18%, and 9% respectively.

As above calculated the DA on Basic Salary, in the same manner HRA would also be calculated on the Basic Salary. Now considering that the duty of an employee’s Job is at ‘X’ category of city then HRA will be calculated at 27% of basic salary.

Here, continuing with the same example of calculation with a basic salary of 18000/-, the amount of HRA would be 4,840/-

Transport Allowance

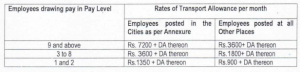

After calculation of DA and HRA, Central government employees are also provided with Transport Allowance (TA). After the 7th CPC the revised rates of Transport Allowance were released by the Ministry of Finance and Department of Expenditure in the Notification No. 21/5/2017-EII(B) wherein, a table giving detailed rates were produced.

The same table is reproduced hereinafter.

As mentioned above in the table, all the employees are given Transport Allowance according to their pay level and place of their duties. The list of annexed cities are given in the same Notification No. 21/5/2017-EII(B).

Again, continuing with the same example of calculation with a Basic Salary of 18000/- and assuming place of duty at the city mentioned in the annexure, the rate of Transport Allowance would be 1350/-

Apart from that, DA on TA is also provided as per the ongoing rate of DA. For example, if TA is 1350/- and rate of current DA on basic Salary is 42% then 42% of TA would be added to the calculation of gross salary. Here, DA on TA would be 567/-.

Calculation of Gross Salary

After calculating all the above benefits the Gross Salary is calculated.

Here, after calculating Basic Salary+DA+HRA+TA the gross salary would be 32,317/-

However, the Gross Salary is subject to few deductions such as NPS, Professional Tax, Medical as subject to the rules and directions by the Central Government. After the deductions from the Gross Salary an employee gets the Net Salary on hand.

However, it is pertinent to note that benefits such as HRA and TA are not absolute, these allowances are only admissible if an employee is not provided with a residence by the Central Government or facility of government transport.

Conclusion

Government service is not a contract. It is a status. The employees expect fair treatment from the government. The States should play a role model for the services. The Apex Court in the case of Bhupendra Nath Hazarika and another vs. State of Assam and others (reported in 2013(2)Sec 516) has observed as follows:

“………It should always be borne in mind that legitimate aspirations of the employees are not guillotined and a situation is not created where hopes end in despair. Hope for everyone is gloriously precious and that a model employer should not convert it to be deceitful and treacherous by playing a game of chess with their seniority. A sense of calm sensibility and concerned sincerity should be reflected in every step. An atmosphere of trust has to prevail and when the employees are absolutely sure that their trust shall not be betrayed and they shall be treated with dignified fairness then only the concept of good governance can be concretized. We say no more.”

The consideration while framing Rules and Laws on payment of wages, it should be ensured that employees do not suffer economic hardship so that they can deliver and render the best possible service to the country and make the governance vibrant and effective.

Written by Husain Trivedi Advocate

SEBI AIF Regulations 2012: A Comprehensive Analysis

Introduction

The Securities and Exchange Board of India (SEBI) introduced the Alternative Investment Funds (AIF) Regulations in 2012 to create a structured regulatory framework for private pools of capital in India. Prior to these regulations, alternative investments operated under a fragmented regulatory landscape, with venture capital funds regulated under the SEBI (Venture Capital Funds) Regulations, 1996, while many other investment vehicles remained largely unregulated. The SEBI AIF Regulations, 2012 represented a watershed moment in India’s financial regulatory history, bringing diverse investment vehicles under a unified regulatory framework while acknowledging their distinct characteristics and requirements.

The regulations emerged at a critical juncture when India’s private capital markets were gaining momentum but lacked the regulatory clarity needed to instill investor confidence and facilitate orderly market development. By establishing clear categories, investment conditions, and disclosure requirements, the regulations aimed to balance investor protection with the flexibility needed for alternative investment strategies to flourish.

Historical Context and Regulatory Background

Before 2012, India’s alternative investment landscape was characterized by regulatory ambiguity. Venture capital funds operated under the 1996 regulations, which had become outdated given the evolution of the industry. Private equity funds, hedge funds, and other alternative strategies operated in a regulatory gray area, creating uncertainty for both fund managers and investors.

This fragmented approach hindered the development of India’s private capital markets, limiting their ability to channel resources to emerging sectors and innovative businesses. Recognizing these challenges, SEBI initiated a consultative process to develop a comprehensive regulatory framework for alternative investments.

The AIF Regulations were notified on May 21, 2012, replacing the earlier Venture Capital Fund Regulations. The regulatory objective was articulated by SEBI’s then-Chairman U.K. Sinha, who stated: “The AIF framework aims to recognize alternative investments as a distinct asset class, provide them regulatory legitimacy, and create an environment conducive to their growth while ensuring adequate investor protection.”

Categories of Alternative Investment Funds Under Regulation 3

The cornerstone of the SEBI AIF Regulations 2012 is the categorization of funds based on their investment focus and impact objectives. Regulation 3(4) establishes three distinct categories:

“Category I Alternative Investment Fund” encompasses funds that invest in sectors or areas that the government or regulators consider socially or economically desirable. These include venture capital funds, SME funds, social venture funds, and infrastructure funds. Regulation 3(4)(a) specifies that these funds shall receive “consideration in the form of exemption from certain regulations or incentives or concessions from the government or any other regulator,” recognizing their potential positive externalities.

“Category II Alternative Investment Fund” includes funds that do not fall under Category I or III and do not undertake leverage or borrowing other than to meet day-to-day operational requirements. Private equity funds and debt funds typically fall under this category. Regulation 3(4)(b) states that these funds “shall not undertake leverage or borrowing other than to meet day-to-day operational requirements and as permitted in these regulations.”

“Category III Alternative Investment Fund” comprises funds that employ diverse or complex trading strategies, including the use of leverage. Hedge funds fall under this category. Regulation 3(4)(c) explicitly states that these funds “may employ diverse or complex trading strategies and may employ leverage including through investment in listed or unlisted derivatives.”

This categorization has provided much-needed clarity to the market, enabling investors to understand the nature and risk profile of different fund types while allowing regulators to apply tailored requirements based on each category’s characteristics.

Registration Requirements Under Chapter II

Chapter II of the SEBI AIF Regulations 2012 establishes comprehensive registration requirements for AIFs. Regulation 3(1) unequivocally states: “No entity or person shall act as an Alternative Investment Fund unless it has obtained a certificate of registration from the Board in accordance with these regulations.”

The application process, detailed in Regulation 3, requires submission of information about the fund’s proposed activities, investment strategy, key personnel, and risk management systems. SEBI evaluates applications based on criteria including the applicant’s track record, professional competence, financial soundness, and regulatory compliance history.

Capital adequacy requirements vary by category, with Regulation 10 mandating a minimum corpus of “ten crore rupees” for all AIFs. The regulations also require funds to have a continuing interest of the lower of “two and half percent of the corpus or five crore rupees,” ensuring that fund managers have skin in the game.

The registration framework has played a crucial role in professionalizing India’s alternative investment industry, setting minimum standards for fund managers and providing institutional legitimacy to AIFs.

Investment Conditions and Restrictions Under Chapter III

Chapter III establishes investment conditions and restrictions tailored to each AIF category, balancing investor protection with investment flexibility. Regulation 15(1)(a) mandates that “Category I and II Alternative Investment Funds shall invest not more than twenty-five percent of the investable funds in one Investee Company.” This diversification requirement aims to mitigate concentration risk.

For Category III AIFs, which typically employ more complex strategies, Regulation 15(1)(b) sets the single-investment limit at “ten percent of the corpus,” with additional leverage and exposure restrictions detailed in Regulation 16.

Investment strategies are further guided by category-specific provisions. For instance, Regulation 16(1)(c) requires that Venture Capital Funds under Category I invest “at least two-thirds of their investable funds in unlisted equity shares or equity linked instruments of a venture capital undertaking or in companies listed or proposed to be listed on a SME exchange or SME segment of an exchange.”

The regulations also address potential conflicts of interest. Regulation 20(2) prohibits investments in “associates” except with investor approval and subject to conditions. This provision aims to prevent fund managers from channeling investments to related entities on preferential terms.

These investment conditions have created a structured framework for AIFs while preserving the flexibility needed for different investment strategies, contributing to the rapid growth of India’s private capital markets.

General Obligations and Responsibilities Under Chapter IV

Chapter IV establishes comprehensive obligations for AIF managers, setting high standards for governance and conduct. Regulation 21(1) articulates the overarching responsibility: “The manager and sponsor shall be responsible for all the activities of the Alternative Investment Fund and shall ensure compliance with all applicable regulations as well as formulated schemes or funds or plans for the Alternative Investment Fund.”

Fiduciary duties are explicitly established, with Regulation 21(3) mandating that managers “act in a fiduciary capacity towards their investors” and ensure activities are “executed in compliance with the objectives of the AIF as disclosed in the placement memorandum.”

The regulations also address operational aspects, with Regulation 19 requiring the appointment of custodians for funds with corpus exceeding “five hundred crore rupees” and Regulation 20 establishing conflict of interest provisions. These governance requirements have enhanced investor protection while professionalizing fund management practices.

Transparency and Disclosure Requirements Under Regulation 23

Regulation 23 establishes robust transparency and disclosure requirements for AIFs. Regulation 23(1) mandates that AIFs “shall ensure transparency in their functioning and make such disclosures to investors as specified in the placement memorandum, including but not limited to the following: (a) financial, risk management, operational, portfolio, and transactional information regarding fund investments; (b) any fees ascribed to the Manager or Sponsor; and any fees charged to the Alternative Investment Fund or any investee company by an associate of the Manager or Sponsor; (c) any inquiries or legal actions by legal or regulatory bodies in any jurisdiction; (d) any material liability arising during the Alternative Investment Fund’s tenure; (e) any breach of a provision of the placement memorandum or agreement made with the investor or any other fund documents; (f) change in control of the Sponsor or Manager or Investee Company; (g) any change in the constitution or legal status of the Manager or Sponsor or the Alternative Investment Fund; and (h) any change in the fee structure or hurdle rate.”

The regulation further requires periodic disclosures to investors, with Regulation 23(2) mandating quarterly reports on “material changes during the quarter” and annual reports containing audited financial information. These disclosure requirements have significantly enhanced transparency in what was previously an opaque market segment.

Landmark Cases Shaping the Regulatory Landscape

ILFS Investment Managers v. SEBI (2019)

This landmark case before the Securities Appellate Tribunal (SAT) addressed governance standards for AIFs, particularly regarding conflicts of interest. ILFS Investment Managers challenged a SEBI order regarding inadequate disclosures about investments in related entities.

The SAT ruling emphasized the importance of robust governance, stating: “The fiduciary nature of the AIF manager’s role requires the highest standards of transparency regarding potential conflicts of interest. The purpose of the AIF Regulations is not merely to create a registration framework but to ensure that alternative investments operate with integrity and transparency.”

This judgment established that AIF managers must maintain arm’s length relationships with investee companies and provide comprehensive disclosures about potential conflicts, reinforcing the governance standards embedded in the regulations.

Venture Intelligence v. SEBI (2016)

This case clarified information disclosure requirements under the regulations. Venture Intelligence, a data provider, challenged SEBI’s interpretation of confidentiality provisions regarding fund performance data.

The SAT ruling balanced transparency with legitimate confidentiality concerns, stating: “While the AIF Regulations prioritize investor transparency, they do not mandate public disclosure of all fund information. Proprietary investment strategies and detailed portfolio information may warrant confidentiality protection, provided investors receive the disclosures required under Regulation 23.”

This decision provided important guidance on balancing transparency with the confidentiality needed for certain investment strategies, helping data providers and fund managers navigate disclosure boundaries.

India REIT Asset Managers v. SEBI (2020)

This case addressed the distinction between AIFs and Real Estate Investment Trusts (REITs), clarifying the regulatory boundaries between these investment vehicles. India REIT Asset Managers challenged SEBI’s determination that certain of their investment activities required AIF registration.

The SAT ruling elucidated the regulatory distinction, stating: “The defining characteristic of an AIF under Regulation 2(1)(b) is that it is a privately pooled investment vehicle that collects funds from investors for investing in accordance with a defined investment policy. The mere investment in real estate assets does not automatically subject an entity to REIT regulations if its structure and operations align with the AIF definition.”

This judgment provided important clarity on the regulatory perimeter, helping investment managers structure vehicles appropriately based on their investment focus and operational model.

Impact on Private Capital Market Development

The SEBI AIF Regulations 2012 have catalyzed remarkable growth in India’s private capital markets. SEBI data reveals that the AIF industry has grown from approximately ₹20,000 crores in 2014 to over ₹4.4 lakh crores by 2021, reflecting the confidence instilled by the regulatory framework.

The regulations have facilitated capital formation across diverse sectors. Category I AIFs, particularly venture capital funds, have channeled significant resources to startups and emerging businesses, contributing to India’s entrepreneurial ecosystem. Data from industry associations indicates that AIF investments have supported over 3,000 startups between 2012 and 2021.

The regulatory framework has also attracted foreign capital, with several global private equity and venture capital firms establishing India-focused AIFs. This international participation has enhanced not only capital availability but also global best practices in investment management and governance.

Effectiveness in Balancing Regulation and Flexibility

The SEBI AIF Regulations 2012 have generally succeeded in balancing investor protection with the flexibility needed for alternative investments to thrive. The category-based approach allows tailored requirements based on investment strategies and risk profiles, avoiding a one-size-fits-all approach that might stifle innovation.

Investor protection mechanisms, including custodian requirements, disclosure obligations, and conflict of interest provisions, have enhanced market integrity. Simultaneously, the regulations provide flexibility regarding investment strategies within defined parameters, enabling fund managers to pursue diverse approaches.

However, implementation challenges remain. Industry feedback suggests that certain aspects of the regulations, particularly around taxation and overseas investments, require further refinement to enhance flexibility while maintaining regulatory oversight. SEBI has demonstrated willingness to adapt the framework, issuing several amendments since 2012 to address emerging market needs.

Comparative Analysis with Global PE/VC Regulations

The Indian AIF framework shares similarities with global models but exhibits distinct characteristics reflecting India’s market conditions. Compared to the US regulatory approach under the Investment Advisers Act and exemptions for private funds, India’s framework is more prescriptive, with specific category-based requirements rather than blanket exemptions.

The European Union’s Alternative Investment Fund Managers Directive (AIFMD) similarly establishes comprehensive regulations for alternative investments but focuses more on the manager than the fund itself. The Indian approach regulates both managers and funds, reflecting the developing nature of India’s market, where both entities require regulatory oversight.

In terms of disclosure requirements, the Indian framework is more prescriptive than the US model but less onerous than the EU’s AIFMD. This middle-ground approach reflects a pragmatic balancing of investor protection with the need to avoid excessive compliance burdens in an emerging market context.

Economic Impact of AIF Investments

The economic impact of investments facilitated by the AIF framework has been substantial. Industry studies estimate that AIF investments have contributed to the creation of over 600,000 direct and indirect jobs between 2012 and 2021, particularly in knowledge-intensive sectors like technology, healthcare, and financial services.

Beyond employment, these investments have fostered innovation and productivity improvements. Venture capital funds, operating under Category I, have supported numerous technology startups that have developed solutions addressing India-specific challenges in areas like financial inclusion, healthcare access, and agricultural productivity.

Infrastructure AIFs have channeled capital to critical projects in energy, transportation, and urban development, complementing public investment and addressing India’s infrastructure gaps. Debt AIFs have provided alternative financing sources for mid-sized companies facing challenges accessing traditional bank credit.

From a macroeconomic perspective, the formalization of alternative investments under the AIF framework has contributed to deeper and more diverse capital markets, enhancing the financial system’s efficiency in capital allocation and risk management.

Conclusion and Future Outlook

The SEBI (Alternative Investment Funds) Regulations, 2012 represent a pivotal development in India’s financial regulatory landscape, transforming what was once a fragmented, partially regulated sector into a structured, transparent market segment. By establishing clear categories, investment conditions, and governance standards, the regulations have facilitated substantial growth in private capital while enhancing investor protection.

Looking ahead, several challenges and opportunities will shape the continued evolution of AIF regulation in India. The integration of AIFs with other regulatory frameworks, particularly around taxation and foreign investment, requires further streamlining to enhance operational efficiency. Emerging investment themes like impact investing, climate finance, and technology-focused strategies may necessitate regulatory refinements to accommodate their unique characteristics.

As India’s capital markets continue to mature, the AIF framework will likely evolve toward a more principles-based approach with greater emphasis on risk management and governance rather than prescriptive investment restrictions. This evolution would align with the trajectory of more developed markets while maintaining the investor protection focus essential for market integrity.

The SEBI AIF Regulations 2012 have laid a strong foundation for India’s private capital markets, enabling them to play an increasingly important role in the country’s economic development. Their continued refinement, based on market feedback and evolving global standards, will be crucial for sustaining this positive trajectory and maximizing the contribution of alternative investments to India’s growth story.

References

- Securities and Exchange Board of India (SEBI) (2012). SEBI (Alternative Investment Funds) Regulations, 2012. Gazette of India, Part III, Section 4.

- Securities Appellate Tribunal (2019). ILFS Investment Managers v. SEBI. SAT Appeal No. 274 of 2019.

- Securities Appellate Tribunal (2016). Venture Intelligence v. SEBI. SAT Appeal No. 135 of 2016.

- Securities Appellate Tribunal (2020). India REIT Asset Managers v. SEBI. SAT Appeal No. 192 of 2020.

- SEBI (2020). Annual Report 2019-20. Chapter on Alternative Investment Funds.

- Indian Private Equity and Venture Capital Association (IVCA) (2021). Impact Assessment Report: AIFs in Indian Economy.

- Ministry of Finance (2015). Report of the Alternative Investment Policy Advisory Committee.

- Reserve Bank of India (2019). Report on Trends and Progress of Banking in India 2018-19. Chapter VI: Non-Banking Financial Institutions.

- European Securities and Markets Authority (2019). AIFMD – A Framework for Risk Monitoring.

- U.S. Securities and Exchange Commission (2013). Implementing Dodd-Frank Wall Street Reform and Consumer Protection Act – Transitioning to Alternative Investment Fund Regulatory Regime.

SEBI (Investment Advisers) Regulations 2013: A Comprehensive Analysis

Introduction

The Securities and Exchange Board of India (SEBI) introduced the Investment Advisers Regulations in 2013 as a watershed regulatory framework designed to transform the landscape of financial advisory services in India. These regulations emerged from the recognition that investors needed protection from conflicts of interest inherent in the traditional financial distribution model, where advice and product sales were often intertwined. By establishing a distinct regulatory framework for investment advisers, SEBI aimed to foster a more transparent, accountable, and professional advisory ecosystem that prioritizes investor interests.

The regulations marked a paradigm shift in how financial advice is delivered in India, drawing inspiration from global regulatory developments while adapting to the unique characteristics of the Indian financial marketplace. Their introduction represented SEBI’s commitment to enhancing investor protection and improving the quality of financial advice available to Indian investors across the wealth spectrum.

The Road to SEBI’s 2013 Investment Adviser Regulations

Prior to 2013, investment advisory services in India operated in a relatively unregulated environment. Financial intermediaries often provided “advice” as an ancillary service to their primary business of distributing financial products, creating inherent conflicts of interest. Advisers frequently recommended products that generated the highest commissions rather than those best suited to client needs.

Recognizing these issues, SEBI initiated consultations on regulating investment advisory services in 2007. After multiple rounds of stakeholder engagement and public comments, the SEBI (Investment Advisers) Regulations, 2013 were finally notified on January 21, 2013, with implementation beginning in April of that year.

The regulations drew inspiration from international developments, particularly the Retail Distribution Review (RDR) in the UK and evolving fiduciary standards in the US. However, they were distinctly tailored to address India-specific challenges, including low financial literacy, the predominance of commission-based distribution models, and the nascent stage of fee-based advisory services in the country.

Registration Requirements Under Chapter II

The cornerstone of the regulatory framework is the mandatory registration requirement established under Chapter II. Regulation 3(1) explicitly states: “On and from the commencement of these regulations, no person shall act as an investment adviser or hold itself out as an investment adviser unless he has obtained a certificate of registration from the Board under these regulations.”

This provision effectively ended the era of unregistered advisory services, bringing all investment advisers under SEBI’s regulatory purview. The registration process is rigorous, with Regulation 6 establishing specific eligibility criteria related to qualifications, experience, certification, and capital adequacy.

For individual advisers, Regulation 6(k) mandates that they “shall have a professional qualification or post-graduate degree or post graduate diploma (minimum two years) in finance, accountancy, business management, banking, insurance, or related subjects from a university or an institution recognized by the central government or any state government or a recognized foreign university or institution or association.” Additionally, they must have at least five years of relevant experience.

Corporate entities seeking registration must satisfy additional requirements, including net worth criteria of “not less than twenty five lakh rupees” as specified in Regulation 6(m). The regulations also impose “fit and proper” criteria, ensuring that only individuals and entities with untarnished reputations and appropriate competence can provide investment advice.

The registration framework established under Chapter II serves as a gatekeeper mechanism, ensuring that only qualified and financially sound entities can enter the advisory business. This has significantly raised entry barriers, leading to a more professionalized advisory landscape.

Disclosure and Conduct Obligations for SEBI-Registered Investment Advisers

Chapter III of the regulations establishes comprehensive obligations for investment advisers, setting high standards for professional conduct. Regulation 13 mandates detailed risk disclosures and the provision of material information to clients.

Regulation 13(1) specifically requires that investment advisers “disclose to a prospective client, all material information about itself including its business, disciplinary history, the terms and conditions on which it offers advisory services, affiliations with other intermediaries and such other information as is necessary to take an informed decision on whether or not to avail its services.”

The regulations also impose strict requirements regarding disclosure of conflicts of interest. Regulation 13(c) mandates disclosure of “any actual or potential conflicts of interest arising from any connection to or association with any issuer of products or securities, including any material information or facts that might compromise its objectivity or independence in carrying on investment advisory services.”

These disclosure requirements represent a significant departure from previous practices, where conflicts often remained hidden from investors. By mandating transparency, the regulations empower investors to make more informed decisions about their choice of adviser.

Fiduciary Responsibilities Under Regulation 15

Perhaps the most transformative aspect of the regulations is the explicit establishment of fiduciary duties for investment advisers. Regulation 15(1) unequivocally states that “an investment adviser shall act in a fiduciary capacity towards its clients and shall disclose all conflicts of interests as and when they arise.”

This fiduciary standard represents the highest legal duty of care, requiring advisers to place client interests above their own under all circumstances. This stands in stark contrast to the previous suitability standard that generally governed financial product distribution, which merely required recommendations to be “suitable” rather than optimal for clients.

Regulation 15(2) further specifies that an investment adviser shall “not divulge any confidential information about its client, which has come to its knowledge, without taking prior permission of its clients, except where such disclosures are required to be made in compliance with any law for the time being in force.” This reinforces the position of trust that advisers occupy and their obligation to safeguard client information.

The imposition of fiduciary duty has fundamentally altered the advisory landscape, shifting the primary obligation of advisers from sales to client welfare. This has been particularly impactful in addressing conflicts of interest that previously plagued the financial advisory industry in India.

Risk Profiling and Suitability Under Regulation 16

The regulations establish a structured approach to advisory services through Regulation 16, which mandates risk profiling and suitability assessments. Regulation 16(a) requires investment advisers to “obtain from the client, such information as is necessary for the purpose of giving investment advice, including the following: (i) age; (ii) investment objectives including time horizons; (iii) risk appetite/tolerance; (iv) income details; (v) existing investments/assets/liabilities; (vi) such other information as is relevant…”

This requirement institutionalizes a systematic approach to understanding client needs before providing advice, moving away from product-centric recommendations toward client-centric solutions.

Regulation 16(b) further mandates that advisers “ensure that the advice is suitable and appropriate to the risk profile of the client,” while Regulation 16(c) requires them to “ensure that all investments on which investment advice is provided are appropriate to the risk profile of the client.”

These provisions have transformed how advisory services are delivered, necessitating comprehensive fact-finding, structured risk assessment, and personalized recommendations. The “know your client” principles embedded in Regulation 16 have elevated the quality of financial advice available to Indian investors.

Segregation of Advisory and Distribution Activities

One of the most contentious but transformative aspects of the regulations is the requirement to segregate advisory and distribution functions. Regulation 22 addresses this critical issue, aiming to minimize conflicts of interest that arise when the same entity provides advice and sells products.

Regulation 22(1) states that “an investment adviser which is also engaged in activities other than investment advisory services shall ensure that its investment advisory services are clearly segregated from all its other activities.” This requirement has forced many financial intermediaries to restructure their operations to maintain compliance.

The segregation requirement has been further strengthened through amendments, with SEBI mandating that advisers provide clients with options from multiple product providers rather than focusing on in-house products. This has significantly reduced the scope for biased advice driven by sales incentives.

Key Judicial Decisions Defining SEBI Investment Adviser Regulations

Amit Rathi v. SEBI (2017)

This landmark case before the Securities Appellate Tribunal (SAT) helped clarify the definition of “investment advice” under the regulations. Amit Rathi challenged SEBI’s interpretation that certain communications constituted investment advice requiring registration.

The SAT ruling provided crucial guidance, stating: “The mere provision of general information about financial products does not constitute investment advice. For communications to qualify as investment advice under the regulations, they must include specific recommendations tailored to the recipient’s financial situation and objectives.”

This judgment established important boundaries between general financial information and personalized investment advice, clarifying when registration requirements apply. It has become a touchstone for determining when communications cross the threshold into regulated advisory services.

Bajaj Capital v. SEBI (2015)

This case addressed the contentious issue of separating advisory and distribution activities. Bajaj Capital challenged SEBI’s directive requiring strict segregation between its advisory arm and distribution business.

The SAT ruling upheld SEBI’s position, stating: “The regulatory intent behind Regulation 22 is to eliminate conflicts of interest that inevitably arise when the same entity both advises clients and earns commissions from product sales. The segregation requirement is not merely organizational but functional, requiring distinct operations with appropriate safeguards.”

This ruling reinforced SEBI’s authority to enforce the segregation requirement, accelerating industry restructuring as firms adapted their business models to comply with the regulatory mandate.

ICICI Securities v. SEBI (2019)

This case clarified obligations regarding fee structure disclosures under the regulations. ICICI Securities challenged a SEBI order regarding inadequate disclosure of fee arrangements.

The SAT ruling emphasized the importance of transparent fee disclosures, stating: “Fee transparency is not a procedural formality but a substantive requirement that enables investors to make informed decisions. Investment advisers must provide clear, comprehensive information about all direct and indirect compensation they receive in connection with their advisory services.”

This judgment established higher standards for fee transparency, requiring advisers to disclose not only direct fees charged to clients but also any indirect compensation that might influence their recommendations.

Impact of SEBI Investment Advisers Regulations on Advice Quality and Distribution

The Investment Advisers Regulations have significantly transformed India’s financial advisory landscape. Research indicates that the quality of financial advice has improved, with advisers now conducting more thorough needs-based assessments before making recommendations. The structured approach to risk profiling mandated by Regulation 16 has led to more appropriate asset allocation strategies aligned with client risk tolerance.

Distribution practices have also evolved in response to the regulations. Traditional distributors have pursued several adaptation strategies: some have obtained investment adviser registration and transitioned to fee-based models, others have clearly demarcated their advisory and distribution functions, while some have chosen to focus exclusively on distribution without providing personalized advice.

The regulations have fostered greater specialization within the industry, with clear differentiation emerging between pure advisers and product distributors. This specialization has benefited investors by clarifying the nature of services they receive and the associated compensation structures.

Fee-Based vs. Commission-Based Advisory Models

The regulations have catalyzed the growth of fee-based advisory models in India, though commission-based distribution remains predominant. Fee-based advisers typically charge clients directly for their services, either through fixed fees, hourly rates, or percentage-based fees calculated on assets under advice.

Research indicates that fee-based models are associated with more objective advice, as advisers’ compensation is not tied to product recommendations. However, the transition to fee-based models has been gradual, with many investors still reluctant to pay explicitly for advice they previously perceived as “free” under commission-based arrangements.

The regulations have created a more level playing field for fee-based advisers, who previously struggled to compete with “free” advice subsidized by product commissions. By requiring clear disclosure of all compensation arrangements, the regulations have helped investors understand the true cost of advice under different models.

Effectiveness in Addressing Conflicts of Interest

While the regulations have established a robust framework for addressing conflicts of interest, implementation challenges remain. The segregation requirement has been particularly effective in reducing conflicts at the organizational level, forcing entities to choose between advisory and distribution as their primary business model.

The fiduciary standard established under Regulation 15 has elevated the legal duty of care for registered investment advisers, providing investors with stronger protection against conflicted advice. However, enforcement challenges persist, as proving violations of fiduciary duty often requires detailed evidence of adviser intent and client harm.

The regulations have been most effective in addressing obvious conflicts, such as those arising from commission incentives. More subtle conflicts, such as those stemming from affiliations with financial institutions or product providers, remain challenging to eliminate entirely despite the disclosure requirements.

Comparison with International Regulatory Models

The SEBI Investment Advisers Regulations share similarities with international frameworks but exhibit distinct characteristics reflecting India’s unique market conditions. Compared to the UK’s Retail Distribution Review (RDR), which effectively banned commissions for retail investment advice, SEBI’s approach has been more gradual, focusing on segregation and disclosure rather than outright prohibition of commission-based models.

The regulations align with the fiduciary standards emerging in the US financial advisory space, though they provide more prescriptive guidance on implementation. While the US has experienced regulatory oscillation regarding fiduciary standards, SEBI has maintained a consistent trajectory toward stronger investor protection.

Both the Indian regulations and international frameworks share the core objective of reducing conflicts of interest in financial advice. However, SEBI’s implementation acknowledges the developmental stage of India’s advisory market, allowing for a measured transition rather than a disruptive overhaul that might limit advice accessibility.

Conclusion and Future Outlook for SEBI Investment Advisers Regulations

The SEBI (Investment Advisers) Regulations, 2013 represent a significant milestone in the evolution of India’s financial advisory landscape. By establishing clear registration requirements, imposing fiduciary duties, mandating risk profiling, and addressing conflicts of interest, the regulations have elevated standards across the industry.

Looking ahead, several challenges and opportunities will shape the continued evolution of investment advisory regulation in India. Digital transformation is creating new models for advice delivery, requiring regulatory adaptation to address emerging technologies like robo-advisors and algorithm-based recommendation systems.

The persistent challenge of expanding access to quality financial advice beyond affluent segments remains. Fee-based advisory models, while reducing conflicts, have sometimes limited accessibility for middle and lower-income investors who may be unwilling or unable to pay explicit advisory fees.

As the regulations continue to evolve, finding the balance between robust investor protection and advice accessibility will remain a central challenge. SEBI’s ongoing engagement with stakeholders and willingness to refine the regulatory framework based on implementation experience will be crucial in addressing this balance.

The SEBI Investment Advisers Regulations have established a foundation for a more professional, transparent, and client-centric advisory industry in India. While implementation challenges persist, the regulations have set in motion a transformation that continues to enhance investor protection and advice quality in one of the world’s fastest-growing financial markets.

References

- Securities and Exchange Board of India (SEBI) (2013). SEBI (Investment Advisers) Regulations, 2013. Gazette of India, Part III, Section 4.

- Securities Appellate Tribunal (2017). Amit Rathi v. SEBI. SAT Appeal No. 147 of 2017.

- Securities Appellate Tribunal (2015). Bajaj Capital v. SEBI. SAT Appeal No. 112 of 2015.

- Securities Appellate Tribunal (2019). ICICI Securities v. SEBI. SAT Appeal No. 208 of 2019.

- SEBI (2020). Consultation Paper on Review of SEBI (Investment Advisers) Regulations, 2013.

- SEBI (2016). Report of the Committee to Review the SEBI (Investment Advisers) Regulations, 2013.

- Financial Conduct Authority (UK) (2012). Retail Distribution Review Implementation.

- U.S. Department of Labor (2016). Fiduciary Rule: Conflict of Interest Final Rule.

- Reserve Bank of India (2017). Report on Household Finance in India. Committee on Household Finance.

- Ministry of Finance (2013). Financial Sector Legislative Reforms Commission Report.

SEBI (Mutual Funds) Regulations 1996: The Framework for India’s Asset Management Industry

Introduction

Mutual funds are investment vehicles that pool money from many investors to buy stocks, bonds, and other securities. They allow ordinary people to access professional investment management even with small amounts of money. In India, mutual funds are regulated by the SEBI (Mutual Funds) Regulations, 1996.

These regulations provide the rules for how mutual funds should be set up, managed, and operated in India. They cover everything from registration requirements to investment restrictions, from fee structures to disclosure standards. The goal is to protect investors while allowing the mutual fund industry to grow.

The regulations have created a structure where mutual funds are organized as trusts, managed by Asset Management Companies (AMCs), and overseen by trustees. This three-tier structure helps ensure that the money invested by people is handled properly and in their best interests.

Since 1996, the regulations have been amended multiple times to address new challenges and opportunities in the investment landscape. These changes have helped make mutual funds one of the most popular investment options for Indians today, with the industry managing over 37 lakh crore rupees as of 2023.

Historical Development and Regulatory Evolution of India’s Mutual Fund Industry

The mutual fund industry in India began in 1963 with the establishment of Unit Trust of India (UTI), which had a monopoly for almost three decades. UTI was set up by an Act of Parliament and was not regulated by SEBI initially.

In 1987, public sector banks and insurance companies were allowed to set up mutual funds, bringing some competition to the industry. Then in 1993, private sector mutual funds were permitted, leading to rapid growth and diversification in the industry.

Before 1996, mutual funds were regulated by guidelines issued by the Ministry of Finance and later by SEBI. These guidelines were not comprehensive and lacked the legal strength of formal regulations. There was a need for a stronger regulatory framework as the industry grew.

The SEBI (Mutual Funds) Regulations, 1996, filled this gap by providing a comprehensive regulatory framework. They consolidated and replaced earlier guidelines, creating a level playing field for all mutual funds, whether public sector or private sector.

The early 2000s saw a significant test for these regulations when US-64, a popular scheme from UTI, faced a crisis. This led to UTI being split into two parts, with one part coming under SEBI regulations. This episode highlighted the importance of strong regulation and transparency in the mutual fund industry.

Another important milestone was the abolition of entry loads (upfront commissions) in 2009, which was a major step towards reducing the cost of investing in mutual funds. This was followed by other investor-friendly measures like the categorization of schemes in 2017 to reduce confusion for investors.

The regulations have evolved from focusing mainly on registration and basic operations to addressing more complex issues like risk management, investor protection, and governance. This evolution reflects the growing maturity and sophistication of India’s mutual fund industry.

Mutual Fund Registration Process and Criteria

Chapter II of the SEBI (Mutual Funds) Regulations, 1996 deals with the registration process for mutual funds. This is the first step in establishing a mutual fund in India and ensures that only qualified entities enter this business.

Regulation 7 sets out the eligibility criteria for an entity seeking to sponsor a mutual fund. These include a sound track record of at least 5 years in financial services, positive net worth in all the immediately preceding 5 years, and net profit in at least 3 of the immediately preceding 5 years.

The application for registration must include detailed information about the sponsor, the proposed trustees, the Asset Management Company, and the custodian. SEBI examines these details carefully to ensure that the proposed mutual fund has adequate resources, expertise, and systems.

Regulation 7(3) explicitly states: “The applicant shall be a fit and proper person.” This means SEBI assesses not just financial criteria but also the integrity and reputation of the applicant. Any history of regulatory violations or fraud can lead to rejection of the application.

After reviewing the application, SEBI may grant a certificate of registration, which is valid permanently unless suspended or cancelled. The regulations allow SEBI to impose conditions while granting registration to ensure proper functioning of the mutual fund.

The registration requirements have helped ensure that only serious players with adequate resources and expertise enter the mutual fund industry. This has contributed to the stability of the industry and protected investor interests by keeping out fly-by-night operators.

Constitution and Management of Mutual Funds and AMCs

Chapter III of the SEBI (Mutual Funds) Regulations, 1996 establishes the structure for mutual funds in India, which follows a three-tier model: sponsors, trustees, and the Asset Management Company (AMC).

The sponsor is the entity that establishes the mutual fund. According to Regulation 10, the mutual fund must be established as a trust under the Indian Trusts Act, 1882, with the sponsor acting as the settlor of the trust. This creates a legal separation between the mutual fund and its sponsor.

The trust is governed by trustees who have a fiduciary responsibility to unit holders (investors). Regulation 18 states: “The trustees shall ensure that the activities of the mutual fund are in accordance with the provisions of these regulations.” This makes trustees the primary guardians of investor interests.

The actual investment management is done by an Asset Management Company (AMC) appointed by the trustees. Regulation 21 mandates that the AMC must have a net worth of at least Rs. 50 crore and must be approved by SEBI. The AMC works under the supervision of the trustees.

The regulations establish clear separation between these entities to avoid conflicts of interest. For example, the AMC must be a separate legal entity from the sponsor and must have at least 50% independent directors. Similarly, at least two-thirds of the trustees must be independent of the sponsor.

Regulation 24 prohibits the AMC from undertaking any business other than asset management without specific approval from SEBI. This ensures that the AMC focuses on its core function of managing investor money without distractions or conflicts from other businesses.

The regulations also require proper records of the meetings and decisions of trustees and the AMC board. These records must be made available to SEBI during inspections, ensuring transparency and accountability in decision-making.

Schemes of Mutual Funds

Chapter V of the SEBI (Mutual Funds) Regulations, 1996 deals with the different types of schemes that mutual funds can offer and the process for launching them. A scheme is a specific investment product offered by a mutual fund, like an equity fund or a debt fund.

Regulation 28 requires that every mutual fund scheme must be approved by the trustees and a copy of the offer document must be filed with SEBI. While SEBI doesn’t approve schemes in advance, it can ask for changes if it finds any issues with the scheme.

The regulations classify schemes into open-ended schemes (where investors can buy and sell units at any time) and close-ended schemes (which have a fixed maturity date). Different rules apply to each type to address their specific characteristics and risks.

For close-ended schemes, Regulation 33(1) states: “No scheme shall be launched with a maturity period of more than fifteen years.” This limits the time horizon of such schemes, though infrastructure funds and REITs can have longer durations with special approval.

The regulations also specify the process for launching new schemes, including preparing an offer document with all relevant information, appointing a collecting bank for receiving applications, and following specific timelines for opening and closing the offer.

In 2017, SEBI introduced a major reform by categorizing mutual fund schemes into specific categories like large-cap equity, small-cap equity, corporate bond, etc. This standardization has helped investors compare similar schemes across different mutual funds and reduced product proliferation.

Regulation 39 deals with the winding up of schemes, which can happen when the trustees believe it’s in the best interest of unit holders, when 75% of unit holders of a scheme pass a resolution for winding up, or when SEBI directs the mutual fund to wind up in the interest of investors.

Investment Objectives and Valuation Policies

Chapter VII of the SEBI (Mutual Funds) Regulations, 1996 sets out the rules for investments by mutual funds. These rules are designed to ensure that mutual funds invest prudently and in line with their stated objectives.

Regulation 43 requires that investments by mutual funds must be in transferable securities in the money market or capital market, privately placed debentures, securitized debt instruments, gold or gold-related instruments, real estate assets, and infrastructure debt instruments.

The regulations impose concentration limits to prevent mutual funds from taking excessive risks. For example, a mutual fund scheme generally cannot invest more than 10% of its assets in a single company’s securities, and not more than 15% in a group of companies under the same management.

Regulation 44(1) states: “A mutual fund may invest in the securities of an overseas issuer in accordance with the guidelines issued by the Board in this regard.” This allows mutual funds to diversify internationally, but under guidelines to manage the additional risks of overseas investments.

The regulations require proper valuation of securities held by mutual funds. According to Regulation 47, mutual funds must ensure that the purchase or sale of securities is effected at a fair price, and investments must be valued according to principles established by SEBI.

In 2021, SEBI introduced significant changes to the valuation norms, particularly for debt securities. These changes were prompted by episodes like the Franklin Templeton crisis and aimed at ensuring more accurate valuation of debt instruments, especially in stressed market conditions.

Mutual funds must disclose their valuation policies in their offer documents and follow these policies consistently. Any deviation must be reported to the trustees with justification. This ensures transparency and prevents arbitrary valuation changes that could harm some investors.

Restrictions on Business Activities

Chapter VI of the SEBI (Mutual Funds) Regulations, 1996 imposes various restrictions on mutual fund business activities to protect investor interests and prevent conflicts of interest. These restrictions apply to both the mutual fund itself and the AMC that manages it.

Regulation 42 prohibits mutual funds from borrowing except for meeting temporary liquidity needs, and even then, borrowing is limited to 20% of the net assets of the scheme and for a maximum period of six months. This prevents mutual funds from taking on excessive leverage.

The regulations prohibit mutual funds from investing in other mutual funds, underwriting issues of securities, and lending or guaranteeing loans. These restrictions prevent mutual funds from engaging in activities that could create conflicts with their primary duty of managing investor money.

Regulation 25 restricts transactions between mutual funds, schemes of the same mutual fund, and associates or group companies of the sponsor or AMC. Such transactions are allowed only when they are done on an arm’s length basis and in the interest of unit holders.

The AMC and its employees are prohibited from receiving any kickbacks or undue benefits in connection with investments made by the mutual fund. This prevents conflicts of interest that might lead to investment decisions that benefit the AMC but harm investors.

Regulation 24(b) states: “The asset management company shall not act as a trustee of any mutual fund.” This separation of roles ensures proper checks and balances in the mutual fund structure, with the trustee supervising the AMC.

The regulations also impose strict limits on investments in unlisted securities, derivatives, and other complex instruments. These limits are designed to ensure that mutual funds maintain a reasonable risk profile appropriate for retail investors.

Landmark Cases Shaping SEBI Mutual Fund Regulations

Several important cases have helped shape the interpretation and application of the Mutual Funds Regulations. These cases provide guidance on how the regulations work in practice and how SEBI exercises its regulatory authority.

The Franklin Templeton Trustee Services v. SEBI (2021) case was a watershed moment for the industry. In April 2020, Franklin Templeton suddenly announced the winding up of six debt schemes, locking in investor money during the COVID-19 pandemic. This led to legal challenges from investors.

The Karnataka High Court ruled that the decision to wind up required unit holder approval, contrary to Franklin’s interpretation of Regulation 39. The court stated: “The power of trustees to wind up schemes under Regulation 39(2)(a) is not unilateral and requires consent of unit holders.” This was a significant ruling clarifying investor rights in winding up situations.

The Unit Trust of India v. SEBI (2002) case dealt with SEBI’s regulatory jurisdiction over UTI, which was established by a separate Act of Parliament. The Supreme Court ruled that SEBI had jurisdiction over all mutual funds, including UTI, under the SEBI Act.

The Court noted: “The SEBI Act is a special statute and the regulatory control of all mutual funds, including UTI, vests with SEBI. The UTI Act does not exclude the application of other regulatory laws.” This case helped establish SEBI’s comprehensive authority over the mutual fund industry.

The Sahara Asset Management Company v. SEBI (2015) case involved SEBI’s power to cancel the registration of a mutual fund. SEBI had cancelled Sahara Mutual Fund’s registration due to its sponsor’s failure to meet “fit and proper person” criteria following regulatory violations by other Sahara group companies.

The SAT upheld SEBI’s order, stating: “SEBI has wide powers to take action in the interest of investors, and the ‘fit and proper person’ criteria must be satisfied on a continuous basis, not just at the time of initial registration.” This affirmed SEBI’s authority to enforce high standards of conduct in the industry.

The HDFC Asset Management Company v. SEBI (2017) case dealt with requirements for scheme changes. HDFC AMC had changed the fundamental attributes of a scheme without giving exit options to investors as required by Regulation 18(15A).

The SAT ruled: “Any change in the fundamental attributes of a scheme requires giving unit holders an exit option at prevailing NAV without exit load. This is a mandatory requirement that cannot be circumvented.” This case reinforced investor rights regarding scheme changes.

Evolution of Mutual Fund Industry Under SEBI Regulation

The Mutual Funds Regulations have played a crucial role in shaping India’s asset management industry over the past 25 years. The industry has grown from managing just a few thousand crores in 1996 to over 37 lakh crore rupees today.

In the early years after the regulations were introduced, the focus was on establishing basic regulatory standards and creating a level playing field for public and private sector mutual funds. This period saw the entry of many new players, including foreign asset managers.

The early 2000s saw increased focus on disclosure standards and investor education. SEBI mandated standardized fact sheets, risk-o-meters, and other investor-friendly disclosures. These measures helped increase transparency and build investor confidence in mutual funds.

The mid-2000s witnessed rapid growth in equity mutual funds as the stock market boomed. The regulations were amended to address new challenges like the growth of systematic investment plans (SIPs) and the need for better risk management practices.

A significant shift came in 2009 when SEBI abolished entry loads, which were upfront commissions of up to 2.25% charged to investors. This bold move reduced the cost of investing in mutual funds and aligned the interests of distributors more closely with long-term investor outcomes.

The 2010s saw increased regulation of distributor practices, introduction of direct plans (without distributor commissions), and clearer categorization of schemes. These changes made it easier for investors to understand and compare different mutual fund products.

Recent years have seen a focus on risk management, particularly in debt funds following episodes like the IL&FS crisis and the Franklin Templeton case. SEBI has introduced stricter liquidity norms, stress testing requirements, and valuation guidelines to make debt funds safer.

The regulations have evolved from focusing mainly on registration and basic operations to addressing more complex issues like risk management, investor protection, and governance. This evolution reflects the growing maturity and sophistication of India’s mutual fund industry.

Impact of Regulatory Framework on Investor Protection

Investor protection is a core objective of the Mutual Funds Regulations, and several provisions directly address this goal. These measures have helped build trust in mutual funds as an investment avenue for ordinary Indians.

The three-tier structure of mutual funds (sponsor, trustee, AMC) creates multiple layers of oversight. Trustees have a fiduciary duty to unit holders and must ensure that the AMC acts in their best interest. This structure puts investor interests at the center of mutual fund governance.

The regulations require extensive disclosure of information to investors. Mutual funds must publish scheme information documents, key information memorandums, annual reports, and regular portfolio disclosures. This transparency helps investors make informed decisions.

Regulation 77 mandates: “Every mutual fund shall compute and carry out valuation of its investments in accordance with the valuation norms specified in the Eighth Schedule.” This ensures fair valuation of assets and equitable treatment of entering, existing, and exiting investors.

The regulations limit mutual fund expenses through Total Expense Ratio (TER) caps. These caps were revised downward in 2018, particularly for larger funds, reducing the cost burden on investors. Lower expenses directly translate to better returns for investors over the long term.

SEBI has introduced several investor-friendly measures over the years, such as risk-o-meters to visually represent a scheme’s risk level, standardized scheme categorization, and instant redemption facilities in liquid funds. These measures have made mutual funds more accessible and understandable.

The regulations require mutual funds to handle investor complaints promptly and have proper grievance redressal mechanisms. SEBI monitors complaint resolution closely and can take action against mutual funds that fail to address investor grievances satisfactorily.

In 2020, SEBI introduced side pocketing provisions, allowing mutual funds to separate troubled assets from the main portfolio. This protects the interests of existing investors while providing a fair mechanism for recovery if the troubled assets eventually perform better.

Analysis of Distribution Practices

The distribution of mutual funds in India has evolved significantly under SEBI’s regulatory framework. The regulations have progressively addressed conflicts of interest and misaligned incentives in the distribution ecosystem.

Before 2009, mutual funds charged entry loads (upfront commissions) of up to 2.25% from investors, which were paid to distributors. This created an incentive for distributors to churn portfolios and sell funds based on commissions rather than investor needs. SEBI’s bold decision to abolish entry loads in 2009 was a watershed moment for the industry.

Regulation 76 now prohibits upfront commissions and allows only trail commissions that are paid as long as the investor remains invested. This aligns distributor incentives with investor success and encourages long-term investing rather than frequent switching.

In 2012, SEBI introduced direct plans that allow investors to buy mutual funds directly from AMCs without going through distributors. Direct plans have lower expense ratios since they don’t include distributor commissions. This has created a low-cost option for informed investors.

The regulations require mutual funds to disclose commissions paid to distributors in the half-yearly consolidated account statements sent to investors. This transparency helps investors understand how much they are paying for distribution services.

SEBI has also introduced certification requirements for mutual fund distributors. Distributors must pass a certification test conducted by the Association of Mutual Funds in India (AMFI) and follow a code of conduct. This has helped improve the quality of advice given to investors.

The regulations have been particularly focused on preventing mis-selling of mutual funds. SEBI has introduced concepts like appropriateness and risk profiling to ensure that distributors recommend products suitable for the investor’s needs and risk appetite.

Recent regulatory focus has been on addressing conflicts in the online distribution space, where many platforms receive commissions from AMCs while appearing to offer “free” services to investors. SEBI has mandated clearer disclosure of such arrangements to ensure transparency.

Comparative Study with Global Asset Management Regulations

India’s mutual fund regulations have both similarities and differences compared to regulatory frameworks in other major markets. These comparisons provide perspective on the strengths and unique features of India’s approach.

The US regulates mutual funds primarily through the Investment Company Act of 1940. Like India, the US has a strong focus on disclosure and transparency. However, the US allows mutual funds to be structured as corporations rather than trusts, giving investors voting rights on certain matters.

The US has a concept of “independent directors” who must form at least 40% of a fund’s board, similar to India’s requirement for independent trustees. However, the US system places more governance responsibilities on the fund board itself, while India’s three-tier structure divides these responsibilities.

The European Union’s regulatory framework is based on the Undertakings for Collective Investment in Transferable Securities (UCITS) Directive. Like India, the EU emphasizes investor protection through investment restrictions and risk management requirements. However, UCITS allows more flexibility in fund structures and distribution across borders.

The UK’s regulatory approach focuses heavily on the “conduct of business” rules for asset managers, emphasizing their fiduciary duty to clients. This is similar to India’s focus on the obligations of AMCs and trustees, though India’s rules are more prescriptive in many areas.

India’s regulatory framework is more restrictive regarding investment options compared to some developed markets. For example, alternative investment strategies like short-selling and leveraged funds, which are common in the US and Europe, are more limited in India.

India’s expense ratio caps are more prescriptive than many global markets, where competition rather than regulation often determines fee levels. This reflects India’s focus on keeping mutual funds affordable for retail investors who may not have the bargaining power of institutional investors.

A unique aspect of India’s regulations is the emphasis on standardized categorization of schemes, which helps investors compare similar funds across different AMCs. This level of standardization is not as common in other markets, where fund naming and categorization can be more varied.

Current Challenges and Future Outlook

Despite its growth and maturity, India’s mutual fund industry faces several challenges that may shape future regulatory developments. These challenges reflect both market realities and evolving investor needs.

Penetration of mutual funds in India remains low compared to developed markets. Only about 3% of India’s population invests in mutual funds, compared to much higher percentages in countries like the US. Future regulatory changes may focus on simplifying products and processes to reach more investors.

The disparity between equity and debt markets poses challenges for balanced portfolio management. While equity markets are deep and liquid, the corporate bond market remains relatively underdeveloped. This limits diversification options for mutual funds, especially in fixed income.

Technology is transforming how mutual funds are distributed and managed. The regulations will need to evolve to address issues like robo-advisory services, digital onboarding, and the use of artificial intelligence in investment management. SEBI has already introduced an Innovation Sandbox to test new technologies in a controlled environment.

Regulation 28 may need updating to accommodate innovative investment strategies and instruments. As global investment landscapes evolve, Indian mutual funds may seek more flexibility to offer products like ESG (Environmental, Social, Governance) focused funds, thematic investments, and alternative strategies.

The Franklin Templeton episode highlighted liquidity management challenges in debt funds, especially for less liquid corporate bonds. Future regulatory changes may focus on strengthening liquidity risk management frameworks and stress testing requirements.

Investor education remains a challenge, with many investors still lacking basic understanding of mutual fund concepts like NAV, expense ratios, and different fund categories. SEBI and the industry will need to continue their focus on financial literacy initiatives.

As passive investing grows in India, regulations may need to address specific aspects of index funds and ETFs, such as tracking error limits, index construction, and market making mechanisms. These are currently covered by general mutual fund regulations but may require more targeted approaches.

Conclusion

The SEBI (Mutual Funds) Regulations, 1996, have been instrumental in shaping India’s asset management industry over the past 25 years. They have created a robust framework that balances investor protection with industry growth and innovation.

From humble beginnings in 1996, the mutual fund industry has grown into a cornerstone of India’s financial system, channeling household savings into productive investments in the economy. This growth has been facilitated by the clarity and stability provided by the regulatory framework.

The regulations have evolved continuously to address emerging challenges and opportunities. From basic registration requirements in the early years to sophisticated risk management frameworks today, SEBI has demonstrated its commitment to keeping the regulations relevant and effective.

Investor protection has been at the heart of these regulations. The trustee-AMC structure, investment restrictions, disclosure requirements, and expense caps all serve to safeguard investor interests. These protections have helped build trust in mutual funds as an investment avenue for ordinary Indians.

The distribution landscape has been transformed by regulatory interventions like the abolition of entry loads, introduction of direct plans, and focus on distributor conduct. These changes have made the industry more investor-friendly and reduced conflicts of interest.

Recent episodes like the Franklin Templeton case have tested the regulatory framework and led to further strengthening of investor protections. SEBI’s willingness to learn from such episodes and update regulations accordingly is a positive sign for the long-term health of the industry.

Looking ahead, the regulations will need to continue evolving to address emerging challenges like technology disruption, new investment strategies, and the need for greater financial inclusion. SEBI’s consultative approach to regulation suggests that it will engage with industry and investors to find balanced solutions.

For investors, the mutual fund regulations provide a safety net that makes investing in mutual funds less risky than direct investment in securities. Understanding these regulations can help investors make more informed choices and better appreciate the safeguards that protect their investments.

References

- Securities and Exchange Board of India. (1996). SEBI (Mutual Funds) Regulations, 1996. Gazette of India.

- Securities and Exchange Board of India. (2021). Amendment to SEBI (Mutual Funds) Regulations, 1996. SEBI Circular dated October 5, 2021.