Introduction

Whenever a Job notification is out the first thing we do is go to the salary section and check what is the remuneration for that particular job. In order to apply for that particular job and later put all the effort and hard-work to get selected, is a long and tiring process. If our efforts are not compensated satisfactorily, we might not really like to get into the long time consuming process.

When we go through the salary section we often see words like Pay Scale, Grade Pay, or even level one or two salary and it is common to get confused between these jargons and to know the perfect amount of salary that we are going to receive.

To understand what pay scale, grade pay, various numbers of levels and other technical terms, we first need to know what pay commission is and how it functions.

Pay Commission

The Constitution of India under Article 309 empowers the Parliament and State Government to regulate the recruitment and conditions of service of persons appointed to public services and posts in connection with the affairs of the Union or any State.

The Pay Commission was established by the Indian government to make recommendations regarding the compensation of central government employees. Since India gained its independence, seven pay commissions have been established to examine and suggest changes to the pay structures of all civil and military employees of the Indian government.

The main objective of these various Pay Commissions was to improve the pay structure of its employees so that they can attract better talent to public service. In this 21st century, the global economy has undergone a vast change and it has seriously impacted the living conditions of the salaried class. The economic value of the salaries paid to them earlier has diminished. The economy has become more and more consumerized. Therefore, to keep the salary structure of the employees viable, it has become necessary to improve the pay structure of their employees so that better, more competent and talented people could be attracted to governance.

In this background, the Seventh Central Pay Commission was constituted and the government framed certain Terms of Reference for this Commission. The salient features of the terms are to examine and review the existing pay structure and to recommend changes in the pay, allowances and other facilities as are desirable and feasible for civil employees as well as for the Defence Forces, having due regard to the historical and traditional parities.

The Ministry of finance vide notification dated 25th July 2016 issued rules for 7th pay commission. The rules include a Schedule which shows categorically what payment has to be made to different positions. The said schedule is called 7th pay matrix

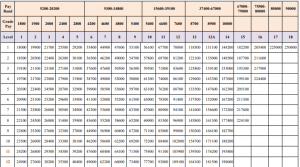

For the reference the table(7th pay matrix) is attached below.

Pay Band & Grade Pay

According to the table given above the first column shows the Pay band.

Pay Band is a pay scale according to the pay grades. It is a part of the salary process as it is used to rank different jobs by education, responsibility, location, and other multiple factors. The pay band structure is based on multiple factors and assigned pay grades should correlate with the salary range for the position with a minimum and maximum. Pay Band is used to define the compensation range for certain job profiles.

Here, Pay band is a part of an organized salary compensation plan, program or system. The Central and State Government has defined jobs, pay bands are used to distinguish the level of compensation given to certain ranges of jobs to have fewer levels of pay, alternative career tracks other than management, and barriers to hierarchy to motivate unconventional career moves. For example, entry-level positions might include security guard or karkoon. Those jobs and those of similar levels of responsibility might all be included in a named or numbered pay band that prescribed a range of pay.

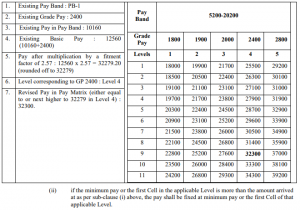

The detailed calculation process of salary according to the pay matrix table is given under Rule 7 of the Central Civil Services (Revised Pay) Rules, 2016.

As per Rule 7A(i), the pay in the applicable Level in the Pay Matrix shall be the pay obtained by multiplying the existing basic pay by a factor of 2.57, rounded off to the nearest rupee and the figure so arrived at will be located in that Level in the Pay Matrix and if such an identical figure corresponds to any Cell in the applicable Level of the Pay Matrix, the same shall be the pay, and if no such Cell is available in the applicable Level, the pay shall be fixed at the immediate next higher Cell in that applicable Level of the Pay Matrix.

The detailed table as mentioned in the Rules showing the calculation:

For example if your pay in Pay Band is 5200 (initial pay in pay band) and Grade Pay of 1800 then 5200+1800= 7000, now the said amount of 7000 would be multiplied to 2.57 as mentioned in the Rules. 7000 x 2.57= 17,990 so as per the rules the nearest amount the figure shall be fixed as pay level. Which in this case would be 18000/-.

The basic pay would increase as your experience at that job would increase as specified in vertical cells. For example if you continue to serve in the Basic Pay of 18000/- for 4 years then your basic pay would be 19700/- as mentioned in the table.

Dearness Allowance

However, the basic pay mentioned in the table is not the only amount of remuneration an employee receives. There are catena of benefits and further additions in the salary such as dearness allowance, HRA, TADA.

According to the Notification No. 1/1/2023-E.II(B) from the Ministry of Finance and Department of Expenditure, the Dearness Allowance payable to Central Government employees was enhanced from rate of 38% to 42% of Basic pay with effect from 1st January 2023.

Here, DA would be calculated on the basic salary. For example if your basic salary is of 18,000/- then 42% DA would be of 7,560/-

House Rent Allowance

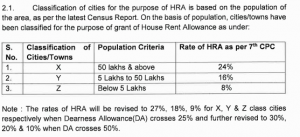

Apart from that the HRA (House Rent Allowance) is also provided to employees according to their place of duties. Currently cities are classified into three categories as ‘X’ ‘Y’ ‘Z’ on the basis of the population.

According to the Compendium released by the Ministry of Finance and Department of Expenditure in Notification No. 2/4/2022-E.II B, the classification of cities and rates of HRA as per 7th CPC was introduced.

See the table for reference

However, after enhancement of DA from 38% to 42% the HRA would be revised to 27%, 18%, and 9% respectively.

As above calculated the DA on Basic Salary, in the same manner HRA would also be calculated on the Basic Salary. Now considering that the duty of an employee’s Job is at ‘X’ category of city then HRA will be calculated at 27% of basic salary.

Here, continuing with the same example of calculation with a basic salary of 18000/-, the amount of HRA would be 4,840/-

Transport Allowance

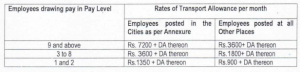

After calculation of DA and HRA, Central government employees are also provided with Transport Allowance (TA). After the 7th CPC the revised rates of Transport Allowance were released by the Ministry of Finance and Department of Expenditure in the Notification No. 21/5/2017-EII(B) wherein, a table giving detailed rates were produced.

The same table is reproduced hereinafter.

As mentioned above in the table, all the employees are given Transport Allowance according to their pay level and place of their duties. The list of annexed cities are given in the same Notification No. 21/5/2017-EII(B).

Again, continuing with the same example of calculation with a Basic Salary of 18000/- and assuming place of duty at the city mentioned in the annexure, the rate of Transport Allowance would be 1350/-

Apart from that, DA on TA is also provided as per the ongoing rate of DA. For example, if TA is 1350/- and rate of current DA on basic Salary is 42% then 42% of TA would be added to the calculation of gross salary. Here, DA on TA would be 567/-.

Calculation of Gross Salary

After calculating all the above benefits the Gross Salary is calculated.

Here, after calculating Basic Salary+DA+HRA+TA the gross salary would be 32,317/-

However, the Gross Salary is subject to few deductions such as NPS, Professional Tax, Medical as subject to the rules and directions by the Central Government. After the deductions from the Gross Salary an employee gets the Net Salary on hand.

However, it is pertinent to note that benefits such as HRA and TA are not absolute, these allowances are only admissible if an employee is not provided with a residence by the Central Government or facility of government transport.

Conclusion

Government service is not a contract. It is a status. The employees expect fair treatment from the government. The States should play a role model for the services. The Apex Court in the case of Bhupendra Nath Hazarika and another vs. State of Assam and others (reported in 2013(2)Sec 516) has observed as follows:

“………It should always be borne in mind that legitimate aspirations of the employees are not guillotined and a situation is not created where hopes end in despair. Hope for everyone is gloriously precious and that a model employer should not convert it to be deceitful and treacherous by playing a game of chess with their seniority. A sense of calm sensibility and concerned sincerity should be reflected in every step. An atmosphere of trust has to prevail and when the employees are absolutely sure that their trust shall not be betrayed and they shall be treated with dignified fairness then only the concept of good governance can be concretized. We say no more.”

The consideration while framing Rules and Laws on payment of wages, it should be ensured that employees do not suffer economic hardship so that they can deliver and render the best possible service to the country and make the governance vibrant and effective.

Written by Husain Trivedi Advocate

SEBI Takeover Code 2011: Key Rules and Provisions

Introduction

The SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011, commonly known as the Takeover Code, provide rules for acquiring shares in listed Indian companies. These regulations are designed to ensure that when someone buys a large number of shares or takes control of a company, they do so in a fair and transparent manner.

The Takeover Code protects existing shareholders, especially minority shareholders, by giving them an opportunity to exit the company at a fair price when control changes hands. It does this by requiring acquirers to make an “open offer” to buy shares from the public when their stake crosses certain thresholds.

These regulations apply to all listed companies in India and affect various stakeholders including promoters, institutional investors, and retail shareholders. The Takeover Code is particularly important in the Indian context where many companies have significant promoter holdings.

The SEBI Takeover Code 2011 replaced the earlier 1997 Takeover Code and brought several significant changes to align with evolving market practices and global standards. They simplified the regulatory framework while strengthening investor protection measures.

Historical Background and Evolution

The regulation of takeovers in India began with the SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 1994. These first regulations were basic and had many gaps that needed to be filled as the market developed.

In 1997, SEBI introduced a more comprehensive Takeover Code based on the recommendations of the Bhagwati Committee. This 1997 Code served as the main framework for regulating takeovers for the next 14 years, though it underwent several amendments during this period.

By 2010, it became clear that a complete overhaul was needed rather than more piecemeal changes. The market had evolved significantly, and there were many new types of transactions that weren’t adequately covered by the 1997 regulations.

SEBI appointed a committee led by Mr. C. Achuthan to review the Takeover Regulations. This committee submitted its report in 2010 with several far-reaching recommendations, many of which were incorporated into the SEBI Takeover Code 2011

The SEBI Takeover Code 2011 introduced several major changes. It increased the open offer trigger threshold from 15% to 25%, raised the minimum open offer size from 20% to 26%, and simplified the calculation of offer price to make it more equitable for all shareholders.

It also introduced the concept of “control” as a trigger for open offers, regardless of share acquisition percentages. This was a significant development as it recognized that control could change hands even without substantial share purchases.

Another important change was the elimination of the non-compete fee that acquirers could earlier pay to promoters over and above the price paid to public shareholders. This ensured that all shareholders were treated equally during takeovers.

Disclosure Requirements for Acquisition of Shares

Chapter II of the SEBI Takeover Code 2011 deals with disclosure requirements. These requirements ensure transparency about who owns significant stakes in listed companies and when these stakes change hands.

According to Regulation 29, any person who acquires 5% or more shares in a listed company must disclose this to the company and to the stock exchanges within 2 working days. This is called the initial disclosure requirement.

The regulation states: “Any acquirer who acquires shares or voting rights in a target company which taken together with shares or voting rights, if any, held by him and by persons acting in concert with him in such target company, aggregates to five per cent or more of the shares of such target company, shall disclose their aggregate shareholding and voting rights in such target company.”

Further, once a person already holds 5% or more, any change in their shareholding by 2% or more (up or down) must also be disclosed within 2 working days. This helps investors track significant changes in shareholding patterns.

Annual disclosure is also required from every person holding 25% or more shares or voting rights in a target company. They must disclose their holdings as of March 31 each year, even if there has been no change during the year.

These disclosures must include details of the acquirer, the target company, the stock exchanges where the company is listed, and the exact shareholding before and after the acquisition. The format for these disclosures is specified in the regulations.

Additionally, Regulation 30 requires promoters (founders or major shareholders who control the company) to disclose any encumbrance (like pledges) on their shares. This information is important because pledged shares might indicate financial stress or could potentially change hands if the pledge is invoked.

Open Offer Thresholds and Requirements

Chapter III of the Takeover Code contains the heart of the regulations – the rules about mandatory open offers. Regulation 3 sets the thresholds that trigger the requirement to make an open offer to public shareholders.

According to Regulation 3(1), any person acquiring 25% or more of the voting rights in a target company must make an open offer to all public shareholders. This is the most common trigger for open offers in India.

The regulation states: “No acquirer shall acquire shares or voting rights in a target company which taken together with shares or voting rights, if any, held by him and by persons acting in concert with him in such target company, entitle them to exercise twenty-five per cent or more of the voting rights in such target company unless the acquirer makes a public announcement of an open offer for acquiring shares of such target company.”

Even after crossing the 25% threshold, further acquisition triggers are in place. Regulation 3(2) states that any person holding between 25% and 75% of shares who acquires more than 5% shares in a financial year must also make an open offer. This prevents creeping acquisitions without giving exit opportunities to public shareholders.

Regulation 4 provides another trigger based on control rather than percentages. It states: “Irrespective of acquisition or holding of shares or voting rights in a target company, no acquirer shall acquire, directly or indirectly, control over such target company unless the acquirer makes a public announcement of an open offer for acquiring shares of such target company.”

The open offer must be for at least 26% of the total shares of the target company. This is mentioned in Regulation 7: “The open offer for acquiring shares to be made by the acquirer and persons acting in concert with him shall be for at least twenty six per cent of total shares of the target company, as of tenth working day from the closure of the tendering period.”

The acquirer must follow a specified timeline for the open offer process. Within 2 working days of crossing the threshold, they must make a public announcement. Within 5 working days of this announcement, they must publish a detailed public statement with more information about the offer.

Exemptions from Open Offer

Chapter IV of the Takeover Code provides for certain situations where an acquirer may be exempted from making an open offer even if they cross the triggers mentioned in Chapter III.

Regulation 10 lists specific cases that are automatically exempt from open offer requirements. These include inheritance, gifts among immediate relatives, transfers among qualifying promoters, and corporate restructuring approved by courts or tribunals.

For example, Regulation 10(1)(a)(i) states: “Any acquisition pursuant to inter-se transfer of shares amongst qualifying persons, being, immediate relatives, promoters named in the shareholding pattern filed by the target company for not less than three years…”

Another important exemption is for debt restructuring. When lenders convert debt into equity as part of a restructuring plan approved by the Reserve Bank of India or a tribunal, this conversion is exempt from open offer requirements.

Buybacks and delisting offers also have exemptions, as do certain increases in voting rights due to share buybacks without actual acquisition of new shares. These exemptions recognize that in such cases, the increase in percentage holding is technical rather than substantive.

Besides these automatic exemptions, Regulation 11 allows SEBI to grant exemptions on a case-by-case basis. Acquirers can apply to SEBI with specific reasons why an exemption should be granted, and SEBI can consider factors like public interest and the interests of investors.

To get such exemptions, acquirers must apply to SEBI before making the acquisition. SEBI may grant the exemption with or without conditions, and its decision is final. This flexibility allows SEBI to address unique situations that may not fit neatly into the predefined exemption categories.

Determination of Offer Price

Chapter V of the Takeover Code deals with how to determine the price at which the open offer must be made. This is crucial because a fair price ensures that public shareholders get equitable treatment when control changes hands.

Regulation 8 provides a detailed formula for calculating the offer price. This formula is designed to ensure that public shareholders receive the highest of several possible prices, which typically include:

The highest price paid by the acquirer for any acquisition during the 26 weeks prior to the public announcement of the open offer. This prevents acquirers from paying more to some shareholders (like promoters) than to others.

The volume-weighted average price paid by the acquirer during the 60 trading days before the public announcement. This captures the acquirer’s recent acquisition history at a fair average.

The highest price paid for any acquisition during the 26 weeks prior to the date when the intention to acquire is announced or the voting rights are acquired. This covers situations where the market might have been influenced by early indications of a potential takeover.

The volume-weighted average market price for 60 trading days before the public announcement. This reflects the recent market valuation of the shares independent of the acquirer’s actions.

For indirect acquisitions (where control of the target company changes due to acquisition of its parent company), the regulations provide additional methods to ensure the offer price is fair. These include looking at the price paid for the parent company and allocating it proportionately to the target company.

Regulation 8(10) states: “Where the offer price is incapable of being determined under any of the preceding sub-regulations, the offer price shall be the fair price of shares of the target company to be determined by the acquirer and the manager to the open offer taking into account valuation parameters.”

This gives some flexibility when standard methods don’t apply, but requires professional valuation to ensure fairness. The regulations also provide for adjustment of the offer price for corporate actions like dividends, rights issues, or bonus issues that occur between the announcement and completion of the offer.

Conditional Offers and Competing Offers

Regulations 19 and 20 deal with conditional offers and competing offers, adding flexibility to the takeover process while ensuring fair treatment of all parties involved.

A conditional offer is one where the acquirer makes the offer conditional upon a minimum level of acceptance. Regulation 19 allows acquirers to specify that the offer will not proceed if they don’t receive a minimum number of shares. However, this minimum cannot be more than 50% of the offer size.

For example, if the open offer is for 26% of the company’s shares, the acquirer can make it conditional on receiving at least 13% (50% of 26%). If this minimum level is not reached, the acquirer can withdraw the offer, returning any shares already tendered.

Regulation 19(1) states: “An acquirer may make an open offer conditional as to the minimum level of acceptance. Where the offer is made conditional upon minimum level of acceptance, the acquirer and persons acting in concert with him shall not acquire, during the offer period, any shares in the target company except through the open offer process.”

Competing offers happen when multiple acquirers are interested in the same target company. Regulation 20 provides a framework for such situations, ensuring a fair bidding process that benefits shareholders.

If a competing offer is made during the original offer period, the offer period for both offers is extended to the same date. This gives shareholders time to consider both offers and choose the better one.

The competing offer must be for at least the same number of shares as the original offer, and at a price not lower than the original offer price. This ensures that competition only improves the terms for shareholders.

Regulation 20(8) states: “Upon the announcement of the competing offer, an acquirer who had made an earlier offer shall have the option to revise the terms of his open offer…” This allows for a bidding war that can benefit target company shareholders.

However, there are limits to prevent endless bidding wars. Regulation 20(2) specifies that no competing offer can be made after the 15th working day from the date of the detailed public statement of the original offer. This provides certainty about the timeline of the process.

Landmark Court Cases

Several important court and tribunal cases have shaped the interpretation and application of the SEBI Takeover Code 2011. These cases provide guidance on how the regulations should be understood in practice.

In Sanofi-Aventis v. SEBI (2013), the Securities Appellate Tribunal (SAT) dealt with the pricing of indirect acquisitions. Sanofi, a French company, had acquired Shantha Biotechnics, an Indian company, through its overseas parent.

The dispute was about how to calculate the open offer price. The SAT held: “In case of indirect acquisitions, the price paid for the overseas entity must be appropriately attributed to the Indian target company based on transparent and objective criteria. The acquirer cannot artificially lower the valuation of the Indian entity to reduce the open offer price.”

This judgment established important principles for valuing Indian companies in global transactions. It ensured that Indian shareholders receive fair value even when the acquisition happens at a foreign parent level.

The Zenotech Laboratories Shareholders v. SEBI (2010) case dealt with non-compete payments in open offers. Before the 2011 regulations explicitly banned the practice, acquirers often paid promoters extra money as “non-compete fees” over and above the share price.

The SAT ruled: “Any premium paid to promoters, whether called non-compete fees or given any other name, must be factored into the open offer price for public shareholders. The principle of equal treatment demands that all shareholders receive the same value for their shares.” This principle was later incorporated into the 2011 Takeover Code.

In Clearwater Capital Partners v. SEBI (2014), the SAT examined the exemptions from open offer requirements. Clearwater had acquired shares beyond the threshold through a preferential allotment that was approved by shareholders.

The tribunal clarified: “Shareholder approval for preferential allotment does not automatically exempt the acquirer from open offer obligations. The Takeover Regulations specifically list the exemptions, and SEBI alone has the power to grant additional exemptions. A company’s shareholders cannot waive the regulatory requirement.”

This case emphasized that takeover regulations are mandatory law that cannot be overridden by shareholder approval, highlighting the protective nature of these regulations for minority shareholders.

The Vishvapradhan Commercial v. SEBI (2019) case dealt with the concept of indirect control acquisition. Vishvapradhan had acquired certain loan facilities that gave it economic interest but not direct shareholding in a media company.

The SAT examined the definition of “control” under the Takeover Code and ruled: “Control must be interpreted broadly to include both de jure (legal) and de facto (practical) control. The ability to significantly influence management decisions or policy matters of the target company constitutes control, even without majority shareholding.”

This case expanded the understanding of control beyond formal share ownership to include practical control through contractual rights, veto powers, or other mechanisms. It underscored that the substance of control matters more than its form when determining open offer obligations.

Evolution from 1997 to SEBI Takeover Code 2011 Regulation

The 2011 Takeover Code represented a significant evolution from the 1997 regulations. Understanding these changes helps us appreciate the current regulatory framework better.

One of the most important changes was raising the initial trigger threshold from 15% to 25%. This change recognized that in the Indian context, a 15% stake was often too low to represent actual control, and the higher threshold reduced unnecessary open offers.

The minimum open offer size was increased from 20% to 26%. This change gave public shareholders a better exit opportunity when control changed hands. Combined with the higher trigger threshold, it balanced the interests of acquirers and public shareholders.

The SEBI Takeover Code 2011 regulations eliminated the concept of “creeping acquisition” of 5% per year without an open offer that existed in the 1997 code. Instead, it introduced a simpler rule: once an acquirer crosses 25%, any acquisition of more than 5% in a financial year triggers an open offer.

The definition of “control” was expanded and clarified in the 2011 regulations. While the 1997 code also recognized control as a trigger, the 2011 version provided a more comprehensive definition that included both direct and indirect control mechanisms.

The 2011 regulations banned non-compete fees that acquirers could earlier pay to promoters over and above the price paid to public shareholders. This ensured equal treatment of all shareholders and prevented promoters from extracting extra value at the expense of minority shareholders.

The calculation of the offer price was simplified and made more equitable in the 2011 regulations. While the basic principle of using the highest of several alternative prices remained, the formula was refined to better capture the fair value of shares.

The SEBI Takeover Code 2011 regulations also introduced clearer rules for indirect acquisitions, competing offers, and withdrawal of offers. These changes addressed gaps in the earlier regulations that had created uncertainty in complex acquisition scenarios.

Impact on M&A Activity in India

The Takeover Code has significantly influenced how mergers and acquisitions happen in India. By providing a clear regulatory framework, it has both facilitated legitimate transactions and prevented exploitative ones.

The increase in the trigger threshold from 15% to 25% in the SEBI Takeover Code 2011 regulations made it easier for investors to take substantial stakes in companies without triggering open offer requirements. This has encouraged more institutional investment in Indian companies.

The regulations have also shaped how deals are structured. Acquirers often try to stay just below trigger thresholds or seek to qualify for exemptions. This has led to creative transaction structures that comply with the letter of the law while achieving business objectives.

For listed companies with high promoter holdings (which is common in India), the Takeover Code has created a strong protection against hostile takeovers. Since promoters often hold more than 50% of shares, it becomes nearly impossible for an outsider to take control without promoter consent.

The requirement for competing offers has occasionally led to bidding wars that benefit shareholders of target companies. In several cases, the initial offer price has been significantly increased due to competition, demonstrating the regulations’ effectiveness in ensuring fair value.

Foreign investors and multinational companies have had to adapt their global acquisition strategies to comply with India’s Takeover Code. This has sometimes caused delays or additional costs, but has ensured that global deals don’t disadvantage Indian shareholders.

The ban on non-compete payments has reduced the premium that promoters could earlier extract when selling their companies. This has made the M&A process more equitable but has sometimes reduced promoters’ incentives to sell, potentially limiting market activity.

Comparative Analysis with Global Takeover Regulations

India’s Takeover Code shares similarities with takeover regulations in other countries but also has unique features reflecting India’s specific market conditions.

The UK’s City Code on Takeovers and Mergers is often considered the global benchmark for takeover regulations. Like India’s code, it requires acquirers to make a mandatory offer when crossing certain thresholds (30% in the UK compared to 25% in India).

However, the UK code follows a “no frustration” rule that limits the target company’s board from taking defensive measures without shareholder approval. India’s Takeover Code doesn’t have similar restrictions, giving Indian companies more freedom to resist unwanted takeovers.

The US approach to takeovers is more permissive than India’s. The US doesn’t have mandatory offer requirements at the federal level, though some states have anti-takeover laws. Instead, the US relies more on disclosure requirements through the Williams Act and fiduciary duties of directors.

In contrast to both the UK and US, India’s Takeover Code places more emphasis on promoter-controlled companies, which are more common in India. The regulations are designed with this ownership structure in mind.

The European Union’s Takeover Directive requires member states to implement mandatory bid rules when someone acquires “control,” but leaves the definition of control and the threshold to each country (typically between 30-33%). India’s 25% threshold is lower than most European countries.

Japan’s takeover regulations require an open offer when an acquirer crosses 33.3% ownership. However, unlike India, partial offers are allowed in Japan, meaning the acquirer doesn’t have to offer to buy shares from all shareholders.

India’s pricing rules for open offers are more prescriptive than many other jurisdictions, specifying multiple reference points for determining the minimum offer price. This reflects the regulator’s emphasis on protecting minority shareholders in a market with less developed corporate governance.

Assessment of Minority Shareholder Protection

The Takeover Code’s primary goal is to protect minority shareholders when control of a company changes hands. Several provisions specifically address this objective.

The mandatory open offer requirement ensures that minority shareholders can exit at a fair price when a new investor takes control. Without this protection, the controlling shareholder might extract private benefits at the expense of remaining shareholders.

The regulation states in its preamble that it aims “to provide [an] exit opportunity to the shareholders of the target company and to ensure that the public shareholders are treated fairly and equitably in case of substantial acquisition of shares or voting rights or control…”

The formula for determining the offer price protects minority shareholders by requiring acquirers to pay the highest price from several alternatives. This prevents acquirers from paying a premium to the controlling shareholders while offering less to public shareholders.

The ban on non-compete payments, introduced in the SEBI Takeover Code 2011 regulations, was a significant enhancement of minority shareholder protection. It closed a loophole that had allowed promoters to receive extra payments not available to other shareholders.

The disclosure requirements enable minority shareholders to make informed decisions about whether to participate in open offers. By knowing who is acquiring shares and at what price, shareholders can better assess the implications for their investment.

The competing offer provisions benefit minority shareholders by potentially leading to higher offer prices. When multiple acquirers bid for the same company, the resulting competition usually drives up the price, benefiting all shareholders who tender their shares.

However, some critics argue that the Takeover Code doesn’t adequately address certain situations. For example, when an acquirer takes control by buying slightly over 25% and makes an open offer for 26% more, they may end up with 51% control while some minority shareholders remain “locked in” against their will.

Current Challenges and Future Outlook

Despite its comprehensive nature, the Takeover Code faces several challenges in today’s rapidly evolving market environment.

The definition of “control” continues to create interpretative challenges. As companies use increasingly complex structures and investment instruments, determining when control has passed can be difficult. SEBI has been considering a more specific definition but has yet to finalize it.

The rise of new types of investors, such as private equity funds, sovereign wealth funds, and activist investors, has created scenarios not fully anticipated by the regulations. These investors may exercise significant influence without crossing formal thresholds.

Digital and technology companies often have unique governance structures, such as dual-class shares or founder control through special rights. The Takeover Code, designed primarily for traditional companies, sometimes struggles to address these new models effectively.

The interaction between the Takeover Code and other regulations, such as foreign investment rules, competition law, and sectoral regulations (like banking or insurance), creates complexity that can be challenging for acquirers to navigate.

The pricing formula, while comprehensive, can sometimes result in offer prices significantly above market value, especially in volatile market conditions. This can make some legitimate transactions economically unviable.

Looking ahead, the Takeover Code will likely continue to evolve to address these challenges. SEBI has been receptive to market feedback and has made several amendments since 2011 to clarify or update specific provisions.

Future changes might include a more nuanced approach to the definition of control, refinements to the pricing formula to better reflect fair value in all market conditions, and perhaps special provisions for new-age companies with unconventional structures.

Conclusion

The SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011, represent a significant milestone in the evolution of India’s securities market regulations. By providing a comprehensive framework for acquisitions and takeovers, they have contributed to creating a more orderly, transparent, and fair market environment.

The regulations balance multiple objectives: protecting minority shareholders, facilitating legitimate business transactions, preventing market abuse, and ensuring transparency. While no regulatory framework is perfect, the Takeover Code has generally succeeded in meeting these objectives.

The mandatory open offer requirement, equitable pricing rules, and ban on differential payments ensure that minority shareholders are treated fairly when control changes hands. The disclosure requirements promote transparency, allowing investors to make informed decisions.

At the same time, the clear thresholds and exemption provisions provide certainty to acquirers, allowing them to plan their transactions with a clear understanding of their regulatory obligations. This predictability is crucial for a well-functioning mergers and acquisitions market.

The evolution of the regulations from 1994 to 2011 and the subsequent amendments demonstrate SEBI’s responsive approach, adapting the framework to changing market conditions and addressing gaps or ambiguities as they become apparent.

As India’s capital markets continue to develop and integrate with global markets, the Takeover Code will remain a crucial element of the regulatory architecture. Its effectiveness will depend on how well it adapts to new challenges while maintaining its core principles of fairness, transparency, and investor protection.

For companies, investors, and advisors operating in India’s capital markets, a thorough understanding of the Takeover Code is essential. Its provisions significantly impact strategic decisions about investments, divestments, and corporate control, making it one of the most important sets of regulations in Indian securities law.

SEBI LODR Regulations 2015: Ensuring Corporate Transparency and Governance

Introduction

The SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, commonly known as LODR Regulations, are a set of rules that companies must follow after listing their shares on stock exchanges. These regulations replaced the earlier Listing Agreement, which was a contract between companies and stock exchanges. The SEBI LODR Regulations 2015 aim to ensure that listed companies maintain good corporate governance and regularly share important information with their shareholders and the public. This helps investors make informed decisions and promotes transparency in the market. The regulations cover various aspects like board composition, financial reporting, disclosure of important events, related party transactions, and shareholder rights. They apply to all companies listed on recognized stock exchanges in India.

Background and Evolution of SEBI LODR Regulations

Before 2015, listed companies had to follow something called the Listing Agreement. This was a contract they signed with stock exchanges where their shares were traded. The problem was that this agreement wasn’t as legally strong as regulations made under the SEBI Act.

The Listing Agreement had evolved over time, with major changes in 2000 and 2006, especially in the area of corporate governance. Clause 49 of this agreement, which dealt with corporate governance, was particularly important and underwent several revisions.

In 2013, India got a new Companies Act which included many provisions for better corporate governance. SEBI needed to update its rules to match this new law and also to make the rules legally stronger.

So in 2015, SEBI converted the Listing Agreement into proper regulations under the SEBI Act. This gave the rules more legal power and made them easier to enforce. Companies breaking these rules could now face stronger penalties.

Corporate Governance Requirements for Listed Entities

Chapter IV of the SEBI LODR Regulations 2015 contains detailed rules about corporate governance. Regulation 17 deals with the board of directors. It states that a company’s board must have at least six members, with a good mix of executive and non-executive directors.

At least half the board must be independent directors if the chairperson is related to the promoter. Independent directors are people who don’t have any material relationship with the company and can provide unbiased oversight.

The regulations also have specific requirements for women directors. Regulation 17(1)(a) states: “Board of directors shall have an optimum combination of executive and non-executive directors with at least one woman director.”

Another important aspect is board meetings. Regulation 17(2) requires: “The board of directors shall meet at least four times a year, with a maximum time gap of one hundred and twenty days between any two meetings.” This ensures regular oversight of company affairs.

The regulations also require companies to have certain committees of the board. The audit committee (Regulation 18) oversees financial reporting and disclosure. The nomination and remuneration committee (Regulation 19) decides on appointment and payment of directors.

The stakeholders relationship committee (Regulation 20) looks into complaints from shareholders. The risk management committee (Regulation 21) helps the board handle various risks faced by the company.

Obligations of Listed Entities Under SEBI LODR Regulations

Chapter III of the SEBI LODR Regulations 2015 sets out the general obligations of listed companies. Regulation 4 lays down principles that should guide listed entities in their dealings with stakeholders.

These principles include transparency, protection of shareholder rights, timely disclosure of information, and ethical behavior. Listed companies must incorporate these principles in their day-to-day functioning.

Regulation 7 requires companies to appoint a qualified company secretary as the compliance officer. This person is responsible for ensuring that the company follows all the rules and requirements under the LODR Regulations.

The regulations also specify how companies should handle their securities. Regulation 9 states: “The listed entity shall have a policy for preservation of documents, approved by its board of directors, classifying them in at least two categories.”

Companies must maintain a functional website that contains basic information about the company, its business, financial data, shareholding pattern, and contact information. This makes it easier for investors to find important information about the company.

Regulation 13 deals with investor complaints. Companies must register with SEBI’s online complaint system called SCORES (SEBI Complaints Redress System) and resolve investor grievances in a timely manner.

Disclosure of Events and Information Requirements Under SEBI LODR Regulations

Regulations 30 and 31 cover the disclosure of material events and information, which is one of the most important aspects of the LODR Regulations. Listed companies must immediately inform stock exchanges about any important events that could affect their share price.

Regulation 30(4) provides the criteria for determining whether an event is material: “The listed entity shall consider the following criteria for determination of materiality of events/information: (a) the omission of an event or information, which is likely to result in discontinuity or alteration of event or information already available publicly; or (b) the omission of an event or information is likely to result in significant market reaction if the said omission came to light at a later date.”

The regulation divides events into two categories. The first category includes events that are deemed material and must always be disclosed, such as acquisitions, mergers, demergers, changes in directors, and issuance of securities.

The second category includes events that need to be disclosed if the company considers them material based on the criteria mentioned above. This includes things like signing new contracts, launching new products, and changes in credit ratings.

Companies must disclose these events within 24 hours. For certain events like board meeting outcomes, the disclosure must be made within 30 minutes of the meeting ending. This ensures that all investors get important information at the same time.

Besides event-based disclosures, companies must make regular periodic disclosures. This includes quarterly financial results, shareholding patterns, corporate governance reports, and annual reports. These periodic disclosures help investors track the company’s performance over time.

Compliance Requirements and Penalties

Chapter VI of the SEBI LODR Regulations 2015 deals with what happens if a company doesn’t follow the rules. SEBI has various powers to take action against non-compliant companies and their directors or promoters.

Regulation 98 states: “The stock exchange(s) shall monitor the compliance by the listed entity with the provisions of these regulations.” If stock exchanges find violations, they must report them to SEBI, which can then take further action.

The penalties for violations can be severe. Under Section 12A of the SEBI Act, non-compliance can lead to penalties of up to Rs. 25 crore or three times the amount of profits made from such non-compliance, whichever is higher.

In serious cases, SEBI can also suspend trading in a company’s shares, delist the company, or take other actions like freezing promoter shareholding. Directors and key management personnel can also face penalties for their company’s non-compliance.

The regulations also provide for the submission of compliance reports. Regulation 27 requires companies to submit quarterly compliance reports on corporate governance. Similarly, Regulation 40(9) requires a certificate from a practicing company secretary confirming compliance with share transfer formalities.

Special Provisions for SME Exchanges

Chapter IX of the LODR Regulations contains special provisions for small and medium enterprises (SMEs) listed on designated SME exchanges. These provisions recognize that smaller companies may find it difficult to comply with all the requirements applicable to larger companies.

For instance, SMEs need to have only two independent directors instead of half the board. They are also exempt from having certain committees like the risk management committee, which larger companies must have.

SMEs are required to publish half-yearly financial results instead of quarterly results. This reduces the compliance burden on these smaller companies, allowing them to focus more on their business operations.

However, even with these relaxations, SMEs must maintain minimum standards of disclosure and corporate governance. They must still disclose material events promptly and ensure that their board functions effectively.

These special provisions have helped many smaller companies access capital markets through SME exchanges while maintaining appropriate levels of investor protection. As these companies grow and move to the main board, they become subject to the full set of LODR Regulations.

Landmark Cases Clarifying SEBI LODR Regulations Compliance

Several important court cases have helped clarify the interpretation and application of the LODR Regulations. These cases provide guidance on how companies should comply with the regulations in practice.

In Diageo Plc v. SEBI (2018), the Securities Appellate Tribunal (SAT) dealt with the issue of corporate governance disclosures. Diageo, which had acquired control of United Spirits Limited (USL), discovered certain financial irregularities in USL’s past operations.

The tribunal held that the new management had a duty to disclose these irregularities promptly, even though they occurred before their takeover. The SAT stated: “The duty of disclosure under LODR Regulations applies regardless of when the events occurred, if they have a material impact on the company’s current financial position or operations.”

Another significant case is Fortis Healthcare v. SEBI (2019), which established standards for material disclosure compliance. SEBI found that Fortis had failed to disclose certain material inter-corporate deposits, which affected its financial position.

The SAT upheld SEBI’s order and clarified: “The test of materiality is not just about the amount involved but also the nature of the transaction and its potential impact on the company’s financial health and investor decision-making. Companies cannot withhold information merely because they subjectively consider it immaterial.”

In Infosys v. SEBI (2020), the focus was on whistleblower disclosure requirements. When Infosys received whistleblower complaints about alleged unethical practices, questions arose about when and how much to disclose.

The SAT noted: “While companies need time to investigate whistleblower allegations, they cannot delay disclosure if the allegations are potentially material. Even if the allegations are eventually found to be untrue, investors have the right to know about them if they could significantly impact investment decisions.”

The Yes Bank v. SEBI (2021) case dealt with the accuracy of financial disclosures. Yes Bank had understated its non-performing assets (NPAs) in its financial statements, which SEBI found to be a violation of the LODR Regulations.

In its judgment, the SAT observed: “The accuracy of financial disclosures is fundamental to market integrity. Banking companies have an even higher responsibility given their role in the financial system. Hiding bad loans through creative accounting violates both the letter and spirit of the disclosure requirements.”

Impact on Corporate Governance Practices

The LODR Regulations have significantly improved corporate governance practices in Indian companies. By making corporate governance requirements legally binding rather than just contractual obligations, SEBI has ensured greater compliance.

Independent directors now play a more active role in company boards. They chair important committees like the audit committee and the nomination and remuneration committee, providing checks and balances against excessive power of promoters.

The regulations have also improved gender diversity in Indian boardrooms. The requirement for at least one woman director has increased female representation, though there is still a long way to go for true gender balance at the top.

Disclosure practices have become more standardized and robust. Companies now promptly disclose material events, giving investors timely information to make decisions. The quality and quantity of information available about listed companies have increased substantially.

Board processes have become more structured with clear roles and responsibilities. Regular board meetings, committee meetings, and independent director meetings ensure continuous oversight of company management.

Shareholder activism has increased as shareholders become more aware of their rights under the regulations. They now actively participate in important decisions and hold management accountable for company performance.

However, challenges remain. Some companies still treat compliance as a box-ticking exercise rather than embracing the spirit of good governance. Family-owned businesses sometimes struggle with the concept of independent oversight.

Relationship Between Disclosure Requirements and Market Efficiency

Disclosure requirements under the SEBI LODR Regulations 2015 have a direct impact on market efficiency. Efficient markets need information to be quickly and equally available to all participants.

When companies disclose material information promptly, it reduces information asymmetry. This means that no investor has an unfair advantage over others due to having access to non-public information.

Research studies have shown that stocks of companies with better disclosure practices tend to have lower volatility and more accurate pricing. This is because investors have more information to assess the company’s true value.

The quarterly financial reporting requirement helps investors track company performance regularly. This reduces the chances of big surprises and helps in more accurate valuation of shares.

Event-based disclosures ensure that any significant developments are quickly reflected in the stock price. This increases market efficiency by allowing prices to adjust rapidly to new information.

Corporate governance disclosures help investors assess the quality of company management and board oversight. Companies with stronger governance structures often enjoy higher valuations due to lower perceived risk.

However, some critics argue that the focus on short-term quarterly results can lead to short-termism in company management. Companies might focus too much on meeting quarterly expectations rather than long-term value creation.

Compliance Challenges Faced by Listed Entities

Despite the clear benefits, companies face several challenges in complying with the SEBI LODR Regulations 2015. One major challenge is keeping up with frequent amendments and circulars issued by SEBI to clarify or modify the regulations.

Smaller listed companies often struggle with the compliance burden. They may not have dedicated teams for compliance and might find it difficult to implement all the requirements, particularly those related to board composition and committee structures.

The timely disclosure of material events can be challenging, especially when the materiality is not clear-cut. Companies must make quick judgments about whether an event is material enough to warrant disclosure, often with limited information.

Related party transaction regulations are particularly complex. Companies with extensive group structures must carefully track all transactions with related entities and ensure proper approvals and disclosures.

Companies also face challenges in managing the expectations of different stakeholders. What may seem like adequate disclosure to the company might not satisfy institutional investors or proxy advisory firms looking for more detailed information.

The cost of compliance is significant. Companies need to invest in systems, processes, and qualified personnel to ensure compliance. They also incur costs for board and committee meetings, independent directors’ fees, and compliance certifications.

Cultural challenges exist too, especially in promoter-driven companies. The concept of independent oversight and transparent disclosure may clash with traditional management styles that prefer to keep information closely held.

Trends and Effectiveness of SEBI LODR Regulations

SEBI’s enforcement of the LODR Regulations has evolved over time. Initially, the focus was on educating companies about the new requirements and encouraging voluntary compliance.

In recent years, SEBI has become more strict in its enforcement. It has imposed significant penalties on companies and their directors for violations of disclosure and corporate governance norms.

The regulator has particularly focused on financial disclosure violations. Cases involving misstatement of financial results or hiding material information about a company’s financial condition have attracted severe penalties.

SEBI has also been strict about board composition requirements. Companies that fail to have the required number of independent directors or women directors have faced penalties and public censure.

Stock exchanges, which act as the first line of enforcement, have improved their monitoring systems. They track compliance through regular reports submitted by listed companies and flag potential violations to SEBI.

The effectiveness of enforcement can be seen in improved compliance statistics. For instance, most listed companies now have the required number of independent directors and women directors, compared to significant non-compliance when these requirements were first introduced.

However, enforcement challenges remain. With thousands of listed companies to monitor, SEBI and stock exchanges have limited resources for detailed surveillance. They often rely on complaints or media reports to identify violations.

The penalty amounts, though increased in recent years, may still not be deterrent enough for large companies. The cost-benefit analysis might sometimes favor non-compliance, especially if the penalties are perceived as just a cost of doing business.

Conclusion

The SEBI LODR Regulations 2015, have transformed corporate governance and disclosure practices in India. By converting the earlier contractual Listing Agreement into legally binding regulations, SEBI has created a stronger framework for investor protection.

The regulations have improved board effectiveness through requirements for independent directors, regular meetings, and specialized committees. They have enhanced transparency through detailed disclosure requirements for material events and financial information.

Listed companies have generally adapted well to the new regime, though compliance challenges remain, particularly for smaller entities. The regulatory framework continues to evolve through amendments and clarifications based on market feedback and emerging issues.

The landmark cases discussed in this article have helped clarify the practical application of the regulations. They demonstrate SEBI’s commitment to enforcing both the letter and spirit of the disclosure and governance requirements.

Going forward, the focus should be on encouraging substantive compliance rather than just technical adherence to the rules. True corporate governance goes beyond ticking boxes and requires a cultural commitment to transparency, accountability, and ethical behavior.

As Indian capital markets continue to grow and attract global investors, the LODR Regulations will play a crucial role in building and maintaining investor confidence. By ensuring that listed companies meet high standards of governance and disclosure, these regulations contribute to the overall development and integrity of the securities market.

References

- Securities and Exchange Board of India. (2015). SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015. Gazette of India.

- Securities and Exchange Board of India. (2021). Amendment to SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015. SEBI Circular dated September 7, 2021.

- Securities Appellate Tribunal. (2018). Diageo Plc v. SEBI. SAT Appeal No. 6/2017, Order dated February 9, 2018.

- Securities Appellate Tribunal. (2019). Fortis Healthcare v. SEBI. SAT Appeal No. 110/2019, Order dated November 15, 2019.

- Securities Appellate Tribunal. (2020). Infosys Ltd. v. SEBI. SAT Appeal No. 125/2020, Order dated September 8, 2020.

- Securities Appellate Tribunal. (2021). Yes Bank v. SEBI. SAT Appeal No. 45/2021, Order dated April 12, 2021.

- Balasubramanian, N., & Anand, M. (2020). “Corporate Governance Practices in India: A Decade of LODR Regulations.” Indian Institute of Management Bangalore Review, 32(2), 65-88.

- Khanna, V., & Mathew, S. (2019). “Effectiveness of Corporate Governance Regulations in India.” National Law School Journal, 17(1), 112-137.

- Varottil, U. (2019). “Evolution of Corporate Governance in India.” In Comparative Corporate Governance (pp. 321-352). Cambridge University Press.

- SEBI Annual Report 2020-21. Chapter on Corporate Governance and Compliance Monitoring.

- Chakrabarti, R., Megginson, W., & Yadav, P. K. (2018). “Corporate Governance in India: Evolution and Challenges.” In Global Perspectives on Corporate Governance (pp. 187-215). Oxford University Press.

- Mathur, S. K., & Shah, A. (2020). “Impact of LODR Regulations on Market Efficiency: Evidence from Indian Stock Markets.” Journal of Financial Markets and Governance, 15(3), 228-249.

- Report of the Committee on Corporate Governance. (2017). Submitted to SEBI by the Kotak Committee.

- Institutional Investor Advisory Services. (2021). Corporate Governance Scorecard: Evaluating LODR Compliance in Top 100 Listed Companies in India.

- Pande, S., & Ahmad, A. (2021). “Comparing Corporate Governance Standards: India, UK, and US.” International Journal of Corporate Governance, 12(2), 152-175.

SEBI ICDR Regulations 2018: Guide to Raising Capital in Indian Markets

Introduction

When companies need money to grow, build factories, develop new products, or expand to new places, they often turn to the public for funds by selling shares. This process of selling shares to the public is very important for both companies and the economy, but it needs proper rules to make sure everything happens fairly. The SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018, commonly called ICDR Regulations, provide these rules in India. These regulations tell companies exactly what information they must share with the public, how they should price their shares, and what they can and cannot do during the whole process of raising money. The SEBI ICDR Regulations 2018 replaced the older 2009 regulations and brought many changes to make the process better, simpler, and safer for everyone. In this article, we will explore these regulations in detail, looking at what they say, how they work in practice, some famous cases related to them, and how they compare with similar rules in other countries. By the end, you will have a good understanding of how companies in India raise money from the public and how investors are protected during this process.

Historical Background and Evolution of SEBI ICDR Regulations 2018

The story of how India regulates companies raising money from the public goes back many decades and has seen many changes as the economy and markets have grown. Before 1992, the Controller of Capital Issues (CCI), which was part of the Finance Ministry, controlled this area through the Capital Issues Control Act, 1947. In those days, the government decided almost everything about public issues, including the price at which shares could be sold. Companies had very little freedom, and the whole process was slow and complicated. This old system was not working well for a growing economy that needed more investment and faster processes.

When economic reforms started in 1991, the government made big changes. The Capital Issues Control Act was cancelled, and the Securities and Exchange Board of India (SEBI), which had been created in 1988, was given legal powers in 1992 through the SEBI Act. SEBI then became the main organization responsible for regulating how companies raise money from the public. At first, SEBI issued various guidelines and instructions through different circulars. In 2000, it brought all these together into the SEBI (Disclosure and Investor Protection) Guidelines to make things more organized.

Then in 2009, SEBI took a big step by replacing these guidelines with the first ICDR Regulations, which made the rules more formal and legally stronger. These 2009 Regulations worked well for several years but eventually needed updating because markets change, new types of businesses emerge, and global standards evolve. After extensive discussions with market experts, companies, and investor groups, SEBI introduced the new SEBI ICDR regulations 2018. These new regulations were not just a small update but a complete overhaul that reorganized everything to make it more logical and user-friendly. They reduced the number of chapters from twenty to sixteen and made the language clearer. The 2018 Regulations kept the good parts of the earlier rules while adding new features to make the capital raising process more efficient and in line with global best practices.

Initial Public Offerings (IPO) Requirements

The most common way for a company to raise money from the public for the first time is through an Initial Public Offering (IPO). Chapter II of the ICDR Regulations deals specifically with IPOs and sets out detailed rules about which companies can do an IPO and what conditions they must meet. According to Regulation 6, a company must fulfill several conditions to be eligible for an IPO. It must have net tangible assets of at least three crore rupees in each of the previous three years. It also needs to have made an average operating profit of at least fifteen crore rupees during the previous three years, with profit in each year. The company must have a net worth (total assets minus total liabilities) of at least one crore rupees in each of the last three years. And if the company has changed its name within the last year, at least half of its revenue in the previous year should have come from the activity suggested by the new name. These requirements ensure that only companies with a proven track record can raise money from the public.

However, the regulations also provide alternative routes for newer companies, especially in technology sectors, that might not meet these traditional criteria but have strong growth potential. For example, Regulation 6(2) allows loss-making companies to do an IPO if they allocate at least 75% of the net public offer to Qualified Institutional Buyers (QIBs) like banks, insurance companies, and mutual funds. This provision has been particularly helpful for many technology startups and e-commerce companies that typically operate at a loss in their early years while building market share. The regulations also specify details about the minimum offer size, promoter contribution, lock-in periods, and pricing methods. For instance, promoters (founders or main shareholders) must contribute at least 20% of the post-issue capital and keep these shares locked in (not allowed to sell) for at least three years. These requirements ensure that promoters have “skin in the game” and remain committed to the company’s success even after raising money from the public.

Rights Issue and Preferential Issue Requirements

Beyond IPOs, the SEBI ICDR Regulations 2018 also cover other ways companies can raise money. Chapters III and V deal with rights issues and preferential issues, respectively. A rights issue is when a company that is already listed offers new shares to its existing shareholders in proportion to their current holding. This method respects the right of existing shareholders not to have their ownership percentage diluted. According to Regulation 60, a listed company making a rights issue must send a letter of offer to all shareholders at least three days before the issue opens. This letter must contain all important information about the company’s business, financial position, how the money will be used, and any risks involved. The company must also keep a specific portion of the issue for employees if they want to include them. The pricing of a rights issue is generally more flexible than an IPO, and companies often offer shares at a discount to attract shareholders to participate.

The regulations also specify timelines for rights issues, including the minimum and maximum period the issue should remain open (typically 7 to 30 days). A preferential issue, covered in Chapter V, is when a company issues new shares or convertible securities to a select group of investors rather than to all existing shareholders or the general public. This method is often used when companies want to bring in strategic investors or when they need money quickly. Regulation 164 specifies how to calculate the minimum price for preferential issues, which is generally based on the average of weekly high and low closing prices over a certain period. The regulations also impose a lock-in period of one year on shares issued through preferential allotment to ensure that these investors don’t quickly sell their shares for short-term profits. Additionally, preferential issues require shareholder approval through a special resolution, and the money raised must be used for the specific purposes mentioned in that resolution. These detailed rules for different types of capital raising methods ensure that regardless of how a company chooses to raise money, proper disclosures are made, and investor interests are protected.

Qualified Institutions Placement (QIP)

Chapter VI of the ICDR Regulations introduces a special method for listed companies to raise money quickly from institutional investors, known as Qualified Institutions Placement (QIP). This method was created to allow companies to raise money without the lengthy process required for public issues while still maintaining proper disclosure standards. QIP is only available to companies that are already listed and have been complying with listing requirements for at least one year. According to Regulation 172, in a QIP, shares can only be issued to Qualified Institutional Buyers (QIBs), which include institutions like banks, insurance companies, mutual funds, foreign portfolio investors, and pension funds. The minimum number of allottees in a QIP must be two if the issue size is less than or equal to ₹250 crores, and five if the issue size is greater than ₹250 crores.

No single allottee is allowed to receive more than 50% of the issue. This ensures that the shares are not concentrated in the hands of just one or two investors. The pricing of shares in a QIP is based on the average of the weekly high and low closing price during the two weeks preceding the “relevant date” (usually the date of the board meeting deciding to open the issue). Companies can offer a discount of up to 5% on this price, subject to shareholder approval. Regulation 175 mandates that the issue must be completed within 365 days of the special resolution approving it. The funds raised through QIP must be utilized for the purposes stated in the placement document, and any major deviation requires shareholder approval. QIPs have become increasingly popular for Indian companies looking to raise capital quickly. For example, in 2020 and 2021, many banks and financial institutions used the QIP route to strengthen their capital base during the COVID-19 pandemic. The streamlined process allowed these institutions to raise funds in challenging market conditions when traditional public issues might have been difficult to execute.

General Obligations and Disclosures

Regardless of the method a company uses to raise capital, the SEBI ICDR Regulations 2018 impose certain general obligations and disclosure requirements that apply to all types of issues. These are primarily covered in Chapter IX and are designed to ensure transparency and protect investor interests. One fundamental principle is that the offer document (whether a prospectus, letter of offer, or placement document) must contain all material information necessary for investors to make an informed decision. Regulation 24 states explicitly: “The draft offer document and offer document shall contain all material disclosures which are true and adequate so as to enable the applicants to take an informed investment decision.” The regulations define “material” as any information that is likely to affect an investor’s decision to invest in the issue. This includes details about the company’s business, its promoters and management, its financial position, risks and concerns, legal proceedings, and how the money raised will be used. The offer document must be certified by the company’s directors as containing “true, fair and adequate” information.

Making false or misleading statements in an offer document is a serious offense that can lead to penalties, including imprisonment in severe cases. The ICDR Regulations also require companies to make continuous disclosures even after the issue is completed. They must inform investors about how the money raised is being used through regular updates to stock exchanges. If there are any significant deviations from the stated use of funds, companies must explain these deviations and seek shareholder approval if necessary. Another important requirement is the appointment of a monitoring agency (usually a bank or financial institution) for issues above a certain size to oversee the use of funds. This agency must submit regular reports on whether the company is using the money as promised in the offer document. These general obligations ensure that the capital raising process remains transparent from beginning to end, with sufficient safeguards to protect investor interests.

Landmark Court Cases

Several important court cases have shaped how the ICDR Regulations are interpreted and applied. These cases have clarified unclear aspects of the regulations and established precedents for future issues. One of the most significant cases is DLF Ltd. v. SEBI (2015) SAT Appeal No. 331/2014. This case involved India’s largest real estate company, which was penalized by SEBI for not disclosing certain information in its IPO prospectus. DLF had not fully disclosed details about its subsidiaries and certain legal proceedings. When this came to light, SEBI barred DLF and its directors from accessing the capital markets for three years. DLF appealed to the Securities Appellate Tribunal (SAT), arguing that the undisclosed information was not material.

However, the SAT upheld SEBI’s order, stating: “The duty of an issuer company while filing a prospectus is not only to make true and correct disclosures but also to ensure that such disclosures are adequate… Inadequate disclosures even if they are true would not meet the requirement of the ICDR Regulations.” This judgment established an important principle that the adequacy of disclosure is as important as its accuracy. Another landmark case is Sahara Prime City v. SEBI (2013), which dealt with Sahara’s attempt to raise money through an IPO. SEBI found that the Sahara Group was simultaneously raising money through other means (through instruments called OFCDs – Optionally Fully Convertible Debentures) without proper disclosures. The case eventually reached the Supreme Court, which ruled in favor of SEBI and ordered Sahara to refund the money collected through OFCDs. The Court emphasized the importance of disclosure and regulatory compliance, stating: “Disclosure isn’t only about telling the truth but telling the whole truth.” A more recent case is PNB Housing Finance v. SEBI (2021) in the Delhi High Court, which dealt with preferential allotment pricing. PNB Housing Finance had approved a preferential issue to certain investors, including Carlyle Group, at a price that some shareholders felt was too low. SEBI directed the company to halt the issue until a valuation was done by an independent registered valuer. The company challenged this in court, arguing that it had followed the formula prescribed in the ICDR Regulations. The case raised important questions about whether SEBI can impose additional requirements beyond what is specified in the regulations and the balance between letter and spirit of the law. These cases show how the courts have generally supported SEBI’s role in ensuring proper disclosures and protecting investor interests, even when it means interpreting the regulations strictly.

Comparative Analysis with Global Regulations

India’s SEBI ICDR Regulations 2018 share similarities with capital raising regulations in other major markets like the United States and the United Kingdom, but there are also significant differences reflecting India’s unique market conditions. In the United States, the Securities Act of 1933 and rules issued by the Securities and Exchange Commission (SEC) govern public offerings. Like India’s ICDR Regulations, the US system emphasizes disclosure through detailed registration statements (Form S-1 for IPOs). However, the US has more flexible criteria for company eligibility, focusing primarily on disclosure rather than prescribing minimum financial thresholds like the three-year profit track record required in India. The US also has special provisions for “emerging growth companies” under the JOBS Act of 2012, allowing smaller companies certain exemptions from disclosure requirements. The United Kingdom’s regulations, administered by the Financial Conduct Authority (FCA), are more principles-based compared to India’s more prescriptive approach.