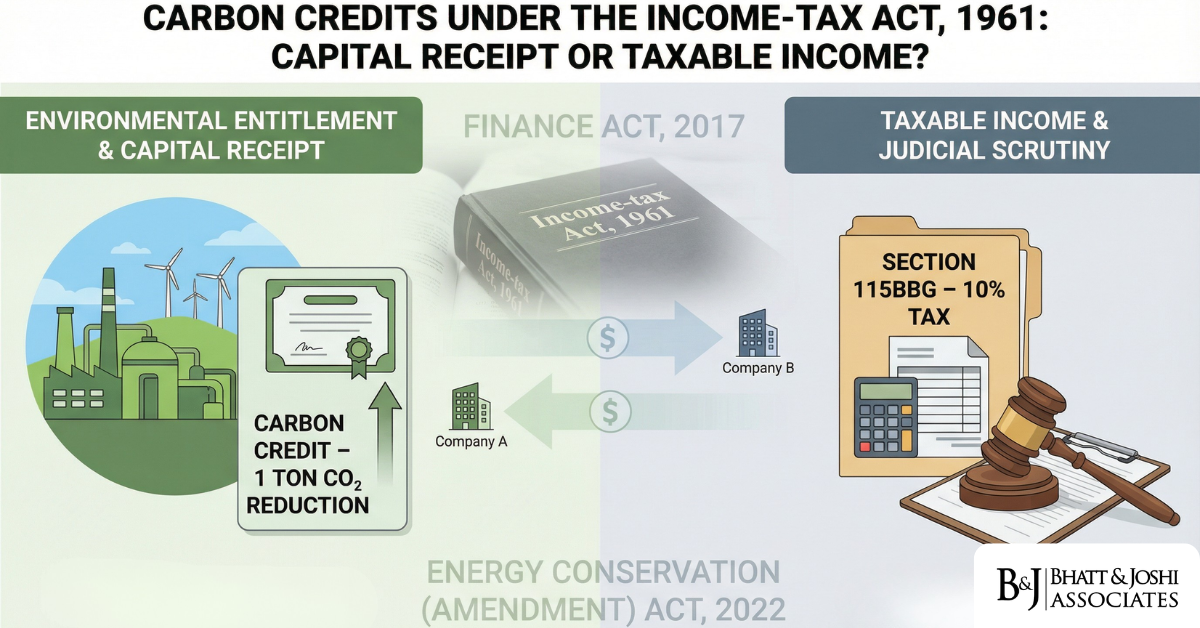

Income Tax Treatment of Carbon Credits: Asset, Income, or Capital Receipt Under the IT Act, 1961?

Introduction Carbon credits — formally known as Certified Emission Reductions (CERs) — have occupied an increasingly contentious space in Indian tax jurisprudence over the past

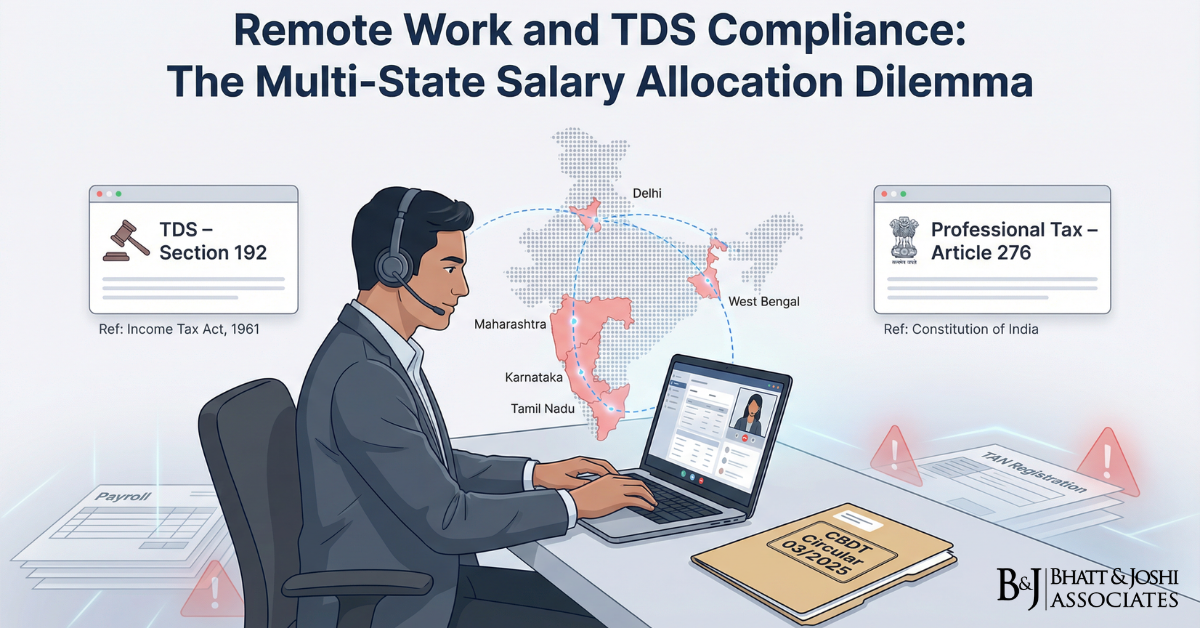

TDS on Salary for Remote Employees Across Multiple Indian States Under Section 192: Compliance Challenges”

Introduction The rise of remote work in post-pandemic India has created a TDS on salary compliance challenge that neither the Income Tax Act, 1961 nor the CBDT has clearly addresse

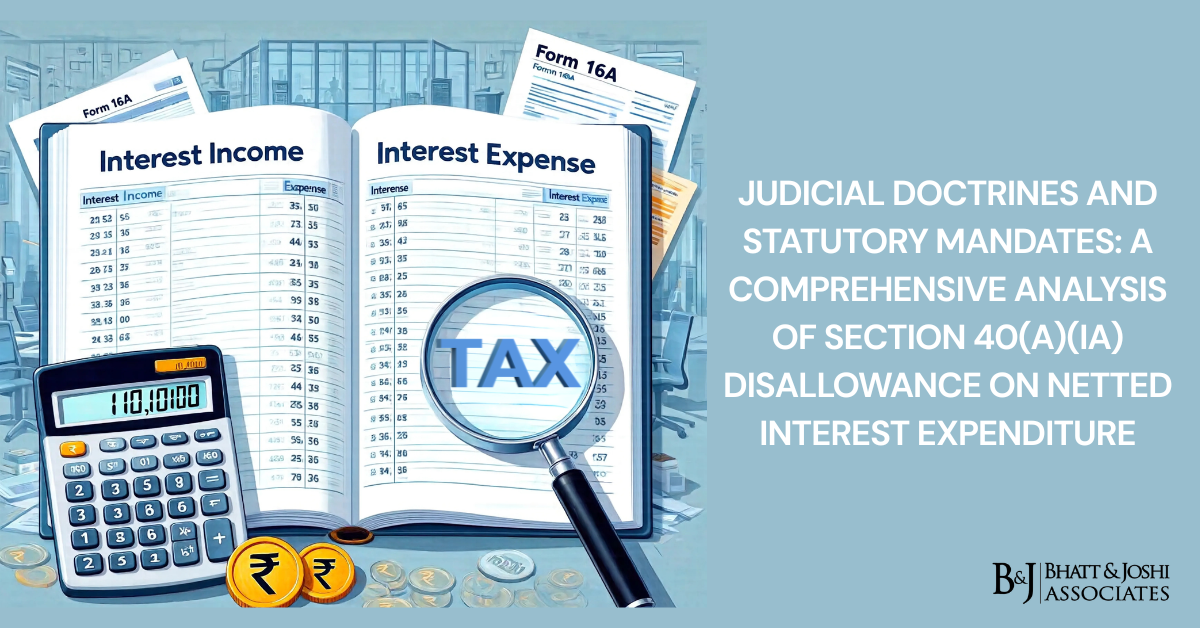

Judicial Doctrines and Statutory Mandates: A Comprehensive Analysis of Section 40(a)(ia) Disallowance for Netting Off Interest

Executive Summary The intersection of financial accounting standards and tax statutory compliance often presents complex interpretive challenges. A prominent area of contention ari

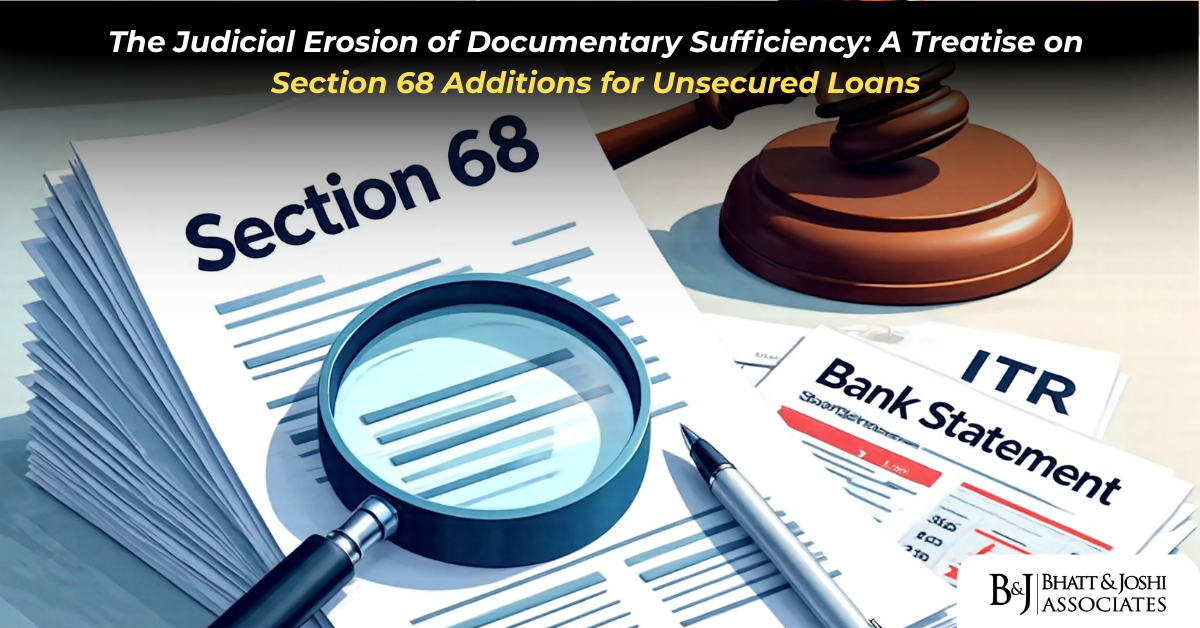

Unexplained Cash Credits (Section 68): Judicial Shift on Documentary Sufficiency for Unsecured Loans (2023–2025)

1. Introduction: The Doctrinal Shift in Unexplained Cash Credits under Section 68 The adjudication of unexplained cash credits under Section 68 of the Income Tax Act, 1961, has und

Derivatives Vs Shares: Tax Clarity On The Horizon

The Indian financial markets have witnessed unprecedented growth in derivative trading over the past decade, with retail participation reaching historic levels. This surge has brou

The Satisfaction Note Doctrine in Income Tax Search Assessments: From Calcutta Knitwears to Jasjit Singh

A Comprehensive Legal Analysis of Procedural Safeguards, Judicial Safeguards, and Practical Implementation Under the Income Tax Act, 1961 Executive Summary: Key Takeaways on the Sa

Income Tax Penalty Appeal: Complete Guide to CIT(A), ITAT & High Court with Practical Remedies [2024-25]

Complete Guide to Multi-Level Appeal Structure, Remedies, and Judicial Review of Penalty Orders Under Income Tax Act Introduction: A Comprehensive Multi-Level Appeal Structure The

Recorded Satisfaction in Income Tax Penalty Proceedings: Jurisdictional Requirements Under Sections 271E, 271AAC, and 271AAB

Introduction: Understanding “Satisfaction” as a Foundational Concept In the landscape of income tax penalty proceedings, few concepts are as critical—yet equally misu

Delhi High Court Strengthens Evidence Standards in Tax Prosecution: Critical Analysis of Foreign Banking Data Authentication Requirements

Introduction In a landmark ruling that significantly strengthens evidentiary standards for tax prosecution cases involving foreign banking data, the Delhi High Court has establishe

Gujarat High Court on Reassessment Notices: Defining Validity and Protecting Taxpayer Rights

Introduction In a significant ruling that has implications for taxpayers and the Income Tax Department alike, the High Court of Gujarat at Ahmedabad, in its decision on reassessmen

Whatsapp

Whatsapp